Archer Daniels Beats by a Penny - Analyst Blog

May 03 2011 - 5:09AM

Zacks

Archer Daniels Midland Company (ADM) reported

robust third-quarter 2011 results. Net income for the reported

quarter was $578.0 million or 86 cents per share compared with

$421.0 million or 65 cents per share in the year-ago quarter.

Quarterly earnings also outpaced the Zacks Consensus Estimate by a

penny.

The robust quarterly result was primarily attributable to

increased segmental profit, partially offset by negative

discrepancy from changes in Last-In-First-Out (LIFO) inventory

valuations caused by higher agricultural commodity prices.

Quarterly Details

Archer Daniels' quarterly net sales increased 32.6% year over

year to $20,077.0 million, beating the Zacks Consensus Estimate of

$17,279.0 million. The growth in net sales was mainly attributable

to a robust jump of 37.6% in Agricultural Services to $9,340.0

million, a 30.6% rise in Oilseeds Processing revenues to $6,642.0

million and an increase of 28.2% in Corn Processing revenues to

$2,513.0 million.

Total segment operating profit for Archer Daniels increased to

$1,006.0 million from $696.0 million in the prior-year quarter.

Operating profit for Agricultural Services segment grew 3.6% to

$171.0 million from $165 million in the year-ago period, reflecting

strong results from global merchandising operations and record

export volumes from the United States, partially offset by

significant volatility in agricultural commodity prices, regional

instability in Middle East and North Africa and earthquake and

tsunami in Japan.

Archer Daniels' Corn Processing segment's operating profit

climbed to $204.0 million from $104.0 million last year. The

increase was primarily attributed to a significant improvement in

bio-products performance, stemming from better margins of ethanol

and lysine. Moreover, processing volume increased by 13%. However,

growth in the segment operating income was partially offset by

higher net corn costs.

Archer Daniels' Oilseeds Processing segment recorded a quarterly

operating profit of $512.0 million compared with an operating

profit of $405.0 million in the year-ago period. The increase was

primarily attributable to better performance in North America and a

favorable mark-to-market timing effect in Europe, partially offset

by a weak performance in Asia. Operating profit from the Other

business segment came in at $119.0 million compared with an

operating profit of $22.0 million in the year-ago quarter.

The long-term debt-to-capitalization ratio was 33.8% compared

with a long-term debt-to-capitalization ratio of 32.9% in the

prior-year quarter.

Archer Daniels, which competes with Bunge

Limited (BG) and Corn Products International

Inc. (CPO), currently has a Zacks #3 Rank, implying a

short-term Hold rating on the stock. Besides, the company retains a

long-term Neutral recommendation.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

Zacks Investment Research

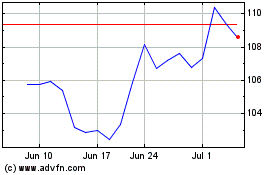

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

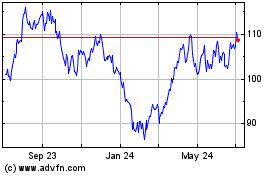

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024