Brinker International Inc.'s (EAT) fiscal second-quarter

earnings more than doubled, but both sales and traffic at banner

brand Chili's Grill & Bar still haven't recovered.

A key indicator of the casual-dining chain's performance,

same-store sales and customer traffic declines illustrate Chili's

continued struggles coming out of the recession as it aims to

revamp its operations and image.

Brinker, the parent company of Chili's and Maggiano's, benefited

from stronger margins and lower overhead costs in its fiscal second

quarter, reporting results that beat analysts' expectations.

But same-store sales dropped 3.5% at company-owned restaurants,

for the quarter ended Dec. 29, including a 4.9% slide at Chili's

that was partially offset by a 4.7% rise at the family-style

Italian chain Maggiano's.

Chili's customer traffic was down 7.1%, though that was an

improvement from the fiscal first quarter when it dropped 8.1%.

"A lot of what we're seeing in the traffic has more to do with

the promotional aspect and our less aggressive promotional

strategy," than the actual strength of the brand, said Chili's

President Wyman Roberts.

Chili's biggest competitors in the space, Ruby Tuesday Inc. (RT)

and DineEquity Inc.'s (DIN) Applebee's, have seen significant sales

improvement in recent quarters, implying they are leaving Chili's

in the dust--with less of what little bar-and-grill market share

remains.

Roberts said Chili's could create "all kinds of sales driving

strategies" if it wanted to. But instead, it is filtering them by

the overall business model impact they would have. "The key is:

(promotions) must not deteriorate our returns or the guest

experience," he said.

Brinker's shares rose 8% to $22.59 in recent trading.

Chili's has emerged from the recession considerably smaller and

hasn't quite carved out a new niche in the overly saturated bar and

grill sector.

"Despite undeniably impressive margin improvements, we continue

to wait for evidence of top-line momentum, which has yet to

materialize," Morgan Stanley analyst John Glass says in a note.

Continuing increases in key commodities such as wheat and beef

stand in the way of restaurants keeping prices down. Brinker says

71% of its commodities are locked in through the end of the fiscal

year.

Guy Constant, chief financial officer, said he expects

commodities costs to be slightly favorable to flat through the

third quarter, but slightly unfavorable moving into the fourth

quarter.

"There's the potential for commodity inflation in our fiscal

2012," Constant said. "We definitely saw some increase in the

burger contract when we just renewed it in the last couple of

months, and we expect to see that on steaks as well, as the first

indicators of some inflation perhaps for fiscal 2012."

Chili's has been focused on spicing up its existing locations to

better stand up to the competition and striking a balance of

discounting without letting it cut too deep into profits.

Chili's latest deal is a lunch combo that offers an appetizer,

sandwich and fries for $6 to $8. Chili's says the combo is a

permanent menu fixture rather than a promotion and is looking to

build business around it.

Combined with quicker ticket times, the lunch combo puts Chili's

in a better competitive stance against the growing fast-casual

industry, including poster child Chipotle Mexican Grill Inc. (CMG),

which is said to be stealing market share from chains like

Chili's.

Even with the permanent additions of the lunch combo and its "2

for $20" deal, which includes two entrees and a shared appetizer,

Chili's year-over-year same-store-sales comparisons are likely to

remain weak for another couple months as it laps last year's more

aggressive "3 for $20" promotion, which included dessert.

Cost restructuring has been Brinker's biggest redemption, as it

lowers labor costs and makes Chili's kitchens more cost-efficient

through redesigns.

The kitchen retrofit is all about improving the cooking and

serving pace as well as food's consistency. The company is still in

a test phase with just a few kitchens equipped, but plans to

install new equipment into an additional 10 to 15 restaurants in

the late part of the third fiscal quarter.

"These investments require a longer lead time, to prove out the

return on capital and select the best overall solution," Roberts

said. "But once in place, these programs will accelerate the gains

from the previous initiatives and aggressively help us take market

share."

Brinker estimates capital expenditures for the year will be

about $105 million as it rolls out these so-called kitchens of the

future, a $10 million reduction from previous guidance.

For the quarter, Brinker reported a profit of $37.5 million, or

41 cents a share, up from $18.3 million, or 18 cents a share, a

year earlier. Excluding restructuring-related expenses and

restaurant closings, earnings from continuing operations were 38

cents a share, up from 25 cents.

Revenue decreased 4.8% to $671.9 million, though that was an

improvement from a year earlier, when revenue fell 18%, partly on

restaurant closures and the sale of the Romano's Macaroni Grill

locations.

Analysts polled by Thomson Reuters most recently forecast

earnings of 32 cents on revenue of $670 million.

Restaurant operating margin rose 2.1 percentage points to

17.4%.

-By Annie Gasparro and Tess Stynes, Dow Jones Newswires;

212-416-2244; annie.gasparro@dowjones.com

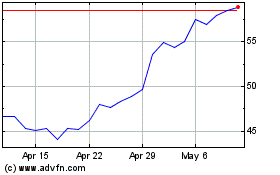

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

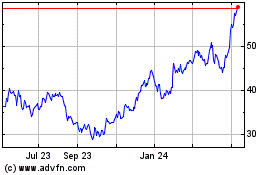

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024