Current Report Filing (8-k)

July 02 2018 - 2:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 2, 2018

CENTENE CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-31826

|

|

42-1406317

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

7700 Forsyth Blvd.,

St. Louis, Missouri

|

|

63105

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (314)

725-4477

(Former Name or Former Address, if Changed Since Last Report): N/A

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

INTRODUCTORY NOTE

On July 2, 2018, Centene Corporation (“

Centene

”) announced that it completed the previously announced acquisition of substantially all

of the assets of New York State Catholic Health Plan, Inc. d/b/a Fidelis Care New York (“

Fidelis Care

”). Pursuant to the terms of the previously disclosed Asset Purchase Agreement, dated September 12, 2017, as amended by

that certain Amendment No. 1 to the Asset Purchase Agreement, dated June 18, 2018 (as so amended, the “

Asset Purchase Agreement

”), by and among Centene and Fidelis Care, following the receipt of all required regulatory

approvals, Centene has completed its acquisition of substantially all of the assets of Fidelis Care (the “

Acquisition

”).

Centene

financed the Acquisition with available cash and the net proceeds from the previously disclosed equity offering and notes offering.

|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

As previously disclosed, on May 23, 2018, Centene

Escrow I Corporation, a wholly owned subsidiary of Centene (the “

Escrow Issuer

”), entered into an Indenture, dated as of May 23, 2018 (the “

Indenture

”), by and between the Escrow Issuer and The Bank of New York

Mellon Trust Company, N.A., as trustee, pursuant to which the Escrow Issuer issued $1.8 billion aggregate principal amount of 5.375% Senior Notes due 2026 (the “

Notes

”).

Upon issuance of the Notes, the gross proceeds of the offering, along with certain additional funds (the “

Escrowed Funds

”) were deposited

into an escrow account. In connection with the Acquisition, the Escrowed Funds were released from escrow and were used, together with the net proceeds of the previously disclosed equity offering, to fund the cash consideration for the Acquisition

and to pay related fees and expenses.

In connection with the release of the Escrowed Funds from escrow, the Escrow Issuer merged with and into Centene,

with Centene as the surviving entity in the merger, and by entry into a supplemental indenture to the Indenture (the “

Supplemental Indenture

”), Centene assumed all of the Escrow Issuer’s obligations as the issuer under the

Indenture and the Notes.

The foregoing description of the Supplemental Indenture does not purport to be complete and is qualified in its entirety by

reference to the complete terms of the Supplemental Indenture, a copy of which is filed as Exhibit 4.2 hereto and is incorporated herein by reference.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On July 2, 2018, Centene completed the

previously announced Acquisition, effective as of July 1, 2018. Subject to the terms of the Asset Purchase Agreement, at the effective time of the Acquisition (the “

Effective Time

”), Fidelis Care sold, assigned, transferred,

conveyed and delivered to Centene, and Centene purchased from Fidelis Care, all of its rights, title and interest in, to and under substantially all assets, properties, rights and claims of Fidelis Care, which are used or held for use by Fidelis

Care in the operation of its health care plan.

The Asset Purchase Agreement contains representations, warranties and covenants by each of the parties

thereto which were made only for purposes of the Asset Purchase Agreement and:

|

|

•

|

|

were made as of specific dates;

|

|

|

•

|

|

were made solely for the benefit of the parties to the Asset Purchase Agreement;

|

|

|

•

|

|

may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Asset Purchase

Agreement instead of establishing these matters as facts; and

|

|

|

•

|

|

may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors.

|

Accordingly, investors should not rely on the representations, warranties or covenants or any descriptions

thereof as characterizations of the actual state of facts or condition of Centene, Fidelis Care or any of their respective subsidiaries or affiliates. Investors are not entitled to rely on the representations and warranties, which are only for the

benefit of the parties to the Asset Purchase Agreement. Moreover, information concerning the subject matter of the representations, warranties and covenants may change, or may have changed, after the date of the Asset Purchase Agreement, which

subsequent information may or may not be fully reflected in Centene’s public disclosures. The Asset Purchase Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Asset Purchase

Agreement, the Acquisition, Centene, Fidelis Care and their respective affiliates and businesses, which is contained in or incorporated by reference into the documents that Centene has publicly filed or will file in reports and statements with the

U.S. Securities and Exchange Commission (the “

SEC

”).

In connection with the Asset Purchase Agreement, Centene and Fidelis Care entered

into certain ancillary agreements at the Effective Time, including, among others, a transition services agreement, certain assignment agreements and certain reinsurance agreements with respect to Fidelis Care’s Medicare and Qualified Health

Plan businesses.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the complete terms of the

Asset Purchase Agreement, a copy of which is incorporated herein by reference as Exhibit 2.1.

|

Item 2.03.

|

Creation of a Direct Financing Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The disclosure required by this item is included in Item 1.01 and is incorporated herein by reference.

On July 2, 2018, Centene issued a press release announcing the completion of the

Acquisition. A copy of the press release announcing the completion of the Acquisition is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

(a)

|

Financial statements of businesses acquired.

|

The audited consolidated financial statements of Fidelis Care as

of and for the years ended December 31, 2017 and 2016 are incorporated herein by reference as Exhibit 99.2. The unaudited consolidated financial statements of Fidelis Care as of March 31, 2018 and for the three months ended March 31,

2018 and 2017 are incorporated herein by reference as Exhibit 99.3.

|

(b)

|

Pro forma financial information.

|

Centene’s unaudited pro forma condensed combined financial information

and explanatory notes for the year ended December 31, 2017 and as of and for the three months ended March 31, 2018, are attached as Exhibit 99.4 hereto and incorporated by reference herein.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2.1

|

|

Asset Purchase Agreement, dated September

12, 2017, between Centene and Fidelis Care (incorporated by reference to Exhibit 2.1 of Centene’s Current Report on Form

8-K

filed with the SEC on September 12, 2017)

|

|

|

|

|

4.1

|

|

Indenture, dated as of May

23, 2018, by and between Centene Escrow I Corporation, as issuer, and The Bank of New York Mellon Trust Company, N.A., as trustee (incorporated by reference to Exhibit 4.1 of Centene’s Current Report on

Form

8-K

filed with the SEC on May 23, 2018)

|

|

|

|

|

4.2

|

|

First Supplemental Indenture, dated as of July 1, 2018, by and between Centene and The Bank of New York Mellon Trust Company, N.A., as trustee

|

|

|

|

|

99.1

|

|

Press Release of Centene announcing completion of the Acquisition, dated July 2, 2018

|

|

|

|

|

99.2

|

|

Audited consolidated financial statements of Fidelis Care as of and for the years ended December

31, 2017 and 2016 (incorporated by reference to Exhibit 99.1 of Centene’s Current Report on Form 8-K filed with the SEC on March 26, 2018)

|

|

|

|

|

99.3

|

|

Unaudited consolidated financial statements of Fidelis Care as of March 31, 2018 and for the three months ended March

31, 2018 and 2017 (incorporated by reference to Exhibit 99.1 of Centene’s Current Report on

Form 8-K

filed with the SEC on April 30, 2018)

|

|

|

|

|

99.4

|

|

Unaudited pro forma condensed combined financial information and explanatory notes for the year ended December 31, 2017 and as of and for the three months ended March 31, 2018

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CENTENE CORPORATION

|

|

|

|

|

|

|

Dated: July 2, 2018

|

|

|

|

By:

|

|

/s/ Jeffrey A. Schwaneke

|

|

|

|

|

|

Name:

|

|

Jeffrey A. Schwaneke

|

|

|

|

|

|

Title:

|

|

Executive Vice President & Chief Financial Officer

|

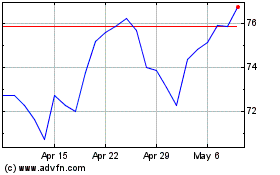

Centene (NYSE:CNC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Centene (NYSE:CNC)

Historical Stock Chart

From Jan 2024 to Jan 2025