UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

|

For the month of November 2023

|

|

Commission File Number 001-33159

|

AERCAP HOLDINGS N.V.

(Translation of Registrant’s Name into English)

AerCap House, 65 St. Stephen’s Green, Dublin D02 YX20, Ireland, +353 1 819 2010

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Other Events

On November 16, 2023, AerCap Holdings N.V. (the “Company”) issued a press release announcing the completion of the underwritten secondary offering by GE Capital US Holdings, Inc. (the “Selling Shareholder”), a wholly owned subsidiary of General

Electric Company, of 30,729,878 ordinary shares of the Company at a price to the public of $65.25 per ordinary share (the “Secondary Offering”). This includes the exercise in full by the underwriters of their

option to purchase up to an additional 4,008,245 ordinary shares from the Selling Shareholder. As part of the Secondary Offering, AerCap purchased 7,859,163 ordinary shares from the underwriters at a price per ordinary share equal to $63.62. A copy

of the press release is attached hereto as Exhibit 99.1. As a result of the completion of the Secondary Offering, General Electric Company and its subsidiaries no longer beneficially own any of the Company’s

ordinary shares.

The information contained in this Form 6-K is incorporated by reference into the Company’s Registration Statements on Form F-3, File Nos. 333-270326 and 333-260359, Registration Statements on Form S-8, File Nos. 333-194638, 333-194637, 333-180323,

333-165839, and 333-154416, and related Prospectuses, as such Registration Statements and Prospectuses may be amended from time to time.

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AERCAP HOLDINGS N.V.

|

|

| |

|

|

|

|

|

By:

|

/s/ Aengus Kelly

|

|

| |

|

Name: |

Aengus Kelly

|

|

| |

|

Title: |

Authorized Signatory

|

|

| |

|

|

|

| |

|

|

|

Date: November 16, 2023

|

|

|

|

EXHIBIT INDEX

99.1 AerCap Holdings N.V. Press Release

4

Exhibit 99.1

| |

For Investors: Joseph McGinley

Head of Investor Relations

jmcginley@aercap.com; +353 1 418 0428

|

For Media: Gillian Culhane

Vice President Corporate Communications

gculhane@aercap.com; +353 1 636 0945

|

AerCap Holdings N.V. Announces Completion of Secondary Share Offering, Including the Full Exercise of Underwriters’ Option to Purchase Additional

Shares

DUBLIN – November 16, 2023 - AerCap Holdings N.V. (“AerCap” or the “Company”) (NYSE: AER) today announced the completion of the secondary public

offering of 30,729,878 of its ordinary shares by GE Capital US Holdings, Inc. (the “Selling Shareholder”), a wholly owned subsidiary of General Electric Company, at a price to the public of $65.25 per ordinary share (the “Secondary Offering”). This

includes the exercise in full by the underwriters of their option to purchase up to an additional 4,008,245 ordinary shares from the Selling Shareholder. As part of the Secondary Offering, AerCap purchased 7,859,163 ordinary shares from the

underwriters at a price per ordinary share equal to $63.62. AerCap will not receive any proceeds from the offering. As a result of the completion of the Secondary Offering, General Electric Company and its subsidiaries no longer beneficially own any of

AerCap's ordinary shares.

Goldman Sachs & Co. LLC, Citigroup, Deutsche Bank Securities, BNP PARIBAS, BofA Securities, J.P. Morgan, Credit Agricole CIB, Mizuho, MUFG and SOCIETE GENERALE acted as joint

book-running managers for the Secondary Offering. BBVA, ING, UniCredit Capital Markets, Santander, Academy Securities, R. Seelaus & Co., LLC and Siebert Williams Shank acted as co-managers for the Secondary Offering.

The Company has filed a registration statement (including a prospectus) on Form F-3 with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this

communication relates. The registration statement automatically became effective upon filing on March 7, 2023. Investors should read the accompanying prospectus, dated March 7, 2023, the prospectus supplement relating to the offering, dated November

13, 2023, and other documents the Company has filed with the SEC for more complete information about the Company and the offering.

These documents may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. The accompanying prospectus and prospectus supplement relating to the

Secondary Offering may also be obtained from: Goldman Sachs & Co. LLC, Attn: Prospectus Department, 200 West Street, New York, New York 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316, or by emailing prospectus-ny@ny.email.gs.com; Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 1-800-831-9146; Deutsche Bank Securities Inc., Attn:

Prospectus Department, at 1 Columbus Circle, New York, NY 10019, by telephone at 1-800-503-4611 or by email at prospectus.cpdg@db.com; BNP Paribas Securities Corp., by email at DL_prospectus_requests@us.bnpparibas.com; BofA Securities, Attention: Prospectus Department, NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, or by email at dg.prospectus_requests@bofa.com; or J.P. Morgan Securities LLC, c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 1-866-803-9204, or by email at prospectus-eq_fi@jpmchase.com.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the Company’s ordinary shares or any other securities, nor shall there be any offer,

solicitation or sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About AerCap

AerCap is the global leader in aviation leasing with one of the most attractive order books in the industry. AerCap serves approximately 300 customers around the world with

comprehensive fleet solutions. AerCap is listed on the New York Stock Exchange (AER) and is based in Dublin with offices in Shannon, Miami, Singapore, Memphis, Amsterdam, Shanghai, Dubai, Seattle, Toulouse and other locations around the world.

AerCap Holdings N.V.

65 St. Stephen’s Green, Dublin D02 YX20, Ireland

www.aercap.com

Forward-Looking Statements

This press release contains certain statements, estimates and forecasts with respect to future performance and events. These statements, estimates and forecasts are

“forward-looking statements”. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “might,” “should,” “expect,” “plan,” “intend,” “will,” “aim,” “estimate,” “anticipate,” “believe,”

“predict,” “potential” or “continue” or the negatives thereof or variations thereon or similar terminology. All statements other than statements of historical fact included in this press release are forward-looking statements and are based on various

underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include projections of our future financial performance based on our growth strategies and anticipated trends in our business.

These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the

results, level of activity, performance or achievements expressed or implied in the forward-looking statements, including, among other things, the availability of capital to us and to our customers and changes in interest rates; the ability of our

lessees and potential lessees to make lease payments to us; our ability to successfully negotiate flight equipment (which includes aircraft, engines and helicopters) purchases, sales and leases, to collect outstanding amounts due and to repossess

flight equipment under defaulted leases, and to control costs and expenses; changes in the overall demand for commercial aviation leasing and aviation asset management services; the continued impacts of the Ukraine Conflict, including the resulting

sanctions by the United States, the European Union, the United Kingdom and other countries, on our business and results of operations, financial condition and cash flows; the rate of recovery in air travel related to the Covid-19 pandemic, the aviation

industry and global economic conditions; the potential impacts of the pandemic and responsive government actions on our business and results of operations, financial condition and cash flows; the effects of terrorist attacks on the aviation industry

and on our operations; the economic condition of the global airline and cargo industry and economic and political conditions; development of increased government regulation, including travel restrictions, sanctions, regulation of trade and the

imposition of import and export controls, tariffs and other trade barriers; the impact of current hostilities in the Middle East, or any escalation thereof, on the aviation industry or our business; a downgrade in any of our credit ratings; competitive

pressures within the industry; regulatory changes affecting commercial flight equipment operators, flight equipment maintenance, engine standards, accounting standards and taxes.

As a result, we cannot assure you that the forward-looking statements included in this press release will prove to be accurate or correct. These and other important factors and

risks are discussed in AerCap’s annual report on Form 20-F and other filings with the SEC. In light of these risks, uncertainties and assumptions, the future performance or events described in the forward-looking statements in this press release might

not occur. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. Except as required by

applicable law, we do not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

AerCap Holdings N.V.

65 St. Stephen’s Green, Dublin D02 YX20, Ireland

www.aercap.com

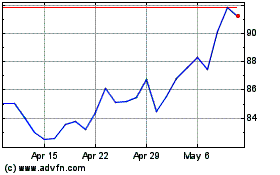

Aercap Holdings NV (NYSE:AER)

Historical Stock Chart

From Mar 2024 to Apr 2024

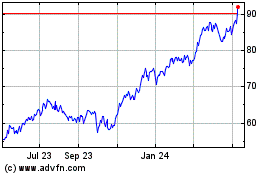

Aercap Holdings NV (NYSE:AER)

Historical Stock Chart

From Apr 2023 to Apr 2024