Ashford Hospitality Trust to Acquire 30-Hotel Portfolio for $465 Million

April 27 2005 - 9:36AM

PR Newswire (US)

Ashford Hospitality Trust to Acquire 30-Hotel Portfolio for $465

Million Reports First Quarter Revpar Increase of 12.5% DALLAS,

April 27 /PRNewswire-FirstCall/ -- Ashford Hospitality Trust, Inc.

(NYSE:AHT) announced it has signed a definitive agreement to

acquire a 30-property, 4,328-room hotel portfolio from CNL Hotels

and Resorts for $465 million in cash. The purchase price equates to

a trailing twelve-month net operating income capitalization rate of

approximately 8.4% on the entire 30-hotel portfolio. The portfolio

consists of 13 Residence Inns by Marriott in 9 states; 6 Courtyards

by Marriott in 5 states; 7 TownePlace Suites by Marriott in 6

states; and 4 SpringHill Suites by Marriott in 3 states. The hotels

in the portfolio have an average age of 8.9 years with a majority

of the hotels built between 1997 and 2000. For 2004, the

portfolio's occupancy improved by 340 basis points to 75.1%, ADR

increased 5.6% to $93.65, and RevPAR increased 10.5% to $70.37. For

the first quarter of 2005, RevPAR for the portfolio increased 15.6%

over the first quarter 2004. Marriott International will continue

to operate the hotels under an incentive management agreement. For

2005 and 2006, the Company projects investing, including the normal

reserves, a total of approximately $34 million in capital

expenditures comprised of approximately $18 million to be committed

in 2005 and approximately $16 million to be committed in 2006. The

scope and completion dates vary by property, but the majority of

the work is concentrated in the 13 Residence Inns and the 7

TownePlace Suites. The Company intends to fund the transaction from

several sources including: a financing commitment from Merrill

Lynch Mortgage Lending, Inc. for $370 million at a fixed rate

locked at 5.32%, undrawn proceeds from Security Capital's remaining

convertible preferred or participation in Ashford's January common

stock offering, revolver capacity or cash on the balance sheet.

Upon closing, Ashford Hospitality Trust will own 82 hotels

containing 13,244 rooms. Seventy-six percent (76%) of the hotels

are Marriott, Hilton, Starwood and Hyatt branded. With the addition

of these assets to the Company, 50% of the portfolio will be full

service, and 50% will be select service. Thirty-one percent (31%)

will be upper-upscale, 54% upscale, and 15% mid- scale. The

Company's debt will be 77% fixed rate and 23% floating rate.

Ninety-five percent (95%) of the total debt is fixed, capped or

hedged. The Company's direct hotel investments will be managed by

seven different managers. Monty J. Bennett, President and CEO of

Ashford Hospitality Trust, said, "This transaction demonstrates

Ashford's broad market strategy of combining solid hotel assets

with financial engineering to deliver high returns on invested

capital to our shareholders. While our most recent large portfolio

transaction was almost entirely full-service, this select service

and extended stay acquisition exemplifies the diversity of our

investment objectives and market reach. These assets contribute to

our growing portfolio of strong RevPAR-performing,

geographically-diversified, premier-branded assets. Through this

transaction, we have also further diversified our property managers

with the addition of Marriott International. With the opportunity

for Marriott to participate in an incentive participation

structure, we expect Marriott to continue to aggressively expand

the RevPAR penetration of these properties within their competitive

sets. We are pleased to expand our portfolio with this attractive

yielding and diversified portfolio. "Regarding our existing

portfolio, our first quarter RevPAR gains reflect the benefits of

our capital expenditures and aggressive asset management. We

acquired our assets at going-in yields at the high end of our

targeted range and continue to see acceleration in performance."

Ashford Hospitality Trust is a self-administered real estate

investment trust focused on investing in the hospitality industry

across all segments and at all levels of the capital structure,

including direct hotel investments, first mortgages, mezzanine

loans and sale-leaseback transactions. Additional information can

be found on the Company's web site at http://www.ahtreit.com/ .

Certain statements and assumptions in this press release contain or

are based upon "forward-looking" information and are being made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

subject to risks and uncertainties. When we use the words "will

likely result," "may," "anticipate," "estimate," "should,"

"expect," "believe," "intend," or similar expressions, we intend to

identify forward-looking statements. Such forward-looking

statements include, but are not limited to, the expectation that

the transaction will close in June 2005, the impact of the

transaction on our business and future financial condition, our

business and investment strategy, our understanding of our

competition and current market trends and opportunities and

projected capital expenditures. Such statements are subject to

numerous assumptions and uncertainties, many of which are outside

Ashford's control. These forward-looking statements are subject to

known and unknown risks and uncertainties, which could cause actual

results to differ materially from those anticipated, including,

without limitation: general volatility of the capital markets and

the market price of our common stock; changes in our business or

investment strategy; availability, terms and deployment of capital;

availability of qualified personnel; changes in our industry and

the market in which we operate, interest rates or the general

economy; and the degree and nature of our competition. These and

other risk factors are more fully discussed in Ashford's filings

with the Securities and Exchange Commission. A capitalization rate

is determined by dividing the property's annual net operating

income by the purchase price. Net operating income is the

property's funds from operations minus a capital expense reserve of

5% of gross revenues. Funds from operations ("FFO"), as defined by

the White Paper on FFO approved by the Board of Governors of the

National Association of Real Estate Investment Trusts ("NAREIT") in

April 2002, represents net income (loss) computed in accordance

with generally accepted accounting principles ("GAAP"), excluding

gains (or losses) from sales or properties and extraordinary items

as defined by GAAP, plus depreciation and amortization of real

estate assets, and net of adjustments for the portion of these

items related to unconsolidated entities and joint ventures. The

forward-looking statements included in this press release are only

made as of the date of this press release. Investors should not

place undue reliance on these forward-looking statements. We are

not obligated to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or circumstances, changes in expectations or otherwise. Contact:

Douglas Kessler Chief Operating Officer and Head of Acquisitions

(972) 490-9600 Tripp Sullivan Corporate Communications, Inc. (615)

254-3376 DATASOURCE: Ashford Hospitality Trust, Inc. CONTACT:

Douglas Kessler, Chief Operating Officer and Head of Acquisitions,

+1-972-490-9600, or Tripp Sullivan, Corporate Communications, Inc.,

+1-615-254-3376, both of Ashford Hospitality Trust, Inc. Web site:

http://www.ahtreit.com/

Copyright

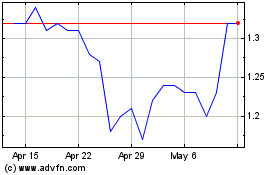

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

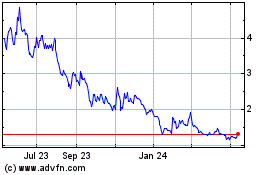

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024