Ashford Hospitality Trust, Inc. (NYSE:AHT) today reported the

following results and performance measures for the fourth quarter

ended December 31, 2006. The proforma performance measurements for

Occupancy, Average Daily Rate (ADR), revenue per available room

(RevPAR), and Hotel Operating Profit include the Company's 66

hotels owned as of December 31, 2006, which excludes 15 hotel

assets held for sale as of that date. Unless otherwise stated, all

reported results compare the fourth quarter ended December 31,

2006, with the fourth quarter ended December 31, 2005. The

reconciliation of non-GAAP financial measures is included in the

financial tables accompanying this press release. FINANCIAL

HIGHLIGHTS Total revenue increased 45% to $143.5 million Net income

available to common shareholders increased to $7.9 million from a

loss of $7.7 million Diluted net income available to common

shareholders increased to $0.09 per share from a loss of $0.18 per

share Adjusted funds from operations (AFFO) increased 50% to $25.5

million, or $0.27 per share Cash available for distribution (CAD)

increased 49% to $21.5 million, or $0.23 per share Declared

quarterly common dividend of $0.20 per diluted share Dividend

coverage in 2006 reaches 124% of CAD STRONG INTERNAL GROWTH

Proforma RevPAR increased 10.3% for hotels not under renovation on

an 8.3% increase in ADR to $129.41 and a 132-basis point

improvement in occupancy Proforma RevPAR increased 8.7% for all

hotels on an 8.3% increase in ADR to $127.88 and a 27-basis point

improvement in occupancy Proforma same-property hotel operating

profit for hotels not under renovation improved 15.5% Proforma

same-property hotel operating profit margins for hotels not under

renovation improved 206 basis points CAPITAL RECYCLING AND ASSET

ALLOCATION Capex invested in fourth quarter and in 2006 totaled $18

million and $48 million, respectively Capital recycling (16 hotels

and two office buildings) projected to generate $170 million in

gross proceeds and net pre-tax gain of $33 million, or $0.35 per

diluted share in 2007 Two asset dispositions completed to date in

2007: Marriott Trumbull in Trumbull, CT, and Fairfield Inn by

Marriott in Princeton, IN EXTERNAL GROWTH CONTINUES TO ENHANCE

RETURNS Total enterprise value increased to $2.2 billion at

December 31, 2006 Mezzanine and first mortgage loan portfolio

totaled $103 million at December 31, 2006, with an average annual

unleveraged yield of 13.2% Acquired Westin O�Hare in Rosemont, IL

for $125 million in cash Acquired seven-hotel portfolio of

upper-upscale, full-service hotels for $267.2 million in cash

Closed on two mezzanine loans totaling $11 million secured by the

Hilton Suites Galleria and Wyndham Dallas North in Dallas, TX

Announced the acquisition of a 51-hotel portfolio of upper-upscale

and premium selective service hotels for $2.4 billion PORTFOLIO

REVPAR GROWTH As of December 31, 2006, the Company had a portfolio

of direct hotel investments consisting of 66 properties classified

in continuing operations. During the fourth quarter, 55 of the

hotels included in continuing operations were not under renovation.

The Company believes reporting its operating metrics for continuing

operations on a proforma total basis (all 66 hotels) and proforma

not-under-renovation basis (55 hotels) is a measure that reflects a

meaningful and more focused comparison of the operating results in

its direct hotel portfolio. The Company's reporting by region and

brand includes the results of all 66 hotels. Details of each

category are provided in the tables attached to this release.

RevPAR growth by region was led by: New England (2 hotels) with a

47.4% increase; West South Central (5) with 31.6%; Mountain (5)

with 14.4%; Pacific (10) with 12.6%; East North Central (8) with

12.4%; Middle Atlantic (4) with 11.3%; West North Central (3) with

8.5%; South Atlantic (27) with 0.8%; and East South Central (2)

with a 2.7% decrease. RevPAR growth by brand was led by: Radisson

(4 hotels) with a 27.2% increase; Hilton (23) with 15.6%; Starwood

(5) with 15.3%; InterContinental (2) with 13.4%; independents (2)

with 9.6%; Hyatt (2) with 3.6%; and Marriott (28) with 2.0%. HOTEL

EBITDA MARGINS AND QUARTERLY SEASONALITY TRENDS For all 66 hotels

as of December 31, 2006, Proforma Hotel EBITDA (adjusted as if all

hotels were included in both periods) increased 11.1% to $41.3

million. Proforma Hotel EBITDA margin (expressed as a percentage of

Total Hotel Revenue) improved 134 basis points to 26.1%. Ashford

believes year-over-year Hotel EBITDA margin comparisons are more

meaningful to gauge the performance of the Company�s hotels than

sequential quarter-over-quarter comparisons. Given the substantial

seasonality in the Company�s portfolio and its active capital

recycling, to help investors better understand this seasonality the

Company provides quarterly detail on its Proforma Hotel EBITDA and

Proforma Hotel EBITDA margin for the current and prior-year periods

based upon the number of core hotels in the portfolio as of the end

of the current period. As Ashford�s portfolio mix changes from time

to time so will the seasonality for Proforma Hotel EBITDA and

Proforma EBITDA margin. For example, on May 3, 2006, Ashford

reported Proforma EBITDA margins for the first quarter 2006 and

2005 for the Company�s 64 core hotels that averaged 28.9%. The

Company�s current core portfolio contains 66 hotels, eight of which

are new from first quarter 2006. Proforma Hotel EBITDA margin for

these current core hotels for the first quarter 2006 and 2005

averages 27.0%. Based upon the current share count, each 60 basis

point change to EBITDA margin for the current 66 core hotels

affects quarterly FFO by approximately $0.01 per share. The range

of current published first quarter 2007 EBITDA margins are well

above the average proforma results for the previous two first

quarters for the current core portfolio. Investors and analysts are

encouraged to carefully consider our seasonality table when

forecasting our quarterly results. Details of the quarterly

calculations for the past two years for the current core portfolio

are provided in tables attached to this release. Monty J. Bennett,

President and CEO, commented, "The results generated by our

portfolio continue to demonstrate the value added by the over $86

million of renovations we have completed over the past two years as

well as the underlying strength of our markets and their favorable

supply and demand balance. By remaining an active capital recycler,

we have been able to narrow the focus of our portfolio on the

segments, brands, managers and markets that meet our target return

and performance goals. The end result has been our strong

performance in terms of RevPAR and margin improvement." FINANCING

ACTIVITY At December 31, 2006, the Company's net debt (defined as

total debt less cash) to total enterprise value (defined as net

debt plus the market value of all common shares, preferred shares

and operating partnership units outstanding) was 45% based upon the

Company's closing stock price of $12.45. As of December 31, 2006,

the Company�s $1.1 billion debt balance consisted of 78% of

fixed-rate debt, with a total weighted average interest rate of

5.9%. The Company�s weighted average fixed-rate debt maturity is 8

years. FOURTH QUARTER INVESTMENT ACTIVITY On November 9, 2006, the

Company acquired the Westin O�Hare hotel property in Rosemont,

Illinois, from JER Partners for approximately $125.0 million in

cash. To fund this acquisition, the Company used cash available on

its balance sheet and proceeds from a 10-year fixed-rate $101.0

million mortgage loan executed on November 16, 2006. The loan bears

interest at 5.81% and is paid interest only for the first five

years. On December 7, 2006, the Company acquired a seven-property

hotel portfolio from a partnership of affiliates of Oak Hill

Capital Partners, The Blackstone Group, and Interstate Hotels and

Resorts for approximately $267.2 million in cash. Of the seven

acquired hotels, five are considered core hotels while two are

considered non-core hotels, which the Company intends to sell. To

fund this acquisition, the Company used cash available on its

balance sheet, and proceeds from a 5-year floating-rate $212.0

million mortgage loan executed on December 7, 2006. The loan bears

interest at LIBOR plus 172 basis points. On December 27, 2006, the

Company closed on a $7.0 million mezzanine loan receivable on the

Hilton Suites Galleria, due December 2009. The loan bears interest

at a rate of LIBOR plus 650 basis points for a term of three years

with two one-year extension options; is interest only and locked

from prepayment for the first 18 months. On December 27, 2006, the

Company closed on a $4.0 million mezzanine loan receivable on the

Wyndham Dallas North, due December 2009. The loan bears interest at

a rate of LIBOR plus 575 basis points for a term of three years

with two one-year extension options; is interest only and locked

from prepayment for the first 18 months. SUBSEQUENT INVESTMENT

ACTIVITY On January 18, 2007, the Company entered into a definitive

agreement to acquire a 51-property hotel portfolio from CNL Hotels

and Resorts, Inc. (�CHR�) for approximately $2.4 billion in cash.

Pursuant to this agreement, the Company will own 100% of 33

properties and 70%-89% of 18 properties through existing joint

ventures. The acquisition is subject to certain closing conditions

including, among other things, approval by a majority of CHR�s

outstanding common shareholders. To fund this acquisition, the

Company intends to use committed debt and equity financing with a

financial institution as well as assumptions of the seller�s

existing debt. The components of the committed debt include

approximately $1.2 billion of ten-year, fixed-rate debt at an

estimated average blended interest rate of 5.95%, approximately

$340 million of three-year, variable-rate debt with two one-year

extension options at LIBOR plus 165 basis points, and approximately

$325 million of one-year, variable-rate debt with a two year

extension option at an interest rate of LIBOR plus 150 basis

points. The committed equity financing represents the anticipated

sale of up to 8 million shares of Series C Cumulative Redeemable

Preferred Stock for up to approximately $200 million at LIBOR plus

250 basis points. The assumed debt includes approximately $463

million of fixed-rate debt, representing ten fixed-rate loans with

an average blended interest rate of 6.22% and expiration dates

ranging from 2008 to 2025. The acquisition is expected to close in

the second quarter of 2007. On February 6, 2007, the Company sold

its Marriott located in Trumbull, Connecticut, for approximately

$28.3 million. As the Company acquired this property on December 7,

2006, no gain or loss was recognized on the sale. On February 8,

2007, the Company sold its Fairfield Inn in Princeton, Indiana, for

approximately $3.2 million. In connection with this sale, the

Company expects to recognize a gain of approximately $1.4 million,

the income tax effects of which will be deferred through a 1031

like-kind exchange. INVESTMENT OUTLOOK Mr. Bennett concluded, "With

the transformational acquisition of the $2.4 billion, 51-hotel

portfolio from CNL Hotels & Resorts on the near horizon, we are

prepared to quickly assimilate these assets into our portfolio. As

evidenced by our recent announcement regarding capital recycling

efforts on $170 million of existing assets and plans for additional

phases of capital recycling in 2007, we are also making good

progress on our deleveraging strategy. Given the projected

favorable operating environment for hotels, we expect continued

execution of our portfolio management and internal growth

strategies to produce favorable results in 2007." INVESTOR

CONFERENCE CALL AND SIMULCAST Ashford Hospitality Trust, Inc. will

conduct a conference call at 11:00 a.m. ET on March 8, 2007, to

discuss the fourth quarter results. The number to call for this

interactive teleconference is (913)�981-5584. A seven-day replay of

the conference call will be available by dialing (719) 457-0820 and

entering the confirmation number, 2646707. The Company will also

provide an online simulcast and rebroadcast of its fourth quarter

2006 earnings release conference call. The live broadcast of

Ashford's quarterly conference call will be available online at the

Company's website at www.ahtreit.com as well as on

http://www.videonewswire.com/event.asp?id=37791 on March 8, 2007,

beginning at 11:00 a.m. ET. The online replay will follow shortly

after the call and continue for approximately one year.

Substantially all of our non-current assets consist of real estate

investments and debt investments secured by real estate. Historical

cost accounting for real estate assets implicitly assumes that the

value of real estate assets diminishes predictably over time. Since

real estate values instead have historically risen or fallen with

market conditions, most industry investors consider supplemental

measures of performance, which are not measures of operating

performance under GAAP, to be helpful in evaluating a real estate

company's operations. These supplemental measures include FFO,

AFFO, EBITDA, Hotel Operating Profit, and CAD. FFO is computed in

accordance with our interpretation of standards established by

NAREIT, which may not be comparable to FFO reported by other REITs

that do not define the term in accordance with the current NAREIT

definition or that interpret the NAREIT definition differently than

us. Neither FFO, AFFO, EBITDA, Hotel Operating Profit, nor CAD

represents cash generated from operating activities as determined

by GAAP and should not be considered as an alternative to a) GAAP

net income (loss) as an indication of our financial performance or

b) GAAP cash flows from operating activities as a measure of our

liquidity, nor are such measures indicative of funds available to

fund our cash needs, including our ability to make cash

distributions. However, management believes FFO, AFFO, EBITDA,

Hotel Operating Profit, and CAD to be meaningful measures of a

REIT's performance and should be considered along with, but not as

an alternative to, net income and cash flow as a measure of our

operating performance. Ashford Hospitality Trust is a

self-administered real estate investment trust focused on investing

in the hospitality industry across all segments and at all levels

of the capital structure, including direct hotel investments, first

mortgages, mezzanine loans and sale-leaseback transactions.

Additional information can be found on the Company's web site at

www.ahtreit.com. Certain statements and assumptions in this press

release contain or are based upon "forward-looking" information and

are being made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are subject to risks and uncertainties.

When we use the words "will likely result," "may," "anticipate,"

"estimate," "should," "expect," "believe," "intend," or similar

expressions, we intend to identify forward-looking statements. Such

forward-looking statements include, but are not limited to, our

business and investment strategy, timing for closings, our

understanding of our competition, current market trends and

opportunities, and projected capital expenditures. Such statements

are subject to numerous assumptions and uncertainties, many of

which are outside Ashford's control. These forward-looking

statements are subject to known and unknown risks and

uncertainties, which could cause actual results to differ

materially from those anticipated, including, without limitation:

general volatility of the capital markets and the market price of

our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of

qualified personnel; changes in our industry and the market in

which we operate, interest rates or the general economy; and the

degree and nature of our competition. These and other risk factors

are more fully discussed in the section entitled "Risk Factors" in

Ashford's Registration Statement on Form S-3, (File Number

333-131878), and from time to time, in Ashford's other filings with

the Securities and Exchange Commission. The forward-looking

statements included in this press release are only made as of the

date of this press release. Investors should not place undue

reliance on these forward-looking statements. We are not obligated

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or

circumstances, changes in expectations or otherwise. ASHFORD

HOSPITALITY TRUST, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In

Thousands, Except Share and Per Share Amounts) (Unaudited) � Years

Ended Three Months Ended Ended December 31, 2006 December 31, 2005

December 31, 2006 December 31, 2005 � REVENUE Rooms $ 365,917� $

235,951� $ 104,713� $ 75,098� Food and beverage 81,081� 48,752�

29,945� 15,734� Other 17,312� 12,062� 5,187� 3,894� Total hotel

revenue 464,310� 296,765� 139,845� 94,726� � Interest income from

notes receivable 14,858� 13,323� 3,341� 3,836� Asset management

fees from affiliates 1,266� 1,258� 331� 318� Total Revenue 480,434�

311,346� 143,517� 98,880� � EXPENSES Hotel operating expenses Rooms

82,022� 53,007� 24,631� 17,559� Food and beverage 60,146� 36,886�

21,116� 11,964� Other direct 8,197� 5,165� 2,484� 1,547� Indirect

137,298� 91,531� 41,765� 29,807� Management fees 17,850� 10,889�

5,294� 3,916� Total hotel expenses 305,513� 197,478� 95,290�

64,793� � Property taxes, insurance, and other 26,286� 16,264�

8,175� 5,234� Depreciation and amortization 49,564� 28,169� 14,896�

10,233� Corporate general and administrative: Stock-based

compensation 5,204� 3,446� 1,083� 963� Other corporate and

administrative 15,155� 11,077� 4,317� 3,154� Total Operating

Expenses 401,722� 256,434� 123,761� 84,377� � � � � OPERATING

INCOME 78,712� 54,912� 19,756� 14,503� � Interest income 2,917�

1,027� 852� 300� Interest expense (46,419) (34,448) (12,716)

(12,232) Amortization of loan costs (2,038) (3,956) (569) (832)

Write-off of loan costs and exit fees (788) (5,803) -� (5,652) Loss

on debt extinguishment -� (10,000) -� (7,743) INCOME BEFORE INCOME

TAXES AND MINORITY INTEREST 32,384� 1,732� 7,323� (11,656) Benefit

from income taxes 2,920� 2,584� 2,321� 2,190� Minority interest

(4,274) (887) (387) 1,912� INCOME (LOSS) FROM CONTINUING OPERATIONS

31,030� 3,429� 9,257� (7,554) Income from discontinued operations,

net 6,766� 6,008� 1,404� 2,554� � NET INCOME (LOSS) 37,796� 9,437�

10,661� (5,000) Preferred dividends 10,875� 9,303� 2,719� 2,719�

NET INCOME (LOSS) AVAILABLE TO COMMON SHAREHOLDERS $ 26,921� $ 134�

$ 7,942� $ (7,719) � Income (Loss) From Continuing Operations Per

Share Available To Common Shareholders: Basic $ 0.33� $ (0.15) $

0.09� $ (0.24) Diluted $ 0.32� $ (0.15) $ 0.08� $ (0.24) Income

From Discontinued Operations Per Share: Basic $ 0.11� $ 0.15� $

0.02� $ 0.06� Diluted $ 0.11� $ 0.15� $ 0.02� $ 0.06� Net Income

(Loss) Per Share Available To Common Shareholders: Basic $ 0.44� $

-� $ 0.11� $ (0.18) Diluted $ 0.43� $ -� $ 0.09� $ (0.18) Weighted

Average Common Shares Outstanding: Basic 61,713,178� 40,194,132�

71,781,641� 43,145,657� Diluted 62,127,948� 40,194,132� 85,788,414�

43,145,657� ASHFORD HOSPITALITY TRUST, INC. CONSOLIDATED BALANCE

SHEETS (In Thousands, Except Share and Per Share Amounts)

(Unaudited) � December 31, December 31, 2006� 2005� � ASSETS

Investment in hotel properties, net $ 1,632,946� $ 1,106,668� Cash

and cash equivalents 73,343� 57,995� Restricted cash 9,413� 27,842�

Accounts receivable, net 22,081� 21,355� Inventories 2,110� 1,186�

Assets held for sale 119,342� 117,873� Notes receivable 102,833�

107,985� Deferred costs, net 14,143� 13,975� Prepaid expenses

11,154� 9,662� Other assets 7,826� 4,014� Intangible assets, net -�

1,181� Due from third-party hotel managers 15,964� 12,274� Due from

affiliates 757� 476� Total assets $ 2,011,912� $ 1,482,486� � �

LIABILITIES AND OWNERS' EQUITY Indebtedness $ 1,091,150� $ 908,623�

Capital leases payable 177� 453� Accounts payable 16,371� 9,984�

Accrued expenses 32,591� 21,054� Dividends payable 19,975� 13,703�

Deferred income 294� 338� Deferred incentive management fees 3,744�

-� Unfavorable management contract liability 15,281� -� Due to

third-party hotel managers 1,604� 1,385� Due to affiliates 4,152�

5,654� Total liabilities 1,185,339� 961,194� � Commitments and

contingencies Minority interest 109,864� 87,969� � Preferred stock,

$0.01 par value: Series B Cumulative Convertible Redeemable

Preferred Stock, 7,447,865 issued and outstanding at December 31,

2006 and 2005, respectively 75,000� 75,000� � Preferred stock,

$0.01 par value, 50,000,000 shares authorized: Series A Cumulative

Preferred Stock, 2,300,000 issued and outstanding at December 31,

2006 and 2005, respectively 23� 23� Common stock, $0.01 par value,

200,000,000 shares authorized, 72,942,841 and 43,831,394 shares

issued and outstanding at December 31, 2006 and 2005, respectively

729� 438� Additional paid-in capital 708,420� 403,919� Unearned

compensation -� (4,792) Accumulated other comprehensive income 111�

1,372� Accumulated deficit (67,574) (42,637) Total owners' equity

641,709� 358,323� � � Total liabilities and owners' equity $

2,011,912� $ 1,482,486� ASHFORD HOSPITALITY TRUST, INC. EBITDA (In

Thousands) (Unaudited) � Year Year Three Months Three Months Ended

Ended Ended Ended December 31, 2006 December 31, 2005 December 31,

2006 December 31, 2005 � Net income $ 37,796� $ 9,437� $ 10,661� $

(5,000) � Add back: Interest income (2,917) (1,027) (852) (300)

Interest expense and amortization of loan costs 48,457� 38,404�

13,285� 13,064� Minority interest 5,277� 2,425� 417� (1,265)

Depreciation and amortization 52,863� 30,286� 15,743� 11,101�

Benefit from income taxes (2,719) (184) (2,027) (1,231) 100,961�

69,904� 26,566� 21,369� � � � � EBITDA $ 138,757� $ 79,341� $

37,227� $ 16,369� � � For the year ended December 31, 2006, EBITDA

has not been adjusted to add back the write-off of loan costs of

approximately $788,000 and the loss from reclassification from

discontinued to continuing of approximately $863,000 or deduct the

amortization of the unfavorable management contract liability of

approximately $531,000. � For the year ended December 31, 2005,

EBITDA has not been adjusted to add back the loss on debt

extinguishment of approximately $10.0 million and the write-off of

loan costs and exit fees of approximately $5.8 million. � For the

three months ended December 31, 2006, EBITDA has not been adjusted

to deduct the amortization of the unfavorable management contract

liability of approximately $318,000. � For the three months ended

December 31, 2005, EBITDA has not been adjusted to add back the

loss on debt extinguishment of approximately $7.7 million and the

write-off of loan costs and exit fees of approximately $5.7

million. � � � ASHFORD HOSPITALITY TRUST, INC. FFO and Adjusted FFO

(In Thousands, Except Share And Per Share Amounts) (Unaudited) �

Year Year Three Months Three Months Ended Ended Ended Ended

December 31, 2006 December 31, 2005 December 31, 2006 December 31,

2005 � Net income available to common shareholders $ 26,921� $ 134�

$ 7,942� $ (7,719) � Plus real estate depreciation and amortization

52,550� 30,182� 15,663� 11,056� Remove minority interest 5,277�

2,425� 417� (1,265) FFO available to common shareholders $ 84,748�

$ 32,741� $ 24,022� $ 2,072� � Add back dividends on convertible

preferred stock 5,958� 4,386� 1,490� 1,490� Add back write-off of

loan costs and exit fees 788� 5,803� -� 5,652� Add back loss on

debt extinguishment -� 10,000� -� 7,743� Add back loss from

reclassification of discontinued to continuing 863� -� -� -�

Adjusted FFO $ 92,357� $ 52,930� $ 25,512� $ 16,957� � Adjusted FFO

per diluted share available to common shareholders $ 1.13� $ 0.96�

$ 0.27� $ 0.27� � Diluted weighted average shares outstanding

81,884,419� 55,149,994� 93,236,279� 61,869,686� ASHFORD HOSPITALITY

TRUST, INC. CASH AVAILABLE FOR DISTRIBUTION ("CAD") (In Thousands,

Except Per Share Amounts) (Unaudited) � Year Year Ended Ended

December 31, 2006 (per dilutedshare) December 31, 2005 (per

dilutedshare) � Net income available to common shareholders $

26,921� $ 0.33� $ 134� $ 0.00� Add back dividends on convertible

preferred stock 5,958� 0.07� 4,386� 0.08� Total $ 32,879� $ 0.40� $

4,520� $ 0.08� � Plus real estate depreciation and amortization

52,550� $ 0.64� 30,182� $ 0.55� Remove minority interest 5,277�

0.06� 2,425� 0.04� Plus stock-based compensation 5,204� 0.06�

3,446� 0.06� Plus amortization of loan costs 2,038� 0.02� 3,956�

0.07� Plus write-off of loan costs 788� 0.01� 5,803� 0.11� Plus

loss on debt extinguishment -� 0.00� 10,000� 0.18� Plus loss from

reclassification of discontinued to continuing 863� 0.01� -� 0.00�

Less debt premium amortization to reduce interest expense (151)

(0.00) (518) (0.01) Less capital improvements reserve (18,369)

(0.22) (11,429) (0.21) CAD $ 81,079� $ 0.99� $ 48,385� $ 0.88� � �

Three Months Three Months Ended Ended December 31, 2006 (per

dilutedshare) December 31, 2005 (per dilutedshare) � Net income

available to common shareholders $ 7,942� $ 0.09� $ (7,719) $

(0.12) Add back dividends on convertible preferred stock 1,490�

0.02� 1,490� 0.02� Total $ 9,432� $ 0.10� $ (6,229) $ (0.10) � Plus

real estate depreciation and amortization 15,663� $ 0.17� 11,056� $

0.18� Remove minority interest 417� 0.00� (1,265) (0.02) Plus

stock-based compensation 1,083� 0.01� 963� 0.02� Plus amortization

of loan costs 569� 0.01� 832� 0.01� Plus write-off of loan costs -�

-� 5,652� 0.09� Plus loss on debt extinguishment -� -� 7,743� 0.13�

Less debt premium amortization to reduce interest expense (75)

(0.00) (55) (0.00) Less capital improvements reserve (5,552) (0.06)

(4,198) (0.07) CAD $ 21,537� $ 0.23� $ 14,499� $ 0.23� ASHFORD

HOSPITALITY TRUST, INC. KEY PERFORMANCE INDICATORS - PRO FORMA

(Unaudited) � � Three Months Ended Twelve Months Ended December 31,

December 31, 2006� 2005� % Variance 2006� 2005� % Variance � ALL

HOTELS INCLUDED IN CONTINUING OPERATIONS: � Room revenues (1) $

116,414,683� $ 109,218,959� 6.59% $ 459,869,722� $ 422,242,728�

8.91% RevPAR (1) $ 89.76� $ 82.59� 8.68% $ 94.33� $ 85.50� 10.32%

Occupancy 70.19% 69.92% 0.38% 74.59% 73.15% 1.96% ADR $ 127.88� $

118.12� 8.27% $ 126.47� $ 116.88� 8.20% � � NOTE: The above pro

forma table assumes the 66 hotel properties owned and included in

continuing operations at December 31, 2006 were owned as of the

beginning of the periods presented. � � � Three Months Ended Twelve

Months Ended December 31, December 31, 2006� 2005� % Variance 2006�

2005� % Variance � ALL HOTELS NOT UNDER RENOVATION INCLUDED IN

CONTINUING OPERATIONS: � Room revenues (1) $ 106,146,050� $

98,345,972� 7.93% $ 417,407,933� $ 380,189,207� 9.79% RevPAR (1) $

92.31� $ 83.67� 10.33% $ 96.14� $ 86.31� 11.38% Occupancy 71.33%

70.01% 1.89% 75.17% 73.15% 2.77% ADR $ 129.41� $ 119.50� 8.29% $

127.89� $ 118.00� 8.39% � � NOTE: The above pro forma table assumes

the 55 hotel properties owned and included in continuing operations

at December 31, 2006 but not under renovation for the three and

twelve months ended December 31, 2006 were owned as of the

beginning of the periods presented. � � Excluded Hotels Under

Renovation: Residence Inn Evansville, Courtyard Columbus Tipton

Lakes, SpringHill Suites Kennesaw, SpringHill Suites Jacksonville,

Sea Turtle Inn Jacksonville, Courtyard Atlanta Alpharetta, Hilton

Santa Fe, SpringHill Suites BWI Airport, SpringHill Suites

Centreville, SpringHill Suites Gaithersburg, Courtyard Overland

Park � � (1) On March 26, 2006, the Company converted its Radisson

hotel in Ft. Worth, Texas, to a Hilton hotel, which resulted in a

room count reduction from 517 to 294. Consequently, the increase in

pro forma RevPAR exceeded the increase in pro forma room revenues

for the three and twelve months ended December 31, 2006 compared to

the same 2005 periods. ASHFORD HOSPITALITY TRUST, INC. Pro Forma

Hotel RevPAR by Region (Unaudited) � Three Months Ended Twelve

Months Ended Percent December 31, December 31, Change in RevPAR

Region Number of Hotels Number of Rooms 2006� 2005� 2006� 2005�

Quarter YTD � Pacific (1) 10� 2,723� $97.17� $86.29� $100.99�

$91.48� 12.6% 10.4% Mountain (2) 5� 869� $93.39� $81.62� $97.79�

$88.42� 14.4% 10.6% West North Central (3) 3� 690� $80.00� $73.73�

$85.55� $77.97� 8.5% 9.7% West South Central (4) 5� 987� $91.99�

$69.90� $91.00� $70.07� 31.6% 29.9% East North Central (5) 8�

1,628� $78.88� $70.18� $83.42� $73.65� 12.4% 13.3% East South

Central (6) 2� 236� $77.54� $79.71� $83.83� $82.01� -2.7% 2.2%

Middle Atlantic (7) 4� 853� $82.99� $74.55� $89.39� $80.71� 11.3%

10.7% South Atlantic (8) 27� 5,036� $92.84� $92.14� $99.35� $93.88�

0.8% 5.8% New England (9) 2� 300� $53.45� $36.27� $52.80� $42.71�

47.4% 23.6% � � � � � � � � Total Portfolio 66� 13,322� $89.76�

$82.59� $94.33� $85.50� 8.7% 10.3% � � � (1) Includes Alaska and

California (2) Includes Nevada, Arizona, New Mexico, and Utah (3)

Includes Minnesota and Kansas (4) Includes Texas (5) Includes Ohio,

Illinois, and Indiana (6) Includes Kentucky and Alabama (7)

Includes New York and Pennsylvania (8) Includes Virginia, Florida,

Georgia, Maryland, and North Carolina (9) Includes Massachusetts �

� NOTE: The above pro forma table assumes the 66 hotel properties

owned and included in continuing operations as of December 31, 2006

were owned as of the beginning of the periods presented. ASHFORD

HOSPITALITY TRUST, INC. Pro Forma Hotel RevPAR by Brand (Unaudited)

� Three Months Ended Twelve Months Ended Percent December 31,

December 31, Change in RevPAR Brand Number of Hotels Number of

Rooms 2006� 2005� 2006� 2005� Quarter YTD � Hilton 23� 4,212�

$90.02� $77.87� $92.80� $80.76� 15.6% 14.9% Hyatt 2� 970� $95.82�

$92.44� $98.20� $93.50� 3.6% 5.0% InterContinental 2� 420� $123.37�

$108.75� $133.01� $117.18� 13.4% 13.5% Independent 2� 317� $70.01�

$63.87� $79.29� $80.08� 9.6% -1.0% Marriott 28� 4,975� $94.36�

$92.51� $98.59� $92.53� 2.0% 6.5% Radisson 4� 859� $56.45� $44.39�

$60.95� $53.60� 27.2% 13.7% Starwood 5� 1,569� $81.65� $70.80�

$93.62� $81.85� 15.3% 14.4% � � � � � � � � Total Portfolio 66�

13,322� $89.76� $82.59� $94.33� $85.50� 8.7% 10.3% � � � NOTE: The

above pro forma table assumes the 66 hotel properties owned and

included in continuing operations as of December 31, 2006 were

owned as of the beginning of the periods presented. ASHFORD

HOSPITALITY TRUST, INC. PRO FORMA HOTEL OPERATING PROFIT (In

Thousands) (Unaudited) � ALL HOTELS INCLUDED IN CONTINUING

OPERATIONS: � Years Ended Three Months Ended Dec. 31, 2006 � Dec.

31, 2005 � % Variance Dec. 31, 2006 � Dec. 31, 2005 � % Variance �

REVENUE Rooms (1) $ 459,870� $ 422,243� 8.91% $ 116,415� $ 109,219�

6.59% Food and beverage 125,799� 119,287� 5.46% 36,319� 34,708�

4.64% Other 23,408� 23,302� 0.45% 5,707� 6,431� -11.26% Total hotel

revenue 609,077� 564,832� 7.83% 158,441� 150,358� 5.38% � EXPENSES

Hotel operating expenses Rooms (1) 101,792� 95,387� 6.71% 26,610�

25,630� 3.82% Food and beverage 90,888� 85,972� 5.72% 25,153�

24,360� 3.26% Other direct 11,214� 10,718� 4.63% 2,860� 2,686�

6.48% Indirect 172,749� 161,985� 6.65% 45,549� 44,376� 2.64%

Management fees, includes base and incentive fees 29,455� 25,942�

13.54% 8,096� 8,027� 0.86% Total hotel operating expenses 406,098�

380,004� 6.87% 108,268� 105,079� 3.03% � Property taxes, insurance,

and other 33,703� 29,304� 15.01% 8,888� 8,106� 9.65% � � � � � �

HOTEL OPERATING PROFIT (Hotel EBITDA) $ 169,276� $ 155,524� 8.84% $

41,285� $ 37,173� 11.06% � NOTE: The above pro forma table assumes

the 66 hotel properties owned and included in continuing operations

at December 31, 2006 were owned as of the beginning of the periods

presented. ALL HOTELS NOT UNDER RENOVATION INCLUDED IN CONTINUING

OPERATIONS: � Years Ended Three Months Ended Dec. 31, 2006 � Dec.

31, 2005 � % Variance Dec. 31, 2006 � Dec. 31, 2005 � % Variance �

REVENUE Rooms (1) $ 417,408� $ 380,189� 9.79% $ 106,146� $ 98,346�

7.93% Food and beverage 118,782� 112,995� 5.12% 34,520� 32,965�

4.72% Other 22,273� 22,060� 0.97% 5,435� 6,030� -9.87% Total hotel

revenue 558,463� 515,244� 8.39% 146,101� 137,341� 6.38% � EXPENSES

Hotel operating expenses Rooms (1) 92,603� 86,600� 6.93% 24,158�

23,227� 4.01% Food and beverage 85,658� 81,009� 5.74% 23,830�

23,006� 3.58% Other direct 10,604� 10,244� 3.51% 2,684� 2,569�

4.48% Indirect 158,442� 148,248� 6.88% 41,619� 40,739� 2.16%

Management fees, includes base and incentive fees 26,902� 23,635�

13.82% 7,490� 7,295� 2.67% Total hotel operating expenses 374,209�

349,736� 7.00% 99,781� 96,836� 3.04% � Property taxes, insurance,

and other 30,963� 26,910� 15.06% 8,131� 7,434� 9.38% � � � � � �

HOTEL OPERATING PROFIT (Hotel EBITDA) $ 153,291� $ 138,598� 10.60%

$ 38,189� $ 33,071� 15.48% � NOTE: The above pro forma table

assumes the 55 hotel properties owned and included in continuing

operations at December 31, 2006 but not under renovation for the

year and three months ended December 31, 2006 were owned as of the

beginning of the periods presented. � � � (1) On March 26, 2006,

the Company converted its Radisson hotel in Ft. Worth, Texas, to a

Hilton hotel, which resulted in a room count reduction from 517 to

294. Consequently, the increase in pro forma RevPAR exceeded the

increase in pro forma room revenues for the year and three months

ended December 31, 2006 compared to the same 2005 periods. ASHFORD

HOSPITALITY TRUST, INC. PRO FORMA HOTEL OPERATING PROFIT MARGIN

(Unaudited) � � 55 HOTELS NOT UNDER RENOVATION AND INCLUDED IN

CONTINUING OPERATIONS AT DECEMBER 31, 2006 AS IF SUCH HOTELS WERE

OWNED AS OF THE BEGINNING OF THE PERIODS PRESENTED: � � HOTEL

OPERATING PROFIT (EBITDA) MARGIN: � 4th Quarter 2006 26.14% 4th

Quarter 2005 � 24.08% Variance � 2.06% � HOTEL OPERATING PROFIT

(EBITDA) MARGIN VARIANCE BREAKDOWN: � Rooms 0.38% Food &

Beverage and Other Departmental 0.47% Administrative & General

0.18% Sales & Marketing 0.22% Hospitality -0.09% Repair &

Maintenance 0.51% Energy 0.70% Franchise Fee -0.45% Management Fee

0.00% Incentive Management Fee 0.19% Insurance -0.16% Property

Taxes 0.01% Leases/Other � 0.12% Total � 2.06% ASHFORD HOSPITALITY

TRUST, INC. PRO FORMA SEASONALITY TABLE (In Thousands) (Unaudited)

� � ALL 66 HOTELS OWNED AND INCLUDED IN CONTINUING OPERATIONS AS OF

DECEMBER 31, 2006: � � � � � � 1st Quarter 2nd Quarter 3rd Quarter

4th Quarter Year End � 2005� Total Hotel Revenue 129,114� 145,211�

140,148� 150,358� 564,832� Hotel EBITDA 35,652� 43,730� 38,969�

37,173� 155,524� Hotel EBITDA Margin 27.6% 30.1% 27.8% 24.7% 27.5%

� � 2006� Total Hotel Revenue 142,436� 159,780� 148,420� 158,441�

609,077� Hotel EBITDA 37,517� 48,740� 41,734� 41,285� 169,276�

Hotel EBITDA Margin 26.3% 30.5% 28.1% 26.1% 27.8% � � NOTE: The

above pro forma table assumes that the 66 hotel properties owned

and included in continuing operations as of December 31, 2006 were

owned as of the beginning of the periods presented. ASHFORD

HOSPITALITY TRUST, INC. Pro Forma Hotel Operating Profit by Region

(In Thousands) (Unaudited) � Three Months Ended Twelve Months Ended

Percent Change in December 31, December 31, Hotel Operating Profit

Region Number of Hotels � Number of Rooms 2006� � % Total 2005� � %

Total 2006� � % Total 2005� � % Total Quarter � YTD � Pacific (1)

10� 2,723� $8,700� 21.1% $7,307� 19.7% $35,064� 20.7% $32,993�

21.2% 19.1% 6.3% Mountain (2) 5� 869� $2,832� 6.9% $2,085� 5.6%

$11,725� 6.9% $9,867� 6.3% 35.8% 18.8% West North Central (3) 3�

690� $2,152� 5.2% $1,947� 5.2% $9,201� 5.4% $8,017� 5.2% 10.5%

14.8% West South Central (4) 5� 987� $2,760� 6.7% $1,877� 5.0%

$10,042� 5.9% $8,445� 5.4% 47.0% 18.9% East North Central (5) 8�

1,628� $4,823� 11.7% $4,001� 10.8% $20,709� 12.2% $18,003� 11.6%

20.5% 15.0% East South Central (6) 2� 236� $634� 1.5% $602� 1.6%

$3,151� 1.9% $3,080� 2.0% 5.3% 2.3% Middle Atlantic (7) 4� 853�

$2,024� 4.9% $1,503� 4.0% $8,536� 5.0% $6,403� 4.1% 34.7% 33.3%

South Atlantic (8) 27� 5,036� $17,051� 41.3% $17,967� 48.3%

$69,995� 41.3% $68,261� 43.9% -5.1% 2.5% New England (9) 2� 300�

$309� 0.7% ($116) -0.3% $853� 0.5% $455� 0.3% 366.4% 87.5% � � � �

� � � � � � � � � � � � � Total Portfolio 66� 13,322� $41,285� �

100.0% $37,173� � 100.0% $169,276� � 100.0% $155,524� � 100.0%

11.1% � 8.8% � � � (1) Includes Alaska and California (2) Includes

Nevada, Arizona, New Mexico, and Utah (3) Includes Minnesota and

Kansas (4) Includes Texas (5) Includes Ohio, Illinois, and Indiana

(6) Includes Kentucky and Alabama (7) Includes New York and

Pennsylvania (8) Includes Virginia, Florida, Georgia, Maryland, and

North Carolina (9) Includes Massachusetts � � NOTE: The above pro

forma table assumes the 66 hotel properties owned and included in

continuing operations as of December 31, 2006 were owned as of the

beginning of the periods presented. Ashford Hospitality Trust, Inc.

Debt Summary As of December 31, 2006 (in millions) � Fixed-Rate

Floating-Rate Total Debt Debt Debt � $487.1 million mortgage note

payable secured by 32 hotel properties, matures between July 1,

2015 and February 1, 2016, at an average interest rate of 5.41% � $

487.1� $ -� $ 487.1� $211.5 million term loan secured by 16 hotel

properties, matures between December 11, 2014 and December 11,

2015, at an average interest rate of 5.73% � 211.5� -� 211.5�

$150.0 million secured credit facility secured by 9 hotel

properties, matures August 16, 2008, at an interest rate of LIBOR

plus a range of 1.6% to 1.85% depending on the loan-to-value ratio

� � -� 25.0� 25.0� $100.0 million secured credit facility secured

by 6 mezzanine notes receivable, matures December 23, 2008, at an

interest rate of LIBOR plus a range of 1.5% to 2.75% depending on

the loan-to-value ratio and collateral pledged � � -� -� -� $47.5

million secured credit facility secured by 1 hotel property,

matures October 10, 2008, at an interest rate of LIBOR plus 1.0% to

1.5% depending on the outstanding balance � � -� -� -� Mortgage

note payable secured by one hotel property, matures December 1,

2017, at an interest rate of 7.24% through December 31, 2007 and

7.39% thereafter � 52.6� -� 52.6� Mortgage note payable secured by

one hotel property, matures December 8, 2016, at an interest rate

of 5.81% 101.0� -� 101.0� Mortgage note payable secured by seven

hotel properties, matures December 11, 2009, at an interest rate of

LIBOR plus 1.72% -� 212.0� 212.0� Total Debt Excluding Premium $

852.2� $ 237.0� $ 1,089.2� Mark-to-Market Premium 2.0� Total Debt

Including Premium $ 1,091.2� � Percentage of Total 78.24% 21.76%

100.00% � Weighted Average Interest Rate at December 31, 2006 5.93%

ASHFORD HOSPITALITY TRUST, INC. Capital Expenditures Calendar 66

Core Hotels � � � � � � � � � � � � � � � � � � � � � � � � � � � �

� � � 2004� � 2005� � 2006� � 2007� Actual Actual Actual Actual

Actual Actual Actual Actual Actual Actual Actual Actual Estimated

Estimated Estimated Estimated Rooms � 1st Quarter � 2nd Quarter �

3rd Quarter � 4th Quarter � 1st Quarter � 2nd Quarter � 3rd Quarter

� 4th Quarter � 1st Quarter � 2nd Quarter � 3rd Quarter � 4th

Quarter � 1st Quarter � 2nd Quarter � 3rd Quarter � 4th Quarter �

Doubletree Suites Columbus 194� x x x Embassy Suites East Syracuse

215� x x x Embassy Suites Phoenix Airport 229� x x x Sheraton Bucks

County 187� x x x x Hyatt Regency Orange County 654� x x x Hampton

Inn Mall of Georgia 92� x x Radisson Milford 173� x x x x Hampton

Inn Terre Haute 112� x x x Hampton Inn Evansville 141� x x x Hilton

St. Petersburg Bayfront 333� x x x Courtyard Bloomington 117� x x x

Courtyard Columbus Tipton Lakes 90� x x x x Residence Inn

Evansville 78� x x x x x Residence Inn Salt Lake City 144� x Hilton

Fort Worth 294� x x x x Residence Inn Palm Desert 130� x x Historic

Inns of Annapolis 124� x x x x Embassy Suites Houston 150� x x

Radisson Rockland 127� x x Residence Inn San Diego Sorrento Mesa

150� x x Hilton Nassau Bay - Clear Lake 243� x x Crowne Plaza

Beverly Hills 260� x x Radisson City Center - Indianapolis 371� x x

x x Sheraton Minneapolis West 222� x x x Embassy Suites West Palm

Beach 160� x x x Residence Inn Fairfax Merrifield 159� x Courtyard

Crystal City Reagan Airport 272� x x Courtyard Palm Desert 151� x

SpringHill Suites Kennesaw 90� x x SpringHill Suites Jacksonville

102� x x Courtyard Atlanta Alpharetta 154� x x Sea Turtle Inn

Jacksonville 193� x x x x x x SpringHill Suites BWI Airport 133� x

x SpringHill Suites Centreville 136� x x SpringHill Suites

Gaithersburg 162� x x Courtyard Overland Park 168� x x Hilton Santa

Fe 157� x x x Marriott at Research Triangle Park 225� x x Marriott

Crystal Gateway 697� x x Hilton Garden Inn Jacksonville 119� x x

Homewood Suites Mobile 86� x x Hyatt Dulles 316� x x x JW Marriott

San Francisco 338� x x x Embassy Suites Las Vegas Airport 220� x x

Embassy Suites Philadelphia Airport 263� x x Embassy Suites Walnut

Creek 249� x x Hilton Minneapolis Airport 300� x x Sheraton San

Diego Mission Valley 260� x x Westin O'Hare 525� x x Sheraton

Anchorage 375� x Residence Inn Lake Buena Vista 210� x Courtyard

Louisville Airport 150� x SpringHill Suites Charlotte 136� x

SpringHill Suites Raleigh Airport 120� x SpringHill Suites Mall of

Georgia 96� Hampton Inn Lawrenceville 86� Courtyard Ft. Lauderdale

Weston 174� Courtyard Foothill Ranch Irvine 156� Embassy Suites

Austin Arboretum 150� Embassy Suites Dallas Galleria 150� Embassy

Suites Dulles Int'l 150� Embassy Suites Flagstaff 119� Fairfield

Inn and Suites Kennesaw 87� Crowne Plaza La Concha - Key West 160�

Radisson Hotel MacArthur Airport 188� Residence Inn Orlando Sea

World 350�

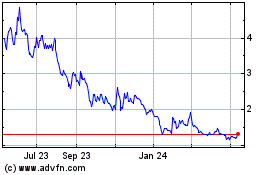

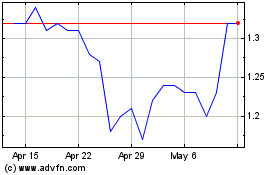

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024