United America Indemnity, Ltd. Completes Sale of Agency Operations

October 02 2006 - 9:30AM

PR Newswire (US)

GEORGE TOWN, Cayman Islands, Oct. 2 /PRNewswire-FirstCall/ --

United America Indemnity, Ltd. (NASDAQ:INDM), announced today that,

effective September 30, 2006, it completed the sale of

substantially all of the assets of Penn Independent Corporation

(PIC), a wholesale broker of commercial excess and surplus lines

and specialty property and casualty insurance, to Brown &

Brown, Inc. (NYSE:BRO). Terms of the transaction are not disclosed;

however, the sale is expected to result in an increase to 2006 net

income of approximately $10 million to United America and an

increase in book value of approximately $0.27 per share. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040211/MXW002LOGO) United

America acquired PIC on January 25, 2005 simultaneously with its

acquisition of Penn-America Group, Inc., a specialty excess and

surplus lines insurance company. With the divestiture of PIC

complete, United America will remain focused on its core

competency, providing excess and surplus lines and specialty

property and casualty insurance and reinsurance products. About

United America Indemnity, Ltd. United America Indemnity, Ltd.

through its several direct and indirect wholly owned subsidiary

insurance companies is a national and international provider of

excess and surplus lines and specialty property and casualty

insurance and reinsurance, both on an admitted and on a

non-admitted basis. The company's principal operating subsidiaries

include: * Penn-America, a provider to small businesses across the

United States of excess and surplus lines property and casualty

insurance through a select network of general agents; * United

National, a provider of specialty excess and surplus lines property

and casualty insurance products in four distinct market segments -

professional liability, class specific property and casualty

insurance programs, specialty property and casualty brokerage, and

umbrella/excess liability; * Wind River Insurance Company, Ltd., a

Bermuda based treaty and facultative reinsurer of excess and

surplus lines and specialty property and casualty insurance. For

more information, visit the United America Indemnity, Ltd.'s

Website at http://www.uai.ky/. Forward-Looking Information This

release contains forward-looking information about United America

Indemnity, Ltd. and the operations of United America Indemnity,

Ltd. that is intended to be covered by the safe harbor for

forward-looking statements provided by the Private Securities

Litigation Reform Act of 1995. Forward looking statements are

statements that are not historical facts. These statements can be

identified by the use of forward-looking terminology such as

"believe," "expect," "may," "will," "should," "project," "plan,"

"seek," "intend," or "anticipate" or the negative thereof or

comparable terminology, and include discussions of strategy,

financial projections and estimates and their underlying

assumptions, statements regarding plans, objectives, expectations

or consequences of the transactions, and statements about the

future performance, operations, products and services of the

companies. The business and operations of United America Indemnity,

Ltd. is and will be subject to a variety of risks, uncertainties

and other factors. Consequently, actual results and experience may

materially differ from those contained in any forward-looking

statements. Such risks, uncertainties and other factors that could

cause actual results and experience to differ from those projected

include, but are not limited to, the following: (1) the

ineffectiveness of United America Indemnity, Ltd.'s business

strategy due to changes incurrent or future market conditions; (2)

the effects of competitors' pricing policies, and of changes in

laws and regulations on competition, including industry

consolidation and development of competing financial products; (3)

greater frequency or severity of claims and loss activity than

United America Indemnity, Ltd.'s underwriting, reserving or

investment practices have anticipated; (4) decreased level of

demand for United America Indemnity, Ltd.'s insurance products or

increased competition due to an increase incapacity of property and

casualty insurers; (5) risks inherent in establishing loss and loss

adjustment expense reserves; (6) uncertainties relating to the

financial ratings of United America Indemnity, Ltd.'s insurance

subsidiaries; (7) uncertainties arising from the cyclical nature of

United America Indemnity, Ltd.'s business; (8) changes in United

America Indemnity, Ltd.'s relationships with, and the capacity of,

its general agents; (9) the risk that United America Indemnity,

Ltd.'s reinsurers may not be able to fulfill obligations; (10)

investment performance and credit risk; and (11) uncertainties

relating to governmental and regulatory policies. The foregoing

review of important factors should be read in conjunction with the

other cautionary statements that are included in United America

Indemnity, Ltd.'s Annual Report on Form 10-K for the fiscal year

ended December 31, 2005, as well as in the materials filed and to

be filed with the U.S. Securities and Exchange Commission (SEC).

United America Indemnity, Ltd. does not make any commitment to

revise or update any forward-looking statements in order to reflect

events or circumstances occurring or existing after the date any

forward-looking statement is made.

http://www.newscom.com/cgi-bin/prnh/20040211/MXW002LOGO DATASOURCE:

United America Indemnity, Ltd. CONTACT: Financial, Kevin L. Tate,

CPA, Chief Financial Officer, +1-610-660-6813, or ; or Media, Paula

Negro, Assistant Vice President, Marketing, +1-610-668-6938, or ,

both for United America Indemnity, Ltd. Web site:

http://www.uai.ky/

Copyright

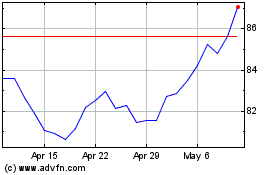

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2024 to Jun 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Jun 2023 to Jun 2024