Ameriprise Lags on Higher Expenses - Analyst Blog

October 27 2011 - 8:45AM

Zacks

Ameriprise Financial Inc.’s (AMP) third quarter

2011 operating earnings of $1.04 per share significantly missed the

Zacks Consensus Estimate of $1.22 and also compared unfavorably

with the year-ago quarter’s earnings of $1.35 per share.

Operating results exclude the consolidation of certain

investment entities, net realized gains or losses, integration and

restructuring charges, market impact on variable annuity guaranteed

living benefits and discontinued operations.

Net income attributable to Ameriprise for the reported quarter

came in at $271 million or $1.12 per share compared with $346

million or $1.33 per share in the comparable quarter last year.

Ameriprise’s third quarter results primarily benefited from

increased asset-based fees and impressive results at Asset

Management and Advice & Wealth Management segments. However,

higher expenses and decrease in asset under management formed the

downside.

Quarterly Details

On an operating basis, Ameriprise’s net revenues for the third

quarter rose 8% year over year to $2.52 billion, reflecting

substantial growth in management and distribution fees. However,

net revenues stood below the Zacks Consensus Estimate of $2.59

billion.

GAAP expenses in the quarter climbed 17.0% year over year to

$2.22 billion, while operating expenses escalated 20% from the

year-ago quarter to $2.2 billion. These represent significant

increase in distribution expenses and general and administrative

expenses, partially offset by lower benefits, claims, losses and

settlement costs.

Asset Position

Total assets under management and administration fell 4% year

over year to $600 billion as of September 30, 2011, primarily due

to decline in equity markets and Asset Management segment net

outflows, partially mitigated by retail client net inflows.

Share Repurchase

During the third quarter, Ameriprise repurchased 9.9 million

shares of its common stock for $447 million. Through September 30,

2011, the company repurchased $1.2 billion of shares and still has

$1.7 billion available in its share repurchase authorization that

expires in June 2013.

Peer Performance

One of Ameriprise’s competitors, BlackRock Inc.

(BLK) reported third quarter adjusted earnings of $2.83 per share,

fairly ahead of the Zacks Consensus Estimate of $2.74, primarily

aided by an improved top line, which was offset partially by higher

operating expenses.

Our Viewpoint

Though there is concern over the sluggish market recovery,

improvement in retail client activity as well as decent growth in

Advice & Wealth Management and Asset Management businesses

would drive operating leverage in the upcoming quarters.

Furthermore, Ameriprise’s capital deployment activity would also

boost investors’ confidence in the stock.

Ameriprise currently retains a Zacks # 3 Rank, which translates

into a short-term ‘Hold’ rating. Also, considering the

fundamentals, we maintain our long-term “Neutral” recommendation on

the stock.

AMERIPRISE FINL (AMP): Free Stock Analysis Report

BLACKROCK INC (BLK): Free Stock Analysis Report

Zacks Investment Research

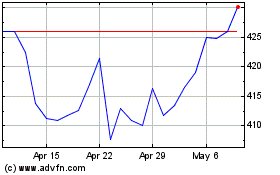

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Sep 2023 to Sep 2024