DAYTONA BEACH and TAMPA, Fla., Oct. 17 /PRNewswire-FirstCall/ --

Brown & Brown, Inc. (NYSE:BRO) announced net income for the

third quarter of 2005 of $34,783,000, or $0.50 per share, an

increase of 15.6% from the $30,086,000, or $0.43 per share,

reported for the quarter ended September 30, 2004. Total revenue

for the quarter ended September 30, 2005 was $190,645,000, compared

with 2004 third-quarter revenue of $160,381,000, an increase of

18.9%. Total revenue for the first nine months of 2005 was

$588,950,000, compared with revenue of $483,888,000 for the

comparable period in 2004, an increase of 21.7%. Net income for the

first nine months of 2005 was $114,834,000, versus $98,587,000

during the comparable 2004 period, an increase of 16.5%. Net income

per share for the nine months ended September 30, 2005 was $1.65,

versus the $1.42 per share posted during the same 2004 period, an

increase of 16.2%. J. Hyatt Brown, Chairman and CEO, noted, "The

third quarter was challenging given the continued softening of

insurance premium rates, coupled with another heavy

August/September hurricane season. Despite these challenges, our

outstanding team of insurance professionals remains focused on

driving new business sales and providing outstanding service to our

customers." President and Chief Operating Officer Jim W. Henderson

added, "We are very proud of how well our recent acquisitions are

performing and the strong operating results that they have added to

our Company. Hyatt and I would also like to pay special tribute to

our employees in our four Louisiana offices that were directly

impacted by hurricanes Katrina and Rita. The manner in which our

team responded to the needs of our customers and neighbors was

remarkable. Our employees throughout the country have additionally

responded with financial aid to the victims of these horrific

storms." Brown & Brown, Inc. and its subsidiaries offer a broad

range of insurance and reinsurance products and services, as well

as risk management, third party administration, and managed health

care programs. Providing service to business, public entity,

individual, trade and professional association clients nationwide.

The Company is ranked by Business Insurance magazine as the United

States' seventh largest independent insurance intermediary. The

Company's Web address is http://www.bbinsurance.com/ . This press

release may contain statements relating to future results which are

forward-looking statements, including those relating to continuing

our revenue, earnings and operating growth, as well as identifying

and consummating attractive acquisition opportunities. These

statements are not historical facts, but instead represent only the

Company's current belief regarding future events, many of which, by

their nature, are inherently uncertain and outside of the Company's

control. It is possible that the Company's actual results,

financial condition and achievements may differ, possibly

materially, from the anticipated results, financial condition and

achievements contemplated by these forward-looking statements.

Further information concerning the Company and its business,

including factors that potentially could materially affect the

Company's financial results and condition, as well as its other

achievements, are contained in the Company's filings with the

Securities and Exchange Commission. Some factors include: general

economic conditions around the country; downward commercial

property and casualty premium pressures; the competitive

environment; the integration of the Company's operations with those

of businesses or assets the Company has acquired or may acquire in

the future and the failure to realize the expected benefits of such

integration; the potential occurrence of a disaster that affects

certain areas of the States of Arizona, California, Florida,

Georgia, New Jersey, New York, Pennsylvania and/or Washington,

where significant portions of the Company's business are

concentrated; the actual costs of resolution of contingent

liabilities; those factors relevant to Brown & Brown's

consummation and integration of announced acquisitions, including

any matters analyzed in the due diligence process, material adverse

changes in the customers of the companies whose operations are

acquired, and material adverse changes in the business and

financial condition of either or both companies and their

respective customers; and the cost and impact on the Company of

previously disclosed litigation initiated against the Company and

regulatory inquiries regarding industry and Company practices with

respect to compensation received from insurance carriers. All

forward-looking statements made herein are made only as of the date

of this release and the Company does not undertake any obligation

to publicly update or correct any forward-looking statements to

reflect events or circumstances that subsequently occur or of which

the Company hereafter becomes aware. Brown & Brown, Inc.

CONSOLIDATED STATEMENTS OF INCOME (in thousands, except per share

data) (unaudited) For the For the Three Months Ended Nine Months

Ended September 30 September 30 2005 2004 2005 2004 REVENUES

Commissions and fees $188,444 $158,852 $581,497 $479,915 Investment

income 1,786 586 4,275 1,607 Other income, net 415 943 3,178 2,366

Total revenues 190,645 160,381 588,950 483,888 EXPENSES Employee

compensation and benefits 94,009 79,449 278,493 232,000 Non-cash

stock grant compensation 681 374 2,360 1,885 Other operating

expenses 25,638 22,042 78,760 63,421 Amortization 8,452 5,777

24,344 16,077 Depreciation 2,538 2,238 7,432 6,661 Interest 3,638

2,245 10,891 3,699 Total expenses 134,956 112,125 402,280 323,743

Income before income taxes 55,689 48,256 186,670 160,145 Income

taxes 20,906 18,170 71,836 61,558 Net income $34,783 $30,086

$114,834 $98,587 Net income per share: Basic $0.50 $0.44 $1.66

$1.43 Diluted $0.50 $0.43 $1.65 $1.42 Weighted average number of

shares outstanding: Basic 69,242 69,009 69,187 68,828 Diluted

69,819 69,588 69,752 69,361 Dividends declared per share $0.08

$0.07 $0.24 $0.21 Brown & Brown, Inc. INTERNAL GROWTH SCHEDULE

Core Commissions and Fees(1) Three Months Ended September 30, 2005

(in thousands) (unaudited) Quarter Quarter Total Total Less

Internal Ended Ended Net Net Acquisition Net 9/30/05 9/30/04 Change

Growth % Revenues Growth % Florida Retail $38,153 $33,917 $4,236

12.5 % $1,456 8.2 % National Retail 49,174 49,177 (3) (0.0)% 1,176

(2.4)% Western Retail 27,116 28,388 (1,272) (4.5)% 642 (6.7)% Total

Retail 114,443 111,482 2,961 2.7 % 3,274 (0.3)% Professional

Programs 10,682 10,964 (282) (2.6)% -- (2.6)% Special Programs

21,945 19,712 2,233 11.3 % 2,566 (1.7)% Total Programs 32,627

30,676 1,951 6.4 % 2,566 (2.0)% Brokerage 31,990 8,949 23,041 257.5

% 20,717 26.0 % TPA Services 6,821 6,163 658 10.7 % -- 10.7 % Total

Core Commissions and Fees (1) $185,881 $157,270 $28,611 18.2 %

$26,557 1.3 % Reconciliation of Internal Growth Schedule to Total

Commissions and Fees Included in the Consolidated Statements of

Income for the Three Months Ended September 30, 2005 and 2004 (in

thousands) (unaudited) Quarter Quarter Ended Ended 9/30/05 9/30/04

Total core commissions and fees(1) $185,881 $157,270 Contingent

commissions 2,563 986 Divested business -- 596 Total commissions

& fees $188,444 $158,852 (1) Total core commissions and fees

are our total commissions and fees less (i) contingent commissions

(revenue derived from special revenue- sharing commissions paid by

insurance companies based primarily upon the profitability of the

business placed with such companies during the prior year, and in

some cases upon the volume or growth of that business), and (ii)

divested business (commissions and fees generated from offices,

books of business or niches sold by the Company or terminated).

Brown & Brown, Inc. CONSOLIDATED BALANCE SHEETS (in thousands,

except per share data) (unaudited) September 30, December 31, 2005

2004 ASSETS Current assets: Cash and cash equivalents $ 76,730 $

188,106 Restricted cash and investments 235,263 147,483 Short-term

investments 2,639 3,163 Premiums, commissions and fees receivable

235,116 172,395 Other current assets 27,473 28,819 Total current

assets 577,221 539,966 Fixed assets, net 38,526 33,438 Goodwill

528,296 360,843 Amortizable intangible assets, net 362,381 293,009

Investments 9,294 9,328 Other assets 10,021 12,933 Total assets

$1,525,739 $1,249,517 LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Premiums payable to insurance companies $ 372,053 $

242,414 Premium deposits and credits due customers 36,083 32,273

Accounts payable 19,238 16,257 Accrued expenses 57,430 58,031

Current portion of long-term debt 50,065 16,135 Total current

liabilities 534,869 365,110 Long-term debt 217,455 227,063 Deferred

income taxes, net 29,571 24,859 Other liabilities 9,045 8,160

Shareholders' equity: Common stock, par value $0.10 per share;

authorized 280,000 shares; issued and outstanding 69,502 at 2005

and 69,159 at 2004 6,950 6,916 Additional paid-in capital 199,189

187,280 Retained earnings 523,879 425,662 Accumulated other

comprehensive income 4,781 4,467 Total shareholders' equity 734,799

624,325 Total liabilities and shareholders' equity $1,525,739

$1,249,517 DATASOURCE: Brown & Brown, Inc. CONTACT: Cory T.

Walker, Chief Financial Officer, Brown & Brown, +1-386-239-7250

Web site: http://www.bbinsurance.com/

Copyright

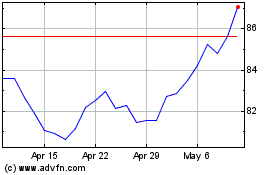

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2024 to Jun 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Jun 2023 to Jun 2024