Ashford Hospitality Trust Increases Funding Flexibility With Amendment to Security Capital Financing

February 10 2005 - 4:00PM

PR Newswire (US)

Ashford Hospitality Trust Increases Funding Flexibility With

Amendment to Security Capital Financing DALLAS, Feb. 10

/PRNewswire-FirstCall/ -- Ashford Hospitality Trust, Inc.

(NYSE:AHT) today announced that it has amended the terms of its

Convertible Preferred Stock Purchase Agreement dated December 27,

2004, with Security Capital Preferred Growth Incorporated. The

Company had previously closed in December 2004 a private placement

of up to $75 million in cumulative convertible preferred stock with

Security Capital to provide potential funding for the Company's

previously announced acquisition of a 21-hotel portfolio for total

consideration of approximately $250 million expected to close in

March 2005. The private placement of Series B cumulative

convertible preferred stock to Security Capital Preferred Growth

was originally a two-stage transaction with a $20 million first

tranche, $10 million of which was funded on December 30, 2004, and

a $55 million second tranche. Under the terms of the purchase

agreement, Security Capital is also entitled to purchase up to 20%

of any equity security offering the Company completes until no

later than July 31, 2005. Pursuant to this participation right and

as a result of the Company's recent common stock offering closed on

January 20, 2005, Security Capital has the right to acquire up to

2,070,000 shares of common stock at the offering price less

underwriting discounts. Ashford and Security Capital have agreed to

modify the terms of the Convertible Preferred Stock Purchase

Agreement in two areas. First, the purchase agreement has been

modified by giving the Company and Security Capital the option,

exercisable up to October 11, 2005 (in the case of Security

Capital) and no later than October 12, 2005 (in the case of the

Company), to sell (or purchase) on November 1, 2005, the common

shares representing the 20% participation in the Company's recent

common stock offering. However, the Company, at its option, may

issue the common stock to Security Capital on an earlier date

provided that the Company has sold the entire $75 million in

convertible preferred stock to Security Capital under the purchase

agreement. Second, in lieu of Security Capital's right to purchase

$14.7 million of Series B preferred stock upon the closing of the

currently pending 21-hotel acquisition and an additional $20

million by June 30, 2005, the modification provides that if the

Company has not given notice to Security Capital of its intent to

sell $34.7 million of the second tranche by June 14, 2005, Security

Capital can cause the Company to issue $34.7 million in preferred

stock on June 30, 2005. Commenting on the announcement, Monty J.

Bennett, President and CEO of Ashford Hospitality Trust, stated,

"We are pleased to complete this modification of our agreement with

Security Capital. In doing so, we have more closely aligned the

timing of this funding with our expected capital needs while at the

same time minimizing our borrowing costs. This arrangement has

provided a very flexible source of capital, and we look forward to

continuing our relationship with Security Capital as we move

forward with the closing of our previously announced 21-hotel

portfolio acquisition." Ashford Hospitality Trust is a

self-administered real estate investment trust focused on investing

in the hospitality industry across all segments and at all levels

of the capital structure, including direct hotel investments, first

mortgages, mezzanine loans and sale-leaseback transactions.

Additional information can be found on the Company's web site at

http://www.ahtreit.com/ . Certain statements and assumptions in

this press release contain or are based upon "forward-looking"

information and are being made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks and

uncertainties. When we use the words "will likely result," "may,"

"anticipate," "estimate," "should," "expect," "believe," "intend,"

or similar expressions, we intend to identify forward-looking

statements. Such forward-looking statements include, but are not

limited to, the expectation that the 21-hotel portfolio transaction

will close, the impact of the transaction on our business and

future financial condition, our business and investment strategy,

our understanding of our competition and current market trends and

opportunities and projected capital expenditures. Such statements

are subject to numerous assumptions and uncertainties, many of

which are outside Ashford's control. These forward-looking

statements are subject to known and unknown risks and

uncertainties, which could cause actual results to differ

materially from those anticipated, including, without limitation:

general volatility of the capital markets and the market price of

our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of

qualified personnel; changes in our industry and the market in

which we operate, interest rates or the general economy; and the

degree and nature of our competition. These and other risk factors

are more fully discussed in Ashford's filings with the Securities

and Exchange Commission. The forward-looking statements included in

this press release are only made as of the date of this press

release. Investors should not place undue reliance on these

forward-looking statements. We are not obligated to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or circumstances, changes in

expectations or otherwise. Contact: Douglas Kessler COO and Head of

Acquisitions (972) 490-9600 or Tripp Sullivan Corporate

Communications, Inc. (615) 254-3376 DATASOURCE: Ashford Hospitality

Trust, Inc. CONTACT: Douglas Kessler, COO and Head of Acquisitions

of Ashford Hospitality Trust, Inc., +1-972-490-9600; or Tripp

Sullivan of Corporate Communications, Inc., +1-615-254-3376, for

Ashford Hospitality Trust, Inc. Web site: http://www.ahtreit.com/

Copyright

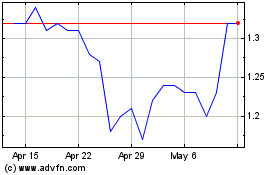

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

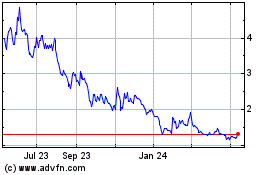

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024