Current Report Filing (8-k)

April 02 2020 - 6:06AM

Edgar (US Regulatory)

false0001130310CENTERPOINT ENERGY INCCommon Stock, $0.01 par valueCNP

0001130310

2020-04-01

2020-04-01

0001130310

cnp:NewYorkStockExchangeMember

us-gaap:CommonStockMember

2020-04-01

2020-04-01

0001130310

cnp:NewYorkStockExchangeMember

cnp:DepositarysharesMember

2020-04-01

2020-04-01

0001130310

cnp:ChicagoStockExchangeMember

us-gaap:CommonStockMember

2020-04-01

2020-04-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 1, 2020

CENTERPOINT ENERGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________

|

|

|

|

|

|

|

|

|

|

Texas

|

|

1-31447

|

|

|

74-0694415

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

1111 Louisiana

|

|

|

|

|

|

Houston

|

Texas

|

|

77002

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(713)

|

207-1111

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

CNP

|

The New York Stock Exchange

|

|

Chicago Stock Exchange, Inc.

|

|

Depositary Shares for 1/20 of 7.00% Series B Mandatory Convertible Preferred Stock, $0.01 par value

|

CNP/PB

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

CenterPoint Energy, Inc. (the “Company”) owns, indirectly through its wholly-owned subsidiary CenterPoint Energy Midstream, Inc., approximately 53.7% of the common units representing limited partner interests in Enable Midstream Partners, LP (“Enable”). On April 1, 2020, Enable announced a reduction in its quarterly distributions per common unit from $0.3305 distributed for the fourth quarter 2019 to $0.16525, representing a 50% reduction. This reduction is expected to result in one or more quarterly distributions to the Company that fall below the Company’s previously disclosed expected minimum quarterly distribution from Enable of $0.2875 per common unit. This reduction in Enable’s quarterly distributions per common unit is expected to reduce Enable common unit distributions to the Company by approximately $155 million per year.

The Company issued a press release on April 1, 2020 (the “Press Release”) and supplemental materials (the “Supplemental Materials”) on April 2, 2020 to provide a business update related to certain measures it expects to take in response to the current business environment to strengthen its financial position and to adjust for the reduction in cash flow related to the reduction in Enable quarterly common unit distributions recently announced by Enable. These measures are expected to include reducing the Company’s (i) quarterly common stock dividend per share from $0.2900 to $0.1500; (ii) anticipated 2020 capital spending by approximately $300 million, with the Company continuing to target five-year total capital investment of approximately $13 billion as previously disclosed; and (iii) anticipated operation and maintenance expenses for 2020 by a target of approximately $40 million, excluding certain merger costs, utility costs to achieve, severance and amounts with revenue offsets. For additional information regarding these measures, please refer to the Press Release and Supplemental Materials, which are furnished herewith as Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference. The Press Release and Supplemental Materials highlight certain topics that are expected to be addressed on the Company’s first quarter 2020 earnings conference call, which is currently scheduled for May 7, 2020.

The information in this Item 7.01 of this Current Report on Form 8-K, including the Press Release and Supplemental Materials (Exhibits 99.1 and 99.2 hereto) is being furnished, not filed, pursuant to Item 7.01. Accordingly, the information in this Item 7.01 of this Current Report on Form 8-K, the Press Release and Supplemental Materials (i) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and (ii) will not be incorporated by reference into any registration statement filed by CenterPoint Energy under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 8.01. Other Events.

The information in the first paragraph of Item 7.01 above relating to the announcement by Enable of the reduction of Enable’s quarterly distributions per common unit and the related impact on the Company’s cash flows is incorporated in this Item 8.01 by reference.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

EXHIBIT

NUMBER

|

EXHIBIT DESCRIPTION

|

|

99.1

|

|

|

99.2

|

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

CENTERPOINT ENERGY, INC.

|

|

|

|

|

|

Date: April 2, 2020

|

By:

|

/s/ Jason M. Ryan

|

|

|

|

Jason M. Ryan

|

|

|

|

Senior Vice President and General Counsel

|

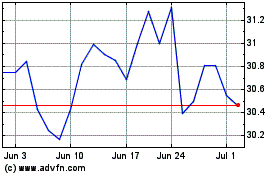

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

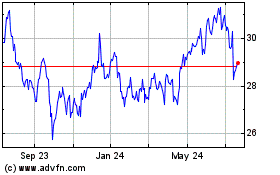

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Apr 2023 to Apr 2024