Chemed Corporation Announces Proposed Offering of $160 Million Senior Convertible Notes

May 07 2007 - 5:20PM

Business Wire

Chemed Corporation ("Chemed")(NYSE:CHE) today announced that it

intends to offer, subject to market conditions and other factors,

up to $160 million aggregate principal amount of senior convertible

notes due 2014 (the "Notes") to qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the "Securities Act"). The Company also intends to grant the

initial purchasers an option to purchase an additional $24 million

aggregate principal amount of such Notes. As this offering is a

private placement, it will not be made to the general public. The

Notes will be unsecured, unsubordinated obligations of the Company,

will pay interest semi-annually, and will be convertible upon

satisfaction of certain conditions. The Notes will be convertible

into cash up to the principal amount of the Notes and, with respect

to any excess conversion value, into shares of the Company's

capital stock. Holders of the Notes will have the right to require

the Company to repurchase for cash all or some of their Notes upon

the occurrence of certain events. The interest rate, conversion

rate and other terms are to be determined by negotiations between

the Company and the initial purchasers. The Company expects to

enter into convertible note hedge transactions with affiliates of

the initial purchasers of the Notes (the "hedge counterparties")

and intends to use a portion of the net proceeds from this offering

to pay for the convertible note hedge transactions. The Company

also expects to enter into separate warrant transactions with the

hedge counterparties, which would result in additional proceeds to

the Company, and would partially offset the cost of the convertible

note hedge transactions. In connection with the convertible note

hedge and warrant transactions, the hedge counterparties have

advised the Company that they or their affiliates may enter into

various derivative transactions with respect to the capital stock

of the Company, concurrently with or shortly following pricing of

the Notes. These activities could have the effect of increasing or

preventing a decline in the price of the capital stock of the

Company concurrently or following the pricing of the Notes. In

addition, the hedge counterparties or their affiliates may from

time to time, following the pricing of the Notes, enter into or

unwind various derivative transactions with respect to the capital

stock of the Company and/or purchase or sell capital stock of the

Company in secondary market transactions. These activities could

have the effect of decreasing the price of the capital stock of the

Company and could affect the price of the Notes during any

averaging period related to the conversion of Notes. In addition,

the Company expects to use a portion of the net proceeds of this

offering to repurchase approximately $100 million of its capital

stock in negotiated transactions from institutional investors

concurrently with this offering and in open market transactions

after the completion of the offering. On April 30, 2007, the

Company announced that its Board of Directors increased the

Company's stock repurchase authorization to $163.6 million. On May

3, 2007 and May 4, 2007, respectively, the Company purchased an

aggregate of 118,500 shares of its capital stock for approximately

$6.9 million at prices ranging from $57.12 per share to $59.00 per

share. As a result of purchases since April 30, 2007, $156.7

million is available for future Chemed stock repurchases. The

Company intends to continue such repurchases, subject to market

conditions and other factors. The Company intends to use the

remaining net proceeds to repay borrowings under its revolving

credit facility. If the initial purchasers exercise their

over-allotment option, or if the Company otherwise has proceeds

remaining, the Company may use a portion of such net proceeds for

general corporate purposes, or to enter into additional convertible

note hedge transactions, or to repurchase additional shares of its

capital stock in the open market or in negotiated transactions. The

Notes and the shares of capital stock issuable upon conversion of

the Notes will not be registered under the Securities Act or the

securities laws of any other jurisdiction and may not be offered or

sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act.

This announcement does not constitute an offer to sell or the

solicitation of offers to buy any security and shall not constitute

an offer, solicitation or sale of any security in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

Statements in this press release or in other Chemed communications

may relate to future events or Chemed�s future performance. Such

statements are forward-looking statements and are based on present

information Chemed has related to its existing business

circumstances. Investors are cautioned that such forward-looking

statements are subject to inherent risk that actual results may

differ materially from such forward-looking statements. Further,

investors are cautioned that Chemed does not assume any obligation

to update forward-looking statements based on unanticipated events

or changed expectations.

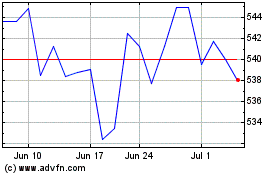

Chemed (NYSE:CHE)

Historical Stock Chart

From May 2024 to Jun 2024

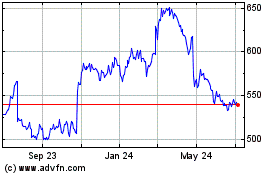

Chemed (NYSE:CHE)

Historical Stock Chart

From Jun 2023 to Jun 2024