CoreSite Realty Corporation (NYSE: COR), a national provider of

powerful, network-rich data centers, today announced financial

results for the first quarter 2011.

Highlights:

- Reported revenue of $40 million,

representing an increase of $1.6 million, or 4.2%, over the prior

quarter

- Reported FFO of $0.25 per diluted

share

- Executed gross leasing of 75,000 NRSF,

including 42,583 NRSF of new and expansion data center leases

representing $5.8 million of annualized GAAP rent with a

weighted-average lease term of 6 years

- Achieved a 92.9% rent-retention ratio

with 23.3% GAAP rent growth on renewals

- Increased data center occupancy by 310

basis points over Q4 2010

Tom Ray, CoreSite’s Chief Executive Officer, commented,

“CoreSite executed its plan purposefully and successfully in the

first quarter. We recorded strong leasing momentum marked by robust

new and expansion lease executions. We also achieved solid renewal

activity, achieving a rent-retention ratio of 92.9% and rent growth

of 23.3% on a GAAP basis. Our leasing for the quarter was

distributed throughout our national portfolio, reflecting the

strength of our national platform and the breadth of our business

model. We made significant progress expanding our platform in key

markets and remain on schedule with our construction activities at

Coronado-Stender and 12100 Sunrise Valley Drive. In summary, we are

pleased with our accomplishments for the quarter and excited about

our organization’s position to achieve our goals for the year.”

Financial Results

The Company reported funds from operations (“FFO”) of $11.3

million, or $0.25 per diluted share, for the three months ended

March 31, 2011. Total operating revenue for the three months ended

March 31, 2011 was approximately $40.0 million, a 4.2% increase on

a sequential quarter basis. The Company reported a net loss for the

three months ended March 31, 2011 of $7.9 million and a net loss

attributable to common shares of $3.4 million, or $0.17 per diluted

share. Results from the quarter reflect a charge of $0.6 million in

property tax expenses attributable to prior periods.

A reconciliation of GAAP net loss to funds from operations can

be found in the Company’s supplemental financial presentation

available on its website at www.CoreSite.com.

Operations and Leasing

Activity

The Company signed approximately 75,000 net rentable square feet

(“NRSF”) of gross leasing activity, including 52,134 NRSF of new

and expansion leases during the quarter. The new and expansion

leases were comprised of 42,583 NRSF of data center leases at a

weighted average GAAP rate of $137 per NRSF with a weighted average

lease term of 6.0 years and 9,551 NRSF of office and light

industrial leases at a GAAP rental rate of $30 per NRSF.

During the first quarter, data center lease commencements

totaled 41,812 NRSF at a weighted average GAAP rental rate of $138

per NRSF. Data center occupancy increased to 83.6% for a gain of

310 basis points from the period ended December 31, 2010. The

leases that commenced during the quarter include 22,649 NRSF signed

during the quarter and 19,163 NRSF signed in prior periods. As of

March 31, 2011, the Company had executed and not yet commenced

leases for 40,037 NRSF of space, which upon full commencement will

contribute an additional $6.0 million in annualized rent.

Renewal leases totaling 22,452 NRSF commenced in the first

quarter at a weighted average rate of $158 per NRSF, representing a

retention rate of 92.9% and a 23.3% increase over expiring leases

on a GAAP basis, or a 16.7% increase on a cash basis. The strong

renewal results were driven by activity at the Company’s

network-dense sites.

Development and Redevelopment

Activity

As of March 31, 2011, the Company owned land and buildings

sufficient to increase its operating data center space by 973,590

NRSF, or 86.2%, through the development or redevelopment of (1)

102,686 NRSF of data center space currently under construction, (2)

326,820 NRSF of office and industrial space currently available for

redevelopment, (3) 148,234 NRSF of currently operating space

targeted for future redevelopment, comprised of 45,283 NRSF of

office space and 102,951 NRSF of data center space targeted for

upgrade to more robust specifications, and (4) 395,850 NRSF of new

data center space that can be developed on land that the Company

currently owns at its Coronado-Stender properties.

The total estimated cost to complete the 102,686 NRSF under

construction at March 31, 2011 plus the 97,946 NRSF of

redevelopment the Company plans to commence construction on prior

to December 31, 2011 is $137.7 million. $28.4 million has already

been incurred through March 31, 2011, including investments during

the first quarter of $16.2 million in its 2972 Stender Way project

and $4.2 million in its 12100 Sunrise Valley Drive project. The

Company estimates that the total cost of 2972 Stender will be $67.0

million and the total cost of the 12100 Sunrise Valley Drive

project will be approximately $30.5 million.

Balance Sheet and

Liquidity

As of March 31, 2011, the Company had $125.6 million of total

long-term debt equal to 14.4% of the undepreciated book value of

total assets and equal to 2.2x annualized adjusted EBITDA for the

quarter ended March 31, 2011.

At quarter end, the Company had $73.2 million of cash available

on its balance sheet and $100.8 million of available capacity under

its revolving credit facility.

Subsequent to the end of the quarter, CoreSite closed on a

discounted payoff of a $10.0 million mezzanine loan that was

secured by its 427 LaSalle property, which was scheduled to mature

in March 2012. The debt was repaid at a 5% discount to par,

resulting in a reduction of $500,000 to the principal balance due

at closing. The payoff reduced the Company’s 2012 maturities to

$30.0 million and total long-term debt to $115.6 million.

Dividend

On March 15, 2011, the Company’s Board of Directors declared a

dividend of $0.13 per share of common stock and common stock

equivalents for the first quarter of 2011.

The dividend was paid on April 15, 2011 to stockholders of

record as of March 31, 2011.

Upcoming Conferences and

Events

The Company will participate in NAREIT’s REITWeek conference

from June 7th through June 9th at the Waldorf Astoria in New York,

New York.

Conference Call Details

The Company will host a conference call May 5th at 12:00 p.m.

(Eastern Time) to discuss its financial results, current business

trends and market conditions.

The call can be accessed live over the phone by dialing (877)

407-9039 for domestic callers and (201) 689-8470 for international

callers. A replay will be available shortly after the call and can

be accessed by dialing (877) 870-5176 for domestic callers, or for

international callers, (858) 384-5517. The passcode for the replay

is 370194. The replay will be available until May 12, 2011.

Interested parties may also listen to a simultaneous webcast of

the conference call by logging on to the Company's website at

www.CoreSite.com and clicking on the “Investors” tab. The on-line

replay will be available for a limited time beginning immediately

following the call.

About CoreSite

CoreSite Realty Corporation (NYSE: COR) delivers powerful,

network-rich data centers that optimize, secure and interconnect

the mission-critical IT assets of the world’s top organizations.

600+ customers, including Global 1000 enterprises, cloud providers,

financial firms, and government agencies, choose CoreSite for

reliability, service and expertise in delivering customized,

flexible data center solutions. CoreSite offers private data

centers and suites, cage-to-cabinet colocation, and interconnection

services, such as Any2, CoreSite’s Internet exchange. The Company’s

portfolio comprises more than two million square feet, including

space held for redevelopment and development, and provides access

to more than 200 network service providers via 11 data centers in

seven key U.S. economic centers. Obtain more information at

www.CoreSite.com.

Forward Looking Statements

This earnings release and accompanying supplemental information

may contain forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “approximately,” “intends,” “plans,” “pro forma,”

“estimates” or “anticipates” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters. Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and contingencies, many

of which are beyond the Company’s control, that may cause actual

results to differ significantly from those expressed in any

forward-looking statement. These risks include, without limitation:

the geographic concentration of the Company’s data centers in

certain markets and any adverse developments in local economic

conditions or the demand for data center space in these markets;

fluctuations in interest rates and increased operating costs;

difficulties in identifying properties to acquire and completing

acquisitions; significant industry competition; the Company’s

failure to obtain necessary outside financing; the Company’s

failure to qualify or maintain our status as a REIT; financial

market fluctuations; changes in real estate and zoning laws and

increases in real property tax rates; and other factors affecting

the real estate industry generally. All forward-looking statements

reflect the Company’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

Furthermore, the Company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes. For a further discussion

of these and other factors that could cause the Company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the Company’s annual

report on Form 10-K for the year ended December 31, 2010, and other

risks described in documents subsequently filed by the Company from

time to time with the Securities and Exchange Commission.

Consolidated Balance Sheets (in thousands,

except per share data)

March 31,2011

December 31,2010

Assets: (unaudited) Investments in real estate: Land

$ 84,738 $ 84,738 Building and building improvements 454,018

450,097 Leasehold improvements 76,803 75,800

615,559 610,635 Less: Accumulated depreciation and

amortization (41,365 ) (32,943 ) Net investment in

operating properties 574,194 577,692 Construction in progress

34,913 11,987

Net investments in

real estate 609,107 589,679 Cash

and cash equivalents 73,210 86,246 Restricted cash 14,967 14,968

Accounts and other receivables, net 6,185 5,332 Lease intangibles,

net 60,880 71,704 Goodwill 41,191 41,191 Other assets 25,132

23,906

Total assets $

830,672 $ 833,026

Liabilities and stockholders' equity: Liabilities

Mortgage loans payable $ 125,560 $ 124,873 Accounts payable and

accrued expenses 37,488 26,393 Deferred rent payable 2,643 2,277

Acquired below-market lease contracts, net 15,293 16,415 Prepaid

rent and other liabilities 8,683 8,603

Total liabilities 189,667 178,561

Stockholders' equity Common stock, par value

$0.01, 100,000,000 shares authorized and 19,870,508 shares issued

and outstanding at March 31, 2011; 19,644,042 shares issued and

outstanding at December 31 and September 30, 2010 194 194

Additional paid-in capital 239,933 239,453 Accumulated other

comprehensive income 41 52 Accumulated deficit (13,416 )

(7,460 ) Total stockholders' equity 226,752 232,239

Noncontrolling interests 414,253 422,226

Total equity 641,005 654,465

Total liabilities and stockholders' equity

$ 830,672 $ 833,026

Consolidated Statements of Operations

(in thousands, except share and per share data)

Three

Months Ended:

March 31,2011

December 31,2010

Operating revenues: Rental revenue $ 25,210 $ 24,428 Power

revenue 9,781 9,403 Tenant reimbursement 1,720 1,501 Other revenue

3,255 3,020 Total operating revenues

39,966 38,352

Operating expenses: Property operating

and maintenance 12,023 12,107 Real estate taxes and insurance 2,743

1,642 Depreciation and amortization 19,473 19,146 Sales and

marketing 1,377 1,341 General and administrative 5,617 4,987 Rent

4,547 4,551 Total operating expenses

45,780 43,774

Operating

loss (5,814 ) (5,422 ) Interest income 66 77 Interest

expense (2,252 ) (2,325 ) Loss before income

taxes (8,000 ) (7,670 ) Income taxes 84 223

Net loss (7,916 ) (7,447 ) Net loss attributable to

noncontrolling interests (4,544 ) (4,275 ) Net loss

attributable to common shares $ (3,372 ) $ (3,172 ) Weighted

average common shares outstanding - basic and diluted 19,458,605

19,458,605 Net loss per share attributable to common shares

- basic and diluted $ (0.17 ) $ (0.16 )

Reconciliation of net loss to funds

from operations (FFO):

Three Months Ended:

March 31,2011

December 31,2010

Net loss $ (7,916 ) $ (7,447 ) Adjustments: Real estate

depreciation and amortization 19,237 18,936

FFO available to common shareholders and OP unitholders

$ 11,321 $ 11,489 Weighted average

common shares and OP units outstanding - diluted 45,689,418

45,684,670 FFO per common share and OP unit - diluted $ 0.25

$ 0.25

CoreSite Realty Corporation considers FFO to be a supplemental

measure of performance which should be considered along with, but

not as an alternative to, net income and cash provided by operating

activities as a measure of operating performance and liquidity. The

Company calculates FFO in accordance with the standards established

by NAREIT. FFO represents net income (loss) (computed in accordance

with GAAP), excluding gains (or losses) from sales of property,

real estate related depreciation and amortization (excluding

amortization of deferred financing costs) and after adjustments for

unconsolidated partnerships and joint ventures. Management uses FFO

as a supplemental performance measure because, in excluding real

estate related depreciation and amortization and gains and losses

from property dispositions, it provides a performance measure that,

when compared year over year, captures trends in occupancy rates,

rental rates and operating costs.

The Company offers this measure because management recognizes

that FFO will be used by investors as a basis to compare operating

performance with that of other REITs. However, because FFO excludes

depreciation and amortization and captures neither the changes in

the value of the properties that result from use or market

conditions, nor the level of capital expenditures and capitalized

leasing commissions necessary to maintain the operating performance

of the properties, all of which have real economic effect and could

materially impact financial condition and results from operations,

the utility of FFO as a measure of performance is limited. FFO is a

non-GAAP measure and should not be considered a measure of

liquidity, an alternative to net income, cash provided by operating

activities or any other performance measure determined in

accordance with GAAP, nor is it indicative of funds available to

fund cash needs, including the ability to pay dividends or make

distributions. In addition, the Company’s calculations of FFO are

not necessarily comparable to FFO as calculated by other REITs that

do not use the same definition or implementation guidelines or

interpret the standards differently. Investors in the Company’s

securities should not rely on these measures as a substitute for

any GAAP measure, including net income.

Reconciliation of earnings before interest, taxes, depreciation

and amortization (EBITDA): Three Months Ended:

March 31,2011

December 31,2010

Net loss $ (7,916 ) $ (7,447 ) Adjustments: Interest

expense, net of interest income 2,186 2,248 Income taxes (84 ) (223

) Depreciation and amortization 19,473

19,146 EBITDA $ 13,659 $ 13,724 Non-cash compensation

497 517 Adjusted EBITDA $

14,156 $ 14,241

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. We calculate adjusted EBITDA by

adding our non-cash compensation expense to EBITDA. Management uses

EBITDA and adjusted EBITDA as indicators of our ability to incur

and service debt. In addition, we consider EBITDA and adjusted

EBITDA to be appropriate supplemental measures of our performance

because they eliminate depreciation and interest, which permits

investors to view income from operations without the impact of

non-cash depreciation or the cost of debt. However, because EBITDA

and adjusted EBITDA are calculated before recurring cash charges

including interest expense and taxes, and are not adjusted for

capital expenditures or other recurring cash requirements of our

business, their utilization as a cash flow measurement is

limited.

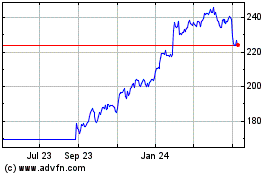

Cencora (NYSE:COR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Jul 2023 to Jul 2024