The Earnings Picture

Second quarter earnings season is over; the attention now shifts to

the third quarter. With the exception of a handful of financials,

most notably

Bank of America (BAC), which had a

$12 billion negative swing in net income from last year, this has

been another great earnings season.

The year-over-year growth rate for the S&P 500 is 11.9%, way

off the 17.1% pace posted in the first quarter. However, it you

exclude the financial sector, growth is 19.3%, actually up slightly

from the 19.1% pace of the first quarter. At the beginning of

earnings season, growth of 9.7% was expected, 12.2%

ex-financials.

The outlook for the third quarter now looks very similar to the

outlook for the second quarter three months ago, with net income

growth of 11.4% expected for both the total and excluding the

financials. We will need another season where positive earnings

surprises far outpace disappointments if we are going to match the

second quarter growth rate. On the top line, growth is also

expected to slow sharply, to 5.59% in total from 11.05% in the

second quarter, and excluding the financials to 9.18% from

13.16%.

Net Margin Forecast

Expanding net margins have been one of the keys to earnings growth.

In the second quarter, total net margins were 9.14%, and excluding

financials they were 9.13%, up from 9.10% and 7.95 ex-financials in

the second quarter of 2010. In the third quarter, the financials

net margins are expected to recover (we will see about that --

depends on the level of net charge-offs at the banks, which are

sort of hard to predict).

Thus, total net margins are expected to rise to 9.60%, while

excluding financials they are expected to drop to 8.94%. Then

again, revenue growth is expected to be much lower for the

financials.

On an annual basis, net margins continue to march northward. In

2008, overall net margins were just 5.88%, rising to 6.37% in 2009.

They hit 8.62% in 2010 and are expected to continue climbing to

9.24% in 2011 and 10.01% in 2012. The pattern is a bit different,

particularly during the recession, if the financials are excluded,

as margins fell from 7.78% in 2008 to 7.04% in 2009, but have

started a robust recovery and rose to 8.23% in 2010. They are

expected to rise to 8.76% in 2011 and 9.24% in 2012.

Full-Year Expectations

The expectations for the full year are very healthy, with total net

income for 2010 rising to $793.0 billion in 2010, up from $543.6

billion in 2009. In 2011, the total net income for the S&P 500

should be $914.1 billion, or increases of 45.9% and 15.3%,

respectively.

The expectation is for 2012 to have total net income passing the $1

Trillion mark to $1.042 Trillion, for growth of 14.0%. That will

also put the “EPS” for the S&P 500 over the $100 “per share”

level for the first time at $109.22. That is up from $56.95 for

2009, $83.10 for 2010 and $95.81 for 2011.

In an environment where the 10-year T-note is yielding 2.05%, a P/E

of 14.6x based on 2010 and 12.6x based on 2011 earnings looks

attractive. The P/E based on 2012 earnings is 11.1x.

Estimate Revisions Near Seasonal Low

Estimate revisions activity is near a seasonal low. What has really

been drying up is estimate increases, as those made immediately

after the second quarter positive earnings surprise roll-off the

four-week moving total I track. The number of cuts has also

declined, but not nearly as sharply and as a result the ratio of

increases to cuts is now at a very bearish level of 0.52.

This has been very widespread; the ratio of firms with rising mean

estimates to falling is down to 0.64 for this year and to 0.43 for

next year, and almost every sector has more cuts than increases for

both this year and next (the one exception is a tie in the Auto

industry for this year, but on an extremely small sample).

In light of the generally downbeat economic news, it is not

surprising that we are not seeing a lot of estimate increases

without the catalyst of positive earnings surprises. During slow

revisions periods, the revisions ratio is generally less

significant that during periods of high activity, but that does not

mean that it should be ignored completely, and it is flashing a

yellow caution light pretty brightly now.

The strong earnings performance we have seen, particularly in large

multinational company earnings (like most of the S&P 500 I

track in this report) is the single most important argument in the

bulls' favor (along with the low valuations based on those

earnings). Thus if that starts to crack in a big way, it would be a

very big concern.

Recap of Key Data and Events

The economic news this week was mostly, but not entirely, on the

downbeat side. Retail sales came in flat for the month, below

expectations for a 0.2% increase, and July’s numbers were revised

down. The government’s tally of auto sales was lighter than one

would have expected based on what the auto companies reported, and

the numbers for ex-autos also came in lighter than expected, rising

0.1% rather than the 0.3% the consensus was looking for.

Industrial Production

We did get some somewhat better than expected news from the report

on industrial production and capacity utilization, particularly if

one backs out the weather related effects on utility output. The

absolute numbers were not great, but still moving in the right

direction and it was better than expected.

On the other hand, inflation ran a bit hotter than expected, mostly

due to gasoline prices. The headline CPI rise 0.4% in August,

rather than the 02% rise that was expected. However, if food and

energy are stripped out, prices rose only 0.2%, in line with

expectations.

Fed Meeting Coming Up

The higher headline number will probably give ammunition to those

on the Fed who don’t want it to do any more to ease monetary

policy. The Fed is deeply divided, and it having a two-day meeting

this week to hash things out. The statement due out on Wednesday

afternoon will be carefully parsed for clues as to its future

direction. One of the key details will be the number of members who

dissent. Last time there were three, an unusually high number.

Jobless Claims

Initial Claims for jobless benefits rose again, to 428,000. Some of

that might been due to Hurricane Irene, but even so, it is not a

very good sign. We really need to see that number fall below the

400,000 level to indicate the job market is returning to health.

Given the severity of the jobs crisis, it will take some time to

heal, even after we get below that level, and we are moving in the

wrong direction. This is not a good sign.

American Jobs Act

I seriously doubt that the “American Jobs Act” which Obama proposed

last week will pass. Thus we are not going to get a lot of help

from fiscal policy in bringing down unemployment. The GOP in the

House is simply too fixated on bringing down the deficit to spend

anything on getting job growth going again, even though the vast

bulk of the package is tax cuts. However, it would largely be paid

for by other tax increases.

The shift in the tax burden makes a lot of sense to me. It would

eliminate lots of special interest deductions that mostly benefit

the very top of the income distribution, and provide a boost to the

take-home pay for the vast majority of workers. It would do so by

increasing the size of the payroll tax cut from 2% of the first

$106,800 someone earns to 3% on the individual side, and also

introduce cuts in the payroll tax on the employer side,

particularly targeted at small businesses. For the median household

(including households of one) that would mean about $500 more in

after tax income than in 2011.

In contrast, if nothing is done the 2011 payroll tax cut will

expire, and the median household will have $1,000 less to spend.

That would be a huge hit to consumer demand (about 70% of the

economy) and would result in even more unemployment.

While small businesses and their owners are often referred to as

the "job creators," that is not really the case. Yes, historically

most new paychecks have been signed by the owners of small

businesses, but no business -- large of small -- is going to hire

people if they don’t think that there are customers for their goods

or services. It is customers who are the job creators, not

businesses.

It is uncertainty about the number of customers, not about taxes or

regulations, which are keeping businesses from hiring. We learned

this week that in 2010, real median income dropped 2.3% from 2009

levels and is now 6.4% below where it was at the start of the Great

Recession and 7.1% below its 1999 peak. We also learned that the

poverty rate rose to 15.1% in 2010 from 14.3% in 2009, and from

12.5% in 2007 before the start of the Great Recession. People in

poverty do not make great customers, and thus are not very good job

creators.

Austerity Measures and the "Super Committee"

The thrust of the “American Jobs Act” runs directly counter to the

thrust of debt-ceiling deal. The “Super Committee” of six Democrats

and six Republicans which is charged with coming up with $1.5

Trillion in deficit reduction over the next decade is on the road

to failure.

If it cannot come up with an agreement by November 23rd, or if

Congress does not pass the package by December 23rd, then automatic

spending cuts of $1.2 Trillion kick in. Half of those would be to

defense, and half to non-defense (mostly discretionary) spending.

That is a "meat cleaver" approach and will be front end loaded,

with big cuts starting in 2013.

There are three entitlements that really matter in the budget:

Social Security, Medicare and Medicaid. Social Security has its own

dedicated tax, and since 1983 that tax has provided more revenues

than Social Security has paid out. The difference was invested in

the safest possible security: U.S. government bonds.

The Social Security Trust Fund created by that excess now stands at

$2.7 Trillion. It is a substantial portion of the $14.8 trillion

federal debt, but it is debt that the government in effect owes to

itself. Under the medium economic assumptions, it is able to pay

out all benefits as scheduled until 2037, and thereafter can pay

out 78% of scheduled benefits forever. Because the benefits are

tied to average wages rather than to inflation, the real value of

that 78% is expected to be higher than the current beneficiaries

get.

The payroll tax is a highly regressive tax, one levied on the very

first dollar of income someone makes, but stopping for earnings

after $106,800. Thus high income workers see a jump in their

take-home pay after their earnings for the year have passed the

threshold. By building up the trust fund, lower-income workers have

in effect been subsidizing the rest of the budget.

The bulk of what we think of as the Federal Government; the

Pentagon, the Federal Court System, and the complete alphabet soup

of agencies are theoretically paid for out of other taxes, most

notably the income tax, both individual and corporate. The budget

deficit numbers you hear bandied about are the combination of both

Social Security and the rest of Government. Thus, since the Social

Security system has been running a surplus, the deficit from the

rest of Government is actually much larger than advertized.

While the overall budget has been in deficit almost always since at

least the 1930’s, generally until 1980 (with the big exception of

WWII) it has been a lower percentage of GDP than the growth rate of

GDP. Thus it is easily rolled over, and as a share of the economy

it is shrinking.

Cutting Medicare and Medicaid

That leaves Medicare and Medicaid as the only places where there is

enough spending to really cut $1.5 Trillion. There are really two

ways to cut those programs, either reducing who they cover, or what

they cover. I favor the latter approach. That, however, would mean

that the programs would have to be able to determine which medical

procedures were both effective medically, and which were also cost

effective.

The ACA started to move in that direction, but was met with cries

of “death panels," and overly intrusive government involvement in

health care decisions. On the other hand, if we start reducing who

is covered, say by increasing to 67 from 65 the age at which you

can get Medicare, the number of people without health insurance at

all will skyrocket. As it is, 16.3% of all Americans, or almost 50

million people, have no health insurance coverage at all. That is

up from 16.1% in 2009.

Because of Medicare, though, very few people over age 65 are

without coverage. The uninsured rate is 18.4% for those under 65,

up from 18.2% in 2009. It is estimated that over 40,000 people die

each year in this country because they lack any access to health

care (other than emergency rooms, which are very expensive and

ultimately paid by tax payers, and don’t tend to catch longer-term

health issues). For more on the poverty report see here.

If taxes are off the table entirely, then I think that we will end

up with the Super Committee in a stalemate, and we will get the

$1.2 Trillion in meat-cleaver cuts. That is not going to raise

anybody’s confidence and will be a body blow to the economy.

Yet the Markets Went Higher

Despite the generally bad economic news, the market was up every

day last week. I think it was mostly due to the valuations simply

being too compelling to ignore. It has been a very long time (with

the exception of the very depths of the financial crisis) since the

dividend yield on the S&P 500 was higher than the 10-year

T-note. Money has to be parked somewhere, and equities look a

lot more attractive to me than bonds -- especially government bonds

-- or real estate.

We also got some better news on the European front. I would not

count on that lasting, though. Perhaps the can might be kicked down

the road a little bit further, but it strikes me that Greece is

bound to default, and that the Euro is destined to fail as a common

currency. What really is in doubt is when, not if.

Pricing In Another Recession

At these levels it is clear to me that the market is pricing in not

just slower growth, but an outright recession, either underway or

just about to get underway. If it turns out that we avoid an

outright recession, and the decline in profits that usually comes

with one, then the market should rally from here.

As I noted above, the expectations are starting to come down,

particularly for 2012, but the vast majority of stocks, and every

economic sector is expected to earn more in 2012 than in 2011. The

decline in the revisions ratio is mostly driven right now by the

drying up of new estimate increases, rather than a flood of new

estimate cuts. It is entirely normal at this point seasonally for

overall revisions activity to slow down dramatically.

Of Euros, PIIGS and Unscrambling Eggs

The demise of the Euro has the potential for enormous dislocations,

and hence big damage to the European economy. That would inevitably

spill over to the U.S. If it were just Greece, perhaps the damage

could be contained, as it really is not that big. However, there

are still big concerns about the rest of the PIIGS.

The economy of Greece, in particular, but also for the rest of the

periphery of Europe continue to weaken, and with that weakness tax

revenues are drying up even more, and the country is missing the

fiscal targets it agreed to just a few months ago.

Ultimately, one of two things is going to have to happen: Either

fiscal policy will have to be consolidated in Europe as a whole

(which means that the individual countries will have to give up

most of their sovereignty -- essentially Italy will have to become

like Florida, and Germany like California), or the common Euro

currency has to fall apart. Italy and Greece, unlike the U.S. do

not have their own printing press (hence when they get downgraded,

their interest rates soar, not sink like here). They have to rely

on the printing press of the ECB, and that is largely controlled by

the Germans.

The process of unscrambling the Euro egg and going back to Drachmas

and Lira would be a very messy one, and will result in huge

dislocations, and thus could potentially cause economic collapse.

Most of the proposals that would integrate Europe fiscally would

take a long time, and would probably require not just passage by

each of the 17 parliaments that use the Euro, but probably changes

in their constitutions as well.

That is not going to happen overnight. It also means that it is

highly unlikely that the Euro, the second-most-important currency

in the world, is going to strengthen dramatically against the

dollar.

European banks are heavily invested in the bonds of the PIIGS, and

there is a real threat to the stability of the European banking

system. If the European banking system goes down, ours will follow

as night follows day (or at the very least we will need to see "Son

of TARP"). This is not a problem caused here, and is not the fault

of Obama, or GW Bush, or Congress or even the Tea Party, for that

matter. It is a mess of the Europeans own making, but its effects

will be felt here, just as the effects of the mortgage mess of our

making were felt there.

Stay Invested but Don’t Shoot for the Stars

On balance I remain bullish. My year-end target remains at 1325 for

the S&P 500. Getting there is going to be a bumpy ride. Strong

earnings should trump a dicey international situation and the drama

in DC. Valuations on stocks look very compelling, with the S&P

trading from just 12.6x 2011, and 11.1x 2012 earnings.

Put in terms of earnings yields, we are looking at 7.92% and 9.03%,

while T-notes are only at 2.05%. The old “Fed Model” suggested that

the forward earnings yield (call it 8.45%) should be in line with

the 10-year note. Instead we have the dividend yield on the S&P

500 higher than the 10-year.

Since the early 1950’s that has happened only twice, in early

November of 2008 and in March of 2009. The second incident was

followed by a doubling of the S&P 500. From a long-term

perspective, stocks look extremely undervalued to me.

Long-term investors should start to take advantage of the current

valuations. However, I would not be shooting for the stars. Look

for those companies with solid dividends (say, over 2.5%), low

payout ratios, solid balance sheets and a history of rising

dividends, which are still seeing analysts raise their estimates

for 2012, or are at least not cutting them aggressively.

Currently, firms like

Abbott Labs (ABT),

Aflac (AFL),

Genuine Parts (GPC)

and Johnson & Johnson (JNJ) would fit that description. I don’t

know if you will be happy doing so next week or even next month,

but I am pretty sure that you will be quite satisfied five years

from now if you do so.

ABBOTT LABS (ABT): Free Stock Analysis Report

AFLAC INC (AFL): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

GENUINE PARTS (GPC): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

Zacks Investment Research

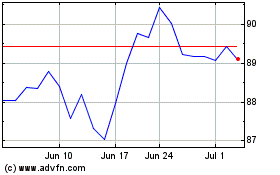

AFLAC (NYSE:AFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

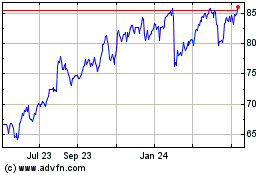

AFLAC (NYSE:AFL)

Historical Stock Chart

From Jul 2023 to Jul 2024