Ameriprise Advisers More Productive, But Summer Is A Drag

October 28 2010 - 1:02PM

Dow Jones News

Ameriprise Financial Inc.'s (AMP) advice and wealth-management

segment reported year-over-year earnings growth and increased

adviser productivity in the third quarter, but seasonality factors

and clients' risk aversion were a drag on the segment's results in

the quarter.

Improved market results along with the company's efforts to

boost adviser productivity and keep expenses in line propelled the

segment to year-over-year gains, James Cracchiolo, chairman and

chief executive of Ameriprise, said Thursday on its quarterly

earnings call. But the slower summer months, historically low

short-term interest rates and a quarterly decline in the "average

equity markets" took their toll in the third quarter, he said.

Net operating revenues for the advice and wealth-management

segment rose 14% to $946 million from the year-ago quarter due to

the adviser productivity gains, growth in average fee assets driven

by market appreciation and lower operating general business

expenses, Ameriprise reported late Wednesday. The segment includes

its franchise advisers and employee advisers, which are both

branded as Ameriprise Financial advisers, in addition to its

independent broker-dealer unit, La Vista, Neb.-based Securities

America Financial Corp.

The segment also reported pre-tax operating earnings of $88

million in the third quarter, up from $28 million a year ago, and

its pre-tax operating margin rose to 9.3%, up from 3.4% a year ago,

and slightly higher than last quarter, it said.

However, the segment's revenue was down 2% from the second

quarter, Ameriprise said. There was improvement in client activity,

though it continued to be below pre-crisis levels, Walter Berman,

the company's executive vice president and chief financial officer,

said on the call. "Average equity markets" were down 4% quarter

over quarter, he said. However, that was partly offset by strong

sales in Ameriprise's new variable annuity product, he said.

Adviser productivity, measured as operating net revenue per

adviser, increased 21% in the quarter from a year ago, the company

said. That increase was due partly to appreciation in the equity

markets, but also came from increased client activity and inflows

that have come into products like its new mutual-fund wrap product

over the past year, Cracchiolo said. Lower-producing advisers have

left and the company has cut costs, he said.

But advisory productivity was off slightly from the prior

quarter mostly due to the slower summer months, Cracchiolo said.

"Clients are more confident now than they were a year ago but

doubts and concerns are persisting and, as a result, investing

behavior continues to show a fairly high level of risk

aversion."

However, even with the seasonality impact, total client assets

for the segment increased $313 billion, up 9%, from a year ago.

Wrap accounts were an important contributor, Cracchiolo said.

In addition, historically low short-term interest rates impacted

the segment's profit "fairly significantly," he said.

Ameriprise's total adviser headcount declined 6% from a year ago

to 11,608 in the quarter, primarily due to the continued departure

of low-producing advisers, it also said Wednesday.

The company has an employee adviser retention rate of 78%, which

is probably the highest it has been, but would like to boost that

rate into the 80s, Cracchiolo said. The company continues to see a

slowing of adviser departures, "though it's probably not done," he

said. With more than 11,000 advisers, "just to replace normal

attrition...you have to make up for all of that," he said.

Ameriprise is trying to add to teams, to give them greater

support to build out their practice with support staff and

assistant advisers, Cracchiolo said. The focus going forward will

be on increased productivity and growth of practices "in

combination to the number of people we have," he said.

Shares of Ameriprise were up 3.9% at midday Thursday at

$52.83.

-By Daisy Maxey, Dow Jones Newswires; 212 416 2237;

daisy.maxey@dowjones.com

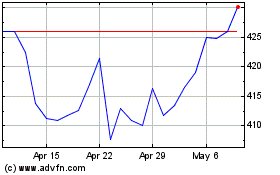

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024