CoreSite Realty Corporation (NYSE:COR), a premier provider of

secure, reliable, high-performance data center and interconnection

solutions across the U.S., today announced financial results for

the third quarter ended September 30, 2016.

Quarterly and Subsequent

Highlights

- Reported third-quarter total operating

revenues of $101.3 million, representing a 17.2% increase year over

year

- Reported third-quarter net income per

diluted share of $0.36, representing 38.5% growth year over

year

- Reported third-quarter funds from

operations (“FFO”) of $0.90 per diluted share and unit,

representing 21.6% growth year over year

- Executed 162 new and expansion data

center leases comprising 59,991 net rentable square feet (NRSF),

representing $11.2 million of annualized GAAP rent at an average

rate of $187 per square foot

- Commenced 50,455 net rentable square

feet of new and expansion leases representing $7.5 million of

annualized GAAP rent at an average rate of $148 per square

foot

- Realized rent growth on signed renewals

of 4.0% on a cash basis and 6.8% on a GAAP basis and recorded

rental churn of 2.2%

- On October 12, 2016, CoreSite announced

the opening of SV7 on its Santa Clara campus, with 62% of the

230,000 NRSF of turn-key data center capacity leased

Paul Szurek, CoreSite’s Chief Executive Officer, commented, “We

delivered another quarter of solid financial and operational

performance in the third quarter, highlighted by strong earnings

growth and leasing momentum. Our third quarter volume of new and

expansion leasing for deployments of 5,000 net rentable square feet

or less set a company record, as the demand for

performance-sensitive retail colocation solutions remains robust.”

Mr. Szurek continued, “Subsequent to the end of the third quarter,

we opened SV7, our 230,000 net rentable square foot turn-key data

center building in Santa Clara, which was 62% leased upon opening

of the facility, another record for CoreSite. As an organization,

we continue to successfully execute on our business plan in terms

of leasing effectiveness, development, and increasing the value of

our network dense, cloud-enabled platform of assets by enhancing

and diversifying our customer base.”

Financial Results

CoreSite reported net income attributable to common shares of

$12.2 million, or $0.36 per diluted share, for the three months

ended September 30, 2016, compared to $6.9 million, or $0.26 per

diluted share, for the three months ended September 30, 2015, an

increase of 38.5% on a per share basis. On a sequential-quarter

basis, net income attributable to common shares decreased 2.7%.

CoreSite reported FFO per diluted share and unit of $0.90 for

the three months ended September 30, 2016, an increase of 21.6%

compared to $0.74 per diluted share and unit for the three months

ended September 30, 2015. On a sequential-quarter basis, FFO per

diluted share and unit increased 1.1%.

Total operating revenues for the three months ended September

30, 2016, were $101.3 million, a 17.2% increase year over year and

an increase of 5.4% on a sequential-quarter basis.

Sales Activity

CoreSite executed 162 new and expansion data center leases

representing $11.2 million of annualized GAAP rent during the third

quarter, comprised of 59,991 NRSF at a weighted-average GAAP rental

rate of $187 per NRSF.

CoreSite’s third-quarter data center lease commencements totaled

50,455 NRSF at a weighted average GAAP rental rate of $148 per

NRSF, which represents $7.5 million of annualized GAAP rent.

CoreSite’s renewal leases signed in the third quarter totaled

$10.9 million in annualized GAAP rent, comprised of 76,735 NRSF at

a weighted-average GAAP rental rate of $142 per NRSF, reflecting a

4.0% increase in rent on a cash basis and a 6.8% increase on a GAAP

basis. The third-quarter rental churn rate was 2.2%, which included

160 basis points of churn related to a customer move-out at

CoreSite’s VA1 data center.

Development Activity

Santa Clara – During the third quarter, CoreSite had

230,000 square feet of turn-key data center capacity under

construction at SV7. As of September 30, 2016, CoreSite had

incurred $208.2 million of the estimated $211.0 million required to

complete this development. On October 12, 2016, CoreSite announced

the opening of SV7, with 62% of the 230,000 net rentable square

feet of turn-key data center capacity leased.

Denver – During the third quarter, CoreSite had 8,276

square feet of turn-key data center capacity under construction at

DE1. As of September 30, 2016, CoreSite had incurred $2.0 million

of the estimated $12.5 million required to complete this expansion

and expects to substantially complete construction in the second

quarter of 2017.

Los Angeles – During the third quarter, CoreSite had

4,726 square feet of turn-key data center capacity under

construction at LA2, which is 100% pre-leased. As of September 30,

2016, CoreSite had incurred $0.4 million of the estimated $2.0

million required to complete this expansion and expects to

substantially construction in the fourth quarter of 2016.

Balance Sheet and

Liquidity

As of September 30, 2016, CoreSite had net principal debt of

$588.5 million, correlating to 2.8 times third-quarter annualized

adjusted EBITDA, and net principal debt and preferred stock

outstanding of $703.5 million, correlating to 3.4 times

third-quarter annualized adjusted EBITDA.

At quarter end, CoreSite had $6.3 million of cash available on

its balance sheet and $250.8 million of borrowing capacity

available under its revolving credit facility.

Dividend

On September 2, 2016, CoreSite announced a dividend of $0.53 per

share of common stock and common stock equivalents for the third

quarter of 2016. The dividend was paid on October 17, 2016, to

shareholders of record on September 30, 2016.

CoreSite also announced on September 2, 2016, a dividend of

$0.4531 per share of Series A preferred stock for the period July

15, 2016, to October 16, 2016. The preferred dividend was paid on

October 17, 2016, to shareholders of record on September 30,

2016.

2016 Guidance

CoreSite is increasing its 2016 guidance for net income

attributable to common shares to a range of $1.46 to $1.50 from the

previous range of $1.41 to $1.49. In addition, CoreSite is

increasing its 2016 guidance for FFO per diluted share and unit to

a range of $3.61 to $3.65 from the previous range of $3.56 to

$3.64, with the difference between FFO and net income being real

estate depreciation and amortization.

This outlook is predicated on current economic conditions,

internal assumptions about CoreSite’s customer base, and the supply

and demand dynamics of the markets in which CoreSite operates. The

guidance does not include the impact of any future financing,

investment or disposition activities, beyond what has already been

disclosed.

Upcoming Conferences and

Events

CoreSite will participate in the RBC Technology, Internet, Media

& Telecommunications Conference on November 9-10 at the Westin

Times Square in New York City and NAREIT’s REITWorld conference on

November 15-17 at the JW Marriott Phoenix Desert Ridge Resort &

Spa in Phoenix, Arizona.

Conference Call Details

CoreSite will host a conference call on October 27, 2016, at

12:00 p.m., Eastern Time (10:00 a.m., Mountain Time), to discuss

its financial results, current business trends and market

conditions.

The call can be accessed live over the phone by dialing

877-407-3982 for domestic callers or 201-493-6780 for international

callers. A replay will be available shortly after the call and can

be accessed by dialing 844-512-2921 for domestic callers or

412-317-6671 for international callers. The passcode for the replay

is 13646351. The replay will be available until November 10,

2016.

Interested parties may also listen to a simultaneous webcast of

the conference call by logging on to CoreSite’s website at

www.CoreSite.com and clicking on the “Investors” link. The on-line

replay will be available for a limited time beginning immediately

following the call.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure,

reliable, high-performance data center and interconnection

solutions to a growing customer ecosystem across eight key North

American markets. More than 1,000 of the world’s leading

enterprises, network operators, cloud providers, and supporting

service providers choose CoreSite to connect, protect and optimize

their performance-sensitive data, applications and computing

workloads. Our scalable, flexible solutions and 400+ dedicated

employees consistently deliver unmatched data center options — all

of which leads to a best-in-class customer experience and lasting

relationships. For more information, visit www.CoreSite.com.

Forward-Looking

Statements

This earnings release and accompanying supplemental information

may contain forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “approximately,” “intends,” “plans,” “pro forma,”

“estimates” or “anticipates” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters. Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and contingencies, many

of which are beyond CoreSite’s control that may cause actual

results to differ significantly from those expressed in any

forward-looking statement. These risks include, without limitation:

the geographic concentration of the company’s data centers in

certain markets and any adverse developments in local economic

conditions or the demand for data center space in these markets;

fluctuations in interest rates and increased operating costs;

difficulties in identifying properties to acquire and completing

acquisitions; significant industry competition; the company’s

failure to obtain necessary outside financing; the company’s

failure to qualify or maintain its status as a REIT; financial

market fluctuations; changes in real estate and zoning laws and

increases in real property tax rates; and other factors affecting

the real estate industry generally. All forward-looking statements

reflect the company’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

Furthermore, the company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes. For a further discussion

of these and other factors that could cause the company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the company’s most

recent annual report on Form 10-K, and other risks described in

documents subsequently filed by the company from time to time with

the Securities and Exchange Commission.

Consolidated Balance Sheets

(in thousands)

September 30,2016

December 31,2015

Assets: Investments in real estate: Land $ 82,463 $ 74,819

Buildings and improvements 1,186,712 1,037,127

1,269,175 1,111,946 Less: Accumulated depreciation and

amortization (345,224 ) (284,219 ) Net investment in

operating properties 923,951 827,727 Construction in progress

272,928 183,189 Net investments in real

estate 1,196,879 1,010,916 Cash and

cash equivalents 6,296 6,854 Accounts and other receivables, net

16,103 12,235 Lease intangibles, net 3,249 4,714 Goodwill 41,191

41,191 Other assets, net 96,274 86,633

Total assets $ 1,359,992

$ 1,162,543 Liabilities and

equity: Liabilities Debt, net $ 590,992 $ 391,007

Accounts payable and accrued expenses 86,129 75,783 Accrued

dividends and distributions 28,630 28,104 Deferred rent payable

7,577 7,934 Acquired below-market lease contracts, net 4,059 4,693

Unearned revenue, prepaid rent and other liabilities 33,444

28,717

Total liabilities

750,831 536,238

Stockholders' equity Series A cumulative preferred stock

115,000 115,000 Common stock, par value $0.01 334 301 Additional

paid-in capital 436,311 390,200 Accumulated other comprehensive

loss (2,141 ) (493 ) Distributions in excess of net income

(105,756 ) (88,891 ) Total stockholders' equity 443,748

416,117 Noncontrolling interests 165,413

210,188

Total equity 609,161

626,305 Total liabilities and

equity $ 1,359,992 $

1,162,543 Consolidated Statements of

Operations (in thousands, except share and per share

data)

Three Months Ended

Nine Months Ended

September 30,2016

June 30,2016

September 30,2015

September 30,2016

September 30,2015

Operating revenues: Data center revenue: Rental revenue $

54,219 $ 52,364 $ 47,135 $ 156,954 $ 133,282 Power revenue 28,844

26,401 23,543 80,819 64,782 Interconnection revenue 13,374 12,977

11,400 39,093 32,210 Tenant reimbursement and other 2,826

2,326 2,357 6,982

6,049 Total data center revenue 99,263 94,068 84,435

283,848 236,323 Office, light-industrial and other revenue 2,011

2,022 1,947 5,996

6,050 Total operating revenues 101,274 96,090 86,382

289,844 242,373

Operating expenses: Property

operating and maintenance 28,283 25,576 24,203 78,522 65,965 Real

estate taxes and insurance 3,524 3,070 3,216 9,659 8,421

Depreciation and amortization 26,981 26,227 24,347 77,978 71,209

Sales and marketing 4,465 4,501 3,775 13,187 11,813 General and

administrative 9,432 8,818 8,644 26,970 24,461 Rent 5,967 5,334

5,440 16,718 15,690 Transaction costs 117 6

6 126 51 Total

operating expenses 78,769 73,532

69,631 223,160 197,610

Operating income 22,505 22,558 16,751

66,684 44,763 Gain on real estate disposal — — — — 36

Interest income 34 — 1 35 5 Interest expense (3,222 )

(2,680 ) (2,188 ) (7,914 ) (5,183 ) Income

before income taxes 19,317 19,878 14,564 58,805 39,621 Income tax

benefit (expense) 2 (43 ) (34 )

(45 ) (149 )

Net income 19,319 19,835

14,530 58,760 39,472 Net income attributable

to noncontrolling interests 5,055 5,715

5,526 17,031 16,193 Net income

attributable to CoreSite Realty Corporation 14,264 14,120 9,004

41,729 23,279 Preferred stock dividends (2,084 )

(2,085 ) (2,084 ) (6,253 ) (6,253 )

Net

income attributable to common shares $ 12,180

$ 12,035 $ 6,920

$ 35,476 $ 17,026

Net income per share attributable to common shares:

Basic $ 0.36 $ 0.38 $

0.26 $ 1.11 $ 0.71

Diluted $ 0.36 $ 0.37

$ 0.26 $ 1.10

$ 0.69 Weighted average common shares

outstanding: Basic 33,425,762 32,022,845 26,126,332 31,906,000

24,029,106 Diluted 33,912,155 32,435,606 26,549,537 32,361,367

24,544,612

Reconciliations of Net Income to FFO

(in thousands, except per share data)

Three Months Ended Nine Months

Ended

September 30,2016

June 30,2016

September 30,2015

September 30,2016

September 30,2015

Net income $ 19,319 $ 19,835 $ 14,530 $ 58,760 $ 39,472 Real estate

depreciation and amortization 25,533 24,864 22,818 73,782 64,414

Gain on real estate disposal — — — —

(36) FFO $ 44,852 $ 44,699 $ 37,348 $ 132,542 $ 103,850

Preferred stock dividends (2,084) (2,085)

(2,084) (6,253) (6,253)

FFO available to common

shareholders and OP unit holders $ 42,768

$ 42,614 $ 35,264 $

126,289 $ 97,597 Weighted average

common shares outstanding - diluted 33,912 32,436 26,550 32,361

24,545 Weighted average OP units outstanding - diluted 13,851

15,239 20,861 15,310 22,839 Total

weighted average shares and units outstanding - diluted 47,763

47,675 47,411 47,671 47,384

FFO per common share and OP

unit - diluted $ 0.90 $ 0.89

$ 0.74 $ 2.65 $ 2.06

Funds From Operations “FFO” is a supplemental measure of our

performance which should be considered along with, but not as an

alternative to, net income and cash provided by operating

activities as a measure of operating performance and liquidity. We

calculate FFO in accordance with the standards established by the

National Association of Real Estate Investment Trusts (“NAREIT”).

FFO represents net income (loss) (computed in accordance with

GAAP), excluding gains (or losses) from sales of property and

undepreciated land and impairment write-downs of depreciable real

estate, plus real estate related depreciation and amortization

(excluding amortization of deferred financing costs) and after

adjustments for unconsolidated partnerships and joint ventures. FFO

attributable to common shares and units represents FFO less

preferred stock dividends declared during the period.

Our management uses FFO as a supplemental performance measure

because, in excluding real estate related depreciation and

amortization and gains and losses from property dispositions, it

provides a performance measure that, when compared year over year,

captures trends in occupancy rates, rental rates and operating

costs.

We offer this measure because we recognize that FFO will be used

by investors as a basis to compare our operating performance with

that of other REITs. However, because FFO excludes depreciation and

amortization and captures neither the changes in the value of our

properties that result from use or market conditions, nor the level

of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our properties,

all of which have real economic effect and could materially impact

our financial condition and results from operations, the utility of

FFO as a measure of our performance is limited. FFO is a non-GAAP

measure and should not be considered a measure of liquidity, an

alternative to net income, cash provided by operating activities or

any other performance measure determined in accordance with GAAP,

nor is it indicative of funds available to fund our cash needs,

including our ability to pay dividends or make distributions. In

addition, our calculations of FFO are not necessarily comparable to

FFO as calculated by other REITs that do not use the same

definition or implementation guidelines or interpret the standards

differently from us. Investors in our securities should not rely on

these measures as a substitute for any GAAP measure, including net

income.

Reconciliations of Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA): (in thousands)

Three Months Ended

Nine Months Ended

September 30,2016

June 30,2016

September 30,2015

September 30,2016

September 30,2015

Net income $ 19,319 $ 19,835 $ 14,530 $ 58,760 $ 39,472

Adjustments: Interest expense, net of interest income 3,188 2,680

2,187 7,879 5,178 Income taxes (2) 43 34 45 149 Depreciation and

amortization 26,981 26,227 24,347

77,978 71,209

EBITDA $ 49,486 $

48,785 $ 41,098 $ 144,662

$ 116,008 Non-cash compensation 2,470 2,311 1,944

6,874 5,305 Gain on real estate disposal — — — — (36) Transaction

costs / litigation 158 26 656 187

931

Adjusted EBITDA $ 52,114 $

51,122 $ 43,698 $ 151,723

$ 122,208

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. We calculate adjusted EBITDA by

adding our non-cash compensation expense, transaction costs and

litigation expense as well as adjusting for the impact of

impairment charges, gains or losses from sales of property and

undepreciated land and gains or losses on early extinguishment of

debt. Management uses EBITDA and adjusted EBITDA as indicators of

our ability to incur and service debt. In addition, we consider

EBITDA and adjusted EBITDA to be appropriate supplemental measures

of our performance because they eliminate depreciation and

interest, which permits investors to view income from operations

without the impact of non-cash depreciation or the cost of debt.

However, because EBITDA and adjusted EBITDA are calculated before

recurring cash charges including interest expense and taxes, and

are not adjusted for capital expenditures or other recurring cash

requirements of our business, their utilization as a cash flow

measurement is limited.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027005784/en/

CoreSite ContactGreer

AvivVice President of Investor Relations and Media/Public

Relations+1 303-405-1012+1 303-222-7276Greer.Aviv@CoreSite.com

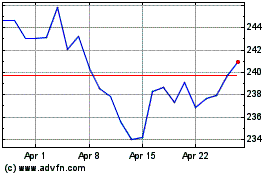

Cencora (NYSE:COR)

Historical Stock Chart

From Jun 2024 to Jul 2024

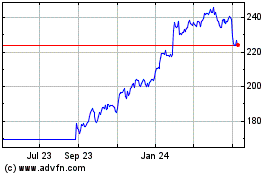

Cencora (NYSE:COR)

Historical Stock Chart

From Jul 2023 to Jul 2024