Ashford Hospitality Trust Sells Non-Core Hotels for $6.28 Million

April 25 2005 - 9:30AM

PR Newswire (US)

Ashford Hospitality Trust Sells Non-Core Hotels for $6.28 Million

Highlights: * Sells Ramada Inn Hyannis Regency for $4.75 million

DALLAS, April 25 /PRNewswire-FirstCall/ -- Ashford Hospitality

Trust, Inc. (NYSE:AHT) today announced it sold the Ramada Inn

Hyannis Regency in Hyannis, Massachusetts, to Sleepy Time, LLC, for

$4.75 million in cash, and the Ramada Inn Warner Robins to Care

Hospitality, for $1.53 million in cash. Acquired by Ashford in

March 2005 as part of a 21-hotel portfolio, the 196-room Ramada Inn

Hyannis Regency and the 164 room Ramada Inn Warner Robins had been

designated as non-core properties along with six other hotels in

this portfolio. Both hotels have a trailing twelve month negative

net operating income. Ashford has now completed the sale of three

of the non-core hotels and is currently pursuing a disposition

strategy for the five remaining non-core hotels. CB Richard Ellis

brokered both transactions for Ashford. Monty J. Bennett, President

and Chief Executive Officer of Ashford, commented, "We are pleased

with the sale of these assets at prices exceeding our expectations.

Both hotels sold were operating with negative cash flow. We expect

to announce additional sales in the coming weeks that will allow us

to redeploy the sale proceeds to higher return investments."

Ashford Hospitality Trust is a self-administered real estate

investment trust focused on investing in the hospitality industry

across all segments and at all levels of the capital structure,

including direct hotel investments, first mortgages, mezzanine

loans and sale-leaseback transactions. Additional information can

be found on the Company's web site at http://www.ahtreit.com/ .

Certain statements and assumptions in this press release contain or

are based upon "forward-looking" information and are being made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

subject to risks and uncertainties. When we use the words "will

likely result," "may," "anticipate," "estimate," "should,"

"expect," "believe," "intend," or similar expressions, we intend to

identify forward-looking statements. Such forward-looking

statements include, but are not limited to, the impact of the

transaction on our business and future financial condition, our

business and investment strategy, our understanding of our

competition and current market trends and opportunities and

projected capital expenditures. Such statements are subject to

numerous assumptions and uncertainties, many of which are outside

Ashford's control. These forward-looking statements are subject to

known and unknown risks and uncertainties, which could cause actual

results to differ materially from those anticipated, including,

without limitation: general volatility of the capital markets and

the market price of our common stock; changes in our business or

investment strategy; availability, terms and deployment of capital;

availability of qualified personnel; changes in our industry and

the market in which we operate, interest rates or the general

economy; and the degree and nature of our competition. These and

other risk factors are more fully discussed in Ashford's filings

with the Securities and Exchange Commission. EBITDA is defined as

net income before interest, taxes, depreciation and amortization.

Net operating income is the property's funds from operations minus

a capital expense reserve of 4% of gross revenues. Funds from

operations ("FFO"), as defined by the White Paper on FFO approved

by the Board of Governors of the National Association of Real

Estate Investment Trusts ("NAREIT") in April 2002, represents net

income (loss) computed in accordance with generally accepted

accounting principles ("GAAP"), excluding gains (or losses) from

sales or properties and extraordinary items as defined by GAAP,

plus depreciation and amortization of real estate assets, and net

of adjustments for the portion of these items related to

unconsolidated entities and joint ventures. The forward-looking

statements included in this press release are only made as of the

date of this press release. Investors should not place undue

reliance on these forward-looking statements. We are not obligated

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or

circumstances, changes in expectations or otherwise. Contact:

Douglas Kessler COO and Head of Acquisitions (972) 490-9600 or

Tripp Sullivan Corporate Communications, Inc. (615) 254-3376

DATASOURCE: Ashford Hospitality Trust, Inc. CONTACT: Douglas

Kessler, COO and Head of Acquisitions of Ashford Hospitality Trust,

Inc., +1-972-490-9600; or Tripp Sullivan of Corporate

Communications, Inc., +1-615-254-3376 Web site:

http://www.ahtreit.com/

Copyright

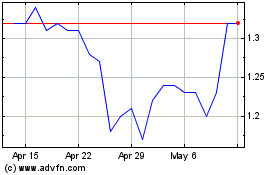

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

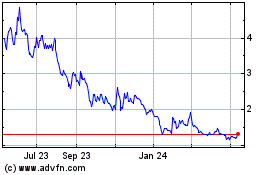

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024