Centene Corporation (NYSE: CNC) today announced its net earnings

from continuing operations for the quarter ended September 30, 2009

were $22.7 million, or $0.51 per diluted share, compared to $18.1

million, or $0.41 per diluted share in the third quarter of 2008.

The results of operations for our New Jersey health plan,

University Health Plans, are classified as discontinued operations.

The discussions below, with the exception of cash flow information,

are in the context of continuing operations and all financial

ratios are calculated using revenues excluding premium taxes and

investment income.

Third Quarter Highlights

- Quarter-end managed care at-risk

membership of 1,386,400, an increase of 215,300 lives year over

year.

- Premium and Service revenues of

$987.3 million, representing 18.1% year over year growth.

- Health Benefits Ratio (HBR) of

83.7%.

- General and Administrative

(G&A) expense ratio of 13.2%.

- Cash flow from operations of

$114.9 million.

- Days in claims payable of

47.1.

- Diluted earnings per share from

continuing operations of $0.51, compared to $0.41 in the third

quarter of 2008. Earnings per diluted share in 2008 included a

$0.06 loss on investments from the Primary Reserve fund.

Other Events

- On August 31, 2009, Centene

announced that the State of Massachusetts had accepted its proposal

to manage healthcare services for the Commonwealth Bridge Program

through its subsidiary, CeltiCare Health Plan of Massachusetts,

effective October 1, 2009, through June 30, 2010.

- Effective September 1, 2009,

Centene converted 62,100 members in Florida from Access Health

Solutions to at-risk under our Sunshine State Health Plan.

- On October 24, 2009, Centene

announced a settlement agreement with Amerigroup Corporation

associated with the sale of our New Jersey health plan. Pursuant to

the settlement agreement, the parties will move forward with the

transaction, which is subject to regulatory approval and expected

to be completed in the first quarter of 2010.

- In August 2009, Jason Harrold,

president and CEO of OptiCare Managed Vision, Inc. was appointed to

Senior Vice President of Centene’s Specialty Business Unit. Mr.

Harrold assumed the leadership role over the specialty companies

previously held by William Scheffel.

- On October 26, 2009 our Board of

Directors approved an extension of our stock repurchase

program.

Michael F. Neidorff, Centene’s Chairman and Chief Executive

Officer, stated, “We are pleased with the ability of our team to

deliver solid results across Centene's products and markets in a

challenging economic environment.”

The following table depicts membership in Centene’s managed care

organizations, by state, at September 30, 2009 and 2008:

September 30, 2009 2008 Arizona

17,400 — Florida 84,400 — Georgia 303,400 283,900 Indiana 200,700

172,400 Massachusetts 500 — Ohio 151,200 132,500 South Carolina

46,100 26,600 Texas 450,200 433,200 Wisconsin 132,500 122,500 Total

at-risk membership 1,386,400 1,171,100 Non-risk membership 63,200*

3,700 Total 1,449,600 1,174,800 ______________________________

* Increase mainly due to

consolidation of our Access Health Solutions LLC investment,

effective January 1, 2009.

The following table depicts membership in Centene’s managed care

organizations, by member category, at September 30, 2009 and

2008:

September 30, 2009 2008 Medicaid

1,040,500 850,500 CHIP & Foster Care 263,400 261,800 ABD &

Medicare 82,500 58,800 Total at-risk membership 1,386,400 1,171,100

Non-risk membership 63,200 3,700 Total 1,449,600 1,174,800

Statement of Operations

- For the third quarter of 2009,

Premium and Service Revenues increased 18.1% to $987.3 million from

$835.7 million in the third quarter of 2008. The increase was

primarily driven by premium rate increases and membership growth in

all states, including the commencement of our Arizona acute care

contract in October 2008, the consolidation of Access and

conversion of members to our at-risk plan in Florida.

- The consolidated HBR, which

reflects medical costs as a percent of premium revenues, was 83.7%.

A reconciliation of the change in HBR from the prior year same

period and from the immediately preceding quarter is presented

below:

Q3:2009 vs. Q3:2008 Q3:2009 vs. Q2:2009

Third Quarter 2008 82.2 % Second Quarter 2009 83.1 % Decrease in

Texas CHIP/Perinate rates 1.0 New markets reserved at higher rates

0.1 Impact of additional costs related to the flu 0.5 Impact of

additional costs related to the flu 0.3 Pass-through payments 0.1

Pass-through payments 0.1 Net change in other markets (0.1 ) Net

change in other markets 0.1 Third Quarter 2009 83.7 % Third

Quarter 2009 83.7 %

The increase in the third quarter of 2009

over the comparable period in 2008 was due to the March 1, 2009

rate decrease for our CHIP/Perinate product in Texas which brought

the HBR more in line with our normal range and the impact of

additional costs related to the flu. We also experienced

improvements in our ABD product, particularly in Ohio, which was

mostly offset by the impact of changes in rates and benefit

structures in other markets. Sequentially, the increase in the HBR

reflects the impact of additional costs related to the flu along

with the effect of reserving at higher rates for new markets and

receiving pass-through payments which increase the HBR ratio.

- Consolidated G&A expense as

a percent of premium and service revenues was 13.2% in the third

quarter of 2009, a decrease from 14.2% in the third quarter of

2008. The reduction in the G&A ratio between years reflects

improved leveraging of our costs over a higher revenue base and the

impact of additional revenue from new business (Arizona Acute Care,

Florida and South Carolina).

- Earnings per diluted share from

continuing operations were $0.51, compared to $0.41 in the third

quarter of 2008. Earnings per diluted share in 2008 included a

$0.06 loss on investments from the Primary Reserve fund.

Balance Sheet and Cash Flow

At September 30, 2009, the Company had cash and investments of

$939.0 million, including $911.4 million held by its regulated

entities and $27.6 million held by its unregulated entities.

Medical claims liabilities totaled $411.0 million, representing

47.1 days in claims payable, a decrease of 0.4 days from June 30,

2009. Total debt was $277.3 million and debt to capitalization was

31.9%. Year to date cash flow from operations was $177.0

million.

A reconciliation of the Company’s change in days in claims

payable from the immediately preceding quarter-end is presented

below:

Days in claims payable, June 30, 2009 47.5 Payment of annual

provider bonuses (0.7) Impact of Florida expansion 0.3 Days in

claims payable, September 30, 2009 47.1

Outlook

The table below depicts the Company’s annual guidance from

continuing operations for 2009:

Full Year 2009 Low High Premium

and Service revenues (in millions) $ 3,850 $ 3,900 Earnings per

diluted share $ 1.91 $ 1.97

Stock Repurchase Authorization

On October 26, 2009, the Company’s Board of Directors extended

the Company’s stock repurchase program. The program authorizes the

repurchase of up to 4,000,000 shares of the Company’s common stock

from time to time on the open market or through privately

negotiated transactions. No duration has been placed on the

repurchase program and we reserve the right to discontinue the

repurchase program at any time.

Conference Call

As previously announced, the Company will host a conference call

Tuesday, October 27, 2009, at 8:30 A.M. (Eastern Time) to review

the financial results for the second quarter ended September 30,

2009, and to discuss its business outlook. Michael F. Neidorff and

William N. Scheffel will host the conference call. Investors and

other interested parties are invited to listen to the conference

call by dialing 800-273-1254 in the U.S. and Canada, 973-638-3440

from abroad, or via a live Internet broadcast on the Company's

website at www.centene.com, under the Investor Relations section. A

replay will be available for on-demand listening shortly after the

completion of the call until 11:59 PM (Eastern Time) on Tuesday,

November 10, 2009, at the aforementioned URL, or by dialing

800-642-1687 in the U.S. and Canada, or 706-645-9291 from abroad,

and entering access code 30957978.

About Centene Corporation

Centene Corporation is a leading multi-line healthcare

enterprise that provides programs and related services to

individuals receiving benefits under Medicaid, including the

Children’s Health Insurance Program (CHIP), as well as Aged, Blind,

or Disabled (ABD), Foster Care, Long-Term Care and Medicare

(Special Needs Plans). The Company operates local health plans and

offers a wide range of health insurance solutions to individuals

and the rising number of uninsured Americans. It also contracts

with other healthcare and commercial organizations to provide

specialty services including behavioral health, life and health

management, managed vision, telehealth services, pharmacy benefits

management and medication adherence. Information regarding Centene

is available via the Internet at www.centene.com.

The information provided in this press release contains

forward-looking statements that relate to future events and future

financial performance of Centene. Subsequent events and

developments may cause the Company’s estimates to change. The

Company disclaims any obligation to update this forward-looking

financial information in the future. Readers are cautioned that

matters subject to forward-looking statements involve known and

unknown risks and uncertainties, including economic, regulatory,

competitive and other factors that may cause Centene’s or its

industry’s actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Actual results may

differ from projections or estimates due to a variety of important

factors, including Centene’s ability to accurately predict and

effectively manage health benefits and other operating expenses,

competition, changes in healthcare practices, changes in federal or

state laws or regulations, inflation, provider contract changes,

new technologies, reduction in provider payments by governmental

payors, major epidemics, disasters and numerous other factors

affecting the delivery and cost of healthcare. The expiration,

cancellation or suspension of Centene’s Medicaid Managed Care

contracts by state governments would also negatively affect

Centene.

[Tables Follow]

CENTENE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

September 30,

2009

December 31,

2008

ASSETS Current assets: Cash and cash equivalents of

continuing operations $ 389,135 $ 370,999 Cash and cash equivalents

of discontinued operations 4,847 8,100 Total

cash and cash equivalents 393,982 379,099 Premium and related

receivables, net of allowance for uncollectible accounts of $19 and

$595, respectively 104,798 92,531 Short-term investments, at fair

value (amortized cost $45,332 and $108,469, respectively) 45,692

109,393 Other current assets 61,294 75,333 Current assets of

discontinued operations other than cash 8,292 9,987

Total current assets 614,058 666,343 Long-term investments,

at fair value (amortized cost $475,078 and $329,330, respectively)

486,889 332,411 Restricted deposits, at fair value (amortized cost

$17,177 and $9,124, respectively) 17,286 9,254 Property, software

and equipment, net of accumulated depreciation of $96,314 and

$74,194, respectively 209,920 175,858 Goodwill 219,100 163,380

Intangible assets, net 23,454 17,575 Other long-term assets 37,100

59,083 Long-term assets of discontinued operations 27,207

27,248 Total assets $ 1,635,014 $ 1,451,152

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Medical claims liability $ 410,997 $ 373,037 Accounts

payable and accrued expenses 204,411 219,566 Unearned revenue

68,024 17,107 Current portion of long-term debt 645 255 Current

liabilities of discontinued operations 23,846 31,013

Total current liabilities 707,923 640,978 Long-term debt

276,687 264,637 Other long-term liabilities 55,992 43,539 Long-term

liabilities of discontinued operations 1,155 726

Total liabilities 1,041,757 949,880 Commitments and

contingencies Stockholders’ equity: Common stock, $.001 par

value; authorized 100,000,000 shares; issued and outstanding

45,402,369 and 45,071,179 shares, respectively 45 45 Additional

paid-in capital 277,709 263,835 Accumulated other comprehensive

income: Unrealized gain on investments, net of tax 7,812 3,152

Retained earnings 335,192 275,236 Treasury stock, at cost

(2,373,893 and 2,083,415 shares, respectively) (46,497 )

(40,996 ) Total Centene stockholders’ equity 574,261 501,272

Noncontrolling interest 18,996 — Total

stockholders’ equity 593,257 501,272 Total

liabilities and stockholders’ equity $ 1,635,014 $ 1,451,152

CENTENE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except share

data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2009 2008 2009 2008

Revenues: Premium $ 960,009 $ 817,740 $ 2,754,713 $

2,338,550 Service 27,300 17,962 72,740

56,958 Premium and service revenues 987,309 835,702 2,827,453

2,395,508 Premium tax 50,925 22,897 182,685

66,249 Total revenues 1,038,234 858,599

3,010,138 2,461,757

Expenses: Medical costs 803,062

671,920 2,298,108 1,932,172 Cost of services 15,843 12,854 46,364

43,467 General and administrative expenses 130,024 118,628 381,524

323,391 Premium tax 51,295 23,284 183,785

66,636 Total operating expenses 1,000,224

826,686 2,909,781 2,365,666 Earnings from operations

38,010 31,913 100,357 96,091

Other income (expense):

Investment and other income 3,750 2,708 11,781 15,724 Interest

expense (4,064 ) (4,377 ) (12,210 )

(12,436 ) Earnings from continuing operations, before income tax

expense 37,696 30,244 99,928 99,379 Income tax expense

12,426 12,145 35,060 38,464 Earnings from

continuing operations, net of income tax expense 25,270 18,099

64,868 60,915

Discontinued operations, net of income tax

(benefit) expense of $(792), $242, $(1,148) and $390,

respectively (1,460 ) 149 (2,394 )

1,159 Net earnings 23,810 18,248 62,474 62,074

Noncontrolling

interest 2,542 ― 2,518 ―

Net

earnings attributable to Centene Corporation $ 21,268 $ 18,248

$ 59,956 $ 62,074

Amounts attributable to Centene

Corporation common shareholders: Earnings from continuing

operations, net of income tax expense $ 22,728 $ 18,099 $ 62,350 $

60,915 Discontinued operations, net of income tax (benefit) expense

(1,460 ) 149 (2,394 ) 1,159 Net

earnings $ 21,268 $ 18,248 $ 59,956 $ 62,074

Net earnings

(loss) per share attributable to Centene Corporation: Basic:

Continuing operations $ 0.53 $ 0.42 $ 1.45 $ 1.40 Discontinued

operations (0.04 ) ― (0.06 ) 0.03

Earnings per common share $ 0.49 $ 0.42 $ 1.39 $ 1.43 Diluted:

Continuing operations $ 0.51 $ 0.41 $ 1.41 $ 1.37 Discontinued

operations (0.03 ) ― (0.05 ) 0.02

Earnings per common share $ 0.48 $ 0.41 $ 1.36 $ 1.39

Weighted average number of shares outstanding: Basic

43,001,870

43,232,941

43,023,431 43,381,819 Diluted 44,291,604

44,530,347

44,247,153 44,541,424

CENTENE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

Nine Months Ended September 30, 2009

2008 Cash flows from operating

activities: Net earnings $ 62,474 $ 62,074 Adjustments to

reconcile net earnings to net cash provided by operating activities

Depreciation and amortization 30,800 26,018 Stock compensation

expense 11,428 11,576 Loss on sale of investments, net 261 4,923

Deferred income taxes 4,516 13,987 Changes in assets and

liabilities — Premium and related receivables (381 ) (50,797 )

Other current assets (2,595 ) (6,422 ) Other assets (593 ) (713 )

Medical claims liabilities 31,612 28,109 Unearned revenue 54,725

(37,931 ) Accounts payable and accrued expenses (17,656 ) 74,723

Other operating activities 2,386 967 Net cash

provided by operating activities 176,977 126,514

Cash flows from investing activities: Capital expenditures

(42,696 ) (52,588 ) Purchases of investments (647,086 ) (372,221 )

Sales and maturities of investments 546,640 356,367 Investments in

acquisitions, net of cash acquired, and investment in equity method

investee (31,533 )

(83,509

) Net cash used in investing activities (174,675 )

(151,951 )

Cash flows from financing activities: Proceeds

from exercise of stock options 1,717 4,770 Proceeds from borrowings

468,500 152,005 Payment of long-term debt (456,059 ) (109,410 )

Distributions to noncontrolling interest (3,171 ) ― Contribution

from noncontrolling interest 7,495 ― Excess tax benefits from stock

compensation 43 3,016 Common stock repurchases (5,539 ) (18,244 )

Debt issue costs (405 ) ― Net cash provided by

financing activities 12,581 32,137 Net increase in

cash and cash equivalents 14,883 6,700

Cash and

cash equivalents, beginning of period 379,099

268,584

Cash and cash equivalents, end of period $ 393,982 $

275,284 Supplemental disclosures of cash flow information:

Interest paid $ 8,556 $ 8,467 Income taxes paid $ 43,308 $ 28,370

Supplemental disclosure of non-cash investing and financing

activities: Contribution from noncontrolling interest $ 5,491 $ ―

CENTENE CORPORATION

CONTINUING OPERATIONS

SUPPLEMENTAL FINANCIAL DATA

Q3 Q2 Q1 Q4 Q3

2009 2009 2009 2008 2008

MEMBERSHIP Managed Care: Arizona 17,400 16,200 15,500 14,900

— Florida 84,400 22,300 29,100 — — Georgia 303,400 292,800 289,300

288,300 283,900 Indiana 200,700 196,100 179,100 175,300 172,400

Massachusetts 500 — — — — Ohio 151,200 141,200 137,000 133,400

132,500 South Carolina 46,100 46,000 48,500 31,300 26,600 Texas

450,200 443,200 421,100 428,000 433,200 Wisconsin 132,500

131,200 127,700 124,800 122,500 Total

at-risk membership 1,386,400 1,289,000 1,247,300

1,196,000 1,171,100 Non-risk membership 63,200

114,000 96,000 3,700 3,700

TOTAL 1,449,600 1,403,000

1,343,300 1,199,700 1,174,800

Medicaid 1,040,500 958,600 921,100 877,400 850,500

CHIP & Foster Care 263,400 261,400 256,900 257,300 261,800 ABD

& Medicare 82,500 69,000 69,300 61,300

58,800 Total at-risk membership 1,386,400

1,289,000 1,247,300 1,196,000 1,171,100

Non-risk membership 63,200 114,000 96,000

3,700 3,700

TOTAL 1,449,600

1,403,000 1,343,300 1,199,700

1,174,800 Specialty Services(a):

Cenpatico Behavioral Health Arizona 117,300 110,500 104,700 105,000

102,400 Kansas 41,000 41,100 40,600 41,100 40,100 Bridgeway Health

Solutions Long-term Care 2,500 2,400 2,300

2,100 1,900

TOTAL 160,800

154,000 147,600 148,200

144,400 (a) Includes external membership only.

REVENUE PER MEMBER(b) $ 222.77 $ 219.75 $

220.29 $ 218.52 $ 213.28

CLAIMS(b) Period-end

inventory

414,900

362,200

325,000

269,300

323,200

Average inventory 227,100 234,500 267,600 288,600 298,400

Period-end inventory per member 0.30 0.28 0.26 0.23 0.28

(b) Revenue per member and claims information are presented

for the Managed Care at-risk members.

Q3

Q2 Q1 Q4 Q3 2009 2009

2009 2008 2008 DAYS IN CLAIMS

PAYABLE (c) 47.1 47.5 45.3 48.5 47.9 (c) Days in Claims

Payable is a calculation of Medical Claims Liabilities at the end

of the period divided by average claims expense per calendar day

for such period.

CASH AND INVESTMENTS (in millions)

Regulated $ 911.4 $ 825.8 $ 816.8 $ 798.0 $ 692.6 Unregulated

27.6 27.0 28.9 24.1 26.8

TOTAL $ 939.0 $ 852.8 $ 845.7 $ 822.1 $ 719.4

DEBT TO CAPITALIZATION (d) 31.9 % 33.0

% 34.6 % 34.6% 34.4 % (d) Debt to Capitalization is calculated as

follows: total debt divided by (total debt + total equity).

OPERATING RATIOS:

Three Months Ended

September 30,

Nine Months Ended

September 30,

2009 2008 2009

2008 Health Benefits Ratios: Medicaid and CHIP 84.7 % 81.3 %

84.4 % 80.7 % ABD and Medicare 81.1 88.1 81.7 91.4 Specialty

Services 80.5 79.9 79.6 82.9 Total 83.7 82.2 83.4 82.6

General & Administrative Expense Ratio 13.2 % 14.2 % 13.5 %

13.5 %

MEDICAL CLAIMS LIABILITY (In

thousands)Four rolling quarters of the changes in medical

claims liability are summarized as follows:

Balance, September 30, 2008 $ 349,502 Acquisitions —

Incurred related to: Current period 3,051,905 Prior period

(45,634 ) Total incurred 3,006,271 Paid related to:

Current period 2,654,707 Prior period 290,069 Total

paid 2,944,776

Balance, September 30, 2009 $

410,997

Centene’s claims reserving process utilizes a consistent

actuarial methodology to estimate Centene’s ultimate liability. Any

reduction in the “Incurred related to: Prior period” amount may be

offset as Centene actuarially determines “Incurred related to:

Current period.” As such, only in the absence of a consistent

reserving methodology would favorable development of prior period

claims liability estimates reduce medical costs. Centene believes

it has consistently applied its claims reserving methodology in

each of the periods presented.

The amount of the “Incurred related to: Prior period” above

includes the effects of reserving under moderately adverse

conditions, new markets where we use a conservative approach in

setting reserves during the initial periods of operations,

increased receipts from other third party payors related to

coordination of benefits and lower medical utilization and cost

trends for dates of service prior to September 30, 2008.

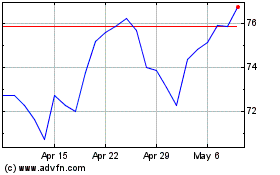

Centene (NYSE:CNC)

Historical Stock Chart

From May 2024 to Jun 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2023 to Jun 2024