Avista Corp. Completes Equity Issuance with Over-allotment Option Fulfilled

December 15 2006 - 4:30PM

PR Newswire (US)

SPOKANE, Wash., Dec. 15 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today announced that it has completed the sale of

3,162,500 shares of common stock in its public offering, including

the full exercise of the over-allotment option granted by the

company to purchase up to 412,500 shares by the sole underwriter

UBS Investment Bank. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO ) The

shares were priced to the public at $25.05 per share, resulting in

net proceeds to the company of $77.7 million, after deducting the

underwriting discounts and the commissions. The intended uses of

the net proceeds of the offering include funding capital

expenditures, such as the completion of a five-year major

transmission infrastructure construction program and the first

steps in upgrading our Cabinet Gorge and Noxon Rapids hydro

generation projects to increase efficiency and productivity. In

addition, proceeds of the transaction will be used to pay maturing

debt and short-term borrowings under the company's committed line

of credit, and other corporate purposes. Avista Corp. is an energy

company involved in the production, transmission and distribution

of energy as well as other energy-related businesses. Avista

Utilities is a company operating division that provides service to

341,000 electric and 298,000 natural gas customers in three Western

states. Avista's non-regulated subsidiaries include Advantage IQ

and Avista Energy. Avista Corp.'s stock is traded under the ticker

symbol "AVA". For more information about Avista, please visit

http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista Corp.

logo are trademarks of Avista Corporation. This news release

contains forward-looking statements, including statements regarding

the use of proceeds from a common stock offering. Such statements

are subject to a variety of risks, uncertainties and other factors,

most of which are beyond the company's control, and many of which

could have a significant impact on the company's operations,

results of operations and financial condition, and could cause

actual results to differ materially from those anticipated. For a

further discussion of these factors and other important factors,

please refer to the company's Annual Report on Form 10-K for the

year ended Dec. 31, 2005 and Quarterly Report on Form 10-Q for the

quarter ended Sept. 30, 2006. The forward-looking statements

contained in this news release speak only as of the date hereof.

The company undertakes no obligation to update any forward-looking

statement or statements to reflect events or circumstances that

occur after the date on which such statement is made or to reflect

the occurrence of unanticipated events. New factors emerge from

time to time, and it is not possible for management to predict all

of such factors, nor can it assess the impact of each such factor

on the company's business or the extent to which any such factor,

or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statement.

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

investors, Jason Lang, +1-509-495-2930, or , or Avista 24/7 Media

Access, +1-509-495-4174 Web site: http://www.avistacorp.com/

Copyright

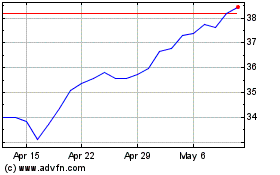

Avista (NYSE:AVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

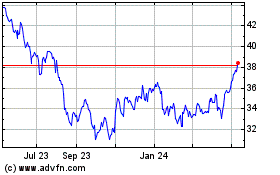

Avista (NYSE:AVA)

Historical Stock Chart

From Jul 2023 to Jul 2024