Air Products to Sell European Unit - Analyst Blog

January 10 2012 - 3:45AM

Zacks

Air Products &

Chemicals Inc.(APD), the US supplier of specialty gas

products, announced its plan to sell its Continental Europe

Homecare business to The Linde Groupe of Germany for 590 million

euros (approximately $750 million).

The Continental Europe Homecare

business provides oxygen therapy, sleep therapy, and infusions, and

operates in Germany, France, Spain, Portugal and Belgium. The

operations have a base of about 260,000 patients.

Air Products intends to sell off

its Europe Homecare business as it does not fit with its core gases

business. On the contrary, this acquisition will boost Linde’s

position in the structural growth market while making it one of the

market leaders in the European respiratory homecare business.

Air Products is also evaluating its

options for its home care business in the U.K., Ireland, Argentina,

and Brazil. The company will continue to operate these businesses

as part of its portfolio. In addition, Air Products will compete to

win new businesses while providing quality patient care.

Linde achieved sales of 1.1 billion

euros in the healthcare segment as a whole, in the 2010 financial

year. The company is the second largest supplier of medical gases

and related services in the world.

In late October 2011, Air Products

reported an increase in profit for the fourth quarter, primarily

reflecting revenue growth amid double-digit increases at three of

its four operational segments.

Air Products reported

fourth-quarter 2011 EPS of $1.51 versus $1.35 in the year-earlier

quarter, in line with the Zacks Consensus Estimate of $1.51. For

full-year 2011, the company reported an EPS of $5.73, up 14% year

over year, matching the Zacks Consensus Estimate of $5.73.

Net sales amounted to $2.6 billion

versus $2.4 billion in the prior-year quarter, in line with the

Zacks Consensus Estimate of $2.6 billion. The improved results were

mainly driven by growth in the emerging markets and strong

performance in its Tonnage Gases business. Despite a slowing global

economy in the second half of 2011, the company won several

projects and also witnessed double-digit sales and earnings

growth.

For fiscal 2011, sales increased

12% year over year to $10,082 million driven by a 9% volume

increase, which was in line with the Zacks Consensus Estimate.

Though the near-term economic

outlook looks bleak and has a lot of global economic and policy

uncertainties, Air Products remains confident of its large backlog

of projects backed by signed customer contracts while remaining

committed to achieve its 2015 goals for growth, margin, and return

on capital.

The company expects fiscal year

2012 EPS to be in the range of $5.90 to $6.30 per share,

representing year-over-year earnings growth of 3% to 10%. For the

first quarter of fiscal 2012, the company expects to earn $1.31 to

$1.39 per share.

The company also forecasts capital

spending in fiscal 2012 to be between $1.9 and $2.2 billion.

Based in Pennsylvania, Air Products

benefits from a long-term take-or-pay contract, a consolidated

industry structure, a diverse customer base and sustained pricing

power. However, soaring energy and raw material costs pose a threat

to margin expansion.

Air Products, which faces stiff

competition from Praxair Inc. (PX), has a Zacks #2

Rank (Buy) on its stock for the short term. We currently

provide a long-term Neutral recommendation on the stock .

AIR PRODS & CHE (APD): Free Stock Analysis Report

PRAXAIR INC (PX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

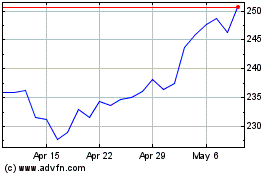

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From May 2024 to Jun 2024

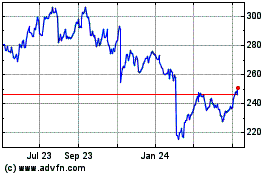

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Jun 2023 to Jun 2024