Allegheny Misses but Profits Increase - Analyst Blog

July 27 2011 - 11:12AM

Zacks

Allegheny Technologies Incorporated (ATI)

reported an increase in profit to $76.7 million or 70 cents per

share (excluding acquisition related expenses of $12.7 million, net

of tax) in the second quarter of 2011 from $36.4 million or 36

cents per share in the same quarter of 2010.

However, the profit was lower than the Zacks Consensus Estimate

of 73 cents per share.

Sales in the quarter increased 28.5% to $1.35 billion, driven by

higher shipments for most high-value products, higher raw material

surcharges and increases in average base selling prices for many

products. It was higher than the Zacks Consensus Estimate of $1.30

billion.

Segment operating profit increased to $173.4 million, or 12.8%

of sales, from $117.3 million, or 11.2% of sales, in the second

quarter of 2010.

Segment Results

Sales in the High Performance Metals segment

surged 45% to $497.2 million. Segment operating profit increased to

$92.9 million, or 18.7% of sales, from $67.3 million, or 19.7% of

sales, in the second quarter of 2010. The increase in operating

profit resulted from higher shipment volumes, improved product

pricing and the benefits of gross cost reductions.

Sales in the Flat-Rolled Products segment

increased 18.2% to $727.3 million, as a result of higher raw

material surcharges and improved base-selling prices for most

high-value products. Operating profit improved to $73.7 million, or

10.1% of sales, from $42.1 million, or 6.8% of sales, in the second

quarter of 2010 due to increased high-value product shipments and

higher base prices for most high-value products.

Sales in the Engineered Products segment soared

33.9% to $127.1 million, driven by higher demand and increased

prices for tungsten-based and carbon alloy steel forging products.

Segment operating profit was $6.8 million compared with $7.9

million in the second quarter of 2010.

Financials

Allegheny’s cash and cash equivalents were $367.8 million as of

June 30, 2011, a decrease from $432.3 million as of December 31,

2010. Total debt was $1.65 billion, reflecting a net

debt-to-capitalization ratio of 32.3% and total debt-top-capital

ratio of 38.0% at June 30, 2011.

In the first half of 2011, cash flow used in operations was

$72.0 million compared with $193.4 million in the year-ago period.

The higher profit was offset by an investment of $455.1 million in

managed working capital due to a higher level of business activity,

higher raw material costs, and additional inventory on-hand to

address operational maintenance outages. Capital expenditures

remained flat at $97.7 million compared with $97.6 million a year

ago.

Outlook

Allegheny expects revenues of $5.4 to $5.5 billion for full year

2011 compared with its previous guidance of $4.6 to $4.8 billion,

and segment operating profit of 13% to 14% of revenues, excluding

the impact of purchase inventory accounting charges.

The guidance is based on the strength in the company’s key

global markets, improving shipments and higher base prices for many

of its high-value products, the expectation of improved demand in

the fourth quarter for its standard stainless products, and the

view that certain raw material costs will moderate slightly or at

least remain at current levels.

The company also anticipates capital expenditures to be

approximately $275 to $300 million during the year, of which $98

million has been spent to date. It expects cash on-hand to increase

in the third quarter as investment in managed working capital

declines.

Over the next 3 to 5 years, Allegheny expects to continue to

benefit from its new alloys and products, diversified global growth

markets and differentiated product mix. Demand is expected to be

strong for its mill products and highly engineered forged and cast

components from the aerospace market. Strong growth is also

expected from the oil and gas/chemical process industry for its

titanium-based alloys, nickel-based alloys and specialty alloys,

and tungsten products.

Allegheny Technologies, based in Pittsburgh, Pennsylvania,

produces and sells specialty metals worldwide. Its primary

competitor includes Carpenter Technology Corp.

(CRS). The company currently retains a Zacks #3 Rank on its stock,

which translates to a short-term rating of “Hold”.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

Zacks Investment Research

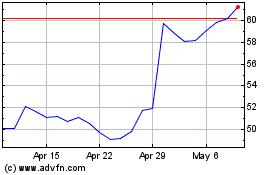

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

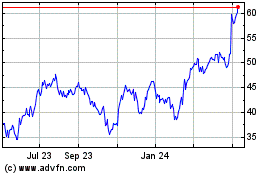

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024