DALLAS, March 8 /PRNewswire-FirstCall/ -- Ashford Hospitality

Trust, Inc. (NYSE:AHT) today reported the following results and

performance measures for the fourth quarter and year ended December

31, 2005. The performance measurements for Occupancy, ADR, RevPar,

and Hotel Operating Profit include the Company's 63 core hotels,

which excludes 17 hotel assets held for sale, and compare the

fourth quarter and full year ended December 31, 2005 to the fourth

quarter and full year ended December 31, 2004. The reconciliation

of non-GAAP financial measures is included in the financial tables

accompanying this press release. FINANCIAL HIGHLIGHTS - Total

revenue increased 157.4% to $104.1 million from $40.4 million - Net

loss available to common shareholders was $7.7 million compared

with a net loss of $794,000 - Net loss available to common

shareholders per share was $0.18 compared with a net loss of $0.03

- Results include debt extinguishment charges and write-off of loan

costs totaling $13.4 million, or $0.31 per share, in the fourth

quarter - Adjusted funds from operations (AFFO) increased 404.5% to

$17.0 million from $3.4 million - AFFO per diluted share increased

145.5% to $0.27 from $0.11 - Cash available for distribution (CAD)

was $14.5 million, or $0.23 per diluted share - CAD per share

increased by 109.1% for the quarter and 104.7% over the 2004 year -

Declared eighth consecutive increase in quarterly common dividend

to $0.20 per share - Dividend payout ratio was 80.7 % of CAD for

the 2005 year STRONG INTERNAL GROWTH - Proforma revenue per

available room (RevPAR) increased 12.7% for hotels not under

renovation on a 9.2% increase in ADR to $107.92 and 224-basis point

improvement in occupancy - Proforma RevPAR increased 9.5% for

consolidated hotels on a 9.0% increase in ADR to $107.32 and

33-basis point improvement in occupancy - Proforma same-property

hotel operating profit for hotels not under renovation improved

10.0% CAPITAL RECYCLING AND ASSET ALLOCATION - Today, 15 select

service hotels remain designated as for sale with closings expected

in 2006 - Capex invested in 2005 totals $38 million - Additional

Capex planned for 2006 totals $75 million EXTERNAL GROWTH - Total

enterprise value improved to $1.5 billion at December 31, 2005 -

Acquired the Hyatt Dulles Airport in Herndon, Virginia, for $72.5

million in cash - Acquired an $18.2 million mezzanine loan on the

Four Seasons Nevis in Nevis, West Indies - Mezzanine and first

mortgage loan portfolio totaled $108.3 million at December 31,

2005, with weighted average interest rate of 14.2% PORTFOLIO REVPAR

REFLECTS BENEFIT OF VALUE-ADDED RENOVATIONS As of December 31,

2005, the Company had a portfolio of direct hotel investments

consisting of 80 properties, 63 of which are included in continuing

operations. During the fourth quarter, 50 of the hotels included in

continuing operations were not under renovation. The Company

believes reporting its operating metrics for continuing operations

on a proforma consolidated and proforma not-under-renovation basis

is a measure that reflects a meaningful and more focused comparison

of the operating improvement in its direct hotel portfolio. The

Company's reporting by region and brand includes the results of the

63 hotels in continuing operations. Details of each category are

provided in the tables attached to this release. - RevPAR growth by

region was led by: Pacific(6 hotels) with a 20.0% increase; West

South Central(5) with 10.8%; Mountain(5) with 10.6%; South

Atlantic(25) with 10.1%; East South Central(4) with 7.7%; Middle

Atlantic(3) with 5.4%; West North Central(2) with 4.4%; East North

Central(11) with a 0.2% decrease; and New England(2) with a 16.1%

decrease - RevPAR growth by brand was led by: Hyatt(2 hotels) with

a 32.4% increase; InterContinental(2) with 15.3%; Hilton(21) with

11.0%; Marriott(27) with 9.7%; Starwood(2) with 1.9%;

independents(2) with a 5.8% decrease; and Radisson(7) with a 8.4%

decrease Monty J. Bennett, President and CEO, commented, "The

strong FFO and RevPAR growth for the quarter was a direct result of

the continued emphasis on reinvesting in our properties and

maximizing the value inherent in these assets. Having previously

targeted hotels that were expected to experience above-market

RevPAR gains, we designed asset management plans together with our

property managers to position each hotel to outperform its market.

With double-digit RevPAR growth for hotels not under renovation in

every quarter during 2005, the value of this patient strategy has

been readily apparent. We intend to continue with this capital

improvement plan during 2006 as we recycle capital to new assets

that best fit within our long-term core portfolio and build on the

operational improvements already underway." FINANCING ACTIVITY

LOWERS BORROWING COSTS WITH FIXED-RATE DEBT At December 31, 2005,

the Company's net debt, defined as total debt less cash, to total

enterprise value, defined as net debt plus the market value of all

common shares, preferred shares and operating partnership units

outstanding was 53.6% based upon the company's closing stock price

of $10.49. As of December 31, 2005, the Company's $908.6 million

debt portfolio consisted of approximately 87% of fixed-rate debt

and approximately 13% of variable-rate debt, with a total weighted

average interest rate of 5.59%. The Company's weighted average debt

maturity is 8.6 years. On October 28, 2005, the Company executed a

$45.0 million mortgage loan, which is secured by one hotel, at an

interest rate of LIBOR plus 2%, matures October 10, 2007, includes

three one-year extension options, and requires monthly

interest-only payments through maturity. In connection with this

loan, the Company purchased a 7.0% LIBOR interest rate cap with a

$45.0 million notional amount, which matures October 15, 2007, to

limit its exposure to rising interest rates on its variable-rate

debt. On November 14, 2005, the Company executed a $211.5 million

mortgage loan, which is secured by 16 hotels divided equally into

two pools. The first pool for $110.9 million incurs interest at a

fixed rate of 5.75%, matures December 11, 2014, and requires

monthly interest-only payments for four years plus monthly

principal payments thereafter based on a twenty-five-year

amortization schedule. The second pool for $100.6 million incurs

interest at a fixed rate of 5.7%, matures December 11, 2015, and

requires monthly interest-only payments for five years plus monthly

principal payments thereafter based on a twenty-five-year

amortization schedule. The Company used proceeds from the loan to

repay its $210.0 million term loan, due October 10, 2006, and its

$6.2 million mortgage loan, due January 1, 2006. On December 23,

2005, the Company executed a $100.0 million senior secured

revolving credit facility with the ability to be increased to

$150.0 million subject to certain conditions, of which drawings

thereon will initially be secured by certain mezzanine loans

receivable, that will mature December 23, 2008, will incur interest

at LIBOR plus a range of 1.5% to 2.75% depending on the

loan-to-value ratio and types of collateral pledged, and will

require monthly interest-only payments through maturity. FOURTH

QUARTER INVESTMENT ACTIVITY On October 28, 2005, the Company

acquired the Hyatt Dulles Airport in Herndon, Virginia, for

approximately $72.5 million in cash. To finance the acquisition,

the company obtained a $45 million 2-year loan at LIBOR plus 200

basis points. On December 16, 2005, the Company acquired a

mezzanine loan receivable of approximately $18.2 million on the

Four Seasons Nevis in Nevis, West Indies. The loan bears interest

at a rate of LIBOR plus 9% and matures in October 2008, with

interest-only payments through maturity. SUBSEQUENT INVESTMENT

ACTIVITY On January 17, 2006, the Company sold two Howard Johnson

hotels located in Commack, New York, and Westbury, New York, for

approximately $11.0 million, or approximately $10.3 million net of

closing costs. These two hotels were originally acquired by the

Company on March 16, 2005, in connection with its acquisition of a

21-property hotel portfolio, and are the last to be sold of the

eight acquired hotels designated for sale from this portfolio. On

January 25, 2006, in an underwritten follow-on public offering, the

Company issued 12,107,623 shares of its common stock at $11.15 per

share, which generated gross proceeds of approximately $135.0

million. The aggregate proceeds to the Company, net of

underwriters' discount and offering costs, was approximately $128.6

million. The 12,107,623 shares issued include 1,057,623 shares sold

pursuant to an over-allotment option granted to the underwriters.

The net proceeds were used for a $60.0 million pay-down on the

Company's $100.0 million credit facility due August 17, 2008, a

$45.0 million pay-down on the Company's $45.0 million mortgage loan

due October 10, 2007, and the acquisition of the Marriott at

Research Triangle Park, as discussed below. On February 16, 2006,

the Company entered into a definitive agreement to acquire the Pan

Pacific San Francisco Hotel in San Francisco, California, for

approximately $95.0 million in cash. The Company intends to use

proceeds from its follow-on public offering on January 25, 2006,

and funds available on its credit facility to fund this

acquisition. The acquisition is expected to close in early April

2006. On February 24, 2006, the Company acquired the Marriott at

Research Triangle Park hotel property in Durham, North Carolina,

for approximately $28.0 million in cash. The Company used proceeds

from its follow-on public offering on January 25, 2006, to fund

this acquisition. INVESTMENT OUTLOOK Mr. Bennett concluded, "The

past year Ashford excelled at its strategic objectives of:

diversified and accretive investments, strong internal growth,

financial stability, and dividend increases. With a very successful

capital raise completed early in the first quarter, we have been

able to make a strong start in 2006 in continuing our core

objectives. Since year end, we have acquired the Marriott at

Research Triangle Park and agreed to purchase the Pan Pacific San

Francisco for a combined investment of $123 million. In addition,

we have an active pipeline. These attractive external growth

opportunities complement the continued improvement in our capital

structure, the double- digit RevPAR growth in our current portfolio

generated by value-added reinvestment and our ongoing capital

recycling program. Combined with a very optimistic industry

outlook, we believe these factors position us to achieve our most

successful year yet in 2006." INVESTOR CONFERENCE CALL AND

SIMULCAST Ashford Hospitality Trust, Inc. will conduct a conference

call at 11:00 a.m. eastern time on March 9, 2006, to discuss the

fourth quarter results. The number to call for this interactive

teleconference is 913-981-5509. A seven- day replay of the

conference call will be available by dialing 719-457-0820 and

entering the confirmation number, 3440675. The Company will also

provide an online simulcast and rebroadcast of its fourth quarter

2005 earnings release conference call. The live broadcast of

Ashford's quarterly conference call will be available online at the

Company's website at http://www.ahtreit.com/ as well as on

http://phx.corporate-/

ir.net/phoenix.zhtml?p=irol-eventDetails&c=147105&eventID=1207269

March 9, 2006, beginning at 11:00 a.m. eastern time. (Due to length

of URL, please cut and paste into browser). The online replay will

follow shortly after the call and continue for approximately one

year. Substantially all of our non-current assets consist of real

estate investments and debt investments secured by real estate.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. Since real estate values instead have historically risen

or fallen with market conditions, most industry investors consider

supplemental measures of performance, which are not measures of

operating performance under GAAP, to be helpful in evaluating a

real estate company's operations. These supplemental measures

include FFO, AFFO, EBITDA, Hotel Operating Profit, and CAD. FFO is

computed in accordance with our interpretation of standards

established by NAREIT, which may not be comparable to FFO reported

by other REITs that do not define the term in accordance with the

current NAREIT definition or that interpret the NAREIT definition

differently than us. Neither FFO, AFFO, EBITDA, Hotel Operating

Profit, nor CAD represents cash generated from operating activities

as determined by GAAP and should not be considered as an

alternative to a) GAAP net income (loss) as an indication of our

financial performance or b) GAAP cash flows from operating

activities as a measure of our liquidity, nor are such measures

indicative of funds available to fund our cash needs, including our

ability to make cash distributions. However, management believes

FFO, AFFO, EBITDA, Hotel Operating Profit, and CAD to be meaningful

measures of a REIT's performance and should be considered along

with, but not as an alternative to, net income and cash flow as a

measure of our operating performance. Ashford Hospitality Trust is

a self-administered real estate investment trust focused on

investing in the hospitality industry across all segments and at

all levels of the capital structure, including direct hotel

investments, first mortgages, mezzanine loans and sale-leaseback

transactions. Additional information can be found on the Company's

web site at http://www.ahtreit.com/. Certain statements and

assumptions in this press release contain or are based upon

"forward-looking" information and are being made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. These forward-looking statements are subject to risks

and uncertainties. When we use the words "will likely result,"

"may," "anticipate," "estimate," "should," "expect," "believe,"

"intend," or similar expressions, we intend to identify

forward-looking statements. Such forward-looking statements

include, but are not limited to, our business and investment

strategy, timing for closings, our understanding of our

competition, current market trends and opportunities, and projected

capital expenditures. Such statements are subject to numerous

assumptions and uncertainties, many of which are outside Ashford's

control. These forward-looking statements are subject to known and

unknown risks and uncertainties, which could cause actual results

to differ materially from those anticipated, including, without

limitation: general volatility of the capital markets and the

market price of our common stock; changes in our business or

investment strategy; availability, terms and deployment of capital;

availability of qualified personnel; changes in our industry and

the market in which we operate, interest rates or the general

economy; and the degree and nature of our competition. These and

other risk factors are more fully discussed in the section entitled

"Risk Factors" in Ashford's Registration Statement on Form S-3,

(File Number 333-114283), and from time to time, in Ashford's other

filings with the Securities and Exchange Commission. The

forward-looking statements included in this press release are only

made as of the date of this press release. Investors should not

place undue reliance on these forward-looking statements. We are

not obligated to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or circumstances, changes in expectations or otherwise. ASHFORD

HOSPITALITY TRUST, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In

Thousands, Except Share and Per Share Amounts) (Unaudited) Three

Three Year Year Months Months Ended Ended Ended Ended Dec. 31, Dec.

31, Dec. 31, Dec. 31, 2005 2004 2005 2004 REVENUE Rooms $250,571

$89,798 $78,698 $29,806 Food and beverage 52,317 14,337 16,720

6,160 Other 14,181 3,923 4,522 1,556 Total hotel revenue 317,069

108,058 99,940 37,522 Interest income from notes receivable 13,323

7,549 3,836 2,603 Asset management fees from affiliates 1,258 1,318

318 318 Total Revenue 331,650 116,925 104,094 40,443 EXPENSES Hotel

operating expenses Rooms 56,991 20,908 18,603 7,312 Food and

beverage 39,711 10,859 12,760 4,630 Other direct 5,420 2,150 1,613

816 Indirect 99,804 35,561 32,141 12,199 Management fees 11,547

3,395 4,088 1,204 Total hotel expenses 213,473 72,873 69,205 26,161

Property taxes, insurance, and other 17,248 6,655 5,495 1,727

Depreciation and amortization 30,286 10,768 11,101 4,040 Corporate

general and administrative: Stock-based compensation 3,446 2,397

963 605 Other corporate and administrative 11,077 9,458 3,154 2,548

Total Operating Expenses 275,530 102,151 89,918 35,081 OPERATING

INCOME 56,120 14,774 14,176 5,362 Interest income 1,027 335 300 88

Interest expense (34,448) (9,217) (12,232) (3,820) Amortization of

loan costs (3,956) (1,884) (832) (965) Write-off of loan costs and

exit fees (5,803) (1,633) (5,652) - Loss on debt extinguishment

(10,000) - (7,743) - INCOME (LOSS) BEFORE INCOME TAXES AND MINORITY

INTEREST 2,940 2,375 (11,983) 665 Benefit from (provision for)

income taxes 2,650 (658) 2,249 29 Minority interest (1,159) (298)

1,966 (133) INCOME (LOSS) FROM CONTINUING OPERATIONS 4,431 1,419

(7,768) 561 Income from discontinued operations, net 5,006 - 2,768

- NET INCOME (LOSS) 9,437 1,419 (5,000) 561 Preferred dividends

9,303 1,355 2,719 1,355 NET INCOME (LOSS) AVAILABLE TO COMMON

SHAREHOLDERS $134 $64 $(7,719) $(794) Basic and Diluted: Income

(Loss) From Continuing Operations Per Share Available To Common

Shareholders $(0.12) $- $(0.24) $(0.03) Income From Discontinued

Operations Per Share $0.12 $- $0.06 $- Net Income (Loss) Per Share

Available To Common Shareholders $- $- $(0.18) $(0.03) Weighted

Average Common Shares Outstanding 40,194,132 25,120,653 43,145,657

25,280,502 ASHFORD HOSPITALITY TRUST, INC. CONSOLIDATED BALANCE

SHEETS (In Thousands, Except Share and Per Share Amounts)

(Unaudited) December 31, December 31, 2005 2004 ASSETS Investment

in hotel properties, net $1,066,962 $427,005 Cash and cash

equivalents 57,995 47,109 Restricted cash 27,842 14,059 Accounts

receivable, net of allowance of $366 and $61, respectively 21,355

5,463 Inventories 1,186 612 Assets held for sale 157,579 2,882

Notes receivable 108,305 79,661 Deferred costs, net 14,046 9,390

Prepaid expenses 9,662 2,639 Other assets 4,014 6,677 Intangible

assets, net 1,181 - Due from third-party hotel managers 12,274 383

Due from affiliates 476 65 Total assets $1,482,877 $595,945

LIABILITIES AND OWNERS' EQUITY Indebtedness $908,623 $300,754

Capital leases payable 453 313 Accounts payable 9,984 8,980 Accrued

expenses 21,054 9,340 Other liabilities - 90 Dividends payable

13,703 6,141 Deferred income 729 401 Due to third-party hotel

managers 1,385 859 Due to affiliates 5,654 1,048 Total liabilities

961,585 327,926 Commitments and contingencies Minority interest

87,969 39,347 Preferred stock, $0.01 par value: Series B Cumulative

Convertible Redeemable Preferred Stock, 7,447,865 and 993,049

issued and outstanding at December 31, 2005 and 2004, respectively

75,000 10,000 Preferred stock, $0.01 par value, 50,000,000 shares

authorized: Series A Cumulative Preferred Stock, 2,300,000 issued

and outstanding at December 31, 2005 and 2004 23 23 Common stock,

$0.01 par value, 200,000,000 shares authorized, 43,831,394 and

25,810,447 shares issued and outstanding at December 31, 2005 and

2004, respectively 438 258 Additional paid-in capital 403,919

234,973 Unearned compensation (4,792) (3,959) Accumulated other

comprehensive income 1,372 554 Accumulated deficit (42,637)

(13,177) Total owners' equity 358,323 218,672 Total liabilities and

owners' equity $1,482,877 $595,945 ASHFORD HOSPITALITY TRUST, INC.

FFO and Adjusted FFO (In Thousands, Except Share And Per Share

Amounts) (Unaudited) Three Three Year Year Months Months Ended

Ended Ended Ended Dec. 31, Dec. 31, Dec. 31, Dec. 31, 2005 2004

2005 2004 Net income (loss) available to common shareholders $134

$64 $(7,719) $(794) Plus real estate depreciation and amortization

30,182 10,713 11,056 4,022 Remove minority interest 2,425 298

(1,265) 133 FFO available to common shareholders $32,741 $11,075

$2,072 $3,361 Add back dividends on redeemable preferred stock

4,386 - 1,490 - Add back write-off of loan costs and exit fees

5,803 1,633 5,652 - Add back loss on debt extinguishment 10,000 -

7,743 - Adjusted FFO $52,930 $12,708 $16,957 $3,361 Adjusted FFO

per diluted share available to common shareholders $0.96 $0.41

$0.27 $0.11 Diluted weighted average shares outstanding 55,149,994

30,993,250 61,869,686 31,492,272 ASHFORD HOSPITALITY TRUST, INC.

EBITDA (In Thousands) (Unaudited) Three Three Year Year Months

Months Ended Ended Ended Ended Dec. 31, Dec. 31, Dec. 31, Dec. 31,

2005 2004 2005 2004 Net income (loss) $9,437 $1,419 $(5,000) $561

Add back: Interest income 1,027 335 300 88 Interest expense and

amortization of loan costs (38,404) (11,101) (13,064) (4,785)

Minority interest (2,425) (298) 1,265 (133) Depreciation and

amortization (30,286) (10,768) (11,101) (4,040) Benefit from

(provision for) income taxes 184 (658) 1,231 29 (69,904) (22,490)

(21,369) (8,841) EBITDA $79,341 $23,909 $16,369 $9,402 For the year

ended December 31, 2005, EBITDA has not been adjusted to add back

the loss on debt extinguishment of approximately $10.0 million and

the write-off of loan costs and exit fees of approximately $5.8

million. For the year ended December 31, 2004, EBITDA has not been

adjusted to add back the write-off of loan costs and exit fees of

approximately $1.6 million. For the three months ended December 31,

2005, EBITDA has not been adjusted to add back the loss on debt

extinguishment of approximately $7.7 million and the write-off of

loan costs and exit fees of approximately $5.7 million. ASHFORD

HOSPITALITY TRUST, INC. CASH AVAILABLE FOR DISTRIBUTION (In

Thousands, Except Per Share Amounts) (Unaudited) Year Year Ended

(per Ended (per Dec. 31, diluted Dec. 31, diluted 2005 share) 2004

share) Net income available to common shareholders $134 $64 Add

back dividends on redeemable preferred stock 4,386 3 Total $4,520

$67 Plus real estate depreciation and amortization 30,182 $0.55

10,713 $0.35 Remove minority interest 2,425 0.04 298 0.01 Plus

stock-based compensation 3,446 0.06 2,397 0.08 Plus amortization of

loan costs 3,956 0.07 1,884 0.06 Plus write-off of loan costs 5,803

0.11 1,633 0.05 Plus loss on debt extinguishment 10,000 0.18 - 0.00

Less debt premium amortization to reduce interest expense (518)

(0.01) - 0.00 Less capital improvements reserve (11,429) (0.21)

(3,799) (0.12) CAD $48,385 $0.88 $13,193 $0.43 Three Three Months

Months Ended (per Ended (per Dec. 31, diluted Dec. 31, diluted 2005

share) 2004 share) Net income (loss) available to common

shareholders $(7,719) $(794) Add back dividends on redeemable

preferred stock 1,490 3 Total $(6,229) $(791) Plus real estate

depreciation and amortization 11,056 0.18 4,022 0.13 Remove

minority interest (1,265) (0.02) 133 0.00 Plus stock-based

compensation 963 0.02 605 0.02 Plus amortization of loan costs 832

0.01 965 0.03 Plus write-off of loan costs 5,652 0.09 - 0.00 Plus

loss on debt extinguishment 7,743 0.13 - 0.00 Less debt premium

amortization to reduce interest expense (55) (0.00) - 0.00 Less

capital improvements reserve (4,198) (0.07) (1,336) (0.04) CAD

$14,499 $0.23 $3,598 $0.11 ASHFORD HOSPITALITY TRUST, INC. KEY

PERFORMANCE INDICATORS - PRO FORMA (Unaudited) Three Months Ended

December 31, % 2005 2004 Variance ALL HOTELS INCLUDED IN CONTINUING

OPERATIONS: Room revenues $79,771,221 $72,851,757 9.50% RevPar

$73.60 $67.22 9.49% Occupancy 68.58% 68.25% 0.49% ADR $107.32

$98.50 8.96% Year Ended December 31, % 2005 2004 Variance ALL

HOTELS INCLUDED IN CONTINUING OPERATIONS: Room revenues

$316,118,078 $286,431,128 10.36% RevPar $77.21 $69.96 10.36%

Occupancy 71.74% 70.84% 1.27% ADR $107.63 $98.77 8.97% NOTE: The

above pro forma table assumes the 63 hotel properties included in

income from continuing operations for the three months and year

ended December 31, 2005 were owned as of the beginning of the

periods presented. For both comparative periods presented, the

above table excludes the 17 hotel properties included in

discontinued operations at December 31, 2005. Three Months Ended

December 31, % 2005 2004 Variance ALL HOTELS NOT UNDER RENOVATION

INCLUDED IN CONTINUING OPERATIONS: Room revenues $62,559,505

$55,501,657 12.72% RevPar $76.94 $68.27 12.70% Occupancy 71.29%

69.05% 3.25% ADR $107.92 $98.86 9.16% Year Ended December 31, %

2005 2004 Variance ALL HOTELS NOT UNDER RENOVATION INCLUDED IN

CONTINUING OPERATIONS: Room revenues $242,886,207 $216,716,876

12.08% RevPar $79.83 $71.30 11.97% Occupancy 73.37% 71.90% 2.05%

ADR $108.80 $99.16 9.72% NOTE: The above pro forma table assumes

the 50 hotel properties not under renovation and included in income

from continuing operations for the three months and year ended

December 31, 2005 were owned as of the beginning of the periods

presented. For both comparative periods presented, the above table

excludes the 17 hotel properties included in discontinued

operations at December 31, 2005. Excluded Hotels Under Renovation:

Crowne Plaza Beverly Hills, Embassy Suites Houston, Embassy Suites

West Palm Beach, Hilton Nassau Bay - Clear Lake, Historic Inns of

Annapolis, Radisson City Center - Indianapolis, Radisson Hotel

Airport - Indianapolis, Radisson Milford, Radisson Plaza Downtown

Fort Worth, Radisson Rockland, Sheraton Minneapolis West, Residence

Inn Palm Desert, Residence Inn San Diego Sorrento Mesa ASHFORD

HOSPITALITY TRUST, INC. Pro Forma Hotel RevPAR by Region

(Unaudited) Region Number of Hotels Number of Rooms Pacific (1) 6

1,501 Mountain (2) 5 869 West North Central (3) 2 390 West South

Central (4) 5 1,210 East North Central (5) 11 1,682 East South

Central (6) 4 573 Middle Atlantic (7) 3 590 South Atlantic (8) 25

4,114 New England (9) 2 300 Total Portfolio 63 11,229 Three Months

Percent Ended Year Ended Change in December 31, December 31, RevPAR

Region 2005 2004 2005 2004 Quarter YTD Pacific (1) $80.95 $67.47

$86.55 $72.27 20.0% 19.8% Mountain (2) $81.62 $73.77 $88.42 $80.45

10.6% 9.9% West North Central (3) $63.75 $61.07 $69.44 $61.58 4.4%

12.8% West South Central (4) $69.90 $63.11 $70.07 $67.90 10.8% 3.2%

East North Central (5) $53.18 $53.29 $56.92 $54.42 -0.2% 4.6% East

South Central (6) $55.98 $51.97 $59.64 $53.17 7.7% 12.2% Middle

Atlantic (7) $63.52 $60.25 $70.17 $67.07 5.4% 4.6% South Atlantic

(8) $85.01 $77.23 $88.56 $79.25 10.1% 11.8% New England (9) $36.27

$43.23 $42.71 $45.48 -16.1% -6.1% Total Portfolio $73.60 $67.22

$77.21 $69.96 9.5% 10.4% (1) Includes California (2) Includes

Nevada, Arizona, New Mexico, and Utah (3) Includes Minnesota and

Kansas (4) Includes Texas (5) Includes Ohio and Indiana (6)

Includes Kentucky and Alabama (7) Includes New York and

Pennsylvania (8) Includes Virginia, Florida, Georgia, Maryland, and

North Carolina (9) Includes Massachusetts NOTE: The above pro forma

table assumes the 63 hotel properties included in income from

continuing operations for the three months and year ended December

31, 2005 were owned as of the beginning of the periods presented.

For both comparative periods presented, the above table excludes

the 17 hotel properties included in discontinued operations at

December 31, 2005. ASHFORD HOSPITALITY TRUST, INC. Pro Forma Hotel

RevPAR by Brand (Unaudited) Brand Number of Hotels Number of Rooms

Hilton 21 3,344 Hyatt 2 970 InterContinental 2 420 Independent 2

317 Marriott 27 3,898 Radisson 7 1,871 Starwood 2 409 Total

Portfolio 63 11,229 Three Months Percent Ended Year Ended Change in

December 31, December 31, RevPAR Brand 2005 2004 2005 2004 Quarter

YTD Hilton $76.89 $69.30 $80.18 $73.23 11.0% 9.5% Hyatt $92.44

$69.80 $93.50 $74.82 32.4% 25.0% InterContinental $108.75 $94.36

$117.18 $98.28 15.3% 19.2% Independent $63.87 $67.83 $80.08 $78.29

-5.8% 2.3% Marriott $77.61 $70.78 $79.30 $71.67 9.7% 10.7% Radisson

$45.47 $49.66 $51.64 $50.99 -8.4% 1.3% Starwood $58.52 $57.45

$68.29 $67.09 1.9% 1.8% Total Portfolio $73.60 $67.22 $77.21 $69.96

9.5% 10.4% NOTE: The above pro forma table assumes the 63 hotel

properties included in income from continuing operations for the

three months and year ended December 31, 2005 were owned as of the

beginning of the periods presented. For both comparative periods

presented, the above table excludes the 17 hotel properties

included in discontinued operations at December 31, 2005. ASHFORD

HOSPITALITY TRUST, INC. PRO FORMA HOTEL OPERATING PROFIT (In

Thousands) (Unaudited) ALL HOTELS INCLUDED IN CONTINUING

OPERATIONS: Three Months Ended Year Ended Dec. 31 Dec. 31 % Dec. 31

Dec. 31 % 2005 2004 Variance 2005 2004 Variance REVENUE Rooms

$79,771 $72,852 9.50% $316,118 $286,431 10.36% Food and beverage

17,170 15,592 10.12% 64,621 56,602 14.17% Other 4,017 3,350 19.91%

14,497 13,945 3.96% Total hotel revenue 100,958 91,794 9.98%

395,236 356,978 10.72% EXPENSES Hotel operating expenses Rooms

18,801 17,172 9.49% 71,504 64,288 11.22% Food and beverage 12,956

10,809 19.86% 48,285 41,509 16.32% Other direct 1,731 1,499 15.48%

6,416 6,411 0.08% Indirect 32,340 28,841 12.13% 120,164 112,616

6.70% Management fees 4,137 3,356 23.27% 14,919 12,207 22.22% Total

hotel operating expenses 69,965 61,677 13.44% 261,288 237,031

10.23% Property taxes, insurance, and other 5,513 4,327 27.41%

21,212 19,654 7.93% HOTEL OPERATING PROFIT (EBITDA) $25,480 $25,790

-1.20% $112,736 $100,293 12.41% NOTE: The above pro forma table

assumes the 63 hotel properties included in income from continuing

operations for the three months and year ended December 31, 2005

were owned as of the beginning of the periods presented. For both

comparative periods presented, the above table excludes the 17

hotel properties included in discontinued operations at December

31, 2005. ALL HOTELS NOT UNDER RENOVATION INCLUDED IN CONTINUING

OPERATIONS: Three Months Ended Year Ended Dec. 31 Dec. 31 % Dec. 31

Dec. 31 % 2005 2004 Variance 2005 2004 Variance REVENUE Rooms

$62,560 $55,502 12.72% $242,886 $216,717 12.08% Food and beverage

11,335 10,244 10.65% 43,554 38,378 13.49% Other 3,034 2,332 30.10%

10,583 9,825 7.72% Total hotel revenue 76,929 68,078 13.00% 297,023

264,920 12.12% EXPENSES Hotel operating expenses Rooms 14,961

13,581 10.16% 56,158 50,414 11.39% Food and beverage 8,785 7,447

17.97% 33,049 29,078 13.66% Other direct 1,219 1,092 11.63% 4,619

4,597 0.48% Indirect 23,217 20,666 12.34% 86,724 81,133 6.89%

Management fees 3,312 2,524 31.22% 11,561 9,422 22.70% Total hotel

operating expenses 51,494 45,310 13.65% 192,111 174,644 10.00%

Property taxes, insurance, and other 3,909 3,196 22.31% 15,543

14,280 8.84% HOTEL OPERATING PROFIT (EBITDA) $21,526 $19,572 9.98%

$89,369 $75,996 17.60% NOTE: The above pro forma table assumes the

50 hotel properties not under renovation and included in income

from continuing operations for the three months and year ended

December 31, 2005 were owned as of the beginning of the periods

presented. For both comparative periods presented, the above table

excludes the 17 hotel properties included in discontinued

operations at December 31, 2005. ASHFORD HOSPITALITY TRUST, INC.

Pro Forma Hotel Operating Profit by Region (In Thousands)

(Unaudited) Region Number of Hotels Number of Rooms Pacific (1) 6

1,501 Mountain (2) 5 869 West North Central (3) 2 390 West South

Central (4) 5 1,210 East North Central (5) 11 1,682 East South

Central (6) 4 573 Middle Atlantic (7) 3 590 South Atlantic (8) 25

4,114 New England (9) 2 300 Total Portfolio 63 11,229 Three Months

Ended December 31, Region 2005 % Total 2004 % Total Pacific (1)

$4,745 18.6% $3,537 13.7% Mountain (2) $2,123 8.3% $2,002 7.8% West

North Central (3) $788 3.1% $922 3.6% West South Central (4) $1,878

7.4% $2,123 8.2% East North Central (5) $1,940 7.6% $2,851 11.1%

East South Central (6) $589 2.3% $794 3.1% Middle Atlantic (7) $847

3.3% $856 3.3% South Atlantic (8) $12,658 49.7% $12,356 47.9% New

England (9) ($88) -0.3% $349 1.4% Total Portfolio $25,480 100.0%

$25,790 100.0% Year Ended December 31, Region 2005 % Total 2004 %

Total Pacific (1) $20,628 18.3% $14,149 14.1% Mountain (2) $9,937

8.8% $8,669 8.6% West North Central (3) $3,842 3.4% $3,330 3.3%

West South Central (4) $8,431 7.5% $8,705 8.7% East North Central

(5) $10,335 9.2% $11,136 11.1% East South Central (6) $3,694 3.3%

$3,236 3.2% Middle Atlantic (7) $3,082 2.7% $3,663 3.7% South

Atlantic (8) $52,322 46.4% $46,368 46.2% New England (9) $465 0.4%

$1,037 1.0% Total Portfolio $112,736 100.0% $100,293 100.0% Percent

Change in Hotel Operating Profit Region Quarter YTD Pacific (1)

34.2% 45.8% Mountain (2) 6.0% 14.6% West North Central (3) -14.5%

15.4% West South Central (4) -11.5% -3.1% East North Central (5)

-32.0% -7.2% East South Central (6) -25.8% 14.2% Middle Atlantic

(7) -1.1% -15.9% South Atlantic (8) 2.4% 12.8% New England (9)

-125.2% -55.2% Total Portfolio -1.2% 12.4% (1) Includes California

(2) Includes Nevada, Arizona, New Mexico, and Utah (3) Includes

Minnesota and Kansas (4) Includes Texas (5) Includes Ohio and

Indiana (6) Includes Kentucky and Alabama (7) Includes New York and

Pennsylvania (8) Includes Virginia, Florida, Georgia, Maryland, and

North Carolina (9) Includes Massachusetts NOTE: The above pro forma

table assumes the 63 hotel properties included in income from

continuing operations for the three months and year ended December

31, 2005 were owned as of the beginning of the periods presented.

For both comparative periods presented, the above table excludes

the 17 hotel properties included in discontinued operations at

December 31, 2005. ASHFORD HOSPITALITY TRUST, INC. Debt Summary As

of December 31, 2005 (in millions) Fixed-Rate Floating-Rate Total

Debt Debt Debt $580.8 million mortgage note payable secured by 40

hotel properties, matures between July 1, 2015 and February 1,

2016, at an average interest rate of 5.4% $580.8 $- $580.8 $211.5

million term loan secured by 16 hotel properties, matures between

December 11, 2014 and December 11, 2015, at an average interest

rate of 5.73% 211.5 - 211.5 $100.0 million secured credit facility

secured by 6 hotel properties, matures August 17, 2008, at an

interest rate of LIBOR plus a range of 1.6% to 1.95% depending on

the loan-to-value ratio - 60.0 60.0 Mortgage note payable secured

by one hotel property, matures October 10, 2007, at an interest

rate of LIBOR plus 2% - 45.0 45.0 Mortgage note payable secured by

one hotel property, matures April 1, 2011, at an interest rate of

the average weekly yield for 30-day commercial paper plus 3.4% -

11.3 11.3 Total Debt Excluding Premium $792.3 $116.3 $908.6

Percentage of Total 87.20% 12.80% 100.00% Weighted Average Interest

Rate at December 31, 2005 5.59% ASHFORD HOSPITALITY TRUST, INC.

Capital Expenditures Calendar 63 Core Hotels 2004 Actual Actual

Actual Actual 1st 2nd 3rd 4th Quarter Quarter Quarter Quarter

Doubletree Suites Columbus x x x Doubletree Suites Dayton x x x

Embassy Suites East Syracuse x x x Embassy Suites Phoenix Airport x

x x Sheraton Bucks County x x Hyatt Regency Orange County x Hampton

Inn Mall of Georgia Hampton Inn Terre Haute Hampton Inn Horse Cave

Hampton Inn Evansville Hilton St. Petersburg Bayfront Fairfield Inn

Evansville West Residence Inn Evansville Fairfield Inn Princeton

Courtyard Columbus Tipton Lakes Courtyard Bloomington Radisson

Milford Residence Inn Salt Lake City Radisson Plaza Downtown Fort

Worth Historic Inns of Annapolis Residence Inn Palm Desert Crowne

Plaza La Concha - Key West Embassy Suites Houston Hilton Santa Fe

Radisson Rockland Sheraton Minneapolis West Residence Inn San Diego

Sorrento Mesa Crowne Plaza Beverly Hills Embassy Suites West Palm

Beach Radisson City Center - Indianapolis Radisson Hotel Airport -

Indianapolis Hilton Nassau Bay - Clear Lake Sea Turtle Inn

Jacksonville Hyatt Dulles SpringHill Suites Kennesaw SpringHill

Suites Jacksonville Courtyard Palm Desert Courtyard Reagan Airport

Residence Inn Fairfax SpringHill Suites BWI Airport SpringHill

Suites Centreville SpringHill Suites Gaithersburg Courtyard

Overland Park Courtyard Alpharetta Courtyard Ft. Lauderdale Weston

Courtyard Irvine Courtyard Louisville Airport Embassy Suites Austin

Arboretum Embassy Suites Dallas Galleria Embassy Suites Dulles

Int'l Embassy Suites Flagstaff Embassy Suites Las Vegas Airport

Fairfield Inn and Suites Kennesaw Hampton Inn Lawrenceville Hilton

Garden Inn Jacksonville Homewood Suites Mobile Radisson Cincinnati

Riverfront Radisson Hotel MacArthur Airport Residence Inn Lake

Buena Vista Residence Inn Sea World SpringHill Suites Charlotte

SpringHill Suites Mall of Georgia SpringHill Suites Raleigh Airport

ASHFORD HOSPITALITY TRUST, INC. Capital Expenditures Calendar 63

Core Hotels 2005 Actual Actual Actual Actual 1st 2nd 3rd 4th

Quarter Quarter Quarter Quarter Doubletree Suites Columbus

Doubletree Suites Dayton Embassy Suites East Syracuse Embassy

Suites Phoenix Airport Sheraton Bucks County x x Hyatt Regency

Orange County Hampton Inn Mall of Georgia x x Hampton Inn Terre

Haute x x x Hampton Inn Horse Cave x x x Hampton Inn Evansville x x

x Hilton St. Petersburg Bayfront x x x Fairfield Inn Evansville

West x x x Residence Inn Evansville x x x Fairfield Inn Princeton x

x x Courtyard Columbus Tipton Lakes x x x Courtyard Bloomington x x

x Radisson Milford x x x Residence Inn Salt Lake City x Radisson

Plaza Downtown Fort Worth x x x Historic Inns of Annapolis x x

Residence Inn Palm Desert x x Crowne Plaza La Concha - Key West

Embassy Suites Houston x Hilton Santa Fe Radisson Rockland x

Sheraton Minneapolis West x Residence Inn San Diego Sorrento Mesa x

Crowne Plaza Beverly Hills x Embassy Suites West Palm Beach x

Radisson City Center - Indianapolis x Radisson Hotel Airport -

Indianapolis x Hilton Nassau Bay - Clear Lake x Sea Turtle Inn

Jacksonville Hyatt Dulles SpringHill Suites Kennesaw SpringHill

Suites Jacksonville Courtyard Palm Desert Courtyard Reagan Airport

Residence Inn Fairfax SpringHill Suites BWI Airport SpringHill

Suites Centreville SpringHill Suites Gaithersburg Courtyard

Overland Park Courtyard Alpharetta Courtyard Ft. Lauderdale Weston

Courtyard Irvine Courtyard Louisville Airport Embassy Suites Austin

Arboretum Embassy Suites Dallas Galleria Embassy Suites Dulles

Int'l Embassy Suites Flagstaff Embassy Suites Las Vegas Airport

Fairfield Inn and Suites Kennesaw Hampton Inn Lawrenceville Hilton

Garden Inn Jacksonville Homewood Suites Mobile Radisson Cincinnati

Riverfront Radisson Hotel MacArthur Airport Residence Inn Lake

Buena Vista Residence Inn Sea World SpringHill Suites Charlotte

SpringHill Suites Mall of Georgia SpringHill Suites Raleigh Airport

ASHFORD HOSPITALITY TRUST, INC. Capital Expenditures Calendar 63

Core Hotels 2006 Estimated Estimated Estimated Estimated 1st 2nd

3rd 4th Quarter Quarter Quarter Quarter Doubletree Suites Columbus

Doubletree Suites Dayton Embassy Suites East Syracuse Embassy

Suites Phoenix Airport Sheraton Bucks County Hyatt Regency Orange

County Hampton Inn Mall of Georgia Hampton Inn Terre Haute Hampton

Inn Horse Cave Hampton Inn Evansville Hilton St. Petersburg

Bayfront Fairfield Inn Evansville West Residence Inn Evansville x x

Fairfield Inn Princeton x x Courtyard Columbus Tipton Lakes x x

Courtyard Bloomington x x Radisson Milford x x Residence Inn Salt

Lake City Radisson Plaza Downtown Fort Worth x x Historic Inns of

Annapolis x Residence Inn Palm Desert x x Crowne Plaza La Concha -

Key West x x Embassy Suites Houston x Hilton Santa Fe x x Radisson

Rockland x Sheraton Minneapolis West x Residence Inn San Diego

Sorrento Mesa x x Crowne Plaza Beverly Hills x x Embassy Suites

West Palm Beach x x x Radisson City Center - Indianapolis x x x

Radisson Hotel Airport - Indianapolis x x Hilton Nassau Bay - Clear

Lake x x Sea Turtle Inn Jacksonville x x x Hyatt Dulles x

SpringHill Suites Kennesaw x SpringHill Suites Jacksonville x

Courtyard Palm Desert x x Courtyard Reagan Airport x Residence Inn

Fairfax x SpringHill Suites BWI Airport x SpringHill Suites

Centreville x SpringHill Suites Gaithersburg x Courtyard Overland

Park x Courtyard Alpharetta Courtyard Ft. Lauderdale Weston

Courtyard Irvine Courtyard Louisville Airport Embassy Suites Austin

Arboretum Embassy Suites Dallas Galleria Embassy Suites Dulles

Int'l Embassy Suites Flagstaff Embassy Suites Las Vegas Airport

Fairfield Inn and Suites Kennesaw Hampton Inn Lawrenceville Hilton

Garden Inn Jacksonville Homewood Suites Mobile Radisson Cincinnati

Riverfront Radisson Hotel MacArthur Airport Residence Inn Lake

Buena Vista Residence Inn Sea World SpringHill Suites Charlotte

SpringHill Suites Mall of Georgia SpringHill Suites Raleigh Airport

Contact: David Kimichik Tripp Sullivan Chief Financial Officer

Corporate Communications, Inc. (972) 490-9600 (615) 254-3376

DATASOURCE: Ashford Hospitality Trust, Inc. CONTACT: David

Kimichik, Chief Financial Officer of Ashford Hospitality Trust,

Inc., +1-972-490-9600; or Tripp Sullivan of Corporate

Communications, Inc., +1-615-254-3376 Web site:

http://www.ahtreit.com/

Copyright

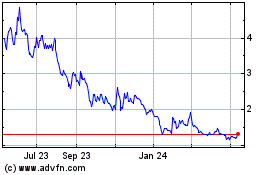

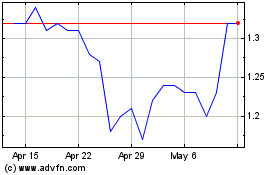

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024