The World Steel industry is rather concentrated in structure, with

a few producers accounting for the lion’s share of sales.

Steel products are classified into four broad categories: flat

steel products, long steel products, scrap and semi-finished

products. Flat products include plates, hot-rolled strip and sheets

and cold-rolled strip and sheets. The long steel product category

comprises wire rods, beams, reinforced bars and merchant bars. The

products under both these categories are rolled from steel slabs,

which are considered as unfinished or semi-finished products that

are generally not sold.

Historically, the automotive and construction markets have remained

the largest consumers of steel, absorbing more than half of the

total steel produced. Large automakers such as

General

Motors Company (GM),

Ford Motor Company

(F),

Toyota Motor Corporation (TM) and

Honda Motor Company (HMC) depend upon the steel

industry. Other steel consuming industries include appliances,

agricultural implements, converters, containers, energy, electrical

equipment and industrial machinery.

Production

The global steel industry has been going through major changes

since 1970. World crude steel production has continued to show a

steady increase since April 2009 on the back of a moderate rise in

demand and the resumption of work at idled facilities. China has

emerged as a major producer and consumer.

According to the World Steel Association (WSA), world crude steel

production was 127 million metric tons (mmt) in April 2011, an

increase of 5.0% from April 2010. In 2010, world crude steel

production reached a record 1,414 mmt, up 15% year over year.

ArcelorMittal (MT) is the world’s largest steel company, with crude

steel production of 90.6 million tons in 2010.

China’s crude steel production for April 2011 was 59 mmt, up 7.1%

year over year. Japan produced 8.4 mmt of crude steel in April

2011, down 6.3% year over year due to the production disruption

caused by the recent earthquake and tsunami. South Korea

experienced an increase of 15.9% from April 2010, producing 5.9 mmt

of crude steel in April 2011.

The US produced 7.1 mmt of crude steel in April 2011, an increase

of 2.1% year over year.

In the EU (European Union), Germany’s crude steel production for

April 2011 was 3.8 mmt, down 1.7% year over year. Italy’s crude

steel production was 2.5 mmt, up 9.8% year over year. Spain

produced 1.5 mmt of crude steel in April 2011, down 5.8% year over

year.

Turkey’s crude steel production for April 2011 was 2.8 mmt, up

14.3% year over year. Egypt crude steel production in April 2011

was 0.5 mmt, down 0.8% year over year.

In April 2011, the world crude steel capacity utilization ratio of

the 64 countries was 82.8%, up 0.9% than in March 2011. Compared to

April 2010, the utilization ratio remained unchanged.

Growth Trends

With the global economy picking up in late 2009, the steel industry

started seeing signs of improvement. However, given its economic

sensitivity, we expect global steel demand to improve gradually, in

line with the recovery in the user industries, especially

automotive and residential construction.

According to World Steel Association, steel demand in the U.S. was

down 41.6% in 2009 to 57.4 million tons. However, with the economy

in recovery mode, production increased by 7.7% to 7.1 million

metric tons in March 2011 from 6.6 million metric tons in February

2011. This marks a 0.2% decrease from the March 2010 production

level.

The steel industry has recorded high growth rates in both

production and consumption over the past few years, benefiting from

soaring steel demand in the automobile and construction sectors

before the recession. Moreover, cost effective and highly efficient

steel-making technologies have lifted the demand for US steel in

the Middle Eastern and Asian countries.

As per the WSA, India was the fourth largest producer of crude

steel during January to September 2010. India produced 50.1 million

tons crude steel during the period. However, according to the

industry estimates, India is likely to be the second-largest

producer of crude steel in the next four years from its current

fourth place.

In the short term, local steel demand in Japan will be lower as the

country's carmakers have suspended production following the

earthquake. However, the need for reconstruction of

earthquake-devastated areas offers the steel industry significant

hope. In the medium term though, steel demand will likely

surge.

However, WSA expects the Chinese steel consumption to decelerate in

2011 as China tries to ease back on its own economic boom.

Here, we will discuss recently quarterly results of a few

companies, whose results were aided by higher selling prices and

increased shipments, and their growth expectations.

Steel giant ArcelorMittal reported diluted net earnings of 69 cents

per share in the first quarter of 2011, above the Zacks Consensus

Estimate of 47 cents as well as last year’s 42 cents per share.

Total steel shipments in the first quarter of 2011 were 22.0

million metric tons compared with 21.0 million metric tons in the

year-ago quarter.

Quarterly revenues increased 27.3% year over year to $22.2 billion

from $17.4 billion in the year-ago quarter and increased 7.2%

sequentially. Sales were higher over the previous quarter primarily

due to higher shipment volumes (+4%). However, the results were

slightly below the Zacks Consensus Estimate of $22.8 billion.

For the second quarter of 2011, management expects EBITDA to be

approximately $3.0 - $3.5 billion. Steel shipment volumes, average

steel selling prices and EBITDA/ton are expected to increase

sequentially, while capacity utilization levels are expected to

improve to approximately 80%.

Additionally, operating costs are expected to increase sequentially

due to higher raw material prices. The company also expects mining

production and profitability to improve sequentially in the second

quarter.

The company expects working capital requirements to increase in

line with the increased activity levels and prices resulting in

further increase in net debt in the second quarter. The company

expects its full-year 2011 capital expenditure to reach $5 billion,

of which $1.4 billion is estimated to be spent on mining.

The commercial metals company AK Steel Holding (AKS) posted

its first-quarter 2011 results delivering an EPS of 8 cents

compared with 2 cents during the year-ago quarter and striding

ahead of the Zacks Consensus Estimate of a loss of a cent.

Net sales were $1,581.1 million on the shipments of 1,423,100 tons

versus $ 1,405.7 million and 1,385,800 tons in the prior-year

quarter. It however, missed the Zacks Estimate of $1,609 million.

The improvement in shipments was mainly due to higher pricing,

which increased 9% on a year-over-year basis to $1,109 per ton.

The company expects shipments in the second quarter of fiscal 2011

to be in the range of 1,500,000 and 1,550,000 tons, indicating a

strong increase over the first-quarter shipments. The company also

anticipates its average per-ton selling price to be 7% higher

compared with the first quarter. The operating profit is expected

to be approximately $65 per ton for the second quarter.

AK Steel is uniquely positioned to focus on products with high

margins. Electrical steel continues to be the company’s strongest

product line, with demand recovering in the U.S. and abroad, though

at a slower rate. AK Steel is operating its plants at above 80%

capacity and is well positioned to serve the end markets when the

demand rebounds.

However, higher input costs, particularly iron ore, are eroding

margins of the company. Iron ore pricing concerns have led to a

negative outlook for steel manufacturers.

Allegheny Technologies Inc. (ATI) also earned

$56.3 million, or 54 cents per share, in the first quarter of 2011,

surpassing the Zacks Consensus Estimate of 49 cents and last year's

$18.2 million, or 18 cents per share. First-quarter results were

impacted by $5.8 million, or $0.05 per share, for previously

announced executive retirements and a discrete tax item.

Quarterly revenues soared 36.5% year over year to $1.23 billion

from $899.4 million on higher shipments and rising raw material

prices. Revenues were above the Zacks Consensus Estimate of $1.12

billion.

Segment wise, revenue increases were distinct in the Engineered

Products segment (46%) and in the Flat-Rolled Products segment

(38%), while sales in the Higher Performance Material segment

increased (32%).

Allegheny continues to expect 2011 revenue growth to be in the

range of 15% to 20% compared with 2010, and expects segment

operating profit to be approximately 15% of sales. The company

targets a minimum of $100 million in new gross cost reductions.

Capital expenditures are forecasted at $300 to $350 million.

During the second quarter of 2011, management anticipates utilizing

approximately $395 million of cash on hand to fund the cash portion

of the merger consideration for the previously announced

acquisition of Ladish and to pay related fees and expenses.

Currently, Allegheny has a short-term (1 to 3 months) Zacks #2 Rank

(Buy).

Nucor Corporation (NUE) reported a stupendous

increase in profit to $190.8 million or 56 cents per share

(excluding special items) in the first quarter of 2011 from $55

million or 15 cents per share (excluding special items) in the same

quarter of 2010. With this, the company has beaten the Zacks

Consensus Estimate by 21 cents per share and its own guidance of 30

cents–35 cents per share.

Consolidated sales surged 32% to $4.83 billion due to a 22%

increase in average price per ton and a 9% rise in shipments (to

6.0 million tons) to outside customers. It was higher than the

Zacks Consensus Estimate of $4.43 billion.

Steel mill shipments grew 10% to 5.2 million tons during the

quarter. The average scrap and scrap substitute cost per ton gained

33% to $424.

Nucor expects results in the second quarter to improve over the

first quarter, despite some market weakness that may impact results

at the end of the second quarter. Further, the company continues to

see slow but steady improvement in real demand in certain end

markets.

The most challenging markets for its products are associated with

residential and non-residential construction. The company retains a

Zacks #3 (Hold) Rank on its stock.

According to the World Steel Association (WSA), in 2011 world steel

demand is expected to grow by 5.9% to reach a historical high of

1,359.2 mmt, up from 1,339.7 mmt predicted in October 2011. While

2012 global steel consumption is forecast to rise 6% to 1,440.6

mmt, the WSA noted that the forecast was made prior to the Japanese

earthquake, which would likely lead to steel demand coming in below

63 mmt estimated by the association in 2011, while steel

consumption will probably be higher than the 2012 forecast of 63

mmt.

Industry Capacity

The global steel industry is capital intensive, cyclical, highly

competitive and has historically been characterized by

overcapacity. Capacity utilization rates were, however, low (around

60%) at the beginning of 2009, in response to the much softer

demand. With steel demand picking up in the latter half of the

year, the world crude steel capacity utilization ratio in January

2011 was 75.6%, up from 73.3% in December 2010.

Steel makers continue to add capacity besides resuming operations

at the idled facilities, inspired by the expected rebound in steel

industry in the longer term.

Price Trends

The steel industry has long witnessed volatility in prices with a

large spot market. Steel prices rose steadily for most of 2008,

after which there was a downtrend. Lower prices had an adverse

effect on steel producers, who recorded lower revenues and margins,

and had to write down finished steel and raw material

inventories.

The period witnessed major steel producers slashing production to

minimize inventory accumulation. The

U.S. Steel

Corporation (X), the eleventh-largest steel producer

worldwide, slashed production by almost 62% during the second

quarter of 2009, while Korean steel maker

POSCO

(PKX) cut production by about 15%. This was the first time in its

history that POSCO was forced to adopt such a measure, which is a

proof of the adverse operating environment.

Although steel prices have been stabilizing since the latter part

of 2009, they are significantly below the pre-crisis level. We

believe that a sustained recovery in steel prices remains uncertain

in the backdrop of sluggish economic activity.

Factors Affecting Steel Prices

Chinese Imports: The steel industry is also affected by

fluctuations in steel import–export and tariffs. China is the

largest steel producer globally, and balances its domestic

production and consumption, which is an important factor in global

steel prices.

Consumers in the U.S. are importing cheaper steel from China, which

is forcing domestic steel producers to sell at lower prices, and

even at a loss, sometimes. To this end, the U.S. government has

been imposing anti-dumping duties on Chinese steel imports.

Economic Sustainability: Concerns about the sustainability

of economic recovery and queries regarding China’s growth momentum

come into play in the pricing equation. This relatively uncertain

Chinese outlook, coupled with a still tentative recovery in the

developed world, is expected to weigh on prices.

Threat from substitutes: Steel has many substitutes like

aluminum, which replaces it in the automotive markets. Cement,

composites, glass, plastic and wood are also used as steel

substitutes. This significantly influences market prices and demand

for steel products.

Raw Material Trends

The key input for steel production is iron ore. Apart from this,

coking coal and coke, scrap, electricity and natural gas are also

used as inputs in steel production. The raw materials industry is

highly concentrated with only three major players --

Vale (VALE),

Rio Tinto (RTP) and

BHP Billiton (BHP) -- having significant pricing

power. The risk lies in further consolidation among raw material

suppliers. For instance, the announced iron ore joint venture

between mining companies BHP Billiton and Rio Tinto would further

increase the pricing power of both the suppliers.

Steel makers would face higher production costs if suppliers shift

to sales based on spot prices from the long-term fixed price

contract system, as spot prices for most of the raw materials,

especially iron ore, remained high from 2006 through 2008. Iron ore

prices dropped 5.7% to $168 a ton for ore with 62% iron content

delivered to China.

Iron ore prices have remained volatile during most of 2010 and are

expected to rise sharply in 2011. ArcelorMittal’s iron ore and coal

mining projects have been a key focus in the recent years and this

focus is only expected to intensify in the medium term, as the

company has a goal to secure 100 million tons of iron ore supply

from its own mines and under strategic long-term supply contracts

on a cost-plus basis. As part of this strategy, in January 2011,

the company announced the acquisition of Baffinland, which holds a

substantial undeveloped iron ore deposit in the Canadian territory

of Nunavut.

Consolidation

Mergers and acquisitions (M&A) have remained an important

growth strategy in the steel industry. M&A activities prevent

additional steel capacity, providing production efficiency and

economies of scale. The biggest example is Mittal Steel’s

acquisition of Arcelor in 2006. The Tata Steel and Corus merger in

2008 is another instance of industry consolidation.

Consolidation has been primarily driven by the urge to increase

global scale and operations, and access new markets. The industry

is likely to see more M&A activity in the coming years as the

industry players prepare themselves for a recovery in the long

run.

Zacks Recommendation

Steel demand in the emerging markets outside China is expected to

grow strongly in 2011. In China, the government’s expansionary

economic policies, easy credit and construction initiatives have

thus far sustained demand. But with China attempting to rein in its

overheated property sector and engineer a soft landing for its

economy, steel demand will most likely soften noticeably in the

coming months. This relatively uncertain Chinese outlook, coupled

with a still tentative recovery in the developed world, is expected

to weigh on prices.

In the short term, we are neutral on steel manufacturers like

AK Steel Holding Corporation (AKS),

Steel

Dynamics Inc. (STLD) and

Allegheny Technologies

Incorporated (ATI).

AK Steel’s cost structure is higher than its peer group due to a

greater reliance on external supply of raw materials such as carbon

scrap, purchased slabs, iron ore and purchased coke. Iron ore is

the key raw material in steel manufacturing operations.

However, industry giants with integrated business models like U.S.

Steel and ArcelorMittal have an edge over their peers. Both steel

makers have substantial captive sources of iron ore and coal and

source about 75%–80% of their coke and iron ore requirements from

owned and/or operated facilities.

AK STEEL HLDG (AKS): Free Stock Analysis Report

ALLEGHENY TECH (ATI): Free Stock Analysis Report

BHP BILLITN LTD (BHP): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

HONDA MOTOR (HMC): Free Stock Analysis Report

ARCELOR MITTAL (MT): Free Stock Analysis Report

NUCOR CORP (NUE): Free Stock Analysis Report

POSCO-ADR (PKX): Free Stock Analysis Report

STEEL DYNAMICS (STLD): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

VALE RIO DO-ADR (VALE): Free Stock Analysis Report

UTD STATES STL (X): Free Stock Analysis Report

Zacks Investment Research

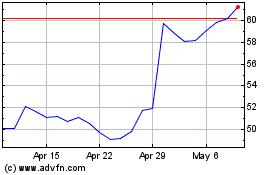

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

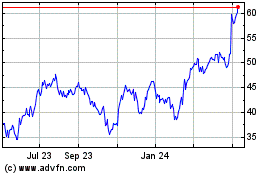

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024