EARNINGS PREVIEW: US Restaurants Seen Buoyed By International Sales

January 18 2011 - 9:29AM

Dow Jones News

TAKING THE PULSE: Most restaurants are expected to report

stronger bottom lines in their latest quarters. Many raised prices

to counter untenable increases in commodity costs, which is tricky

because they're still trying to attract price-sensitive eaters in a

weak economy. Chains also continued to pour money into expansion in

China and to a lesser extent, other emerging international markets.

Those chains that already have a strong presence in those areas are

seen performing particularly well.

COMPANIES TO WATCH:

McDonald's Corp. (MCD) - Reports Jan. 24

Wall Street Expectations: Analysts surveyed by Thomson Reuters

expect earnings of $1.16 a share on revenue of $6.22 billion. For

the same period a year earlier, profit was $1.11 a share including

a small benefit linked to a 2007 license transaction, and revenue

was $5.97 billion.

Key Issues: McDonald's, which succeeded during the downturn

through a dedication to lower prices and an increasingly diverse

menu, raised prices in the latest period but continued to add new

menu options, such as oatmeal for breakfast. Like many, it's

looking for China to be the growth driver in coming years and plans

to boost capital spending there by 40% this year. The bottom line

will suffer slightly from unfavorable foreign exchange.

Brinker International Inc. (EAT) - Reports Jan. 25

Wall Street Expectations: Analysts predict adjusted earnings

from continuing operations of 31 cents a share on revenue of $671

million. The company recorded profit of 29 cents a share on $781.9

million in revenue in the year-ago period.

Key Issues: Brinker management has warned of more sales pressure

as the owner of Chili's Grill & Bar keeps scaling back

promotions, though an improved cost structure should continue to

underlie profit. Brinker is trying to wean itself off the heavy

discounting caused by oversaturation in the bar-and-grill sector.

However, the company is using a lunch discount as it tries to draw

diners attracted to fast-casual restaurants like Chipotle Mexican

Grill Inc. (CMG). Despite the pessimistic sales outlook, Brinker's

board last month approved another $325 million in share

buybacks.

Starbucks Corp. (SBUX) - Reports Jan. 26

Wall Street Expectations: Analysts predict earnings will rise to

39 cents a share on revenue of $2.93 billion. A year earlier,

profit was 32 cents a share including a small restructuring charge

and revenue was $2.72 billion.

Key Issues: The coffee behemoth's successful turnaround has

yielded surging profit and a straight year of comparable-sales

increases, with growth balanced at home and abroad. But the company

is among those that raised prices in the period because of climbing

commodities costs. It also has robust plans for Chinese

expansion--it wants to triple its stores in China in five years and

open its first coffee-bean farm there--and has increased its

attention on India as well. It continues to extend its lucrative

Via instant-coffee brand, although most Starbucks's headlines

recently concerned its vitriolic face-off with Kraft Foods Inc.

(KFT) over terminating a grocery-distribution pact.

Yum! Brands Inc. (YUM) - Reports Feb. 2

Wall Street Expectations: Earnings and revenue are predicted to

rise to 60 cents a share and $3.5 billion, respectively. A year

prior, profit was 45 cents a share including a small amount of

goodwill impairments and other items, while revenue was $3.37

billion.

Key Issues: The owner of KFC, Pizza Hut and Taco Bell is poised

to push the percentage of its total operating profit derived from

China above 50%. Yum already leads other fast-food chain companies

there by number of locations. Yum it calls only the "ground floor"

of its plans in the country. The company's domestic business was

weak in the previous quarter, though. While Chief Executive David

Novak warned in a television interview the company is considering

raising prices, the increases haven't appeared, which may put Yum

under more margin pressure than rivals.

Wendy's/Arby's Group Inc. (WEN) - Expected March 3

Wall Street Expectations: Analysts expect the company to break

even on revenue of $831 million. Profit a year earlier was 3 cents

a share with charges--it was 7 cents excluding them--on revenue of

$900.9 million.

Key Issues: Although the company's stock rose in the fourth

quarter, the strength had more to do with takeover speculation than

signs of robust improvement. In the third quarter, the company

swung to a loss on charges and continuing sales weakness, while

margins suffered from commodities' priciness. But like Yum,

Wendy's/Arby's announced no price increases to ease the pressure.

In November, the company was anxious to know what billionaire

Nelson Peltz's Trian Fund Management had in store for its nearly

one-quarter equity stake, but Trian was mostly silent on the

matter.

(The Thomson Reuters estimates and year-earlier results may not

be comparable because of one-time items and other adjustments.)

-By Joan E. Solsman, Dow Jones Newswires; 212-416-2291;

joan.solsman@dowjones.com

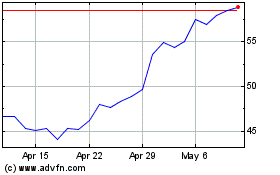

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

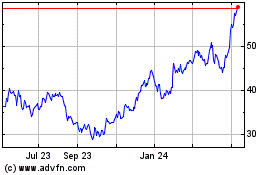

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024