Petrobras Steps Into Brazil Ethanol Consolidation

June 21 2010 - 1:30PM

Dow Jones News

Consolidation in Brazil's sugar and ethanol sector continues to

motor ahead with a new ethanol joint venture between state-run oil

giant Petroleo Brasileiro SA (PBR, PETR4.BR), or Petrobras, and

sugar producer Sao Martinho SA (SMTO3.BR).

Petrobras said on Monday that it will pay 420.8 million

Brazilian reals ($239 million) for the 49% stake in the joint

venture company called Nova Fronteira Bioenergia S.A., which will

operate two mills in Goias state.

The deal marks the third big play by an oil major in Brazil's

fragmented--but rapidly consolidating--ethanol industry, with

companies jockeying for a slice of the world's largest center for

sugarcane-based ethanol production.

"This is another sign of Brazil's sugar and ethanol sector

quickly consolidating and there is plenty of room for more deals,"

Julio Borges, president of JOB Economia, a company specializing in

sugar and ethanol in Sao Paulo, told Dow Jones Newswires.

Oil companies such as Petrobras and even troubled BP PLC (BP) as

well as Cosan Industria e Comercio SA (CSAN3.BR), the world's

largest sugar and ethanol group, and Archer Daniels Midland (ADM)

are all open to making more acquisitions in Brazil's ethanol

sector, Borges said.

Borges said that the market will be increasingly dominated by

large, well-capitalized companies. "This is just the start," he

added.

Monday's deal follows Petrobras's move in May to take a 45.7%

stake in sugar group Guarani for 1.6 billion Brazilian reals ($911

million). Guarani is Brazil's fourth-largest sugarcane miller.

In February, Royal Dutch Shell PLC (RDSA, RDSA.LN) made the

largest foreign investment ever in Brazil's ethanol industry in a

$12 billion tie-up with Cosan. That followed BP's 2008 purchase of

a stake in Tropical Bioenergia SA.

Elsewhere, last year U.S.-based Bunge Ltd. (BG) acquired Usina

Moema Participacoes SA and France's Louis Dreyfus Commodities

purchased giant sugar and ethanol group Santelisa Vale. Cosan also

snapped up local milling group NovAmerica.

Monday's deal benefits both Petrobras and Sao Martinho, Borges

said. Petrobras secures the know-how and expertise of a major

sugarcane milling group, while Sao Martinho gets the financial

backing of Petrobras, he said.

Nova Fronteira will include Sao Martinho's Usina Boa Vista S.A.

ethanol mill and the SMBJ Agroindustrial S.A. greenfield project in

Goias state. Usina Boa Vista currently crushes about 2.5 million

metric tons of sugarcane annually, with plans to boost capacity to

7.0 million tons by the 2014-2015 harvest, Petrobras said.

Bruno Zaneti, a risk consultant at FCStone in Campinas, agreed

that the latest move is part of a shift from family-owned mills.

"Many small mills face heavy debts and they will continue to face

selling pressure from big players," he said.

The move also shows an ongoing migration to the center-west

region from the traditional center-south sugarcane growing region,

which accounts for 90% of the country's sugar output at

present.

Farmland is available in states such as Goias to grow cane at

cheaper prices. But it will require hefty investment in fertilizers

and logistics to reach the main coastal ports for ethanol and sugar

export, Zaneti said.

Petrobras and Sao Martinho will share control of Nova Fronteira,

with each company electing three members to the six-person

board.

-By Tony Danby and Jeff Fick, Dow Jones Newswires;

55-11-3544-7074; Anthony.Danby@dowjones.com

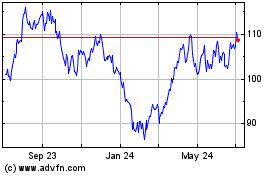

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

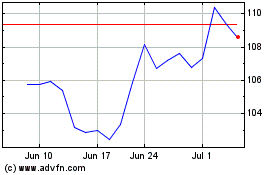

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024