Kimco Reports in Line - Analyst Blog

May 05 2011 - 10:00AM

Zacks

Kimco Realty Corp.

(KIM), a leading real estate investment trust (REIT), reported

first quarter 2011 rental revenues of $224.0 million compared with

$213.4 million in the year-earlier quarter – an increase of 5.0%.

Total revenues for the reported quarter exceeded the Zacks

Consensus Estimate of $216.0 million.

Kimco reported first quarter 2011

FFO (fund from operations) of $115.1 million or 28 cents per share

compared with $126.0 million or 31 cents in the year-ago period.

Fund from operations, a widely used metric to gauge the performance

of REITs, is obtained after adding depreciation and amortization

and other non-cash expenses to net income.

Excluding certain non-recurring

items, FFO for the reported quarter was $121.2 million or 30 cents

per share compared with $115.6 million or 28 cents in the

year-earlier quarter. The recurring FFO for the quarter was in line

with the Zacks Consensus Estimate.

Overall occupancy in Kimco’s

combined shopping center portfolio was 92.8% at the end of the

quarter, an increase of 20 bps compared with first quarter 2010. In

the U.S. portfolio, occupancy was 92.5% as of March 31, 2011, an

increase of 40 bps compared with the year-ago period. Same-store

net operating income (cash-basis, excluding lease termination fees

and including charges for bad debts) in the U.S. portfolio

increased 1.1% year-over-year.

During the reported quarter, Kimco

executed a total of 696 leases spanning 2.6 million square feet.

These included 106 new leases in the same-store portfolio totaling

347,000 pro-rata square feet and 376 lease renewals and options for

1.8 million pro-rata square feet. In addition, Kimco executed over

200 new leases totaling 393,000 square feet for spaces vacant for

more than one year. Leasing spreads in the U.S. portfolio increased

1.4% (cash basis).

The company acquired 2 shopping

centers during the quarter, along with a land parcel for

approximately $37.4 million, including $15.4 million in mortgage

debt. Subsequent to the quarter-end, Kimco acquired a grocery

anchored shopping center for $13.7 million, including $9.3 million

of mortgage debt, and sold 2 unencumbered non-strategic shopping

centers for $3.2 million.

The reported quarter also saw the

company recognizing $9.7 million of fee income related to its

investment management business, including $7.5 million in

management fees, $0.1 million in acquisition fees and $2.1 million

in other ongoing fees. Kimco had 284 properties in investment

management funds with 24 institutional partners at quarter-end.

During the quarter, the company

generated $15.1 million of income from its structured investments

and other non-retail assets, out of which $14.6 million was

recurring in nature. During first quarter 2011, Kimco reduced its

non-retail investments by $11 million primarily from the sale of

marketable securities as well as the sale of one of the Canadian

hotels in the Westmont joint venture. As of April 30, 2011, Kimco

reduced its non-retail assets to approximately $612 million

compared to $1.2 billion at the end of first quarter 2009.

At quarter-end, Kimco had over $1.7

billion available under its revolving credit facilities. The

company’s consolidated net debt to recurring EBITDA (earnings

before interest, tax, depreciation and amortization) ratio was

6.2x. For fiscal 2011, the company reiterated its earlier recurring

FFO guidance in the range of $1.17 – $1.21 per share.

We maintain our ‘Neutral’

recommendation for the long term on the stock, which presently has

a Zacks #3 Rank translating into a short-term ‘Hold’ rating.

However, we have an ‘Outperform’ recommendation and a Zacks #3 Rank

for CBL & Associates Properties Inc. (CBL),

one of the competitors of Kimco.

CBL&ASSOC PPTYS (CBL): Free Stock Analysis Report

KIMCO REALTY CO (KIM): Free Stock Analysis Report

Zacks Investment Research

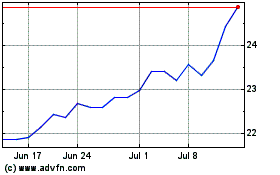

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From May 2024 to Jun 2024

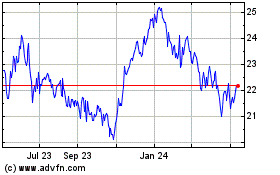

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jun 2023 to Jun 2024