Q3 Results Reflect Improvement for Avista Utilities and a Net Loss

at Avista Energy Primarily as a Result of Natural Gas Inventory

SPOKANE, Wash., Oct. 27 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today reported a net loss of $9.0 million, or $0.19 per

diluted share, for the third quarter of 2005. For the third quarter

of 2004, the net loss was $9.8 million, or $0.20 per diluted share.

Avista Corp.'s net income was $19.8 million, or $0.40 per diluted

share, for the nine months ended Sept. 30, 2005, an increase from

$12.6 million, or $0.26 per diluted share, for the nine months

ended September 30, 2004. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO ) "It

continues to be a challenging year for Avista Energy. As was the

case during the first quarter, substantial increases in natural gas

prices have had a continuing negative effect on Avista Energy's

earnings primarily due to the accounting treatment for Avista

Energy's management of natural gas inventory. This negative impact

is expected to reverse in future periods when the natural gas is

withdrawn from storage," said Avista Chairman, President and Chief

Executive Officer Gary G. Ely. "The utility results for the third

quarter of 2005 were affected by higher electric resource costs and

the absorption of excess costs under the Energy Recovery Mechanism

dead band in the state of Washington. We believe that our utility

operations are well positioned for a strong fourth quarter and

modest improvement for 2006 primarily as a result of general rate

increases. However, we are concerned about the effect that higher

energy prices may have on our customers and ultimately our

shareholders," Ely said. Results for the third quarter of 2005 and

the nine months ended Sept. 30, 2005 (YTD), as compared to the

respective periods of 2004: ($ in thousands, except per-share data)

Q3 2005 Q3 2004 YTD 2005 YTD 2004 Operating Revenues $265,679

$241,552 $901,175 $811,172 Income from Operations $4,811 $4,545

$92,213 $84,339 Net Income (Loss) $(9,037) $(9,782) $19,756 $12,574

Business Segments: (contribution to earnings (loss) per diluted

share) Avista Utilities $(0.04) $(0.15) $0.72 $0.26 Energy

Marketing & Resource Management $(0.17) $(0.03) $(0.34) $0.08

Avista Advantage $0.03 $0.01 $0.06 -- Other $(0.01) $(0.03) $(0.04)

$(0.07) SUBTOTAL (before cumulative effect of accounting change)

$(0.19) $(0.20) $0.40 $0.27 Cumulative effect of accounting change

-- -- -- $(0.01) Total earnings (loss) per diluted share $(0.19)

$(0.20) $0.40 $0.26 Recent Legal Developments On Oct. 19, 2005, the

United States District Court for the Eastern District of Washington

issued an order granting Avista's motion to dismiss a shareholder

lawsuit. This complaint, originally filed against the company and

certain current and former officers in September 2002, alleged

violations of federal securities laws through alleged misstatements

and omissions of material facts with respect to the company's

energy trading practices in western power markets. The order of

dismissal was issued by the Court without prejudice, allowing the

plaintiffs 14 days to amend their complaint to address certain

issues identified by the Court. Third Quarter and Year-to-Date 2005

Highlights Avista Utilities: Avista Utilities had a net loss of

$1.8 million, or $0.04 per diluted share, for the third quarter of

2005, compared to a net loss of $7.3 million, or $0.15 per diluted

share, for the third quarter of 2004. The third quarter is

typically the lowest earnings quarter for Avista Utilities. The

results for the third quarter of 2005 were further reduced

primarily due to higher electric resource costs and the absorption

of $8.2 million of the Energy Recovery Mechanism (ERM) dead band

during the period, which included the reversal of the $0.7 million

benefit from the first half of 2005. In 2004, the entire $9 million

dead band was expensed during the first half of the year. The net

loss for the third quarter of 2004 was primarily due to write-offs

of $14.7 million ($9.6 million, net of taxes) related to the Idaho

Public Utilities Commission (IPUC) general rate case order. Avista

Utilities contributed $35.6 million to net income, or $0.72 per

diluted share, for the nine months ended Sept. 30, 2005, an

increase from $12.6 million, or $0.26 per diluted share, for the

nine months ended Sept. 30, 2004. The increase reflects the

positive effects of general rate increases implemented during the

second half of 2004 in Washington and Idaho and the gain on the

sale of Avista Utilities' South Lake Tahoe natural gas properties.

Comparing 2005 to 2004, in 2004 year-to-date results were reduced

by write-offs related to the IPUC general rate case order. On a

year-to-date basis for 2005, Avista has expensed $7.5 million of

the $9 million dead band and expects to absorb the remaining $1.5

million during the fourth quarter. The expensing of the $9 million

dead band was anticipated in Avista's 2005 earnings guidance.

During the period from January through the first half of March

2005, the Inland Northwest experienced an unusually warm and dry

winter. However, during late March through the second quarter of

2005, precipitation and hydroelectric conditions improved. Avista

expects hydroelectric generation will be approximately 94 percent

of normal in 2005, even with a forecast of below normal

precipitation and streamflows for the fourth quarter. This

expectation is subject to change based upon precipitation,

temperatures and other variables. The earnings impact of below

normal hydroelectric generation is mitigated by regulatory

mechanisms in Washington and Idaho that defer 90 percent of

increased power supply costs for recovery in future periods,

excluding the $9 million dead band in Washington. In March 2005,

Avista Utilities filed a request with the Washington Utilities and

Transportation Commission (WUTC) to increase its base electric and

natural gas rates. On Aug. 12, 2005, Avista, the WUTC staff, the

Northwest Industrial Gas Users and the Energy Project entered into

a settlement that, if approved by the WUTC, would resolve all

issues in Avista's electric and natural gas general rate cases. The

Public Counsel Section of the Washington Attorney General's Office

and the Industrial Customers of Northwest Utilities did not join in

the settlement agreement. Hearings were held in October 2005, and

the parties have requested that the settlement agreement become

effective January 1, 2006. The WUTC can take several actions with

respect to the settlement including, but not limited to, approving

it as presented, rejecting it and ordering additional rate case

proceedings, or approving it with conditions that would also be

subject to the acceptance of the settling parties. The revised rate

increase requests in the settlement are designed to increase annual

electric and natural gas revenues by $22.1 million and $1.0

million, respectively. The majority of the increase in electric

revenues provides for an increased level of power supply costs to

be recovered in base rates. As such, this portion of the increase

will not increase gross margin or net income. The settlement

agreement provides for an overall rate of return of 9.11 percent,

including a return on common equity of 10.4 percent based on an

equity level of 40 percent. Under the settlement agreement, Avista

has agreed to increase the utility equity component to 35 percent

by the end of 2007 and 38 percent by the end of 2008. If these

targets are not met, it could result in a reduction in base retail

rates. The utility equity component was approximately 31 percent as

of September 30, 2005. The settlement agreement also provides for

modifications to the ERM, including a reduction in the dead band

from $9.0 million to $3.0 million. In addition, the current ERM

surcharge of 9.8 percent would be increased to 10.8 percent to

increase the rate at which deferred power costs are recovered.

During the third quarter of 2005, Avista filed purchased gas cost

adjustment requests in Washington, Idaho and Oregon to increase

natural gas rates to reflect higher natural gas costs. Oregon

natural gas rates were increased 22.5 percent effective October 1,

and Avista has received approval for a 23.5 percent increase in

Washington to become effective November 1. Avista has requested a

23.8 percent increase in Idaho to become effective November 1.

These natural gas rate increases are designed to pass through

changes in purchased natural gas costs to customers with no change

in Avista Utilities' gross margin or net income. The company filed

its license application with the Federal Energy Regulatory

Commission (FERC) in July 2005 for the Spokane River Project

representing five hydroelectric plants on the Spokane River.

Avista's current license for the Spokane River Project expires on

Aug. 1, 2007. The company has requested the FERC to consider a

license for Post Falls that is separate from the other four

hydroelectric plants. This is due to the fact that Post Falls

presents more complex issues that may take longer to resolve than

those dealing with the other facilities of the Spokane River

Project. Energy Marketing and Resource Management: This business

segment had a net loss of $8.3 million, or $0.17 per diluted share,

for the third quarter of 2005, compared to a net loss of $1.2

million, or $0.03 per diluted share, for the third quarter of 2004.

The net loss for the third quarter of 2005 was primarily related to

losses in Avista Energy's natural gas portfolio with a significant

portion of the loss due to the accounting for the management of

natural gas inventory that is further discussed below. The net loss

for the third quarter of 2004 was due to an impairment charge

related to a generating asset owned by Avista Power. This business

segment had a net loss of $16.9 million, or $0.34 per diluted

share, for the nine months ended Sept. 30, 2005, compared to net

income of $3.8 million, or $0.08 per diluted share, for the nine

months ended Sept. 30, 2004. The net loss for year-to-date 2005 was

primarily related to losses in Avista Energy's natural gas

portfolio during the first and third quarters. Increases in natural

gas prices had an overall negative impact on results for 2005.

While Avista Energy's portfolio is within its internally

established limits and in accordance with its risk management

practices, losses can and do occur when the market moves contrary

to Avista Energy's positions, which has occurred during 2005. As

markets moved counter to certain positions, Avista Energy acted to

adjust its position consistent with established risk management

practices. This reduced the market risk but had the effect of

locking in losses that were recorded during the first and third

quarters of 2005. These losses can be magnified when there are

large unforeseen fluctuations or disruptions in the market, such as

those caused by the hurricanes in the southeastern United States

during the third quarter. Avista Energy continued to produce

positive results on the electric side of its business that includes

trading, marketing and managing the output and availability of

combustion turbines and hydroelectric assets owned by other

entities. Avista Energy continues to seek opportunities to expand

its business of optimizing generation assets owned by other

entities and has expanded its natural gas end-user business to

commercial and industrial customers in Montana. The operations of

Avista Energy are managed on an economic basis, reflecting all

contracts and assets under management at estimated market value

consistent with industry practices, which is different from the

required accounting for certain contracts and physical assets under

management. Under Statement of Financial Accounting Standards No.

133, "Accounting for Derivative Instruments and Hedging

Activities," certain contracts that are considered derivatives and

accounted for at market value, economically hedge other contracts

and physical assets under management that are not considered

derivatives and are generally accounted for at the lower of cost or

market value. The accounting treatment does not impact the

underlying cash flows or economics of these transactions. These

differences are generally reversed in future periods as market

values change or the contracts are settled or realized. These

differences primarily relate to Avista Energy's management of

natural gas inventory, as well as Avista Energy's control of

natural gas-fired generation through a power purchase agreement.

These differences had a $7.7 million negative effect on results for

the third quarter of 2005 and accounted for almost 70 percent of

the net loss for Avista Energy during the nine months ended Sept.

30, 2005. Avista Energy anticipates that losses of approximately

$12 million, net of tax, associated with natural gas inventory will

be reversed when the natural gas is withdrawn from storage, which

is forecasted to occur during the first quarter of 2006. However,

the loss could increase or decrease prior to that time depending on

changes in natural gas prices. In July 2005, Avista Energy amended

its committed credit agreement to increase the amount available

from $110 million to $145 million and to extend the expiration date

by two years to July 2007. Avista Advantage: This business segment

completed its fifth consecutive quarter of positive earnings,

contributing $1.3 million, or $0.03 per diluted share, for the

third quarter of 2005. This is compared to net income of $0.4

million, or $0.01 per diluted share, for the third quarter of 2004.

For the nine months ended Sept. 30, 2005, Avista Advantage

contributed $3.0 million to net income, or $0.06 per diluted share,

compared to net income of less than $0.1 million for the nine

months ended Sept. 30, 2004. Through Sept. 30, 2005, Avista

Advantage has already exceeded its original earnings guidance for

the full year of 2005. The improvement for the third quarter and

year-to-date 2005 over 2004 was primarily due to an increase in

operating revenues from customer growth, as well as the settlement

of an employment contract during 2004. Avista Advantage's revenues

increased by 38 percent for the nine months ended Sept. 30, 2005,

as compared to the same period one year ago, while the average cost

of processing a bill decreased by 7 percent for the same period.

Other Business Segment: This business segment had a net loss of

$0.2 million, or $0.01 per diluted share, for the third quarter of

2005, compared to a net loss of $1.6 million, or $0.03 per diluted

share, for the third quarter of 2004. For the nine months ended

Sept. 30, 2005, this business segment had a net loss of $2.0

million, or $0.04 per diluted share, compared to a net loss of $3.4

million (excluding the cumulative effect of accounting change), or

$0.07 per diluted share, for the nine months ended Sept. 30, 2004.

Liquidity and Capital Resources: During the nine months ended Sept.

30, 2005, positive cash flows from operations, proceeds from the

sale of Avista's South Lake Tahoe natural gas distribution

properties and a reduction in the company's total cash position

were used to fund the majority of Avista's cash requirements,

including utility capital expenditures and dividends. Utility

capital expenditures totaled approximately $150 million, the most

significant of which was the acquisition of the remaining interest

in Coyote Springs 2. For 2006, Avista is establishing a utility

capital budget of approximately $160 million. In September 2005,

Avista Corp. terminated the lease agreement with and acquired the

Rathdrum CT from WP Funding LP (an entity whose financial

statements have been consolidated since 2003). As a result of this

transaction, Avista Corp. is no longer including WP Funding LP in

its consolidated financial statements as of Sept. 30, 2005. This

transaction and deconsolidation did not have a material effect on

the company's total consolidated assets, liabilities, stockholders'

equity or results of operations. From a consolidated perspective,

the $56.3 million of WP Funding LP debt and third-party investment

was replaced with borrowings on Avista Corp.'s committed line of

credit. Avista Corp. expects to issue long-term debt during the

fourth quarter of 2005 to, among other things, refinance these

borrowings. The balance outstanding under Avista Corp.'s five-year

$350 million committed line of credit increased $89 million during

the nine months ended Sept. 30, 2005, to $157 million as of Sept.

30, 2005, primarily to fund the debt redemption and maturities

including the WP Funding LP transaction. Excluding the planned

long-term debt issuance during the fourth quarter of 2005, Avista

expects cash flows from operations and Avista Corp.'s committed

line of credit to provide adequate resources to pay dividends, fund

capital expenditures, repay maturing long-term debt and meet other

contractual commitments. Earnings Guidance and Outlook For 2005,

Avista is revising its guidance for consolidated earnings to a

range of $0.65 to $0.75 per diluted share from a range of $0.95 to

$1.05 per diluted share, due to the underperformance of the Energy

Marketing and Resource Management segment. The company still

expects Avista Utilities to contribute in the range of $0.95 to

$1.05 per diluted share for 2005. The outlook for the utility

assumes normal weather and temperatures, and below normal

hydroelectric generation for the fourth quarter of 2005. The 2005

outlook for the Energy Marketing and Resource Management segment

has been revised to a range of a loss of $0.30 to $0.35 per diluted

share from a range of a loss of $0.05 to a contribution of $0.05

per diluted share. The revised outlook for this segment assumes

stable natural gas prices and no positive or negative effect of

accounting for the management of natural gas inventory. For the

year 2005, the company expects Avista Advantage to contribute

approximately $0.08 per diluted share and the Other segment to lose

$0.05 per diluted share. For 2006, Avista is initiating its

guidance for consolidated earnings to be in the range of $1.30 to

$1.45 per diluted share. The company expects Avista Utilities to

contribute in the range of $1.00 to $1.15 per diluted share for

2006. The outlook for the utility assumes normal weather,

temperatures and hydroelectric generation, as well as the

implementation of the Washington general rate increase as designed

in the settlement agreement on January 1, 2006. The 2006 outlook

for the Energy Marketing and Resource Management segment is a range

of a contribution of $0.20 to $0.30 per diluted share, excluding

any positive or negative effects of changes in prices on the

accounting for the management of natural gas inventory. The company

expects Avista Advantage to contribute in a range of $0.10 to $0.12

per diluted share and the Other business segment to lose $0.05 per

diluted share. In addition to the earnings forecasts for 2006, if

natural gas prices remain at September 30, 2005 levels, the company

estimates that an additional $0.25 of earnings per diluted share

will be recognized in consolidated earnings in the Energy Marketing

and Resource Management segment when natural gas is withdrawn from

storage. This is forecasted to occur during the first quarter of

2006. Avista Corp. is an energy company involved in the production,

transmission and distribution of energy as well as other

energy-related businesses. Avista Utilities is a company operating

division that provides service to 330,000 electric and 285,000

natural gas customers in three Western states. Avista's

non-regulated subsidiaries include Avista Advantage and Avista

Energy. Avista Corp.'s stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista Corp.

logo are trademarks of Avista Corporation. NOTE: Avista Corp. will

host a conference call on October 27, 2005, at 10:30 a.m. EDT to

discuss this report with financial analysts. Investors, news media

and other interested parties may listen to the simultaneous webcast

of this conference call. To register for the webcast, please go to

http://www.avistacorp.com/. A replay of the conference call will be

available from 12:30 p.m. EDT on October 27 through 11:59 p.m. EST

November 3, 2005. Call 888-286-8010, passcode 56776911 to listen to

the replay. The webcast will be archived at

http://www.avistacorp.com/ for one year. The attached income

statement, balance sheet, and financial and operating highlights

are integral parts of this earnings release. This news release

contains forward-looking statements, including statements regarding

the company's current expectations for future financial performance

and cash flows, capital expenditures, the company's current plans

or objectives for future operations, future hydroelectric

generation projections, and other factors, which may affect the

company in the future. Such statements are subject to a variety of

risks, uncertainties and other factors, most of which are beyond

the company's control and many of which could have significant

impact on the company's operations, results of operations,

financial condition or cash flows and could cause actual results to

differ materially from the those anticipated in such statements.

The following are among the important factors that could cause

actual results to differ materially from the forward-looking

statements: weather conditions, including the effect of

precipitation and temperatures on the availability of hydroelectric

resources and the effect of temperatures on customer demand;

changes in the utility regulatory environment; the impact of

regulatory decisions; the potential effects of any legislation or

administrative rulemaking passed into law; the impact from the

potential formation of a Regional Transmission Organization; the

ability to relicense the Spokane River Project at a cost-effective

level with reasonable terms and conditions; volatility and

illiquidity in wholesale energy markets; changes in wholesale

energy prices; changes in global energy markets; wholesale and

retail competition; unplanned outages at any company-owned

generating facilities; unanticipated delays or changes in

construction costs; natural disasters that can disrupt energy

delivery; blackouts or large disruptions of transmission systems;

changes in industrial, commercial and residential growth and

demographic patterns; the loss of significant customers and/or

suppliers; failure to deliver on the part of any parties from which

the company purchases and/or sells capacity or energy; changes in

the creditworthiness of customers and energy trading

counterparties; the company's ability to obtain financing; the

impact of any potential change in the company's credit ratings;

changes in future economic conditions in the company's service

territory and the United States in general; changes in rapidly

advancing technologies; the potential for future terrorist attacks;

changes in tax rates and/or policies; changes in, and compliance

with, environmental and endangered species laws, regulations,

decisions and policies; the outcome of legal and regulatory

proceedings concerning the company or affecting directly or

indirectly its operations; employee issues, including changes in

collective bargaining unit agreements, strikes, work stoppages or

the loss of key executives, as well as the ability to recruit and

retain employees; changes in actuarial assumptions and the return

on assets with respect to the company's pension plan; increasing

health care costs and the resulting effect on health insurance

premiums; and increasing costs of insurance, changes in coverage

terms and the ability to obtain insurance. For a further discussion

of these factors and other important factors, please refer to the

company's Annual Report on Form 10-K for the year ended Dec. 31,

2004 and Quarterly Report on Form 10-Q for the quarter ended June

30, 2005. The forward-looking statements contained in this news

release speak only as of the date hereof. The company undertakes no

obligation to update any forward-looking statement or statements to

reflect events or circumstances that occur after the date on which

such statement is made or to reflect the occurrence of

unanticipated events. New factors emerge from time to time, and it

is not possible for management to predict all of such factors, nor

can it assess the impact of each such factor on the company's

business or the extent to which any such factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statement. AVISTA CORPORATION

CONSOLIDATED COMPARATIVE STATEMENTS OF INCOME (UNAUDITED) (Dollars

in Thousands except Per Share Amounts) Nine Months Ended Third

Quarter September 30, 2005 2004 2005 2004 OPERATING REVENUES

$265,679 $241,552 $901,175 $811,172 OPERATING EXPENSES: Resource

costs 167,025 136,000 520,157 434,761 Operations and maintenance

35,828 39,900 103,874 106,919 Administrative and general 23,156

26,479 72,490 76,745 Depreciation and amortization 21,368 20,458

65,462 58,770 Taxes other than income taxes 14,375 14,170 51,072

49,638 Total operating expenses 261,752 237,007 813,055 726,833

GAIN ON SALE OF UTILITY PROPERTIES 884 -- 4,093 -- INCOME FROM

OPERATIONS 4,811 4,545 92,213 84,339 OTHER INCOME (EXPENSE):

Interest expense (21,583) (21,481) (64,723) (65,584) Interest

expense to affiliated trusts (1,582) (1,314) (4,548) (4,399)

Capitalized interest 392 417 979 1,393 Net interest expense

(22,773) (22,378) (68,292) (68,590) Other income - net 3,511 2,356

7,173 6,728 Total other income (expense) - net (19,262) (20,022)

(61,119) (61,862) INCOME (LOSS) BEFORE INCOME TAXES (14,451)

(15,477) 31,094 22,477 INCOME TAXES (5,414) (5,695) 11,338 9,443

NET INCOME (LOSS) BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGE

(9,037) (9,782) 19,756 13,034 CUMULATIVE EFFECT OF ACCOUNTING

CHANGE (net of tax) (Note 1) -- -- -- (460) NET INCOME (LOSS)

$(9,037) $(9,782) $19,756 $12,574 Weighted-average common shares

outstanding (thousands), Basic 48,538 48,416 48,508 48,384

Weighted-average common shares outstanding (thousands), Diluted

48,538 48,416 49,046 48,899 EARNINGS (LOSS) PER COMMON SHARE,

BASIC: Earnings (loss) per common share before cumulative effect of

accounting change $(0.19) $(0.20) $0.41 $0.27 Loss per common share

from cumulative effect of accounting change (Note 1) -- -- --

(0.01) Total earnings (loss) per common share, basic $(0.19)

$(0.20) $0.41 $0.26 EARNINGS (LOSS) PER COMMON SHARE, DILUTED:

Earnings (loss) per common share before cumulative effect of

accounting change $(0.19) $(0.20) $0.40 $0.27 Loss per common share

from cumulative effect of accounting change (Note 1) -- -- --

(0.01) Total earnings (loss) per common share, diluted $(0.19)

$(0.20) $0.40 $0.26 Dividends paid per common share $0.135 $0.130

$0.405 $0.385 Note 1. Amount for the nine months ended September

30, 2004 represents the implementation of Financial Accounting

Standards Board Interpretation No. 46R, "Consolidation of Variable

Interest Entities," which resulted in the consolidation of several

minor entities. Issued October 27, 2005 AVISTA CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in

Thousands) September 30, December 31, 2005 2004 Assets Cash and

cash equivalents $62,965 $88,317 Restricted cash 39,466 26,175

Accounts and notes receivable 334,845 308,459 Current energy

commodity assets 1,522,517 284,231 Current utility energy commodity

derivative assets 139,794 12,557 Other current assets 188,459

182,961 Total net utility property 2,079,975 1,956,063 Investment

in exchange power-net 34,096 35,933 Non-utility properties and

investments-net 77,790 78,564 Non-current energy commodity assets

583,796 254,657 Investment in affiliated trusts 13,403 13,403 Other

property and investments-net 18,594 19,721 Regulatory assets for

deferred income taxes 121,151 123,159 Other regulatory assets

22,061 43,428 Non-current utility energy commodity derivative

assets 108,835 55,825 Power and natural gas deferrals 139,600

148,206 Unamortized debt expense 48,647 53,413 Other deferred

charges 23,041 21,109 Total Assets $5,559,035 $3,706,181

Liabilities and Stockholders' Equity Accounts payable $358,757

$325,194 Current energy commodity liabilities 1,511,624 253,527

Current portion of long-term debt 51,516 85,432 Short-term

borrowings 157,498 68,517 Other current liabilities 293,946 143,728

Long-term debt 844,291 901,556 Long-term debt to affiliated trusts

113,403 113,403 Preferred stock (subject to mandatory redemption)

26,250 28,000 Non-current energy commodity liabilities 559,631

215,055 Regulatory liability for utility plant retirement costs

184,021 175,575 Non-current utility energy commodity derivative

liabilities 41,212 33,490 Deferred income taxes 498,612 488,471

Other non-current liabilities and deferred credits 164,316 121,028

Total Liabilities 4,805,077 2,952,976 Common stock - net

(48,561,216 and 48,471,511 outstanding shares) 620,178 617,884

Retained earnings and accumulated other comprehensive loss 133,780

135,321 Total Stockholders' Equity 753,958 753,205 Total

Liabilities and Stockholders' Equity $5,559,035 $3,706,181 Issued

October 27, 2005 AVISTA CORPORATION FINANCIAL AND OPERATING

HIGHLIGHTS (Dollars in Thousands) Nine Months Ended Third Quarter

September 30, 2005 2004 2005 2004 Avista Utilities Retail electric

revenues $121,992 $124,556 $373,211 $374,170 Retail kWh sales (in

millions) 2,047 2,080 6,227 6,176 Retail electric customers at end

of period 333,598 327,410 333,598 327,410 Wholesale electric

revenues $40,260 $15,012 $100,737 $40,514 Wholesale kWh sales (in

millions) 597 326 1,959 1,079 Sales of fuel $6,869 $19,569 $33,122

$58,926 Other electric revenues $4,089 $5,759 $11,932 $14,801 Total

natural gas revenues $48,499 $33,696 $260,741 $200,332 Total therms

delivered (in thousands) 80,441 66,959 373,779 331,330 Retail

natural gas customers at end of period 290,121 300,020 290,121

300,020 Income from operations (pre-tax) $17,284 $8,446 $117,792

$83,800 Net income (loss) $(1,803) $(7,332) $35,590 $12,576 Energy

Marketing and Resource Management Gross margin (operating revenues

less resource costs) $(9,588) $7,617 $(14,398) $24,728 Income

(loss) from operations (pre-tax) $(14,460) $(2,874) $(29,241)

$3,624 Net income (loss) $(8,266) $(1,241) $(16,874) $3,793

Electric sales (millions of kWhs) 7,785 9,019 21,454 24,754 Natural

gas sales (thousands of dekatherms) 45,197 40,561 131,313 155,240

Avista Advantage Revenues $8,201 $6,021 $23,143 $16,808 Income from

operations (pre-tax) $2,201 $823 $5,336 $650 Net income $1,274 $391

$3,000 $24 Other Revenues $4,843 $4,066 $13,476 $12,645 Loss from

operations (pre-tax) $(214) $(1,850) $(1,674) $(3,735) Net loss

before cumulative effect of accounting change $(242) $(1,600)

$(1,960) $(3,359) Net loss $(242) $(1,600) $(1,960) $(3,819) Issued

October 27, 2005

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

media, Jessie Wuerst, +1-509-495-8578, or , or investors, Jason

Lang, +1-509-495-2930, or , or Avista 24/7 Media Access,

+1-509-495-4174, all of Avista Corp. Web site:

http://www.avistacorp.com/

Copyright

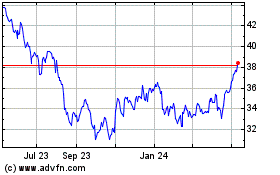

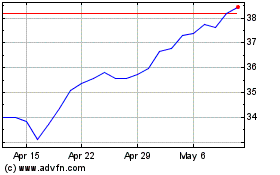

Avista (NYSE:AVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avista (NYSE:AVA)

Historical Stock Chart

From Jul 2023 to Jul 2024