A.M. Best Assigns Ratings to Centene Corporation and Its Insurance Subsidiaries

February 10 2009 - 11:20AM

Business Wire

A.M. Best Co. has assigned financial strength ratings

(FSR) of B+ (Good) and issuer credit ratings (ICR) of �bbb-� to

Peach State Health Plan, Inc. (Smyrna, GA), Superior

HealthPlan, Inc. (Austin, TX), Buckeye Community Health

Plan, Inc. (Columbus, OH), Coordinated Care Corporation

Indiana, Inc. (Indianapolis, IN), Managed Health Services

Insurance Corporation (Milwaukee, WI), Total Carolina Care,

Inc. (Columbia, SC) and Bankers Reserve Life Insurance

Company of Wisconsin (Milwaukee, WI). A.M. Best also has

assigned an FSR of B (Fair) and ICR of �bb� to University Health

Plans, Inc. (Edison, NJ). All of these entities are insurance

subsidiaries of Centene Corporation (Centene) (NYSE: CNC)

(headquartered in St. Louis, MO). The outlook for these ratings is

stable.

Concurrently, A.M. Best has downgraded the FSR to B++ (Good)

from A- (Excellent) and ICR to �bbb� from �a-� of Celtic

Insurance Company (Celtic) (Chicago, IL). The ratings have been

removed from under review with negative implications and assigned a

stable outlook. These ratings were placed under review in March

2008, following the announcement that Centene planned an

acquisition of Celtic. The acquisition closed in July 2008.

Additionally, A.M. Best has assigned an ICR of �bb-� and debt

rating of �bb-� to the $175 million 7.25% senior unsecured notes

due 2014 of Centene. The outlook assigned to these ratings is

stable.

The ratings are based on Centene�s multi-state market presence,

consistent premium revenue growth, growing specialty service

revenue and positive net income levels. Currently, Centene manages

Medicaid contracts in nine states. Centene has consistently

recorded premium revenue growth over the last five years, mainly

driven by acquisitions, and has reported positive net income for

four of the last five years on a consolidated basis. Centene also

provides medical management services to its Medicaid managed care

plans as well as to states that contract for those services

directly. Revenue from these programs has grown to approximately

20% of total revenue. Through the acquisition of Celtic, Centene is

now able to offer health insurance products in 49 states and the

District of Columbia.

Offsetting rating factors include Centene�s revenue and net

income dependence on state and federally funded Medicaid programs,

which could experience pressure due to budget constraints and

general economic conditions. Although Centene has made capital

contributions in support of its subsidiaries, the risked-based

capitalization of the Medicaid insurance subsidiaries is considered

modest.

The downgrading of Celtic�s ratings reflects the company�s

decline in capitalization since its acquisition by Centene. Since

being acquired by Centene, $31 million was dividended out of Celtic

in third quarter 2008, resulting in a substantially lower level of

capitalization. Furthermore, given the current recession and

declining premium revenues, significant premium growth is

unlikely.

For Best�s Debt Ratings, all other Best�s Ratings, an overview

of the rating process and rating methodologies, please visit

www.ambest.com/ratings.

The principal methodologies used in determining these ratings,

including any additional methodologies and factors, which may have

been considered, can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is a global full-service

credit rating organization dedicated to serving the financial and

health care service industries, including insurance companies,

banks, hospitals and health care system providers. For more

information, visit www.ambest.com.

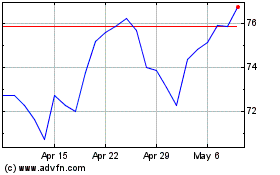

Centene (NYSE:CNC)

Historical Stock Chart

From May 2024 to Jun 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2023 to Jun 2024