Allegheny Technologies Incorporated (NYSE: ATI) reported net

income for the second quarter 2011 of $64.0 million, or $0.59 per

share, on sales of $1.35 billion. Results included acquisition

related expenses of $12.7 million, net of tax, primarily related to

inventory fair value adjustments and transaction costs. Excluding

these items, net income was $76.7 million, or $0.70 per share, on

sales of $1.35 billion and 113.5 million diluted shares. In the

second quarter 2010, ATI reported net income of $36.4 million, or

$0.36 per share, on sales of $1.05 billion.

On May 9, 2011, ATI completed the acquisition of Ladish Co.,

Inc. for $897.6 million, comprised of the issuance of 7.3 million

shares of ATI common stock and payment of $24.00 per Ladish share

in cash. ATI Ladish results are included in the High Performance

Metals segment from the date of the acquisition.

For the six months ended June 30, 2011, net income was $120.3

million, or $1.13 per share, on sales of $2.58 billion. Year to

date 2011 results included $18.5 million of special items, or $0.16

per share, including $3.1 million, net of tax, related to the

accelerated recognition of equity-based compensation expense due to

executive retirements, a discrete tax charge of $2.7 million

primarily related to foreign income taxes, and $12.7 million, net

of tax, in Ladish acquisition related items. Excluding these

special items, net income was $138.8 million, or $1.29 per share

for the first six months of 2011.

For the six months ended June 30, 2010, net income, including

special charges, was $54.6 million, or $0.54 per share. Results

included a non-recurring tax charge of $5.3 million related to the

Patient Protection and Affordable Care Act. Excluding this

non-recurring tax charge, net income was $59.9 million, or $0.60

per share, on sales of $1.95 billion.

“We continue to see strong secular growth in our key global

markets,” said Rich Harshman, Chairman, President and Chief

Executive Officer. “In the second quarter 2011, sales increased 28%

compared to the same period in 2010, and increased 10% compared to

the first quarter 2011.”

- Total titanium mill product shipments

in the second quarter 2011, including Uniti joint venture

conversion, were 12.1 million pounds, an increase of nearly 24%

compared to the second quarter 2010. Titanium shipments in our

Flat-Rolled Products segment were 4.9 million pounds, an increase

of 90%. Total titanium mill product shipments were over 23.5

million pounds for the first six months of 2011, a 24% increase

compared to the first six months of 2010.

- In our High Performance Metals segment,

shipments of nickel-based alloy and specialty alloy mill products

increased 31%.

- In our Flat-Rolled Products segment,

shipments of high-value products increased 15%.

- ATI’s key global markets, aerospace and

defense, oil and gas/chemical processing industry, electrical

energy, and medical, represented 70% of ATI sales. Direct

international sales were nearly 34% of total sales.

“Second quarter 2011 segment operating profit, excluding

inventory fair value adjustments associated with the Ladish

transaction, increased 59% to almost $187 million, or nearly 14% of

ATI sales,” said Mr. Harshman. “Operating profit improved

significantly in our High Performance Metals and Flat-Rolled

Products segments. Flat-Rolled Products segment operating profit

was over 10% of sales, reflecting a strong high-value product mix,

which offset soft demand and low base prices for our standard

stainless sheet and plate products. The supply chain for our

standard stainless products reduced their inventories as surcharges

declined and U.S. GDP weakened in the second quarter.

“Results were impacted by idle facility, start-up and

qualification costs of $9.7 million associated with our titanium

sponge operations, including $6.7 million associated with start-up

and qualification costs at our Rowley, Utah facility. Segment

operating profit for the quarter was also impacted by LIFO charges

of $5.2 million, which was $1.3 million higher than the first

quarter, primarily due to higher titanium and tungsten raw material

costs.

“We have made good progress integrating ATI Ladish since

completing the transaction on May 9. We are pleased with customer

reaction to the combination of ATI Ladish’s operations with ATI’s

High Performance Metals businesses. ATI is now a fully integrated

supplier, from raw material (for titanium) and melt (for other

specialty alloy systems) through highly engineered finished

components. This provides enhanced value to our customers and

expands ATI’s profitable growth opportunities.

“We continued to improve our cost structure with over $32

million in gross cost reductions in the second quarter, bringing

our total gross cost reductions for the year to $59 million. Our

gross cost reduction goal for 2011 is at least $100 million. Our

balance sheet remains strong with cash on-hand of $368 million at

the end of June.

“High Performance Metals segment backlog, including ATI Ladish,

was over $1.38 billion at the end of the second quarter 2011. In

addition, demand for our nickel-based alloys and specialty alloys

continued to be strong in our Flat-Rolled Products segment as we

received additional large project orders in the oil and gas market

extending that segment’s solid backlog for these products through

2011 and into 2012.

“Our Rowley, UT premium-titanium sponge facility has produced

over 5 million pounds of sponge so far this year. This sponge is

being used to produce industrial titanium products. Our primary

focus is to continue the orderly production ramp and begin the

program to achieve standard-grade qualification for Rowley sponge.

We expect to complete this qualification by early 2012. We will

then begin the premium-grade qualification program. Our new PAM

(Plasma Arc Melt) premium-titanium melt furnace in Bakers, NC has

begun melt trials. These new investments are important to ATI as we

expect strong demand growth to continue for our titanium mill

products and titanium forgings and castings.

“We expect to begin construction of our Flat-Rolled Products

segment Hot-Rolling and Processing Facility later this summer. Site

preparation is essentially complete and final engineering drawings

are nearing completion. We currently expect 2011 capital

expenditures to be approximately $275 to $300 million, of which $98

million has been spent to date. We expect cash on-hand to increase

in the third quarter as investment in managed working capital

declines.

“The on-going debate about the U.S. budget deficits and debt

ceiling, combined with the European debt crisis, is having a

negative impact on consumer confidence. In spite of these

challenges, we remain optimistic about the current demand and the

secular growth opportunities over the next several years in our key

diversified global markets.

“In our High Performance Metals segment, we expect demand to

continue to be strong for our mill products and component products,

and anticipate better demand for our exotic alloys in the second

half 2011. We expect additional pre-tax charges in the third

quarter 2011 of approximately $8 to $9 million relating to the

inventory fair-value adjustments from the acquisition of ATI

Ladish. We do not expect any significant similar charges beyond the

third quarter. In our Flat-Rolled Products segment, we expect the

third quarter results to be impacted by seasonal factors, soft

demand, and low base prices for standard stainless sheet and plate

products. Also, this segment’s operating results are expected to be

negatively impacted by approximately $6 million of major

maintenance charges as we take advantage of the seasonally lower

demand for our standard stainless products.

“With the Ladish acquisition now complete, we expect 2011

revenues of $5.4 to $5.5 billion, compared to our previous

expectations of $4.6 to $4.8 billion, and segment operating profit

of 13% to 14% of revenues, excluding the impact of purchase

inventory accounting charges. These expectations are based on the

strength in our key global markets, improving shipments and higher

base prices for many of our high-value products, the expectation of

improved demand in the fourth quarter for our standard stainless

products, and the view that certain raw material costs will

moderate slightly or at least remain at current levels.

“Over the next 3 to 5 years we expect ATI to continue to benefit

from our new alloys and products, diversified global growth

markets, and differentiated product mix. Demand is expected to be

strong for our mill products and highly engineered forged and cast

components from the aerospace market. Strong growth is also

expected from the oil and gas/chemical process industry for our

titanium-based alloys, nickel-based alloys and specialty alloys,

and tungsten products. Global demand is expected to grow

considerably from the electrical energy market driven by increased

need for natural gas-fired turbines, nuclear applications, and

alternative energy applications such as solar and wind, and from

the rebuilding of transmission infrastructure. In addition, medical

market demand for our titanium, zirconium, specialty, and niobium

alloys is expected to grow significantly above global GDP growth

rates.”

Three Months Ended Six Months Ended

June 30 June 30 In Millions 2011

2010 2011 2010 Sales $ 1,351.6 $

1,052.0 $ 2,579.0 $ 1,951.4

Net income attributable to ATI before

acquisition expenses and other charges

$

76.7

$

36.4

$ 138.8

$

59.9

Acquisition expenses and other

charges*

$

(12.7

)

$

0.0

$ (18.5

)

$

(5.3

)

Net income attributable to ATI $ 64.0 $ 36.4 $ 120.3 $ 54.6

Per Diluted Share

Net income attributable to ATI before

acquisition expenses and other charges per common share **

$

0.70

$

0.36

$ 1.29

$

0.60

Acquisition expenses and other charges

$

(0.11

)

$

0.00

$ (0.16

)

$

(0.06

)

Net income attributable to ATI per common share

$

0.59

$

0.36

$ 1.13

$

0.54

* Includes non-recurring Ladish acquisition expenses of $12.7

million for the three months ended June 2011, and accelerated

recognition of equity-based compensation expense due to previously

announced executive retirements and a discrete tax charge for the

six months ended June 2011. For the six months ended June 2010,

charges were related to the impact of tax law changes.

** ATI issued 7.3 million shares of common stock as part of the

Ladish merger consideration. The weighted average impact was 4.4

million shares for the three months ended June 2011 and 2.2 million

shares for the six months ended June 2011. The additional shares

reduced reported results by $0.02 per share for both 2011

periods.

Second Quarter 2011 Financial Results

- Sales for the second quarter

2011 increased 28.5% to $1.35 billion, compared to the second

quarter 2010, primarily as a result of higher shipments for most

high-value products, higher raw material surcharges and increases

in average base selling prices for many products. Compared to the

second quarter 2010, sales increased 45% in the High Performance

Metals segment, 18% in the Flat-Rolled Products segment and 34% in

the Engineered Products segment. For the first six months of 2011,

direct international sales increased $173.9 million, or 26%, and

represented 32.8% of total sales. Compared to the first quarter

2011, total sales were 10% higher with increases of 24% in the High

Performance Metals segment, 2% in the Flat-Rolled Products segment

and 8% in the Engineered Products segments.

- Second quarter 2011 segment

operating profit increased to $173.4 million, or 12.8% of

sales, compared to $117.3 million, or 11.2% of sales, for the

comparable 2010 period. While operating profit improved in the High

Performance Metals and Flat-Rolled Products segments, results for

the second quarter 2011 in the High Performance Metals segment were

impacted by $13.2 million of purchase inventory accounting charges

from the acquisition of ATI Ladish and $9.7 million of idle

facility, start-up, and qualification costs associated with our

titanium sponge operations. In addition, the second quarter 2011

included a LIFO inventory valuation reserve charge of $5.2 million

due primarily to higher titanium and tungsten raw material costs.

The second quarter 2010 included a LIFO inventory valuation reserve

charge of $5.5 million.

- Net income attributable to ATI

for the second quarter 2011 was $64.0 million, or $0.59 per diluted

share, compared to $36.4 million, or $0.36 per diluted share, in

the second quarter 2010. Results for the second quarter 2011

included acquisition related expenses of $12.7 million, net of tax,

primarily related to inventory fair value adjustments and

transaction costs. Excluding these items, net income was $76.7

million, or $0.70 per share. Net income for the second quarter 2010

was $36.4 million, or $0.36 per share.

- The Ladish acquisition was

completed May 9, 2011, for $897.6 million, comprised of the

issuance of 7.3 million shares of ATI common stock and the payment

of $349.2 million in cash, net of $34.8 million of cash acquired.

The acquired operations were renamed ATI Ladish, and results are

included in the High Performance Metals segment from the date of

the acquisition.

- Cash flow used in

operations for the first six months of 2011 was $72.0 million.

Increased profitability was offset by an investment of $455.1

million in managed working capital, due to a higher level of

business activity, higher raw material costs, and additional

inventory on-hand to address operational maintenance outages

scheduled in early third quarter.

- Cash on hand at the end of the

second quarter 2011 was $367.8 million.

- Gross cost reductions, before

the effects of inflation, totaled $32 million in the second quarter

2011, bringing gross cost reductions for the year to $59

million.

High Performance Metals Segment

Market Conditions

- Demand for our titanium and titanium

alloys and our nickel-based and specialty alloys was strong from

the aerospace, medical, electrical energy, and oil and gas markets.

Mill product shipments of our titanium alloys, and nickel-based

alloys and specialty alloys increased 6%, compared to the first

quarter 2011 while shipments of our exotic alloys were 8% lower due

to the timing of major construction projects. Average selling

prices increased 3% for nickel-based and specialty alloys primarily

due to higher raw material indices and improving base prices.

Average selling prices for exotic alloys increased 9% primarily due

to mix. Average selling prices for titanium and titanium alloys

were essentially flat with the first quarter 2011 primarily due to

mix.

Second quarter 2011 compared to second quarter 2010

- Sales were $497.2 million, 45% higher

than the second quarter 2010. Mill product shipments increased 31%

for nickel-based and specialty alloys primarily due to higher

demand from the commercial aerospace market. Shipments of titanium

and titanium alloys mill products were flat with the prior year’s

quarter, although the product mix contained more value-added

product forms. Exotic alloys shipments decreased 13% primarily due

to lower project based demand in the chemical processing industry.

Average selling prices increased 15% for both titanium and titanium

alloys, and nickel-based and specialty alloys primarily due to

higher raw material indices and improving base prices. Average

selling prices for exotic alloys increased 10%.

- Segment operating profit increased to

$92.9 million, or 18.7% of sales, compared to $67.3 million, or

19.7% of sales, for the second quarter 2010. Segment operating

profit excluding purchase accounting inventory charges was 21.3% of

segment sales. The increase in operating profit primarily resulted

from higher shipment volumes, improved product pricing, and the

benefits of gross cost reductions. Second quarter 2011 segment

operating profit was impacted by $13.2 million of acquisition

related charges and $9.7 million of idle facility, start-up, and

qualification costs associated with our titanium sponge operations.

The second quarter 2010 included $7.7 million of start-up and idle

facility costs associated with our titanium sponge operations. In

addition, second quarter 2011 segment operating profit included a

LIFO inventory valuation reserve charge of $4.2 million. The second

quarter 2010 included a LIFO inventory valuation reserve charge of

$2.1 million.

- Results benefited from $17.4 million of

gross cost reductions in the second quarter 2011.

Flat-Rolled Products Segment

Market Conditions

- Demand was strong for high-value

products from the oil and gas/chemical process industry and

aerospace markets and improved from the global automotive market.

Compared to the first quarter 2011, demand increased 6% for

high-value products, which includes titanium, nickel-based alloys,

Precision Rolled Strip® products and grain-oriented electrical

steel, but decreased 12% for standard stainless products. The rapid

decline in nickel prices during the 2011 second quarter and the

resulting effect on future raw material surcharges combined with

slower U.S. GDP growth led standard stainless customers to reduce

order entry activity. Direct international sales represented 32% of

segment sales for the second quarter 2011. Second quarter

Flat-Rolled Products segment titanium shipments, including Uniti

joint venture conversion, were a record 4.9 million pounds, a 90%

increase compared to the second quarter 2010. Average selling

prices for all products increased 7% compared to the first quarter

2011 primarily due to raw material surcharges and higher base

prices for most high-value products.

Second quarter 2011 compared to second quarter 2010

- Sales increased to $727.3 million,

18.2% higher than the second quarter 2010, primarily due to higher

raw material surcharges and improved base-selling prices for most

high-value products. Shipments of high-value products increased 15%

and shipments of standard stainless products (sheet and plate)

decreased 16%. Average transaction prices for all products, which

include surcharges, increased 23% due to higher raw material

surcharges for all products and improved base prices for most

high-value products.

- Segment operating profit improved to

$73.7 million, or 10.1% of sales, compared to $42.1 million, or

6.8% of sales, for the second quarter 2010 due primarily to

increased high-value product shipments and higher base prices for

most high-value products. The second quarter 2011 included a LIFO

inventory valuation reserve benefit of $3.2 million. The second

quarter 2010 included a LIFO inventory valuation reserve charge of

$1.6 million.

- Results benefited from $12.9 million in

gross cost reductions in the second quarter 2011.

Engineered Products Segment

Market Conditions

- Demand improved from the oil and gas,

cutting tool, transportation, construction and mining, aerospace,

and electrical energy markets.

Second quarter 2011 compared to second quarter 2010

- Sales increased to $127.1 million, an

increase of 33.9% compared to the second quarter 2010, primarily as

a result of the improved demand and higher prices for

tungsten-based and carbon alloy steel forging products.

- Segment operating profit was $6.8

million for the second quarter 2011, compared to $7.9 million in

the second quarter 2010. Results for the second quarter 2011

included a LIFO inventory valuation reserve charge of $4.2 million

compared to a $1.8 million LIFO inventory valuation reserve charge

for the comparable 2010 period.

- Results benefited from $2 million of

gross cost reductions in the second quarter 2011.

Other Expenses

- Corporate expenses for the second

quarter 2011 were $25.8 million, compared to $15.0 million in the

year-ago period. The increase in corporate expenses was primarily

related to Ladish transaction costs and higher incentive

compensation expenses associated with long-term performance

plans.

- Interest expense, net of interest

income, was $23.7 million, compared to $15.4 million in the second

quarter 2010. The increase in interest expense was primarily due to

the January 7, 2011 issuance of $500 million of 5.95% Notes due

2021, debt assumed in the Ladish acquisition, and lower interest

expense capitalized on strategic projects due to project

completions.

- Capitalized interest on major strategic

capital projects reduced interest expense by $2.8 million for the

second quarter 2011 compared to $3.4 million for the comparable

2010 period.

- Other expenses, which include expenses

related to closed operations, for the second quarter 2011 were $4.2

million compared to $3.9 million in the year-ago period.

Retirement Benefit Expense

- Retirement benefit expense, which

includes pension expense and other postretirement expense,

decreased to $19.4 million in the second quarter 2011, compared to

$22.4 million in the second quarter 2010. This decrease was

primarily due to higher than expected returns on pension plan

assets in 2010 and the benefits resulting from our voluntary

pension contributions made over the last several years.

- For the second quarter 2011, retirement

benefit expense of $13.4 million was included in cost of sales and

$6.0 million was included in selling and administrative expenses.

For the second quarter 2010, the amount of retirement benefit

expense included in cost of sales was $16.2 million, and the amount

included in selling and administrative expenses was $6.2

million.

Income Taxes

- The second quarter 2011 provision for

income taxes was $34.3 million, or 34.2% of income before tax,

compared to the second quarter 2010 provision for income taxes of

$22.4 million, or 37% of income before tax.

Cash Flow, Working Capital and Debt

- Cash on hand was $367.8 million at June

30, 2011, a decrease of $64.5 million from year-end 2010.

- Cash flow used in operations for the

first half 2011 was $72.0 million. Increased profitability was

offset by an investment of $455.1 million in managed working

capital due to a higher level of business activity, higher raw

material costs, and additional inventory on-hand to address

operational maintenance outages scheduled in early third

quarter.

- The $455.1 million growth in managed

working capital resulted from a $185.4 million increase in accounts

receivable and a $333.1 million increase in inventory, partially

offset by a $63.4 million increase in accounts payable.

- At June 30, 2011, managed working

capital was 35.2% of annualized sales, compared to 34.4% of

annualized sales at year-end 2010. We define managed working

capital as accounts receivable plus gross inventories less accounts

payable.

- Cash used in investing activities was

$444.3 million in the first half of 2011, including $349.2 million

for the Ladish acquisition and $97.7 million of capital

expenditures.

- Cash provided by financing activities

was $451.8 million in the first half 2011, and included $495.0

million in net proceeds from the issuance of $500 million of 5.95%

Notes due January 2021, dividend payments of $36.7 million and $8.7

million of net debt retirements.

- Net debt as a percentage of total

capitalization was 32.3% at the end of the second quarter 2011

compared to 23.6% at the end of 2010. Total debt to total capital

was 38.0% at June 30, 2011, compared to 34.3% at the end of

2010.

- There were no borrowings outstanding

under ATI’s $400 million unsecured domestic borrowing facility,

although a portion of the letters of credit capacity was

utilized.

Allegheny Technologies will conduct a conference call with

investors and analysts on Wednesday, July 27, 2011, at 1:00 p.m. ET

to discuss the financial results. The conference call will be

broadcast live on www.ATImetals.com. To access the broadcast, click

on “Conference Call”. Replay of the conference call will be

available on the Allegheny Technologies website.

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Certain statements in this news release relate to future

events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements include those containing

such words as “anticipates,” “believes,” “estimates,” “expects,”

“would,” “should,” “will,” “will likely result,” “forecast,”

“outlook,” “projects,” and similar expressions. Forward-looking

statements are based on management’s current expectations and

include known and unknown risks, uncertainties and other factors,

many of which we are unable to predict or control, that may cause

our actual results, performance or achievements to materially

differ from those expressed or implied in the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include: (a) material adverse changes in economic or industry

conditions generally, including global supply and demand conditions

and prices for our specialty metals; (b) material adverse changes

in the markets we serve, including the aerospace and defense,

electrical energy, chemical process industry, oil and gas, medical,

automotive, construction and mining, and other markets; (c) our

inability to achieve the level of cost savings, productivity

improvements, synergies, growth or other benefits anticipated by

management, from the Ladish acquisition and other strategic

investments and the integration of acquired businesses, whether due

to significant increases in energy, raw materials or employee

benefits costs, the possibility of project cost overruns or

unanticipated costs and expenses, or other factors;

(d) volatility of prices and availability of supply of the raw

materials that are critical to the manufacture of our products; (e)

declines in the value of our defined benefit pension plan assets or

unfavorable changes in laws or regulations that govern pension plan

funding; (f) significant legal proceedings or investigations

adverse to us; and (g) other risk factors summarized in our Annual

Report on Form 10-K for the year ended December 31, 2010, and in

other reports filed with the Securities and Exchange Commission. We

assume no duty to update our forward-looking statements.

Building the World’s Best Specialty Metals Company®

Allegheny Technologies Incorporated is one of the largest and

most diversified specialty metals producers in the world with

revenues of approximately $4.7 billion for the last twelve months.

ATI has approximately 11,300 full-time employees world-wide who use

innovative technologies to offer global markets a wide range of

specialty metals solutions. Our major markets are aerospace and

defense, oil and gas/chemical process industry, electrical energy,

medical, automotive, food equipment and appliance, machine and

cutting tools, and construction and mining. Our products include

titanium and titanium alloys, nickel-based alloys and superalloys,

grain-oriented electrical steel, stainless and specialty steels,

zirconium, hafnium, niobium, tungsten materials, forgings,

castings, and fabrication and machining capabilities. The ATI

website is www.ATImetals.com.

Allegheny Technologies Incorporated and Subsidiaries

Consolidated Statements of Income (Unaudited, dollars in

millions, except per share amounts)

Three Months Ended Six Months Ended June

30 June 30 2011 2010 2011

2010 Sales $ 1,351.6 $

1,052.0 $ 2,579.0 $ 1,951.4

Costs and expenses: Cost of sales 1,128.6 900.2 2,150.6 1,678.2

Selling and administrative expenses 99.3 76.0

188.0 150.2

Income before interest, other income and

income taxes

123.7 75.8 240.4 123.0 Interest expense, net (23.7 ) (15.4 ) (46.7

) (30.0 ) Other income, net 0.3 0.2

0.4 0.6 Income before income tax

provision 100.3 60.6 194.1 93.6 Income tax provision 34.3

22.4 69.4 35.6

Net income 66.0 38.2 124.7 58.0

Less: Net income attributable to

noncontrolling interests

2.0 1.8 4.4 3.4

Net income attributable to ATI $ 64.0

$ 36.4 $ 120.3

$ 54.6

Basic net income attributable to ATI

per common share

$ 0.63 $ 0.37 $

1.20 $ 0.56

Diluted net income attributable to ATI

per common share

$ 0.59 $ 0.36 $

1.13 $ 0.54

Weighted average common shares outstanding

-- basic (millions)

102.1 97.5 99.9 97.4

Weighted average common shares outstanding

-- diluted (millions)

113.5 108.4 111.2 108.4

Actual common shares outstanding -- end of

period (millions)

106.3 98.6 106.3 98.6

Allegheny Technologies

Incorporated and Subsidiaries Sales and Operating Profit by

Business Segment (Unaudited - Dollars in millions)

Three Months Ended

Six Months Ended June 30 June 30 2011

2010 2011 2010 Sales: High Performance Metals

$ 497.2 $ 341.8 $ 896.6 $ 644.1 Flat-Rolled Products 727.3 615.3

1,437.9 1,131.9 Engineered Products 127.1 94.9

244.5 175.4

Total External

Sales $ 1,351.6 $ 1,052.0

$ 2,579.0 $ 1,951.4

Operating Profit: High Performance Metals $ 92.9 $ 67.3 $

178.5 $ 122.3 % of Sales 18.7 % 19.7 % 19.9 % 19.0 %

Flat-Rolled Products 73.7 42.1 137.1 73.5 % of Sales 10.1 % 6.8 %

9.5 % 6.5 % Engineered Products 6.8 7.9 20.2 9.7 % of Sales

5.4 % 8.3 % 8.3 % 5.5 %

Operating

Profit 173.4 117.3 335.8 205.5 % of

Sales 12.8 % 11.2 % 13.0 % 10.5 % Corporate expenses (25.8 ) (15.0

) (51.6 ) (27.3 ) Interest expense, net (23.7 ) (15.4 ) (46.7 )

(30.0 )

Other expense, net of gains on asset

sales

(4.2 ) (3.9 ) (4.7 ) (9.7 ) Retirement benefit expense (19.4

) (22.4 ) (38.7 ) (44.9 )

Income before income taxes

$ 100.3 $ 60.6 $

194.1 $ 93.6

Allegheny Technologies Incorporated and Subsidiaries

Consolidated Balance Sheets (Current period

unaudited--Dollars in millions)

June 30,

December 31, 2011 2010 ASSETS

Current Assets: Cash and cash equivalents $ 367.8 $ 432.3

Accounts receivable, net of allowances for

doubtful accounts of $7.3 and$5.6 at June 30, 2011 and December 31,

2010, respectively

808.1 545.4 Inventories, net 1,465.4 1,024.5 Deferred income taxes

13.5 -

Prepaid expenses and other current

assets

36.3

112.9

Total Current Assets 2,691.1

2,115.1 Property, plant and equipment, net 2,292.7

1,989.3 Cost in excess of net assets acquired 690.6 206.8 Other

assets 374.6 182.4

Total Assets $

6,049.0 $ 4,493.6 LIABILITIES AND

EQUITY Current Liabilities: Accounts payable $ 503.6 $

394.1 Accrued liabilities 341.0 249.9 Deferred income taxes - 5.6

Short term debt and current portion of

long-term debt

154.2 141.4

Total Current Liabilities

998.8 791.0 Long-term debt 1,496.5 921.9

Accrued postretirement benefits 439.2 423.8 Pension liabilities

97.4 58.3 Deferred income taxes 109.6 68.6 Other long-term

liabilities 127.5 100.6

Total Liabilities

3,269.0 2,364.2 Total ATI

stockholders' equity 2,690.7 2,040.8 Noncontrolling interests

89.3 88.6

Total Equity 2,780.0

2,129.4 Total Liabilities and Equity

$ 6,049.0 $ 4,493.6

Allegheny Technologies Incorporated and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited -

Dollars in millions)

Six Months Ended

June 30 2011 2010 Operating

Activities: Net income $ 124.7 $ 58.0

Depreciation and amortization 80.6 69.8 Deferred taxes (13.1 ) 36.0

Change in managed working capital (455.1 ) (346.8 ) Change in

retirement benefits 6.5 14.6 Accrued liabilities and other

184.4 (25.0 )

Cash used in operating

activities (72.0 ) (193.4

) Investing Activities: Purchases of property, plant and

equipment (97.7 ) (97.6 ) Acquisition of business (349.2 ) - Asset

disposals and other 2.6 1.0

Cash

used in investing activities (444.3 )

(96.6 ) Financing Activities: Borrowings on

long-term debt 500.0 - Payments on long-term debt and capital

leases (11.0 ) (5.3 ) Net borrowings under credit facilities 2.3

5.2 Debt issuance costs (5.0 ) - Dividends paid to shareholders

(36.7 ) (35.3 ) Exercises of stock options 1.1 1.1 Taxes on

share-based compensation and other 1.1 (5.8 )

Cash provided by (used in) financing activities

451.8 (40.1 ) Decrease in

cash and cash equivalents (64.5 ) (330.1

) Cash and cash equivalents at beginning of period

432.3 708.8

Cash and cash equivalents at

end of period $ 367.8 $

378.7 Allegheny Technologies

Incorporated and Subsidiaries Selected Financial Data - Mill

Products (Unaudited)

Three Months Ended

Six Months Ended June 30 June 30 2011

2010 2011 2010 Mill Products Volume:

High Performance Metals (000's lbs.) Titanium 7,132 7,138 13,885

13,235 Nickel-based and specialty alloys 12,493 9,517 24,317 17,961

Exotic alloys 991 1,143 2,070 2,124 Flat-Rolled Products

(000's lbs.) High value 129,785 112,979 251,812 223,474 Standard

149,726 177,539 320,054 334,390

Flat-Rolled Products total 279,511 290,518 571,866 557,864

Mill Products Average Prices: High Performance Metals

(per lb.) Titanium $ 21.20 $ 18.49 $ 21.22 $ 18.64 Nickel-based and

specialty alloys $ 15.35 $ 13.30 $ 15.11 $ 13.41 Exotic alloys $

66.72 $ 60.54 $ 63.83 $ 60.67 Flat-Rolled Products (per lb.)

High value $ 3.35 $ 2.83 $ 3.27 $ 2.71 Standard $ 1.93 $ 1.65 $

1.90 $ 1.55 Flat-Rolled Products combined average $ 2.59 $ 2.11 $

2.50 $ 2.02

Mill Products volume and average price information includes

shipments to ATI Ladish for all periods presented. High Performance

Metals mill product forms include ingot, billet, bar, shapes and

rectangles, rod, wire, and seamless tubes.

Allegheny Technologies Incorporated and Subsidiaries

Computation of Basic and Diluted Earnings Per Share

(Unaudited, in millions, except per share amounts)

Three Months Ended Six Months

Ended June 30 June 30 2011 2010

2011 2010 Numerator for Basic net income per common

share - Net income attributable to ATI $ 64.0 $ 36.4 $ 120.3 $ 54.6

Effect of dilutive securities: 4.25% Convertible Notes due 2014

2.5 2.2 5.0 4.4 Numerator for Dilutive

net income per common share -

Net income attributable to ATI after

assumed conversions

$ 66.5 $ 38.6 $ 125.3 $ 59.0 Denominator for Basic net

income per common share - Weighted average shares outstanding 102.1

97.5 99.8 97.4 Effect of dilutive securities: Share-based

compensation 1.8 1.3 1.8 1.4 4.25% Convertible Notes due 2014

9.6 9.6 9.6 9.6 Denominator for Diluted

net income per common share - Adjusted weighted average assuming

conversions 113.5 108.4 111.2 108.4

Basic net income attributable to ATI per common share

$ 0.63 $ 0.37 $ 1.20

$ 0.56 Diluted net income attributable to ATI

per common share

$ 0.59 $ 0.36 $

1.13 $ 0.54 Allegheny

Technologies Incorporated and Subsidiaries Other Financial

Information Managed Working Capital (Unaudited - Dollars

in millions)

June 30, December 31, 2011

2010 Accounts receivable $ 808.1 $ 545.4 Inventory

1,465.4 1,024.5 Accounts payable (503.6 ) (394.1 )

Subtotal 1,769.9 1,175.8 Allowance for doubtful accounts 7.3

5.6 LIFO reserve 172.1 163.0 Corporate and other 56.0

35.3 Managed working capital $ 2,005.3 $

1,379.7

Annualized prior 2 months sales

$ 5,700.3 $ 4,007.7

Managed working capital as a % of

annualized sales

35.2 % 34.4 %

Year to date change in managed working

capital

$ 625.6 Managed working capital acquired (170.5 ) Net change

in managed working capital $ 455.1

As part of managing the liquidity in our business, we focus on

controlling managed working capital, which is defined as gross

accounts receivable and gross inventories, less accounts payable.

In measuring performance in controlling this managed working

capital, we exclude the effects of LIFO inventory valuation

reserves, excess and obsolete inventory reserves, and reserves for

uncollectible accounts receivable which, due to their nature, are

managed separately.

Allegheny Technologies Incorporated and Subsidiaries

Other Financial Information Debt to Capital

(Unaudited - Dollars in millions)

June 30,

December 31, 2011 2010 Total debt $

1,650.7 $ 1,063.3

Less: Cash

(367.8 ) (432.3 ) Net debt $ 1,282.9 $ 631.0

Net debt $ 1,282.9 $ 631.0 Total ATI stockholders' equity

2,690.7 2,040.8 Net ATI capital $ 3,973.6 $

2,671.8

Net debt to ATI capital 32.3

% 23.6 % Total debt $ 1,650.7 $

1,063.3 Total ATI stockholders' equity 2,690.7

2,040.8 Total ATI capital $ 4,341.4 $ 3,104.1

Total debt to total ATI capital 38.0 %

34.3 %

In managing the overall capital structure of the Company, some

of the measures that we focus on are net debt to net

capitalization, which is the percentage of debt, net of cash that

may be available to reduce borrowings, to the total invested and

borrowed capital of ATI (excluding noncontrolling interest), and

total debt to total ATI capitalization, which excludes cash

balances.

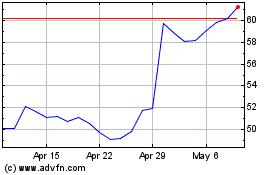

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

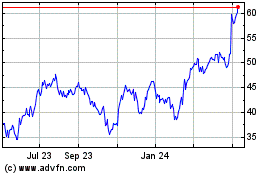

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024