Current Report Filing (8-k)

November 30 2020 - 5:28PM

Edgar (US Regulatory)

falsefalse00009228640000926660MDDECOCO 0000922864 2020-11-30 2020-11-30 0000922864 aiv:AIMCOPropertiesLPMember 2020-11-30 2020-11-30

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 30, 2020

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

MARYLAND (Apartment Investment and Management Company)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

|

|

|

|

4582 South Ulster Street, Suite 1400

|

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code: (303)

757-8101

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to section 12(g) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Investment and Management Company Class A Common Stock

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange act. ☐

Aimco OP L.P., a Delaware limited partnership (“New OP”), has filed a Registration Statement on Form 10 (as amended, the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with AIMCO Properties, L.P.’s (“AIR OP”) previously announced separation (the “Separation”) of New OP, which is more fully described in New OP’s information statement, dated November 30, 2020 (the “Information Statement”), which is filed with this Current Report on Form

8-K

as Exhibit 99.1. The Registration Statement was declared effective by the SEC on November 30, 2020. AIR OP will mail the notice of availability of the Information Statement to all the holders of AIR OP common limited partnership units and AIR OP Class I High Performance partnership units as of the close of business on December 5, 2020, the record date for the distribution.

The Separation will be effected through (i) the pro rata distribution by AIR OP, the operating partnership of Apartment Investment and Management Company (“Aimco”), to the holders of AIR OP common limited partnership units and the holders of AIR OP Class I High Performance partnership units of all of the common limited partnership units of New OP and (ii) the pro rata distribution by Aimco to its stockholders of all of the outstanding shares of common stock of Apartment Income REIT Corp. After the Separation, Aimco and New OP will own the redevelopment and development business and a portfolio of 11 stabilized multifamily properties, primarily located in the Boston and San Diego areas, as well as certain other investments. Aimco will be well-capitalized with an estimated gross asset value of $1.3 billion, and an estimated Net Asset Value, or NAV (as defined in the Information Statement), of $1.2 billion, each as of March 31, 2020 (in each case, without giving effect to the value of the Initial Leased Properties or the Separate Portfolio Assets (each as defined in the Information Statement)).

Cautionary Statement Regarding Forward Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to: the anticipated timing, structure and benefits of the Separation; and tax treatment and tax consequences of the Separation. In addition, we may not complete the Separation at all. We caution investors not to place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: whether or not we complete the Separation on the anticipated terms or at all; the effects of the coronavirus pandemic on Aimco’s and Apartment Income REIT Corp.’s (“AIR”) respective businesses and on the global and U.S. economies generally; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which Aimco and AIR will operate and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions, dispositions, redevelopments and developments; changes in operating costs, including energy costs; negative economic conditions in our geographies of operation; loss of key personnel; Aimco’s or AIR’s ability to maintain current or meet projected occupancy, rental rates and property operating results; Aimco’s or AIR’s ability to meet budgeted costs and timelines, and, if applicable, achieve budgeted rental rates related to redevelopment and development investments; expectations regarding sales of apartment communities and the use of the proceeds thereof; the ability to successfully operate as two separate companies each with more narrowed focus; insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by Aimco; activities by stockholder activists, including a proxy contest; Aimco’s and AIR’s relationship with each other after the consummation of the Separation; the ability and willingness of Aimco and AIR

and their subsidiaries to meet and/or perform their obligations under any contractual arrangements that are entered into among the parties in connection with the Separation and any of their obligations to indemnify, defend and hold the other party harmless from and against various claims, litigation and liabilities; the ability to achieve some or all the benefits that we expect to achieve from the Separation; and such other risks and uncertainties described from time to time in filings by Aimco and AIR with the SEC.

In addition, Aimco’s current and continuing qualification and, if the REIT Distribution is completed, AIR’s qualification and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended (the “Code”), and depends on Aimco’s and, if applicable, AIR’s ability to meet the various requirements imposed by the Code, through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form

10-K

for the year ended December 31, 2019 and in Item 1A of Aimco’s Quarterly Reports on Form

10-Q

for the quarterly periods ended March 31, 2020, June 30, 2020 and September 30, 2020, and the other documents Aimco files from time to time with the SEC. Readers should also carefully review the “Risk Factors” section of each of New OP’s and AIR’s respective registration statements relating to the Separation, and other documents New OP files from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and Aimco and New OP assume no (and disclaim any) obligation to revise or update them to reflect future events or circumstances.

|

|

Financial Statements and Exhibits.

|

(d) The following exhibit is being filed with this report:

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

|

|

|

|

|

|

|

Date: November 30, 2020

|

|

|

|

By:

|

|

|

|

|

|

|

|

Name:

|

|

Terry Considine

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

AIMCO OP L.P.

|

|

|

|

|

|

|

|

By Aimco OP GP, LLC, its general partner

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

Name:

|

|

Terry Considine

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

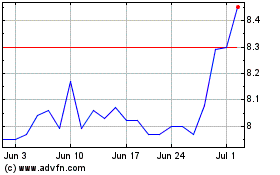

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2024 to May 2024

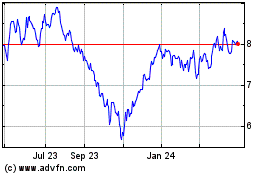

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From May 2023 to May 2024