Filed by Woodside Petroleum Ltd.

Pursuant to Rule 425 of the Securities Act of 1933

Subject Companies: BHP Group Ltd (Commission File No.: 001-09526)

BHP Group Plc (Commission File No.: 001-31714)

INVESTOR UPDATE 2021 8 December 2021 www.woodside.com.au

investor@woodside.com.au

Disclaimer, risks and assumptions Disclaimer and risks Notes to

petroleum resources estimates • Our investors and potential investors have requested that Woodside continues to provide further detail and information in 1. Unless otherwise stated, all petroleum resource estimates are quoted as at the balance

date (i.e. 31 December) of the Reserves respect of Woodside’s overall strategic approach and its potential implications for the company. This presentation is a response Statement in Woodside’s most recent Annual Report released to the

Australian Securities Exchange (ASX) and available at to those requests. It is in summary form and does not purport to be complete. It should be read in conjunction with Woodside’s https://www.woodside.com.au/news-and-media/announcements, net

Woodside share at standard oilfield conditions of 14.696 psi periodic reporting and other announcements made to the Australian Securities Exchange. (101.325 kPa) and 60 degrees Fahrenheit (15.56 degrees Celsius). The Reserves Statement dated 31

December 2020 has been subsequently updated by ASX announcements dated 15 July 2021, 18 August 2021, 21 October 2021, 5 November 2021 and 22 • Given that this presentation is focused on Woodside’s strategy, it is necessarily oriented

towards future events. Neither the November 2021. Woodside is not aware of any new information or data that materially affects the information included in the strategy, nor this presentation more generally, is a statement that future events will or

are likely to occur. Reserves Statement. All the material assumptions and technical parameters underpinning the estimates in the Reserves Statement • The discussion of Woodside’s strategy provides some level of insight into how Woodside

currently intends to direct the continue to apply and have not materially changed. management of its assets and to deploy its capital, in order to achieve certain strategic outcomes. The matters disclosed in this 2. Woodside reports reserves net of

the fuel and flare required for production, processing and transportation up to a reference presentation are a ‘point in time’ disclosure of Woodside’s strategic focus. Woodside operates in a dynamic market and external point. For

offshore oil projects, the reference point is defined as the outlet of the floating production storage and offloading environment. Strategies can and must adapt in response to dynamic market conditions, joint venture decisions, new facility (FPSO),

while for the onshore gas projects the reference point is defined as the inlet to the downstream (onshore) opportunities that might arise or other changing circumstances. Investors should not assume that the strategy and targets processing facility.

discussed in this presentation are locked in. In addition, a number of Woodside’s proposed developments or strategies are complex and may be delayed, more costly than anticipated or unsuccessful for many reasons. 3. Woodside uses both

deterministic and probabilistic methods for estimation of petroleum resources at the field and project levels. Unless otherwise stated, all petroleum estimates reported at the company or region level are aggregated by arithmetic • This

presentation contains forward looking statements that are subject to risk factors, including those associated with oil and gas summation by category. Note that the aggregated Proved level may be a very conservative estimate due to the portfolio

effects businesses as well as those in connection with the proposed combination of Woodside and BHP Group Limited’s oil and gas of arithmetic summation. business (the “Transaction”). The information and statements in this

presentation about Woodside’s future strategy, including 6 with regard to the Transaction, are not guidance, forecasts, guarantees or predictions of future events or performance, but are in 4. ‘MMboe’ means millions (10 ) of

barrels of oil equivalent. Dry gas volumes, defined as ‘C4 minus’ hydrocarbon components and the nature of aspirational targets that Woodside has set for itself and its management of the business. Actual performance non-hydrocarbon

volumes that are present in sales product, are converted to oil equivalent volumes via a constant conversion against these targets (including all items that are described as a target) may be affected by various risks associated with the factor,

which for Woodside is 5.7 Bcf of dry gas per 1 MMboe. Volumes of oil and condensate, defined as ‘C5 plus’ petroleum Woodside business and the Transaction, many of which are beyond Woodside’s control. Further detail on certain of

these risks components, are converted from MMbbl to MMboe on a 1:1 ratio. can be found in the “Risk” section of Woodside’s most recent Annual Report which was released to the Australian Securities 5. The estimates of petroleum

resources are based on and fairly represent information and supporting documentation prepared Exchange on 18 February 2021. Investors and prospective investors should review and have regard to these risks when under the supervision of and approved

by Mr Jason Greenwald, Woodside’s Vice President Reservoir Management. Mr Greenwald considering the information contained in this presentation. The reader is cautioned not to place undue reliance on any forward is a full-time employee of the

company and a member of the Society of Petroleum Engineers. His qualifications include a Bachelor looking statements contained in this presentation. of Science (Chemical Engineering) from Rice University, Houston, Texas, and more than 20 years of

relevant experience. • It is believed that the expectations reflected in these statements are reasonable as at the date of this presentation but they may Assumptions be affected by a variety of variables and changes in underlying assumptions

which could cause actual results or trends to differ • Unless otherwise indicated, the targets set out in this presentation have been estimated on the basis of a variety of economic materially, including but not limited to the Risks referenced

above and price fluctuations, actual demand, currency fluctuations, assumptions including: (1) a US$65/bbl Brent oil price (2022 real terms, inflated at 2.0%); (2) currently sanctioned projects being drilling and production results, reserve

estimates, loss of market, industry competition, environmental risks, physical risks, delivered in accordance with their current project schedules; and (3) applicable growth opportunities being sanctioned and legislative, fiscal and regulatory

developments, changes in accounting standards, economic and financial market conditions in delivered in accordance with the target schedules provided in this presentation. These growth opportunities are subject to various countries and regions,

political risks, project delay or advancement, approvals and cost estimates. Some matters are relevant joint venture participant approvals, commercial arrangements with third parties and regulatory approvals being subject to approval of joint

venture participants. The targets and opportunities described in this presentation might also change obtained in the timeframe contemplated or at all. Woodside expresses no view as to whether its joint venture participants will materially if

Woodside changes its strategy. agree with and support Woodside’s current position in relation to these opportunities, or such commercial arrangements and • Woodside makes no representation, assurance or guarantee as to the accuracy or

likelihood of fulfilment of any forward-looking regulatory approvals will be obtained. Additional assumptions relevant to particular targets or other statements in this statement or any outcomes expressed or implied in any forward-looking statement.

The forward-looking statements in this presentation may be set out in the relevant slides. Any such additional assumptions are in addition to the assumptions and presentation reflect expectations held at the date of this presentation. Woodside does

not undertake to provide ongoing market qualifications applicable to the presentation as a whole. updates on, or otherwise report against, performance in relation to the information in this presentation, or in relation to any • Woodside

“greenhouse gas” or “emissions” information presented are Scope 1 and Scope 2 emissions released to the change in the company’s strategy, except to the extent it has a legal obligation to do so. atmosphere as a result

of an activity, or series of activities, at a facility level. Greenhouse gas definitions and global warming • There is no certainty or assurance that the proposed merger between Woodside and BHP Petroleum will complete on the potentials to

convert emissions into tonnes of carbon dioxide equivalent (tCO -e) are as per Australia’s National Greenhouse and 2 intended schedule or at all. Information in this presentation that is presented on a post-merger basis must be read subject to

Energy Reporting scheme. that uncertainty. Other important information • This document has been prepared by Woodside and relies on information provided by BHP (“BHP Information”). Although • All references to dollars, cents

or $ in this presentation are to US currency, unless otherwise stated. Woodside has taken steps to confirm the BHP Information, it has not independently verified it and expressly disclaims any responsibility for it, to the maximum extent permitted

by law. No representation or warranty, express or implied, is made as to • References to “Woodside” may be references to Woodside Petroleum Ltd or its applicable subsidiaries. the fairness, currency, accuracy, adequacy, reliability

or completeness of the BHP Information. • This presentation does not include any express or implied prices at which Woodside will buy or sell financial products. 2

Agenda STRATEGY 1 2 CAPITAL ALLOCATION SHAREHOLDER RETURNS 3 CLIMATE 4

NEW ENERGY 5 MERGER AND DEVELOPMENTS 6 3

Thriving through the energy transition PROFITABLE LOWER CARBON

RESILIENT OPTIMISE VALUE AND LOW COST DIVERSIFIED SHAREHOLDER RETURNS 4

Strategic framework COMPETITIVE DISCIPLINED CAPITAL ADVANTAGE

ALLOCATION Robust assessment of Highly valued products opportunities, portfolio outcomes World-class Tier 1 assets and shareholder returns Enablers Diversification within known Disciplined capital spend value chains bound by defined targets Safe and

reliable operations Strong balance sheet Technology HIGH PERFORMING MARKET CULTURE ANALYSIS Responsible environmental, social Energy markets supply, and governance (ESG) mindset demand and price outlook Engaged, accountable and Scenarios inform new

energy trajectory diverse workforce and existing business 5

ESG is part of our core business Environmental Social Governance

Climate change resilience and transition Social and cultural impacts on communities Health safety and wellbeing Environment and biodiversity People and culture Corporate governance Decommissioning Supply chain and local content Major incident

preparedness Human Rights 6

Market analysis Estimated cumulative investment under the range of IEA

scenarios ($US trillion) Investment in oil and gas exceeds hydrogen investment in all scenarios Increased investment in hydrogen needed to support the Net Zero Emissions 2050 pathway Stated Not Paris aligned. Global temperature rise Policies (STEPS)

above 2ºC >2.0°C Announced Not Paris aligned. Global temperature rise Pledges (APS) to 2.1ºC with a 50% probability ~2.1°C Paris aligned scenario. Global temperature Sustainable rise is limited to 1.65ºC with a 50%

Development (SDS) probability (potentially 1.5ºC with some ~1.5 to 1.65°C level of net negative emissions) Net Zero Emissions Paris aligned scenario. Global temperature Oil and gas Hydrogen (NZE2050) rise is limited to 1.5ºC with a

50% ~1.5°C probability 7 IEA World Energy Outlook 2021 and IEA Net Zero by 2050: a roadmap for the global energy sector, Woodside analysis, real terms 2019.

Climate testing 1 Indicative average annual free cash flow under the

range of IEA scenarios Product pricing is the primary driver of the variation Portfolio decisions are assessed against a wide range of climate scenarios Climate scenarios include International Energy Agency (IEA) scenarios IEA scenarios are

credible, global, transparent and include independently published Stated Announced Sustainable Net Zero IEA assumptions Policies Pledges Development Emissions SCENARIOS 3 (STEPS) (APS) (SDS) (NZE2050) 2 TESTED >2.0°C ~2.1°C ~1.5 to

1.65°C ~1.5°C 1. Based on the combined Woodside and BHP petroleum portfolio equity of Scarborough (100%), Sangomar (82%), Pluto Train 2 (51%) and a varying mix of future portfolio growth investments. Not guidance, illustrative only. 2.

Woodside’s assessment of IEA scenarios utilising IEA price assumptions for oil, gas and carbon. 3. Using pricing data from IEA WEO 2021, which estimated a global temperature rise of 2.1ºC. The IEA subsequently indicated that an updated

version of the APS could lead 8 to a temperature rise of 1.8ºC if all COP-26 pledges are met in time and in full, but has not released details of this new scenario.

Portfolio and opportunity optimisation Opportunity evaluation

considerations Portfolio evaluation considerations Free cash Funding Emissions Payback Strategic EPS IRR/NPV Risk Breakeven flow capacity profile period fit Growth opportunities are screened against portfolio metrics using price, scenario and

climate analysis 9

Capital allocation framework OIL GAS NEW ENERGY OFFSHORE PIPELINE LNG

DIVERSIFIED Generate high returns to fund New energy products and lower Leveraging infrastructure to monetise undeveloped diversified growth, focusing on carbon services to reduce customers’ FOCUS gas, including optionality for hydrogen high

quality resources emissions; hydrogen, ammonia, CCUS Stable long-term cash High cash generation Long-term cash flow Developing market flow profile Shorter payback period Strong forecast demand Lower capital requirement CHARACTERISTICS Resilient to

commodity Quick to market Upside potential Lower risk profile pricing IRR > 15% IRR > 12% IRR > 10% OPPORTUNITY 1 1 1 TARGETS Payback within 5 years Payback within 7 years Payback within 10 years EMISSIONS 2 30% net emissions reduction by

2030, net zero aspiration by 2050 or sooner REDUCTIONS CCUS refers to carbon capture utilisation and storage. 1. Payback refers to RFSU + X years. 2. Target is for equity net Scope 1 and 2 emissions. Baseline is set as the gross average equity Scope

1 and 2 emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an FID prior to 10 2021. Post-completion of the Woodside and BHP petroleum merger (which remains subject to

conditions including regulatory approvals), the baseline will be adjusted for the then combined Woodside and BHP petroleum portfolio.

Shareholder returns OPTIMISE VALUE AND SHAREHOLDER RETURNS Special

dividends Safe, Dividend Strong Share reliable and Investment policy balance buy-backs low cost expenditure (minimum 50% sheet payout ratio) operations Excess cash Future investment Investment grade Maintain dividend based Targeted credit rating on

NPAT, targeting 15-35% gearing 50-80% payout ratio 11

Thriving in a lower-carbon future DECARBONISATION TARGETS Emissions

reduction targets apply to 15% Woodside’s equity portfolio (operated 30% Net zero and non-operated) by 2025 by 2030 aspiration by 2050 or sooner 1 Equity net emissions reduction targets Clear targets consistent with 3 Paris-aligned pathways $5

billion Diverse carbon abatement through 2 Invested in new energy products and lower carbon services by 2030 • Design out • Operate out • Offset 1. Target is for equity net Scope 1 and 2 emissions. Baseline is set as the gross

average equity Scope 1 and 2 emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an FID prior to 2021. Post-completion of the Woodside and BHP petroleum merger (which remains

subject to conditions including regulatory approvals), the baseline will be adjusted for the then combined Woodside and BHP petroleum portfolio. 2. Investment target assumes completion of the proposed merger with BHP’s petroleum business.

Individual investment decisions are subject to Woodside’s investment hurdles. Not guidance. 3. Scope 1 and Scope 2 net emissions trajectory consistent with the SSP1-1.9 (1.4ºC) to SSP1-2.6 (1.8ºC) pathways in the Working Group 1

contribution to the IPCC’s Sixth Assessment Report. Relative oil and gas versus hydrogen potential investment consistent with a range of outcomes predicted between IEA’s Net Zero Emissions (NZE2050) and Sustainable Development Scenario

(SDS). The NZE2050 global temperature rise is limited to 1.5ºC with a 50% probability and the SDS global temperature rise is limited to 1.65ºC with a 50% 12 probability (potentially 1.5ºC with some level of net negative

emissions).

Scope 3 emissions approach INVEST NEW ENERGY PRODUCTS | LOWER CARBON

SERVICES 1 $5 billion invested by 2030 Collaboration with customers to build market demand Recent announcements: Heliogen, H2Perth, H2TAS, H2OK, CCS SUPPORT PROMOTE CUSTOMER AND SUPPLIER EMISSIONS REDUCTION GLOBAL MEASUREMENT AND REPORTING Carbon

offset cargoes | Methane Emerging harmonisation of global standards Shipping | Contracting | Business travel Transparent emissions reporting 2 Investment consistent with Paris-aligned pathways CCS refers to carbon capture and storage. 1. Investment

target assumes completion of the proposed merger with BHP’s petroleum business. Individual investment decisions are subject to Woodside’s investment hurdles. Not guidance. 2. Relative oil and gas versus hydrogen potential investment

consistent with a range of outcomes predicted between IEA’s Net Zero Emissions (NZE2050) and Sustainable Development Scenario (SDS). The NZE2050 13 global temperature rise is limited to 1.5ºC with a 50% probability and the SDS global

temperature rise is limited to 1.65ºC with a 50% probability (potentially 1.5ºC with some level of net negative emissions).

Energy transition plan 2021 Mid-2020s 2030+ ENERGY TRANSITION

PROGRESS Market Early new energy New energy development transition at scale • Build relationships across value chain• Achieve start-up of new energy • Export liquid hydrogen from projects Australia • Technology flexible

(hydrogen, CCS, renewables)• Scale-up carbon offset projects• Scale-up CCS activities • Secure land and customers for projects• Export ammonia from Australia• Expand production to match market scale • Grow offsets

portfolio to support base • Develop CCU opportunities business • Progress CCS opportunities • Develop CCS opportunities • Leverage existing capabilities • Expected to play a key role in realisation of climate targets

Hydrogen for heavy • Truck manufacturers scaling up hydrogen fuel cell operations vehicle transport • Line of sight to diesel price parity NEAR-TERM CUSTOMER FOCUS AREAS Ammonia for power • Transportable, price competitive option

to reduce carbon emissions generation• Exploring opportunities with existing customers CCS refers to carbon capture and storage. CCU refers to carbon capture and utilisation. 14 All dates and plans are Woodside targets unless otherwise

specified and subject to market conditions, regulatory approvals, government approvals and commercial agreements.

New energy opportunities H2Perth | Flexible design for hydrogen or

ammonia H2OK | Emerging opportunity for heavy transport sector • Initial phase targeting ~110,000 tpa• Initial phase targeting ~33,000 tpa of hydrogen production including of liquid hydrogen leveraging 250 MW electrolysis component

existing renewable network including 250 MW electrolysis component • Future capacity of up to ~550,000 tpa of hydrogen for export • Future capacity of up to (in form of ammonia and liquid ~65,000 tpa of liquid hydrogen hydrogen) •

MOU executed with Hyzon Motors • Potential to scale to more than • Targeting final investment decision 3 GW H2 2022 H2TAS | Well positioned for early renewable hydrogen Heliogen | Breakthrough solar technology • Initial phase

targeting 200,000 tpa • Initial phase targeting 5 MW of ammonia and a 300 MW • Concentrated solar energy system electrolysis component to deliver clean energy with • Potential to support up to 1.7 GW nearly 24/7 availability of

electrolysis • Targeting execution to begin in • Completed studies with potential 2022 customers for ammonia export to • Enables pathway to large-scale, Japan cost-effective renewable power source 15

New energy growth plan Cumulative capacity (megawatts, indicative)

Potential 2030 capacity ~3,000 megawatts Phased project expansion to match customer demand FEED | Execute Phase 1 (Pluto) Phase 2 Power for base business Phase FEED | Execute Phase 1 Phase 2 Heliogen 3 Assess | Select | FEED | Execute Phase 1 Phase

2 H2Perth Select | FEED | Execute Phase 1 Phase 2 H2TAS FEED | Execute Phase 1 Other potential opportunities H2OK All dates and plans are Woodside targets unless otherwise specified and subject to market conditions, regulatory approvals, government

approvals and commercial agreements. 16 Assess/select/FEED/execute phases relevant only to initial phase of projects. Project phase timing and capacity is indicative only. Not guidance.

Carbon business • Diverse, cost competitive foundation

portfolio to support base business and Scarborough demand • Collaboration with customers for supply of carbon offset cargoes Secured offsets to meet 2025 High quality • ~10,000 ha of land secured for planting native trees net emissions

reduction target offsets • Extended relationship with Greening Australia to source and lease portions of farmland in Western Australia On track to meet 2030 net • Existing and planned Australian land-based projects expected to emissions

reduction target deliver ~2.5 million tonnes of offsets (CO -e) by 2040 2 COP26 agreement on Article 6 enables development of a robust • Assessing opportunity to develop a large-scale, multi-user global carbon market project near Karratha,

Western Australia Carbon capture • Consortium established with bp and Japan Australia LNG (MIMI) and storage Pty Ltd to study carbon capture and storage • Supports further emissions reduction after 2030 17

2021 priorities delivered and a merger Cost and efficiency

transformation DISCIPLINED 1 underway EXPENDITURE Achieved targeted Scarborough FID in H2 2021 2 Proposed merger with CREATE AND 5 BHP’s petroleum PROTECT VALUE 3 business Delivering Sangomar Phase 1 Delivering value through BUILD OUR 4 the

energy transition SUSTAINABLE FUTURE 18

Merger strategic rationale + All-stock merger of Woodside and BHP

Petroleum Petroleum Complementary, long-life, high margin, tier 1 assets PORTFOLIO QUALITY Strengthens cash generation and balance sheet CASH GENERATION AND BALANCE SHEET Supports superior returns through continued capital discipline SHAREHOLDER

RETURNS AND CAPITAL DISCIPLINE Enhanced portfolio of high return growth options DEVELOPMENT OPTIONALITY Increased capacity to deliver the energy transition ENERGY TRANSITION LEADERSHIP Opportunities to deliver ongoing attractive synergies SYNERGIES

AND VALUE CREATION 19

International portfolio of Tier 1 assets Senegal Sangomar ~ 200 MMboe

1 2021 production 2 Top 10 independent East coast Australia Houston Bass Strait 10.6 Mt 3 LNG production Gulf of Mexico Shenzi | Wildling | Atlantis | 4 Top 10 global Mad Dog | Trion Scarborough FID Perth achieved Attractive near-term Western

Australia Trinidad & Tobago GOM developments Scarborough | Pluto | North West Shelf | Pyrenees | Angostura | Ruby | Calypso | Macedon | Wheatstone | Ngujima-Yin | Okha T&T South 1. Combined Woodside and BHP for the 12 months to 30 June 2021,

not giving effect to any pro forma adjustments. Includes Algeria production of 3 MMboe. Neptune production volume is included in GOM but divested in May 2021. 2. Source: Wood Mackenzie Corporate Benchmarking Tool production forecasts as at 31 July

2021. Woodside analysis. 3. Equivalent to 95 MMboe. 20 4. Source: LNG Output, Wood Mackenzie LNG Tool, Q2 2020 data set. Woodside and BHP 12 months to 30 June 2021. Woodside analysis.

Timeline to completion Q3 2021 Q4 2021 Q1 2022 Q2 2022 17 August 22

November Target for release of Target for Woodside shareholder Merger commitment deed Share sale agreement and shareholder materials meeting to approve issue of shares executed integration and transitional services agreement executed Pursuing

secondary listings Target for completion date and on the New York Stock distribution of new Woodside Exchange and London shares to BHP shareholders Stock Exchange Due diligence Consents and approvals Shareholder materials including independent

expert’s report 1 Secondary listing identification Secondary listing implementation • Woodside's and BHP Petroleum's respective businesses will remain separate and independent until after completion 21 1. Final implementation of

secondary listings will occur around completion of the merger.

Organisational design after completion CEO Marketing Exploration

Australia International and and New Energy Operations Operations Trading Development Strategy Technical Business Finance and Projects Services Services Climate 22

Planning opportunities to deliver synergies after merger completion

• Implement existing activities already identified by Operations Transform initiatives and identify opportunities for broader implementation after completion • Potential to improve inventory management and consolidation of contracts

OPERATIONS • Implement best practices from the joint portfolio • Prioritise the highest return options GROWTH OPPORTUNITIES • Explore opportunities for supply services synergies across projects $400+ million • Focus on

high-quality prospects 1 estimated annual savings EXPLORATION • Prioritising activities with a clear path to commercialisation • Explore leveraging increased scale to improve shipping utilisation and MARKETING increase optimisation

opportunity • Potential to rationalise applications, licences and subscriptions CORPORATE• Alignment of systems and processes across portfolio • Optimise organisational design for the merged business 23 1. Estimated savings

expected to be fully realised from approximately the end of 2023.

Scarborough and Pluto Train 2 developments approved DEVELOPS

WORLD-CLASS RESOURCE Scarborough floating production unit Pluto platform 11.1 Tcf 957 MMboe 1,433 MMboe 8 Mtpa of LNG 3 increase to 1P reserves development plus increase to 2P reserves resource size, 100% 225 TJ/day domestic gas PROVIDES LONG-TERM

RETURNS Pluto LNG Pluto Train 2 >13.5 % ~$5.8 per MMBtu ~6 years ~$26 billion 1 1 1 expected net cash flow globally competitive cost internal rate of return payback period Domestic gas 1 of supply infrastructure Approved Pluto-KGP Existing

Interconnector 2 $6.9 billion Woodside capital cost | 73.5% offshore, 51% onshore Targeting first cargo 2026 1. IRR, Woodside cost of supply and payback period assume Woodside equity of 73.5% in Scarborough, 51% in Pluto Train 2 and 90% in Pluto

LNG; includes Global Infrastructure Partners (GIP) additional funding of $822m of capital expenditure from the sell- down of Pluto Train 2 and payments due on FID to ExxonMobil and BHP. IRR and payback period are a look forward from January 2021 and

assume US$65/bbl (real terms 2022) Brent oil price. The integrated Woodside cost of supply (real terms 2021) is based on a 10% rate of return (both upstream and downstream), includes shipping to north Asia and is a look forward from January 2020.

Payback period is calculated from undiscounted cash flows, RFSU + approximately 6 years. Not guidance. 2. Includes GIP’s additional funding of $822m of capital expenditure from the sell-down of Pluto Train 2 and excludes contingent payments

due on FID. 24 3. 11.1 Tcf, 100% is consistent with the 2P reserves of 1,433 MMboe, a working interest of 73.5% and a conversion factor of 5.7 Bcf per MMboe.

Scarborough’s role in the energy transition LNG is required

Scarborough is advantaged Woodside’s net zero aspiration 1 in a decarbonising world from a carbon perspective includes Scarborough tCO -e/ LNG can assist coal-to-gas 2 t LNG ~0.1 % ~0.26 switching in Asia Net zero Train 2 design intensity CO

in reservoir 15% 2 30% aspiration by by 2025 by 2030 2050 Aligned with our customers’ Estimated total project emissions (mt CO -e, full life) 2 decarbonisation goals 4 Woodside’s equity emissions reduction targets Scope 1 (upstream and

99.5 downstream) Scarborough is amongst the Scope 3 (use of sold product 778.5 Contributes cash flow to help and transport) lowest carbon intensity fund investment in the energy projects for LNG delivered to 2 3 transition north Asia Total Scope 1

and 3 emissions 878.0 1. Relative to the reservoir CO content and design intensity of other LNG projects. 2 2. Scarborough gas processed through Pluto Train 2. 3. Scarborough Offshore Project Proposal; includes Scarborough, Thebe and Jupiter. 100%

project. 4. Target is for equity net Scope 1 and 2 emissions. Baseline is set as the gross average equity Scope 1 and 2 emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an

FID prior to 2021. 25 Post-completion of the Woodside and BHP petroleum merger (which remains subject to conditions including regulatory approvals), the baseline will be adjusted for the then combined Woodside and BHP petroleum portfolio.

Sangomar progress SUBSEA Umbilical on carousel Inline structure

sliding frame Assembled inline structure FPSO CONVERSION DALIAN Turret support Living quarters Turret support structure structure integration 26

Sangomar progress SENEGAL FPSO TOPSIDES – TIANJIN FPSO TURRET

– PENGLAI Medium pressure gas compression Chain table support system coating Liquid mud plant topsides assembly completed Electrical house Turret head system coating Sumitomo tubular yard 27

Key messages Thriving through the energy transition STRATEGY CAPITAL

ALLOCATION Clear criteria for maximising value from portfolio optionality SHAREHOLDER RETURNS Flexible framework for distributing value to shareholders Corporate emissions reduction targets applying to the larger portfolio; CLIMATE investment target

for new energy products and lower carbon services to 2030 Diversified new energy portfolio NEW ENERGY Planning and scoping underway for integration after completion MERGER AND DEVELOPMENTS 28

Additional information for US investors No offer or solicitation

Disclosure of reserve information and cautionary note to US investors • This presentation includes information relating to the proposed Transaction between Woodside and BHP. • Unless expressly stated otherwise, all estimates of oil and

gas reserves and contingent resources disclosed in This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to this presentation have been prepared using definitions and guidelines consistent with

the 2018 Society of subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction or Petroleum Engineers (SPE)/World Petroleum Council (WPC)/American Association of Petroleum Geologists otherwise, nor

shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, (AAPG)/Society of Petroleum Evaluation Engineers (SPEE) Petroleum Resources Management System (PRMS). solicitation under the securities laws of any

such jurisdiction. No offer of securities in the United States shall Estimates of reserves and contingent resource in this presentation will differ from corresponding estimates be made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of prepared in accordance with the rules of the US Securities and Exchange Commission (the “SEC”) and 1933. disclosure requirements of the US Financial Accounting Standards Board (“FASB”), and

those differences may be material. Important additional information • Estimates of contingent resources are by their nature more speculative than estimates of proved reserves • In connection with the proposed Transaction, Woodside

intends to file with the US Securities and Exchange and would require substantial capital spending over a significant number of years to implement recovery. Commission (the “SEC”) a registration statement on Form F-4 (the

“Registration Statement”) to register the Actual locations drilled and quantities that may be ultimately recovered from our properties will differ Woodside securities to be issued in connection with the proposed Transaction (including a

prospectus substantially. In addition, we have made no commitment to drill, and likely will not drill, all of the drilling therefor). Woodside and BHP also plant o file other documents with the SEC regarding the proposed locations that have been

attributable to these quantities. Transaction. This presentation is not a substitute for the Registration Statement or the prospectus or for any • The Registration Statement to be filed in connection with the Transaction will be required to

include, among other documents that Woodside or BHP may file with the SEC in connection with the Transaction. US other things, disclosure of reserves and other oil and gas information in accordance with U.S. federal INVESTORS AND US HOLDERS OF

WOODSIDE AND BHP SECURITIES ARE URGED TO READ THE securities laws and applicable SEC rules and regulations (collectively, “SEC requirements”). The SEC permits REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE

PROPOSED oil and gas companies that are subject to domestic issuer reporting requirements under U.S. federal TRANSACTION (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS) THAT WILL securities law, in their filings with the SEC, to

disclose only estimated proved, probable and possible reserves BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE that meet the SEC’s definitions of such terms. In addition, the Registration Statement will

include notes to THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE TRANSACTION. the financial statements included therein that include supplementary disclosure in respect of oil and gas Shareholders will be able to obtain free

copies of the Registration Statement, prospectus and other activities, including estimates of proved oil and gas reserves and a standardized measure of discounted documents containing important information about Woodside and BHP once such documents

are filed with future net cash flows relating to proved oil and gas reserve quantities. This supplementary financial the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of such documents may statement disclosure will be

presented in accordance with FASB requirements, which align with also be obtained from Woodside and BHP without charge. corresponding SEC requirements concerning reserve estimation and reporting. 29

Head Office: Woodside Petroleum Ltd Mia Yellagonga 11 Mount Street

Perth WA 6000 Postal Address: GPO Box D188 Perth WA 6840 Australia T: +61 8 9348 4000 F: +61 8 9214 2777 E: companyinfo@woodside.com.au Woodside Petroleum Ltd ABN 55 004 898 962 woodside.com.au

Forward-looking statements

This announcement contains forward-looking statements. The words ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’,

‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or

expressions are intended to identify forward-looking statements. These forward-looking statements are based on assumptions and contingencies that are subject to change without notice and involve known and unknown risks, uncertainties and other

factors, many of which are beyond the control of Woodside, BHP and their respective related bodies corporate and affiliates (and each of their respective directors, officers, employees, partners, consultants, contractors, agents, advisers and

representatives), and could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by those forward-looking statements or any projections or

assumptions on which those statements are based.

The forward-looking statements are subject to risk factors, including those associated with the oil and

gas industry as well as those in connection with the Transaction. It is believed that the expectations reflected in these statements are reasonable, but they may be affected by a range of variables which could cause actual results or trends to

differ materially, including but not limited to: price fluctuations, actual demand, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results, engineering estimates,

reserve estimates, loss of market, industry competition, environmental risks, physical risks, legislative, fiscal and regulatory developments, economic and financial markets, conditions in various countries, approvals and cost estimates.

Investors are strongly cautioned not to place undue reliance on forward-looking statements, particularly in light of the current economic climate and the

significant uncertainty and disruption caused by the COVID-19 pandemic. Forward-looking statements are provided as a general guide only and should not be relied on as an indication or guarantee of future

performance. These statements may assume the success of the Transaction, BHP’s oil and gas portfolio or Woodside’s business strategies, the success of which may not be realised within the period for which the forward-looking statements may

have been prepared, or at all. No guarantee, representation or warranty, express or implied, is made as to the accuracy, likelihood of achievement or reasonableness of any forecasts, prospects, returns, statements or tax treatment in relation to

future matters contained in this presentation.

Past performance and pro forma historical information is given for illustrative purposes only. Pro forma

information is presented on a combined basis, without giving effect to any pro forma adjustments. It should not be relied on and is not indicative of future performance, including future security prices.

Disclosure of reserve information and cautionary note to US investors

Unless expressly stated otherwise, all estimates of oil and gas reserves and contingent resources disclosed in this presentation have been prepared using

definitions and guidelines consistent with the 2018 Society of Petroleum Engineers (SPE)/World Petroleum Council (WPC)/American Association of Petroleum Geologists (AAPG)/Society of Petroleum Evaluation Engineers (SPEE) Petroleum Resources

Management System (PRMS). Estimates of reserves and contingent resource in this presentation will differ from corresponding estimates prepared in accordance with the rules of the US Securities and Exchange Commission (the “SEC”) and

disclosure requirements of the US Financial Accounting Standards Board (“FASB”), and those differences may be material. For additional information regarding the availability of Woodside’s reserves disclosures in accordance with SEC

requirements, please see Woodside’s investor presentation dated 17 August 2021 and released to the ASX. For additional information regarding BHP’s reserves, please see BHP’s annual report on

Form 20-F filed with the SEC.

No offer or solicitation

This communication relates to the proposed Transaction between Woodside and BHP. This communication is not intended to and does not constitute an offer to sell

or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction or otherwise, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities in the United States shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933.

Important additional information and where to find it

In connection with the proposed Transaction, Woodside intends to file with the US Securities and Exchange Commission (the “SEC”) a registration

statement on Form F-4 (the “Registration Statement”) to register the Woodside securities to be issued in connection with the proposed Transaction (including a prospectus therefor). Woodside and BHP

also plan to file other documents with the SEC regarding the proposed Transaction. This communication is not a substitute for the Registration Statement or the prospectus or for any other document that Woodside or BHP may file with the SEC in

connection with the Transaction. US INVESTORS AND US HOLDERS OF WOODSIDE AND BHP SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS

TO THOSE DOCUMENTS) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE PROPOSED TRANSACTION. Shareholders will be able to obtain free

copies of the Registration Statement, prospectus and other documents containing important information about Woodside and BHP once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies

of such documents may also be obtained from Woodside and BHP without charge.

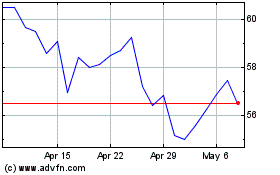

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

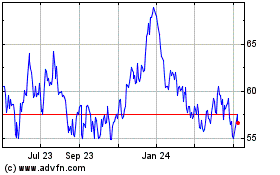

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024