A.M. Best Affirms Ratings of the Primary Life/Health Companies of Assurant Inc.

June 19 2006 - 11:36AM

Business Wire

A.M. Best Co. has affirmed the financial strength ratings (FSRs) of

A (Excellent) and A- (Excellent) and issuer credit ratings (ICRs)

of "a" and "a-" of Assurant, Inc.'s (Assurant) (NYSE: AIZ) (New

York, NY) life/health subsidiaries. Concurrently, A.M. Best has

affirmed the rating of "bbb" on Assurant's senior debt and AMB-2

designation for its commercial paper program. The outlook for all

ratings is stable. (See link below for a detailed list of the

ratings.) The rating affirmations of the life/health companies

reflect Assurant's established presence in various niche markets,

continued favorable operating results and more than adequate

capitalization. Dividends from the numerous subsidiaries can

sufficiently support the debt servicing obligations of the parent

holding company. Assurant's debt-to-capital ratio remains at

approximately 21%, with favorable debt service coverage of

approximately 11 times. Assurant's life/health operations have

traditionally been run through four distinct business units.

American Bankers Life Assurance Company is the lead credit life and

credit accident and health company, which operates as part of

Assurant Solutions, the market leader for credit insurance and

related products. Assurant Health, primarily consisting of the

legal underwriting entities, Time Insurance Company and John Alden

Life Insurance Company, has an established presence in the

individual and small group major markets in targeted states.

Assurant Employee Benefits specializes in offering employee benefit

and worksite products targeted to small to mid-sized employers.

This business is written mostly through the Union Security

Insurance Company, a legal underwriting entity. Finally, Assurant

Preneed concentrates its sales efforts in the United States through

SCI-owned funeral homes, as well as multiple distribution

relationships in Canada. American Memorial Life Insurance Company

is the lead company within Assurant Preneed. Starting in second

quarter 2006, Assurant Preneed will be realigned under the

Assuranct Solutions business unit. The organization's disciplined

approach has enabled it to continue to report quite favorable

operating margins in most of its life/health operating companies in

recent years. However, the bottom line focus, combined with

increased competitive pressures in some of its markets, has caused

recent top line challenges for a number of Assurant's life/health

companies. Competitive pressures are most prevalent currently for

Assurant Health as many large managed care organizations have

become more active in the individual and small group major medical

markets. Given this environment, A.M. Best believes the current

reported combined ratios in the low 90s are probably not

sustainable. With the numerous changes in the credit life and

credit accident and health insurance market over the past five

years, domestic credit life insurance premiums have contracted. To

counter this trend, Assurant Solutions has been active in growing

its international credit insurance business and establishing a

profitable debt deferment operation. A sharpened focus on the small

case market, as well as changes to Assurant Employee Benefit's

sales and compensation models, have caused some premium income

shortfalls in the segment over the past year. Due to a number of

distractions, SCI has not produced the amount of desired preneed

business for Assurant in recent years. Corrective actions have been

implemented to grow this business going forward. For a complete

list of Assurant Inc.'s life/health FSRs, ICRs and debt ratings,

please visit www.ambest.com/press/061903assurant.pdf. A.M. Best

Co., established in 1899, is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit A.M. Best's Web site at www.ambest.com.

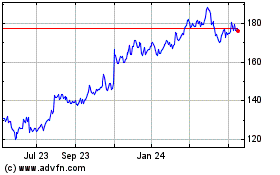

Assurant (NYSE:AIZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

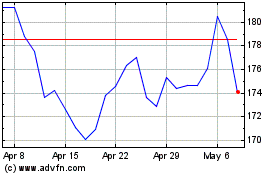

Assurant (NYSE:AIZ)

Historical Stock Chart

From Jul 2023 to Jul 2024