BlackRock Funds

SM

| Service

Shares

> BlackRock Managed Volatility

Portfolio

Fund

|

|

|

|

|

|

|

|

|

|

|

|

Service

Shares

|

|

BlackRock Managed Volatility Portfolio

|

|

|

|

|

|

|

|

|

|

|

|

PCBSX

|

Before you invest, you may want to review the Fund’s

prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and

supplements) and other information about the Fund, including the Fund’s statement of additional information and shareholder report, online at

http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request to

prospectus.request@blackrock.com

, or from your financial professional. The Fund’s prospectus and statement of additional information, both

dated May 15, 2012, as amended November 6, 2012 and as may be further amended and supplemented from time to time, are incorporated by reference into

(legally made a part of) this Summary Prospectus.

This Summary Prospectus contains information you should know

before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or

disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal

offense.

|

Not FDIC Insured • No Bank Guarantee • May Lose Value

|

|

|

|

Summary Prospectus

The investment objective of BlackRock Managed Volatility

Portfolio, formerly BlackRock Asset Allocation Portfolio (“Managed Volatility Portfolio” or the “Fund”), a series of BlackRock

Funds

SM

(the “Trust”), is to seek total return.

Fees and Expenses of the

Fund

This table describes the fees and expenses that you may pay if you

buy and hold shares of Managed Volatility Portfolio.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

Service Shares

|

|

Management Fee

1,2

|

|

|

|

|

0.55

|

%

|

|

Distribution and/or Service (12b-1) Fees

|

|

|

|

|

0.25

|

%

|

|

Other Expenses

|

|

|

|

|

0.40

|

%

|

|

Interest Expense

|

|

|

|

|

0.01%

|

|

|

Miscellaneous Other Expenses

1

|

|

|

|

|

0.39%

|

|

|

Acquired Fund Fees and Expenses

1,3

|

|

|

|

|

0.18

|

%

|

|

Total Annual Fund Operating Expenses

1,3

|

|

|

|

|

1.38

|

%

|

|

Fee Waivers and/or Expense Reimbursements

2

|

|

|

|

|

(0.05

|

)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense

Reimbursements

2

|

|

|

|

|

1.33

|

%

|

|

1

|

|

Miscellaneous Other Expenses and Acquired

Fund Fees and Expenses have been restated to reflect current fees. The Management Fee payable by the Fund is based on assets estimated to be

attributable to the Fund’s direct investments in fixed-income and equity securities and instruments, including exchange-traded funds

(“ETFs”) advised by BlackRock Advisors, LLC (“BlackRock”) or other investment advisers, other investments and cash and cash

equivalents (including money market funds). BlackRock has contractually agreed to waive the Management Fee on assets estimated to be attributed to the

Fund’s investments in other equity, fixed-income and money market mutual funds managed by BlackRock or its affiliates (the

“mutual funds”).

|

|

2

|

|

As described in the “Management of the

Fund” section of the Fund’s prospectus on pages 69-73, BlackRock Advisors, LLC

(“BlackRock”) has contractually agreed to waive 0.05% of its Management Fee until June 1, 2013. In addition, BlackRock has contractually

agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense

Reimbursements (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 1.17% of average

daily net assets until June 1, 2013. The Fund may have to repay some of these waivers and reimbursements to BlackRock in the following two years. The

agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the

outstanding voting securities of the Fund.

|

|

3

|

|

The Total Annual Fund Operating Expenses do not

correlate to the ratio of expenses to average net assets given in the Fund’s most recent annual report which does not include the Acquired Fund

Fees and Expenses or the restatement of Miscellaneous Other Expenses or Acquired Fund Fees and Expenses.

|

Example:

This Example is intended to help you compare the cost of investing

in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated

and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the

Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would

be:

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Service Shares

|

|

|

|

$

|

135

|

|

|

$

|

432

|

|

|

$

|

750

|

|

|

$

|

1,653

|

|

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys

and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in

higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example,

affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 401% of the average value of its

portfolio.

2

Principal Investment

Strategies of the Fund

Managed Volatility Portfolio uses an asset allocation strategy,

investing varying percentages of its portfolio in three major categories: stocks, bonds and money market instruments. The Fund has wide flexibility in

the relative weightings given to each category.

The Fund may also invest a significant portion of its assets in

affiliated and unaffiliated ETFs and mutual funds. See “Information About the ETFs and Mutual Funds.”

With respect to its equity investments, the Fund may invest in

ETFs, mutual funds or individual equity securities to an unlimited extent. The Fund, the ETFs and the mutual funds may invest in common stock,

preferred stock, securities convertible into common stock, non-convertible preferred stock and depositary receipts. The Fund, the ETFs and the mutual

funds may invest in securities of both U.S. and non-U.S. issuers without limit, which can be U.S. dollar-based or non-U.S. dollar-based and may be

currency hedged or unhedged. The Fund, the ETFs and the mutual funds may invest in securities of companies of any market

capitalization.

With respect to its fixed-income investments, the Fund may invest

in ETFs, mutual funds or individual fixed-income securities to an unlimited extent. The Fund, the ETFs and the mutual funds may invest in a portfolio

of fixed-income securities such as corporate bonds and notes, commercial and residential mortgage-backed securities (bonds that are backed by a

mortgage loan or pools of loans secured either by commercial property or residential mortgages, as applicable), collateralized mortgage obligations

(bonds that are backed by cash flows from pools of mortgages and may have multiple classes with different payment rights and protections),

collateralized debt obligations, asset-backed securities, convertible securities, debt obligations of governments and their sub-divisions (including

those of non-U.S. governments), other floating or variable rate obligations, municipal obligations and zero coupon debt securities. The Fund, the ETFs

and the mutual funds may also invest a significant portion of their assets in non-investment grade bonds (junk bonds or distressed securities),

non-investment grade bank loans, foreign bonds (both U.S. dollar- and non-U.S. dollar-denominated) and bonds of emerging market issuers. The Fund, the

ETFs and the mutual funds may invest in non-U.S. dollar-denominated bonds on a currency hedged or unhedged basis.

With respect to its cash investments, the Fund may hold high

quality money market securities, including short term U.S. Government securities, U.S. Government agency securities, securities issued by U.S.

Government-sponsored enterprises and U.S. Government instrumentalities, bank obligations, commercial paper, including asset-backed commercial paper,

corporate notes and repurchase agreements. The Fund may invest a significant portion of its assets in money market funds, including those advised by

BlackRock or its affiliates.

The Fund may invest in derivatives, including, but not limited to,

interest rate, total return and credit default swaps, indexed and inverse floating rate securities, options, futures, options on futures and swaps and

foreign currency transactions (including swaps), for hedging purposes, as well as to increase the return on its portfolio investments. The Fund may

seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using

other investment techniques (such as reverse repurchase agreements or dollar rolls). The Fund may also use forward foreign currency exchange contracts

(obligations to buy or sell a currency at a set rate in the future) to hedge against movement in the value of non-U.S. currencies. The ETFs and the

mutual funds may, to varying degrees, also invest in derivatives.

The Fund may invest in U.S. and non-U.S. real estate investment

trusts (“REITs”), structured products (including, but not limited to, structured notes, credit linked notes and participation notes, or other

instruments evidencing interests in special purpose vehicles, trusts, or other entities that hold or represent interests in fixed-income securities)

and floating rate securities (such as bank loans).

The Fund incorporates a volatility control process that seeks to

reduce risk when portfolio volatility is expected to deviate from the Fund’s targeted total return volatility of 10% over a one-year period.

Volatility is a statistical measurement of the magnitude of up and down fluctuations in the value of a financial instrument or index over time.

Volatility may result in rapid and dramatic price swings. While BlackRock attempts to manage the Fund’s volatility exposure to stabilize

performance, there can be no guarantee that the Fund will reach its target volatility. The Fund will adjust its asset allocation in response to periods

of high or low expected volatility. The Fund may without limitation allocate assets into cash or short-term fixed-income securities, and away from

riskier assets such as equity and high yield fixed-income securities. When volatility decreases, the Fund may move assets out of cash and back into

riskier securities. At any given time, the Fund may be invested entirely in equities, fixed-income or cash. The Fund may engage in active and frequent

trading of portfolio securities to achieve its primary investment strategies.

3

Risk is inherent in all investing. The value of your investment in

Managed Volatility Portfolio, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over

time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The principal

risks set forth below are the principal risks of investing in the Fund, the ETFs and/or the mutual funds. In the following discussion, references to

the “Fund” shall mean any one or more of the relevant ETFs or mutual funds and the Fund, where applicable.

Principal Risks of the Fund’s Fund of Funds

Structure

|

n

|

|

Affiliated Fund Risk

— In managing the Fund,

BlackRock will have authority to select and substitute ETFs or mutual funds. BlackRock may be subject to potential conflicts of interest in selecting

ETFs or mutual funds because the fees paid to BlackRock by some ETFs or mutual funds are higher than the fees paid by other ETFs or mutual funds.

However, BlackRock is a fiduciary to the Fund and is legally obligated to act in the Fund’s best interests when selecting ETFs and mutual

funds.

|

|

n

|

|

Allocation Risk

— The Fund’s ability to

achieve its investment objective depends upon BlackRock’s skill in determining the Fund’s strategic asset class allocation and in selecting

the best mix of ETFs, mutual funds and direct investments. There is a risk that BlackRock’s evaluations and assumptions regarding asset classes or

ETFs or mutual funds may be incorrect in view of actual market conditions.

|

|

n

|

|

Investments in ETFs and Other Mutual Funds Risk

— The Fund’s net asset value will change with changes in the value of the ETFs, mutual funds and other securities in which it invests. As

with other investments, investments in other investment companies, including ETFs, are subject to market risk and, for non-index strategies, selection

risk. In addition, if the Fund acquires shares of investment companies, including ETFs, shareholders bear both their proportionate share of expenses in

the Fund (including management and advisory fees) and, indirectly, the expenses of the investment companies. If the Fund acquires shares of

affiliated mutual funds, shareholders bear both their proportionate share of expenses in the Fund (excluding management and advisory fees) and,

indirectly, the expenses of the mutual funds. To the extent the Fund is held by an affiliated fund, the ability of the Fund itself to hold other

investment companies may be limited.

|

|

|

|

One ETF or mutual fund may buy the same securities that another

ETF or mutual fund sells. In addition, the Fund may buy the same securities that an ETF or mutual fund sells, or vice-versa. If this happens, an

investor in the Fund would indirectly bear the costs of these transactions without accomplishing the intended investment purpose. Also, an investor in

the Fund may receive taxable gains from portfolio transactions by an ETF or mutual fund, as well as taxable gains from transactions in shares of the

ETF or mutual fund by the Fund. Certain of the ETFs or mutual funds may hold common portfolio securities, thereby reducing the diversification benefits

of the Fund.

|

Principal ETF-Specific Risks

|

n

|

|

Cash Transaction Risk

— Certain ETFs intend to

effect creations and redemptions principally for cash, rather than primarily in-kind because of the nature of the ETF’s investments. Investments

in such ETFs may be less tax efficient than investments in ETFs that effect creations and redemptions in-kind.

|

|

n

|

|

Management Risk

— If an ETF does not fully

replicate the underlying index, it is subject to the risk that the manager’s investment management strategy may not produce the intended

results.

|

|

n

|

|

Passive Investment Risk

— ETFs purchased by the

Fund are not actively managed and may be affected by a general decline in market segments relating to their respective indices. An ETF typically

invests in securities included in, or representative of, its index regardless of their investment merits and does not attempt to take defensive

positions in declining markets.

|

|

n

|

|

Representative Sampling Risk

— When an ETF

deviates from a full replication indexing strategy to utilize a representative sampling strategy, the ETF is subject to an increased risk of tracking

error, in that the securities selected in the aggregate for the ETF may not have an investment profile similar to those of its index.

|

|

n

|

|

Shares of an ETF May Trade at Prices Other Than Net Asset

Value

— The trading prices of an ETF’s shares fluctuate continuously throughout trading hours based on market supply and demand

rather than net asset value. The trading prices of an ETF’s shares may deviate significantly from net asset value during periods of market

volatility. Any of these factors may lead to an ETF’s shares trading at a premium or discount to net asset value. However, because shares can be

created and redeemed in Creation Units, which are aggregated blocks of shares that authorized participants who have entered into agreements with the

ETF’s distributor can purchase or redeem directly from the ETF, at net asset value, large discounts or premiums to the net asset value of an ETF

are not likely to be sustained over the long term. If a shareholder purchases at a time when the market price is at a premium to the net asset value or

sells at a time when the market price is at a discount to the net asset value, the shareholder may sustain losses.

|

4

|

n

|

|

Tracking Error Risk

— Imperfect correlation

between an ETF’s portfolio securities and those in its index, rounding of prices, the timing of cash flows, the ETF’s size, changes to the

index and regulatory requirements may cause tracking error, which is the divergence of an ETF’s performance from that of its underlying index.

This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because an

ETF incurs fees and expenses while its underlying index does not.

|

Other Principal Risks of Investing in the

Fund

|

n

|

|

Collateralized Debt Obligations Risk

— The pool

of high yield securities underlying collateralized debt obligations is typically separated into groupings called tranches representing different

degrees of credit quality. The higher quality tranches have greater degrees of protection and pay lower interest rates. The lower tranches, with

greater risk, pay higher interest rates.

|

|

n

|

|

Concentration Risk

— To the extent that the

Fund’s portfolio reflects concentration in the securities of issuers in a particular region, market, industry, group of industries, country, group

of countries, sector or asset class, the Fund may be adversely affected by the performance of those securities, may be subject to increased price

volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that region, market, industry, group

of industries, country, group of countries, sector or asset class.

|

|

n

|

|

Convertible Securities Risk

— The market value

of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security

usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and

their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s

creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject

to the same types of market and issuer risks that apply to the underlying common stock.

|

|

n

|

|

Corporate Loans Risk

— Commercial banks and

other financial institutions or institutional investors make corporate loans to companies that need capital to grow or restructure. Borrowers generally

pay interest on corporate loans at rates that change in response to changes in market interest rates such as the London Interbank Offered Rate

(“LIBOR”) or the prime rates of U.S. banks. As a result, the value of corporate loan investments is generally less exposed to the adverse

effects of shifts in market interest rates than investments that pay a fixed rate of interest. The market for corporate loans may be subject to

irregular trading activity, wide bid/ask spreads and extended trade settlement periods. The corporate loans in which the Fund invests are usually rated

below investment grade.

|

|

n

|

|

Counterparty Risk

— The counterparty to an

over-the-counter derivatives contract or a borrower of the Fund’s securities may be unable or unwilling to make timely principal, interest or

settlement payments, or otherwise to honor its obligations.

|

|

n

|

|

Credit Risk

— Credit risk refers to the

possibility that the issuer of a security will not be able to make payments of interest and principal when due. The degree of credit risk depends on

the issuer’s financial condition and on the terms of the securities.

|

|

n

|

|

Debt Securities Risk

— Debt securities, such as

bonds, involve credit risk. Debt securities are also subject to interest rate risk.

|

|

n

|

|

Derivatives Risk

— The Fund’s use of

derivatives may reduce the Fund’s returns and/or increase volatility. Volatility is defined as the characteristic of a security, an index or a

market to fluctuate significantly in price within a short time period. Derivatives are also subject to counterparty risk, which is the risk that the

other party in the transaction will not fulfill its contractual obligation. A risk of the Fund’s use of derivatives is that the fluctuations in

their values may not correlate perfectly with the overall securities markets. The possible lack of a liquid secondary market for derivatives and the

resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more

difficult for the Fund to value accurately. Derivatives may give rise to a form of leverage and may expose the Fund to greater risk and increase its

costs. Recent legislation calls for new regulation of the derivatives markets. The extent and impact of the regulation is not yet known and may not be

known for some time. New regulation may make derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect the

value or performance of derivatives.

|

|

n

|

|

Distressed Securities Risk

— Distressed

securities are speculative and involve substantial risks in addition to the risks of investing in junk bonds. The Fund will generally not receive

interest payments on the distressed securities and may incur costs to protect its investment. In addition, distressed securities involve the

substantial risk that principal will not be repaid. These securities may present a substantial risk of default or may be in default at the time of

investment.

|

5

|

n

|

|

Dollar Rolls Risk

— Dollar rolls involve the

risk that the market value of the securities that the Fund is committed to buy may decline below the price of the securities the Fund has sold. These

transactions may involve leverage.

|

|

n

|

|

Emerging Markets Risk

— Emerging markets are

riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be

considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S.

investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets.

|

|

n

|

|

Equity Securities Risk

— Stock markets are

volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic

conditions.

|

|

n

|

|

Extension Risk

— When interest rates rise,

certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall.

|

|

n

|

|

Foreign Securities Risk

— Foreign investments

often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks

include:

|

|

—

|

|

The Fund generally holds its foreign securities and cash in

foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or

no regulatory oversight.

|

|

—

|

|

Changes in foreign currency exchange rates can affect the value of

the Fund’s portfolio.

|

|

—

|

|

The economies of certain foreign markets may not compare favorably

with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance

of payments position.

|

|

—

|

|

The governments of certain countries may prohibit or impose

substantial restrictions on foreign investments in their capital markets or in certain industries.

|

|

—

|

|

Many foreign governments do not supervise and regulate stock

exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are

comparable to U.S. securities laws.

|

|

—

|

|

Settlement and clearance procedures in certain foreign markets may

result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments.

|

|

n

|

|

High Portfolio Turnover Risk

— High portfolio

turnover (more than 100%) may result in increased transaction costs to the Fund and potentially higher capital gains or losses for shareholders. The

effects of higher than normal portfolio turnover may adversely affect Fund performance.

|

|

n

|

|

Indexed and Inverse Securities Risk

— Certain

indexed and inverse securities have greater sensitivity to changes in interest rates or index levels than other securities, and the Fund’s

investment in such instruments may decline significantly in value if interest rates or index levels move in a way Fund management does not

anticipate.

|

|

n

|

|

Inflation Indexed Bonds Risk

— The principal

value of an investment is not protected or otherwise guaranteed by virtue of the Fund’s investments in inflation-indexed bonds.

|

|

|

|

Inflation-indexed bonds are fixed-income securities whose

principal value is periodically adjusted according to the rate of inflation. If the index measuring inflation falls, the principal value of

inflation-indexed bonds will be adjusted downward, and consequently the interest payable on these securities (calculated with respect to a smaller

principal amount) will be reduced.

|

|

|

|

Repayment of the original bond principal upon maturity (as

adjusted for inflation) is guaranteed in the case of U.S. Treasury inflation-indexed bonds. For bonds that do not provide a similar guarantee, the

adjusted principal value of the bond repaid at maturity may be less than the original principal value.

|

|

|

|

The value of inflation-indexed bonds is expected to change in

response to changes in real interest rates. Real interest rates are tied to the relationship between nominal interest rates and the rate of inflation.

If nominal interest rates increase at a faster rate than inflation, real interest rates may rise, leading to a decrease in value of inflation-indexed

bonds. Short-term increases in inflation may lead to a decline in value. Any increase in the principal amount of an inflation-indexed bond will be

considered taxable ordinary income, even though investors do not receive their principal until maturity.

|

|

|

|

Periodic adjustments for inflation to the principal amount of an

inflation-indexed bond may give rise to original issue discount, which will be includable in the Fund’s gross income. Due to original issue

discount, the Fund may be required to make annual distributions to shareholders that exceed the cash received, which may cause the Fund to liquidate

certain investments when it is not advantageous to do so. Also, if the principal value of an inflation-indexed

|

6

|

|

|

bond is adjusted downward due to deflation, amounts previously

distributed in the taxable year may be characterized in some circumstances as a return of capital.

|

|

n

|

|

Interest Rate Risk

— Interest rate risk is the

risk that prices of bonds and other fixed-income securities will increase as interest rates fall, and decrease as interest rates rise. In general, the

market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of

shorter term securities.

|

|

n

|

|

Investment Style Risk

— Under certain market

conditions, growth investments have performed better during the later stages of economic expansion and value investments have performed better during

periods of economic recovery. Therefore, these investment styles may over time go in and out of favor. At times when the investment style used by the

Fund is out of favor, the Fund may underperform other funds that use different investment styles.

|

|

n

|

|

Junk Bonds Risk

— Although junk bonds generally

pay higher rates of interest than investment grade bonds, junk bonds are high risk investments that may cause income and principal losses for the

Fund.

|

|

n

|

|

Leverage Risk

— Some transactions may give rise

to a form of economic leverage. These transactions may include, among others, derivatives, and may expose the Fund to greater risk and increase its

costs. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or

to meet any required asset segregation requirements. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund

uses leverage.

|

|

n

|

|

Liquidity Risk

— Liquidity risk exists when

particular investments are difficult to purchase or sell. The Fund’s investments in illiquid securities may reduce the returns of the Fund because

it may be difficult to sell the illiquid securities at an advantageous time or price. To the extent that the Fund’s principal investment

strategies involve derivatives or securities with substantial market and/or credit risk, the Fund will tend to have the greatest exposure to liquidity

risk. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. Illiquid investments may be

harder to value, especially in changing markets, and if the Fund is forced to sell these investments to meet redemption requests or for other cash

needs, the Fund may suffer a loss. In addition, when there is illiquidity in the market for certain securities, the Fund, due to limitations on

illiquid investments, may be subject to purchase and sale restrictions.

|

|

n

|

|

Market Risk and Selection Risk

— Market risk is

the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and

unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the

securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money.

|

|

n

|

|

Mid-Cap Securities Risk

— The securities of

mid-cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of

larger capitalization companies.

|

|

n

|

|

Mortgage- and Asset-Backed Securities Risks

—

Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables

held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are

subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates

(both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities.

|

|

n

|

|

Municipal Securities Risks

— Municipal

securities risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers of municipal

securities, and the possibility of future legislative changes which could affect the market for and value of municipal securities. These risks

include:

|

|

|

|

General Obligation Bonds Risks

— Timely payments

depend on the issuer’s credit quality, ability to raise tax revenues and ability to maintain an adequate tax base.

|

|

|

|

Revenue Bonds Risks

— These payments depend on the

money earned by the particular facility or class of facilities, or the amount of revenues derived from another source.

|

|

|

|

Private Activity Bonds Risks

— Municipalities and

other public authorities issue private activity bonds to finance development of industrial facilities for use by a private enterprise. The private

enterprise pays the principal and interest on the bond, and the issuer does not pledge its faith, credit and taxing power for repayment.

|

|

|

|

Moral Obligation Bonds Risks

— Moral obligation bonds

are generally issued by special purpose public authorities of a state or municipality. If the issuer is unable to meet its obligations, repayment of

these bonds becomes a moral commitment, but not a legal obligation, of the state or municipality.

|

|

|

|

Municipal Notes Risks

— Municipal notes are shorter

term municipal debt obligations. If there is a shortfall in the anticipated proceeds, the notes may not be fully repaid and the Fund may lose

money.

|

7

|

|

|

Municipal Lease Obligations Risks

— In a municipal

lease obligation, the issuer agrees to make payments when due on the lease obligation. Although the issuer does not pledge its unlimited taxing power

for payment of the lease obligation, the lease obligation is secured by the leased property.

|

|

n

|

|

Preferred Securities Risk

— Preferred

securities may pay fixed or adjustable rates of return. Preferred securities are subject to issuer-specific and market risks applicable generally to

equity securities.

|

|

n

|

|

Prepayment Risk

— When interest rates fall,

certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in

securities with lower yields.

|

|

n

|

|

Real Estate Related Securities Risks

— The main

risk of real estate related securities is that the value of the underlying real estate may go down. Many factors may affect real estate values. These

factors include both the general and local economies, the amount of new construction in a particular area, the laws and regulations (including zoning

and tax laws) affecting real estate and the costs of owning, maintaining and improving real estate. The availability of mortgages and changes in

interest rates may also affect real estate values. If the Fund’s real estate related investments are concentrated in one geographic area or in one

property type, the Fund will be particularly subject to the risks associated with that area or property type.

|

|

n

|

|

REIT Investment Risk

— Investments in REITs

involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume and may be more volatile than other

securities.

|

|

n

|

|

Repurchase Agreements and Purchase and Sale Contracts

Risks

— If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the

Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security in

either situation and the market value of the security declines, the Fund may lose money.

|

|

n

|

|

Reverse Repurchase Agreements Risk

— Reverse

repurchase agreements involve the risk that the other party to the reverse repurchase agreement may fail to return the securities in a timely manner or

at all. The Fund could lose money if it is unable to recover the securities and the value of the collateral held by the Fund, including the value of

the investments made with cash collateral, is less than the value of securities. These events could also trigger adverse tax consequences to the

Fund.

|

|

n

|

|

Risks of Loan Assignments and Participations

—

As the purchaser of an assignment, the Fund typically succeeds to all the rights and obligations of the assigning institution and becomes a lender

under the credit agreement with respect to the debt obligation; however, the Fund may not be able unilaterally to enforce all rights and remedies under

the loan and with regard to any associated collateral. Because assignments may be arranged through private negotiations between potential assignees and

potential assignors, the rights and obligations acquired by the Fund as the purchaser of an assignment may differ from, and be more limited than, those

held by the assigning lender. In addition, if the loan is foreclosed, the Fund could become part owner of any collateral and could bear the costs and

liabilities of owning and disposing of the collateral. The Fund may be required to pass along to a purchaser that buys a loan from the Fund by way of

assignment a portion of any fees to which the Fund is entitled under the loan. In connection with purchasing participations, the Fund generally will

have no right to enforce compliance by the borrower with the terms of the loan agreement relating to the loan, nor any rights of set-off against the

borrower, and the Fund may not directly benefit from any collateral supporting the loan in which it has purchased the participation. As a result, the

Fund will be subject to the credit risk of both the borrower and the lender that is selling the participation. In the event of the insolvency of the

lender selling a participation, the Fund may be treated as a general creditor of the lender and may not benefit from any set-off between the lender and

the borrower.

|

|

n

|

|

Second Lien Loans Risk

— Second lien loans

generally are subject to similar risks as those associated with investments in senior loans. Because second lien loans are subordinated or unsecured

and thus lower in priority of payment to senior loans, they are subject to the additional risk that the cash flow of the borrower and property securing

the loan or debt, if any, may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the

borrower.

|

|

n

|

|

Senior Loans Risk

—There is less readily

available, reliable information about most senior loans than is the case for many other types of securities. An economic downturn generally leads to a

higher non-payment rate, and a senior loan may lose significant value before a default occurs. Moreover, any specific collateral used to secure a

senior loan may decline in value or become illiquid, which would adversely affect the senior loan’s value. No active trading market may exist for

certain senior loans, which may impair the ability of the Fund to realize full value in the event of the need to sell a senior loan and which may make

it difficult to value senior loans. Although senior loans in which the Fund will invest generally will be secured by specific collateral, there can be

no assurance that liquidation of such collateral would satisfy the borrower’s obligation in the event of non-payment of scheduled interest or

principal or that such collateral could be readily liquidated. To the extent that a senior loan is collateralized by stock in the borrower or its

subsidiaries, such stock may lose all of its value in the event of the bankruptcy of the

|

8

|

|

|

borrower. Uncollateralized senior loans involve a greater risk of

loss. The senior loans in which the Fund invests are usually rated below investment grade.

|

|

n

|

|

Small Cap and Emerging Growth Securities

Risks

— Small cap or emerging growth companies may have limited product lines or markets. They may be less financially secure than

larger, more established companies. They may depend on a more limited management group than larger capitalized companies.

|

|

n

|

|

Sovereign Debt Risk

— Sovereign debt

instruments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for

example, to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s

debt position in relation to the economy or the failure to put in place economic reforms required by the International Monetary Fund or other

multilateral agencies.

|

|

n

|

|

Structured Products Risk

— Holders of

structured products bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. The Fund may have the

right to receive payments only from the structured product, and generally does not have direct rights against the issuer or the entity that sold the

assets to be securitized. Certain structured products may be thinly traded or have a limited trading market. In addition to the general risks

associated with debt securities discussed herein, structured products carry additional risks, including, but not limited to: the possibility that

distributions from collateral securities will not be adequate to make interest or other payments; the quality of the collateral may decline in value or

default; and the possibility that the structured products are subordinate to other classes.

|

|

n

|

|

Supranational Entities Risk

— The Fund may

invest in obligations issued or guaranteed by the International Bank for Reconstruction and Development (the World Bank). If one or more stockholders

of the World Bank fail to make necessary additional capital contributions, the entity may be unable to pay interest or repay principal on its debt

securities, and the Fund may lose money on such investments.

|

|

n

|

|

Tender Option Bonds and Related Securities Risk

— Investments in tender option bonds, residual interest tender option bonds and inverse floaters expose the Fund to the same risks as investments

in derivatives, as well as risks associated with leverage, described above, especially the risk of increased volatility. An investment in these

securities may be subject to the risk of loss of principal. Residual interest tender option bonds and inverse floaters generally will underperform the

market for fixed rate municipal securities in a rising interest rate environment.

|

|

n

|

|

U.S. Government Mortgage-Related Securities Risk

— There are a number of important differences among the agencies and instrumentalities of the U.S. Government that issue mortgage-related

securities and among the securities that they issue. Mortgage-related securities guaranteed by the Government National Mortgage Association

(“Ginnie Mae”) are guaranteed as to the timely payment of principal and interest by Ginnie Mae and such guarantee is backed by the full faith

and credit of the United States. Ginnie Mae securities also are supported by the right of Ginnie Mae to borrow funds from the U.S. Treasury to make

payments under its guarantee. Mortgage-related securities issued by The Federal National Mortgage Association (“Fannie Mae”) or The Federal

Home Loan Mortgage Corporation (“Freddie Mac”) are solely the obligations of Fannie Mae or Freddie Mac, as the case may be, and are not

backed by or entitled to the full faith and credit of the United States but are supported by the right of the issuer to borrow from the U.S.

Treasury.

|

|

n

|

|

U.S. Government Obligations Risk

— Certain

securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are

not guaranteed by the U.S. Government or supported by the full faith and credit of the United States.

|

|

n

|

|

Variable and Floating Rate Instrument Risk

—

The absence of an active market for these securities could make it difficult for the Fund to dispose of them if the issuer defaults.

|

|

n

|

|

Warrants Risk

— If the price of the underlying

stock does not rise above the exercise price before the warrant expires, the warrant generally expires without any value and the Fund loses any amount

it paid for the warrant. Thus, investments in warrants may involve substantially more risk than investments in common stock.

|

|

n

|

|

Zero Coupon Securities Risk

— While interest

payments are not made on such securities, holders of such securities are deemed to have received income (“phantom income”) annually,

notwithstanding that cash may not be received currently. Some of these securities may be subject to substantially greater price fluctuations during

periods of changing market interest rates than are comparable securities that pay interest currently. Longer term zero coupon bonds are more exposed to

interest rate risk than shorter term zero coupon bonds.

|

9

Effective May 15, 2012, Managed Volatility Portfolio changed its

investment strategy to invest a significant portion of its assets in ETFs and, to a lesser extent, in mutual funds and directly in securities.

Performance for the periods shown below is based on the investment strategy utilized by the Fund prior to May 15, 2012, which focused on investing

directly in securities.

On January 31, 2005, the Fund reorganized with the State Street

Research Asset Allocation Fund (the “SSR Fund”), which had investment objectives and strategies similar to the Fund. For periods prior to

January 31, 2005, the chart and table show performance information for the SSR Fund. The information shows you how the Fund’s performance has

varied year by year and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the

Standard & Poor’s (“S&P”) 500

®

Index, the Barclays U.S. Aggregate Bond Index, the MSCI All Country World Index

(the “MSCI ACWI Index”), the Citigroup World Government Bond Index (hedged into USD) (the “Citigroup WGBI (hedged into USD)”) and

three customized weighted indices comprised of the returns of the S&P 500

®

Index, the MSCI ACWI Index, the Barclays U.S. Aggregate

Bond Index and the Citigroup WGBI (hedged into USD) in the percentages and combinations set forth in the table. Effective October 1, 2011, the Fund

changed one of the components making up the customized weighted index from the S&P 500

®

Index to the MSCI ACWI Index. Fund

management believes that the MSCI ACWI Index better reflects the Fund’s increasing exposure to non-U.S. equities. Effective May 15, 2012, the Fund

changed one of the components making up the customized weighted index from the Barclays U.S. Aggregate Bond Index to the Citigroup WGBI (hedged into

USD). Fund management believes that the Citigroup WGBI (hedged into USD) better reflects the Fund’s increasing global exposure. As with all such

investments, past performance (before and after taxes) is not an indication of future results. Sales charges are not reflected in the bar chart. If

they were, returns would be less than those shown. However, the table includes all applicable fees and sales charges. If BlackRock and its affiliates

had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the

Fund’s results can be obtained by visiting http://www.blackrock.com/funds or can be obtained by phone at (800) 882-0052.

Service Shares

ANNUAL TOTAL RETURNS

1

BlackRock Managed Volatility Portfolio

As of 12/31

During the ten-year period shown in the bar chart, the highest

return for a quarter was 13.78% (quarter ended September 30, 2009) and the lowest return for a quarter was –13.12% (quarter ended December 31,

2008). The year-to-date return as of September 30, 2012 was 9.13%.

10

As of 12/31/11

Average Annual

Total Returns

|

|

|

|

1 Year

|

|

5 Years

1

|

|

10 Years

1

|

|

BlackRock Managed Volatility Portfolio — Service Shares

|

|

Return Before Taxes

|

|

|

|

|

(3.49

|

)%

|

|

|

2.16

|

%

|

|

|

4.35

|

%

|

|

Return After Taxes on Distributions

|

|

|

|

|

(4.03

|

)%

|

|

|

1.39

|

%

|

|

|

3.44

|

%

|

|

Return After Taxes on Distributions and Sale of Shares

|

|

|

|

|

(1.66

|

)%

|

|

|

1.67

|

%

|

|

|

3.46

|

%

|

|

S&P 500

®

Index

(Reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

2.11

|

%

|

|

|

(0.25

|

)%

|

|

|

2.92

|

%

|

|

Barclays U.S. Aggregate Bond Index

(Reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

7.84

|

%

|

|

|

6.50

|

%

|

|

|

5.78

|

%

|

|

MSCI ACWI Index

(Reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

(7.35

|

)%

|

|

|

(1.93

|

)%

|

|

|

4.24

|

%

|

|

Citigroup WGBI (hedged into USD)

(Reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

5.49

|

%

|

|

|

4.92

|

%

|

|

|

4.75

|

%

|

|

60% S&P 500

®

Index/40% Barclays U.S. Aggregate Bond Index

(Reflects no deduction for

fees, expenses or taxes)

|

|

|

|

|

4.69

|

%

|

|

|

2.84

|

%

|

|

|

4.40

|

%

|

|

60% MSCI ACWI Index/40% Barclays U.S. Aggregate Bond Index

(Reflects no deduction for fees, expenses or

taxes)

|

|

|

|

|

(1.14

|

)%

|

|

|

1.91

|

%

|

|

|

5.27

|

%

|

|

60% MSCI ACWI Index/40% Citigroup WGBI (hedged into USD)

(Reflects no deduction for fees, expenses or

taxes)

|

|

|

|

|

(1.96

|

)%

|

|

|

1.38

|

%

|

|

|

4.89

|

%

|

|

1

|

|

A portion of the Fund’s total return was attributable to

proceeds received in the fiscal year ended September 30, 2009 in settlement of litigation.

|

After-tax returns are calculated using the historical highest

individual Federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the

investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares

through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Managed Volatility Portfolio’s investment manager is

BlackRock Advisors, LLC (previously defined as “BlackRock”). The Fund’s sub-advisers are BlackRock Financial Management,

Inc., BlackRock International Limited, BlackRock (Hong Kong) Limited and BlackRock (Singapore) Limited. Where applicable, “BlackRock”

refers also to the Fund’s sub-advisers.

Name

|

Portfolio Manager

of the Fund

Since

|

Title

|

|

Philip Green

|

2006

|

Managing Director of BlackRock, Inc.

|

Purchase and Sale of Fund

Shares

You may purchase or redeem shares of Managed Volatility Portfolio

each day the New York Stock Exchange is open. To purchase or sell shares you should contact your financial intermediary or financial professional, or,

if you hold your shares through the Fund, you should contact the Fund by phone at (800) 537-4942, by mail (c/o BlackRock Funds, P.O. Box 9819,

Providence, Rhode Island 02940-8019), or by the Internet at www.blackrock.com/funds. The Fund’s initial and subsequent investment minimums for

Service Shares generally are as follows, although the Fund may reduce or waive the minimums in some cases:

|

Service Shares

|

|

Minimum Initial Investment

|

$5,000

|

|

Minimum Additional Investment

|

No subsequent minimum.

|

11

Managed Volatility Portfolio’s dividends and distributions

may be subject to Federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing

through a retirement plan, in which case you may be subject to Federal income tax upon withdrawal from such tax-deferred arrangements.

Payments to Broker/Dealers

and Other Financial Intermediaries

If you purchase shares of Managed Volatility Portfolio through a

broker-dealer or other financial intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the

intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other financial intermediary and your individual financial professional to recommend the Fund over another investment. Ask your individual financial

professional or visit your financial intermediary’s website for more information.

|

INVESTMENT COMPANY ACT FILE #811-05742

© BlackRock Advisors, LLC

SPRO-MV-SVC-0512R

|

|

|

|

|

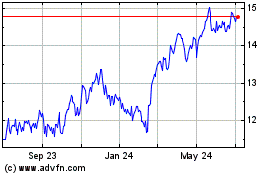

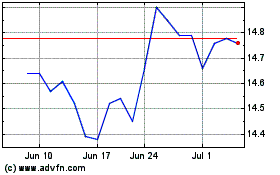

Antero Midstream (NYSE:AM)

Historical Stock Chart

From May 2024 to Jun 2024

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Jun 2023 to Jun 2024