UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): December 9, 2011

ACADIA

REALTY TRUST

(Exact name of registrant as specified in its charter)

|

Maryland

|

1-12002

|

23-2715194

|

|

(State or other

|

(Commission

|

(I.R.S. Employer

|

|

jurisdiction of incorporation)

|

File Number)

|

Identification No.)

|

1311 Mamaroneck Avenue

Suite 260

White Plains, New York 10605

(Address of principal executive offices) (Zip Code)

(914) 288-8100

(Registrant's telephone number, including area code)

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

p

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425 )

p

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

p

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

p

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

Recent Developments

Property Acquisitions

During December 2011, Acadia Realty Trust (the “Company”),

through Acadia Strategic Opportunity Fund III LLC (“Fund III”), acquired two properties, one located in Baltimore,

Maryland and the other in metropolitan New York, for an aggregate purchase price of $34.7 million. These were previously disclosed

as under contract as of September 30, 2011. In addition, the Company, also through Fund III, acquired a shopping center located

in the metropolitan New York area for $11.3 million

During January 2012, the Company purchased a property located in

Chicago, Illinois for $3.9 million.

Note Repurchase

During December 2011, pursuant to the terms of its outstanding 3.75%

Convertible Notes due 2026 (the “Notes”), the Company repurchased $24.0 million of the Notes at face value plus accrued

interest to the date of repurchase. Notes with a principal amount of $0.9 million remain outstanding after the repurchase.

The above acquisitions and repurchase of the Notes were funded with

available Company working capital a portion of which came from the proceeds of the Company’s November 2011 follow-on public

offering that raised $45.2 million in gross proceeds and contributions from non-controlling interests.

Item 9.01 Financial Statements and Exhibits.

Financial Statements

.

During December 2011, the Company, through Fund III, and together

with an unaffiliated joint venture partner, acquired Parkway Crossing (“Parkway”) for $21.5 million, of which $14.0

million was funded with new mortgage debt obtained at closing and the balance of $7.5 million funded with cash. Fund III’s

share of cash required for the acquisition was $6.7 million. The following financial information with respect to Parkway together

with the financial information filed with the Securities and Exchange Commission by the Company on Form 8-K on November 3, 2011,

constitutes the required audited financial information and unaudited pro forma information with respect to a portion of the Company’s

acquisition activity since January 1, 2011.

Index to Financial Information

|

Parkway Crossing:

|

Page

|

|

Independent Auditors’ Report

|

2

|

|

Statements of Revenues and Certain Expenses for the Year Ended

December 31, 2010

and the Nine Months Ended September 30, 2011 (unaudited)

|

3

|

|

Notes to Statements of Revenues and Certain Expenses

|

4

|

Unaudited Pro Forma Condensed Consolidated Financial Statements

As of, and For, the Nine Months Ended

September 30, 2011

For the Year Ended December 31, 2010

Notes to Financial Statements

Parkway Crossing

Independent Auditors’ Report

To the Board of Directors and Management of

Acadia Realty Trust

White Plains, New York

We have audited the accompanying statement of revenues and certain

expenses of Parkway Crossing (the “Company”) for the year ended December 31, 2010. The statement of revenues and certain

expenses is the responsibility of Acadia Realty Trust’s management. Our responsibility is to express an opinion on the statement

of revenues and certain expenses based on our audit.

We conducted our audit in accordance with auditing standards generally

accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial

reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such

opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements,

assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial

statement presentation. We believe that our audit provides a reasonable basis for our opinion.

The accompanying statement of revenues and certain expenses was

prepared for the purpose of complying with the rules and regulations of the Securities and Exchange Commission for inclusion in

a Form 8-K of Acadia Realty Trust. As described in Note 2, material amounts that would not be comparable to those resulting from

the proposed future operations of Parkway Crossing are excluded from the statement of revenues and certain expenses and the statement

of revenues and certain expenses is not intended to be a complete presentation of the Company’s revenues and expenses.

In our opinion, the financial statement referred to above presents

fairly, in all material respects, the revenues and certain expenses of Parkway Crossing for the year ended December 31, 2010, on

the basis of accounting described in Note 2.

/s/ BDO USA, LLP

January 5, 2012

Parkway Crossing

Statements of Revenues and Certain Expenses

|

(in thousands)

|

|

|

Year ended

December 31, 2010

|

|

|

|

Nine Months ended

September 30, 2011 (unaudited)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

Rental revenue

|

|

$

|

1,733

|

|

|

$

|

1,177

|

|

|

Reimbursement revenue

|

|

|

577

|

|

|

|

537

|

|

|

Other revenue

|

|

|

5

|

|

|

|

3

|

|

|

Total Revenues

|

|

|

2,315

|

|

|

|

1,717

|

|

|

Certain Expenses:

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

483

|

|

|

|

350

|

|

|

Real estate taxes

|

|

|

216

|

|

|

|

160

|

|

|

Insurance expense

|

|

|

30

|

|

|

|

23

|

|

|

Total Certain Expenses

|

|

|

729

|

|

|

|

533

|

|

|

Revenues in Excess of Certain Expenses

|

|

$

|

1,586

|

|

|

$

|

1,184

|

|

See accompanying notes to the statements of revenues

and certain expenses.

Notes to Statements of Revenues and Certain Expenses

1. Organization

Parkway Crossing (“Parkway”) is a 27-tenant shopping

center located on Perring Parkway in Baltimore County, Maryland.

Acadia Realty Trust (the “Trust”) and subsidiaries (collectively,

the “Company”) is a fully integrated equity real estate investment trust focused on the acquisition, ownership, management

and redevelopment of high-quality retail properties and urban/infill mixed-use properties with a strong retail component located

primarily in high-barrier-to-entry, densely-populated metropolitan areas along the East Coast and in Chicago, Illinois.

During December 2011, the Company,

through Acadia Strategic Opportunity Fund III LLC (“Fund III”), and together with an unaffiliated joint venture

partner, acquired Parkway Crossing (“Parkway”) for $21.5 million.

2. Basis of Presentation and Significant Accounting Policies

Presented herein are the statements of revenues

and certain expenses of the Property.

The accompanying statements of revenues and

certain expenses (the “Statements”) have been prepared for the purpose of complying with the applicable rules and regulations

of the Securities and Exchange Commission, Regulation S-X, Rule 3-14 and for inclusion in a Current Report on Form 8-K of the Company.

The Statements are not intended to be a complete presentation of the revenues and expenses of the Property. Accordingly, the Statements

exclude depreciation and amortization of fixed assets, amortization of intangible assets and liabilities and asset management fees

not directly related to the future operations.

Revenue Recognition

Minimum rental revenue is recognized on a straight-line

basis over the term of the lease. Certain of the leases acquired provide for the reimbursement to the owner of Parkway of real

estate taxes, insurance and other property operating expenses. These reimbursements are recognized as revenue in the period the

expenses are incurred.

Income Taxes

Parkway was organized as a limited liability

company and is not directly subject to federal, state, or city income taxes.

Use of Estimates

The preparation of the Statements in conformity

with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect

the amounts reported in the statement of revenues and certain expenses and accompanying notes. Actual results could differ from

those estimates.

3. Rental Income

The Company is the lessor to tenants under

operating leases with expiration dates ranging from 2011 to 2032. The minimum rental amounts due under the leases are generally

either subject to scheduled fixed increases or adjustments. The leases generally also require that the tenants reimburse the Company

for the tenants pro rata share of increases in certain operating costs and real estate taxes. Future minimum rents to be received

over the next five years and thereafter for noncancelable operating leases in effect at December 31, 2010 are as follows:

(in thousands)

|

2011

|

|

$

|

1,623

|

|

|

2012

|

|

|

1,539

|

|

|

2013

|

|

|

1,384

|

|

|

2014

|

|

|

1,325

|

|

|

2015

|

|

|

1,254

|

|

|

Thereafter

|

|

|

2,872

|

|

|

Total

|

|

$

|

9,997

|

|

ACADIA REALTY TRUST AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

As of, and For, the Nine Months Ended September

30, 2011 and For the Year Ended December 31, 2010

During December 2011, the Company, through

Fund III, and together with an unaffiliated joint venture partner, acquired Parkway Crossing (“Parkway”) for $21.5

million, of which $14.0 million was funded with new mortgage debt obtained at closing and the balance of $7.5 million funded with

cash. Fund III’s share of cash required for the acquisition was $6.7 million.

The accompanying unaudited pro forma condensed consolidated balance

sheet as of September 30, 2011 has been prepared as if the acquisition of Parkway occurred on September 30, 2011. The accompanying

unaudited pro forma condensed consolidated statements of operations for the nine months ended September 30, 2011 and for the year

ended December 31, 2010 have been prepared as if the acquisition of Parkway occurred as of January 1, 2010.

Our pro forma condensed consolidated financial statements are presented

for informational purposes only and should be read in conjunction with the historical financial statements and related notes thereto

filed with the U.S. Securities and Exchange Commission. In the opinion of the Company’s management, the pro forma condensed

consolidated financial statements include all significant necessary adjustments that can be factually supported to reflect the

effect of the Acquisitions. The unaudited pro forma condensed consolidated financial statements are based on assumptions and estimates

considered appropriate by the Company’s management; however, they are not necessarily, and should not be assumed to be, an

indication of the Company’s financial position or results of operations that would have been achieved had the acquisition

of Parkway been completed as of the date indicated or that may be achieved in the future.

ACADIA

REALTY TRUST AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED BALANCE SHEET

As of September 30, 2011

|

(Amount in thousands, except share and per share data)

|

|

Company Historical

|

|

Previous

Acquisitions

|

|

Acquisition of Parkway

|

|

Company Pro Forma

|

|

|

|

|

(a)

|

|

|

|

(b)

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating real estate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land

|

|

$

|

268,077

|

|

|

$

|

28,544

|

|

|

$

|

—

|

|

|

$

|

296,621

|

|

|

Building and improvements

|

|

|

958,549

|

|

|

|

66,603

|

|

|

|

|

|

|

|

1,025,152

|

|

|

Construction in progress

|

|

|

3,983

|

|

|

|

|

|

|

|

|

|

|

|

3,983

|

|

|

|

|

|

1,230,609

|

|

|

|

95,147

|

|

|

|

|

|

|

|

1,325,756

|

|

|

Less: accumulated depreciation

|

|

|

200,840

|

|

|

|

|

|

|

|

|

|

|

|

200,840

|

|

|

Net operating real estate

|

|

|

1,029,769

|

|

|

|

95,147

|

|

|

|

|

|

|

|

1,124,916

|

|

|

Real estate under development

|

|

|

229,223

|

|

|

|

|

|

|

|

|

|

|

|

229,223

|

|

|

Notes receivable, net

|

|

|

41,304

|

|

|

|

|

|

|

|

|

|

|

|

41,304

|

|

|

Investments in and advances to unconsolidated affiliates

|

|

|

78,420

|

|

|

|

|

|

|

|

6,728

|

|

|

|

85,148

|

|

|

Cash and cash equivalents

|

|

|

98,027

|

|

|

|

(34,514

|

)

|

|

|

(6,728

|

)

|

|

|

56,785

|

|

|

Cash in escrow

|

|

|

27,553

|

|

|

|

|

|

|

|

|

|

|

|

27,553

|

|

|

Rents receivable, net

|

|

|

23,179

|

|

|

|

|

|

|

|

|

|

|

|

23,179

|

|

|

Deferred charges, net

|

|

|

25,696

|

|

|

|

|

|

|

|

|

|

|

|

25,696

|

|

|

Acquired lease intangibles, net

|

|

|

22,975

|

|

|

|

|

|

|

|

|

|

|

|

22,975

|

|

|

Prepaid expenses and other assets

|

|

|

27,637

|

|

|

|

|

|

|

|

|

|

|

|

27,637

|

|

|

Assets of discontinued operations

|

|

|

2,684

|

|

|

|

|

|

|

|

|

|

|

|

2,684

|

|

|

Total assets

|

|

$

|

1,606,467

|

|

|

$

|

60,633

|

|

|

$

|

—

|

|

|

$

|

1,667,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage notes payable

|

|

$

|

846,399

|

|

|

$

|

47,133

|

|

|

$

|

—

|

|

|

$

|

893,532

|

|

|

Convertible notes payable, net

|

|

|

24,824

|

|

|

|

|

|

|

|

|

|

|

|

24,824

|

|

|

Distributions in excess of income from, and investments in, unconsolidated affiliates

|

|

|

21,401

|

|

|

|

|

|

|

|

|

|

|

|

21,401

|

|

|

Accounts payable and accrued expenses

|

|

|

31,992

|

|

|

|

|

|

|

|

|

|

|

|

31,992

|

|

|

Dividends and distributions payable

|

|

|

7,507

|

|

|

|

|

|

|

|

|

|

|

|

7,507

|

|

|

Acquired lease and other intangibles, net

|

|

|

5,592

|

|

|

|

|

|

|

|

|

|

|

|

5,592

|

|

|

Other liabilities

|

|

|

18,914

|

|

|

|

|

|

|

|

|

|

|

|

18,914

|

|

|

Liabilities of discontinued operations

|

|

|

289

|

|

|

|

|

|

|

|

|

|

|

|

289

|

|

|

Total liabilities

|

|

|

956,918

|

|

|

|

47,133

|

|

|

|

—

|

|

|

|

1,004,051

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares, $.001 par value, authorized 100,000,000 shares; issued and outstanding 40,331,366 and 40,254,525 shares, respectively

|

|

|

40

|

|

|

|

|

|

|

|

|

|

|

|

40

|

|

|

Additional paid-in capital

|

|

|

303,783

|

|

|

|

|

|

|

|

|

|

|

|

303,783

|

|

|

Accumulated other comprehensive loss

|

|

|

(4,231

|

)

|

|

|

|

|

|

|

|

|

|

|

(4,231

|

)

|

|

Retained earnings

|

|

|

39,098

|

|

|

|

|

|

|

|

|

|

|

|

39,098

|

|

|

Total shareholders’ equity

|

|

|

338,690

|

|

|

|

|

|

|

|

|

|

|

|

338,690

|

|

|

Noncontrolling interests

|

|

|

310,859

|

|

|

|

13,500

|

|

|

|

|

|

|

|

324,359

|

|

|

Total equity

|

|

|

649,549

|

|

|

|

13,500

|

|

|

|

|

|

|

|

663,049

|

|

|

Total liabilities and equity

|

|

$

|

1,606,467

|

|

|

$

|

60,633

|

|

|

$

|

—

|

|

|

$

|

1,667,100

|

|

The accompanying notes are an integral part

of these unaudited pro forma condensed consolidated financial statements.

ACADIA REALTY TRUST AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

For the Nine Months Ended September 30, 2011

|

(dollars in thousands, except per share amounts)

|

|

Company

Historical

(aa)

|

|

Previous

Acquisitions

(bb)

|

|

Acquisition of

Parkway

(cc)

|

|

Company

Pro Forma

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

85,564

|

|

|

$

|

5,522

|

|

|

|

|

|

|

$

|

91,086

|

|

|

Interest income

|

|

|

9,493

|

|

|

|

|

|

|

|

|

|

|

|

9,493

|

|

|

Expense reimbursements

|

|

|

16,213

|

|

|

|

1,633

|

|

|

|

|

|

|

|

17,846

|

|

|

Management fee income

|

|

|

1,169

|

|

|

|

|

|

|

|

|

|

|

|

1,169

|

|

|

Other

|

|

|

1,849

|

|

|

|

|

|

|

|

|

|

|

|

1,849

|

|

|

Total revenues

|

|

|

114,288

|

|

|

|

7,155

|

|

|

|

|

|

|

|

121,443

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating

|

|

|

22,565

|

|

|

|

543

|

|

|

|

|

|

|

|

23,108

|

|

|

Real estate taxes

|

|

|

13,792

|

|

|

|

1,220

|

|

|

|

|

|

|

|

15,012

|

|

|

General and administrative

|

|

|

17,147

|

|

|

|

|

|

|

|

|

|

|

|

17,147

|

|

|

Depreciation and amortization

|

|

|

24,626

|

|

|

|

1,560

|

|

|

|

|

|

|

|

26,186

|

|

|

Total operating expenses

|

|

|

78,130

|

|

|

|

3,323

|

|

|

|

|

|

|

|

81,453

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

36,158

|

|

|

|

3,832

|

|

|

|

|

|

|

|

39,990

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated affiliates

|

|

|

3,025

|

|

|

|

|

|

|

|

562

|

|

|

|

3,587

|

|

|

Other interest income

|

|

|

219

|

|

|

|

|

|

|

|

|

|

|

|

219

|

|

|

Gain on debt extinguishment

|

|

|

1,268

|

|

|

|

|

|

|

|

|

|

|

|

1,268

|

|

|

Interest and other finance expense

|

|

|

(27,598

|

)

|

|

|

(2,105

|

)

|

|

|

|

|

|

|

(29,703

|

)

|

|

Income from continuing operations before income taxes

|

|

|

13,072

|

|

|

|

1,727

|

|

|

|

562

|

|

|

|

15,361

|

|

|

Income tax provision

|

|

|

(7

|

)

|

|

|

|

|

|

|

|

|

|

|

(7

|

)

|

|

Income from continuing operations

|

|

|

13,065

|

|

|

|

1,727

|

|

|

|

562

|

|

|

|

15,354

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income from discontinued operations

|

|

|

702

|

|

|

|

|

|

|

|

|

|

|

|

702

|

|

|

Impairment of asset

|

|

|

(6,925

|

)

|

|

|

|

|

|

|

|

|

|

|

(6,925

|

)

|

|

Gain on sale of property

|

|

|

32,498

|

|

|

|

|

|

|

|

|

|

|

|

32,498

|

|

|

Income from discontinued operations

|

|

|

26,275

|

|

|

|

|

|

|

|

|

|

|

|

26,275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

39,340

|

|

|

|

1,727

|

|

|

|

562

|

|

|

|

41,629

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interests

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

|

3,597

|

|

|

|

(391

|

)

|

|

|

(451

|

)

|

|

|

2,755

|

|

|

Discontinued operations

|

|

|

731

|

|

|

|

|

|

|

|

|

|

|

|

731

|

|

|

Net loss (income) attributable to noncontrolling interests

|

|

|

4,328

|

|

|

|

(391

|

)

|

|

|

(451

|

)

|

|

|

3,486

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Common Shareholders

|

|

$

|

43,668

|

|

|

$

|

1,336

|

|

|

$

|

111

|

|

|

$

|

45,115

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

0.41

|

|

|

$

|

0.03

|

|

|

$

|

0.00

|

|

|

$

|

0.45

|

|

|

Income from discontinued operations

|

|

|

0.67

|

|

|

|

—

|

|

|

|

—

|

|

|

|

0.67

|

|

|

Basic earnings per share

|

|

$

|

1.08

|

|

|

$

|

0.03

|

|

|

$

|

0.00

|

|

|

$

|

1.12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

0.41

|

|

|

$

|

0.03

|

|

|

$

|

0.00

|

|

|

$

|

0.45

|

|

|

Income from discontinued operations

|

|

|

0.67

|

|

|

|

—

|

|

|

|

—

|

|

|

|

0.67

|

|

|

Diluted earnings per share

|

|

$

|

1.08

|

|

|

$

|

0.03

|

|

|

$

|

0.00

|

|

|

$

|

1.12

|

|

The accompanying notes

are an integral part of these unaudited pro forma condensed consolidated financial statements.

ACADIA

REALTY TRUST AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

For the Year Ended December 31, 2010

|

(dollars in thousands, except per share amounts)

|

|

Company

Historical

(aa)

|

|

Previous

Acqusitions

(bb)

|

|

Acquisition of

Parkway

(cc)

|

|

Company

Pro Forma

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

106,913

|

|

|

$

|

9,276

|

|

|

|

|

|

|

$

|

116,189

|

|

|

Mortgage interest income

|

|

|

19,161

|

|

|

|

|

|

|

|

|

|

|

|

19,161

|

|

|

Expense reimbursements

|

|

|

22,030

|

|

|

|

2,848

|

|

|

|

|

|

|

|

24,878

|

|

|

Lease termination income

|

|

|

290

|

|

|

|

|

|

|

|

|

|

|

|

290

|

|

|

Management fee income

|

|

|

1,424

|

|

|

|

|

|

|

|

|

|

|

|

1,424

|

|

|

Other

|

|

|

2,140

|

|

|

|

|

|

|

|

|

|

|

|

2,140

|

|

|

Total revenues

|

|

|

151,958

|

|

|

|

12,124

|

|

|

|

|

|

|

|

164,082

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating

|

|

|

30,914

|

|

|

|

831

|

|

|

|

|

|

|

|

31,745

|

|

|

Real estate taxes

|

|

|

18,245

|

|

|

|

2,171

|

|

|

|

|

|

|

|

20,416

|

|

|

General and administrative

|

|

|

20,220

|

|

|

|

|

|

|

|

|

|

|

|

20,220

|

|

|

Depreciation and amortization

|

|

|

40,115

|

|

|

|

2,486

|

|

|

|

|

|

|

|

42,601

|

|

|

Total operating expenses

|

|

|

109,494

|

|

|

|

5,488

|

|

|

|

|

|

|

|

114,982

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

42,464

|

|

|

|

6,636

|

|

|

|

|

|

|

|

49,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated affiliates

|

|

|

10,971

|

|

|

|

|

|

|

|

749

|

|

|

|

11,720

|

|

|

Other interest income

|

|

|

408

|

|

|

|

|

|

|

|

|

|

|

|

408

|

|

|

Gain from bargain purchase

|

|

|

33,805

|

|

|

|

|

|

|

|

|

|

|

|

33,805

|

|

|

Interest and other finance expense

|

|

|

(34,471

|

)

|

|

|

(2,993

|

)

|

|

|

|

|

|

|

(37,464

|

)

|

|

Income from continuing operations before income taxes

|

|

|

53,177

|

|

|

|

3,643

|

|

|

|

749

|

|

|

|

57,569

|

|

|

Income tax provision

|

|

|

(2,890

|

)

|

|

|

|

|

|

|

|

|

|

|

(2,890

|

)

|

|

Income from continuing operations

|

|

|

50,287

|

|

|

|

3,643

|

|

|

|

749

|

|

|

|

54,679

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income from discontinued operations

|

|

|

380

|

|

|

|

|

|

|

|

|

|

|

|

380

|

|

|

Income from discontinued operations

|

|

|

380

|

|

|

|

|

|

|

|

|

|

|

|

380

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

50,667

|

|

|

|

3,643

|

|

|

|

749

|

|

|

|

55,059

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interests

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

|

(20,307

|

)

|

|

|

(1,926

|

)

|

|

|

(602

|

)

|

|

|

(22,835

|

)

|

|

Discontinued operations

|

|

|

(303

|

)

|

|

|

|

|

|

|

|

|

|

|

(303

|

)

|

|

Net income attributable to noncontrolling interests

|

|

|

(20,610

|

)

|

|

|

(1,926

|

)

|

|

|

(602

|

)

|

|

|

(23,138

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Common Shareholders

|

|

$

|

30,057

|

|

|

$

|

1,717

|

|

|

$

|

147

|

|

|

$

|

31,921

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

0.75

|

|

|

$

|

0.04

|

|

|

$

|

0.00

|

|

|

$

|

0.80

|

|

|

Income from discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Basic earnings per share

|

|

$

|

0.75

|

|

|

$

|

0.04

|

|

|

$

|

0.00

|

|

|

$

|

0.80

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

0.74

|

|

|

$

|

0.04

|

|

|

$

|

0.00

|

|

|

$

|

0.80

|

|

|

Income from discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Diluted earnings per share

|

|

$

|

0.74

|

|

|

$

|

0.04

|

|

|

$

|

0.00

|

|

|

$

|

0.80

|

|

The accompanying notes are an integral part

of these unaudited pro forma condensed consolidated financial statements.

ACADIA REALTY TRUST AND SUBSIDIARIES

NOTES TO UNAUDITED

PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Basis of Pro Forma Presentation

Acadia Realty Trust and subsidiaries (collectively, the “Company”),

is a fully-integrated equity real estate investment trust focused on the ownership, management and redevelopment of retail properties

and urban/infill mixed-use properties with a retail component concentration located primarily in high-barrier-to-entry, densely-populated

metropolitan areas in the United States along the East Coast and in Chicago.

The consolidated financial statements include the consolidated accounts

of the Company and its investments in partnerships and limited liability companies in which the Company is presumed to have control

in accordance with the consolidation guidance of the Financial Accounting Standards Board Accounting Standards Codification (“ASC”).

Investments in entities for which the Company has the ability to exercise significant influence but does not have financial or

operating control, are accounted for under the equity method of accounting. Accordingly, the Company’s share of the net earnings

(or losses) of entities accounted for under the equity method are included in consolidated net income under the caption, Equity

in Earnings (Losses) of Unconsolidated Affiliates. Investments in entities for which the Company does not have the ability to exercise

any influence are accounted for under the cost method of accounting.

During December 2011, the Company, through

Acadia Strategic Opportunity III LLC (“Fund III”), and together with an unaffiliated joint venture partner, acquired

Parkway Crossing (“Parkway”) for $21.5 million, of which $14.0 million was funded with new mortgage debt obtained at

closing and the balance of $7.5 million funded with cash. Fund III’s share of cash required for the acquisition was $6.7

million.

Note 2 — Adjustments to Unaudited Pro Forma Condensed

Consolidated Balance Sheet

(a) Represents the historical consolidated balance sheet of

the Company as of September 30, 2011.

(b) Reflects those acquisitions as previously disclosed in

the Company’s Form 8-K as filed with the Securities and Exchange Commission on November 3, 2011.

ACADIA REALTY TRUST AND SUBSIDIARIES

NOTES TO UNAUDITED

PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 3 — Adjustments to Unaudited Pro Forma Condensed

Consolidated Statements of Income

(aa) Represents the unaudited historical consolidated statements

of income for the Company for the nine months ended September 30, 2011 and year ended December 31, 2010.

(bb) Represents the unaudited historical combined statements

of revenues and certain operating expenses for those acquisitions as previously disclosed in the Company’s Form 8-K as filed

with the Securities and Exchange Commission on November 3, 2011.

(cc) Represents the unaudited historical statement of revenues

and certain operating expenses for Parkway for the nine months ended September 30, 2011 and the year ended December 31, 2010.

Funds from Operations

Consistent with the National Association of Real Estate Investment

Trusts (“NAREIT”) definition, we define funds from operations (“FFO”) as net income attributable to common

shareholders (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciated property, plus depreciation

and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

We consider FFO and pro forma FFO to be an appropriate supplemental

disclosure of operating performance for an equity REIT due to its widespread acceptance and use within the REIT and analyst communities.

Pro forma FFO is presented to assist investors in analyzing our performance. It is helpful as it excludes various items included

in net income that are not indicative of the operating performance, such as gains (or losses) from sales of operating property

and depreciation and amortization. However, our method of calculating Pro forma FFO may be different from methods used by other

REITs and, accordingly, may not be comparable to such other REITs. Pro forma FFO does not represent cash generated from operations

as defined by GAAP and is not indicative of cash available to fund all cash needs, including distributions. Pro forma FFO should

not be considered as an alternative to net income for the purpose of evaluating our performance or to cash flows as a measure of

liquidity.

ACADIA REALTY TRUST AND SUBSIDIARIES

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

Funds from Operations (continued)

The reconciliation of net income to Pro forma FFO for the year

ended 2010 is as follows:

|

(amounts in thousands except per share amounts)

|

|

Company Historical

|

|

Previous

Acqusitions

(i)

|

|

Acquisition of Parkway

|

|

Company

Pro Forma

|

|

|

|

|

|

|

|

|

|

|

|

Funds From Operations

|

|

|

|

|

|

|

|

|

|

Net income attributable to Common

Shareholders

|

|

$

|

30,057

|

|

|

$

|

1,716

|

|

|

$

|

147

|

|

|

$

|

31,920

|

|

|

Depreciation of real estate and

amortization of leasing costs

(net of noncontrolling interests’ share)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated affiliates

|

|

|

18,445

|

|

|

|

2,486

|

|

|

|

|

|

|

|

20,931

|

|

|

Unconsolidated affiliates

|

|

|

1,561

|

|

|

|

—

|

|

|

|

72

|

|

|

|

1,633

|

|

|

Income attributable to noncontrolling

interests’ in Operating Partnership

|

|

|

377

|

|

|

|

21

|

|

|

|

2

|

|

|

|

400

|

|

|

Funds from operations

|

|

$

|

50,440

|

|

|

$

|

4,223

|

|

|

$

|

221

|

|

|

$

|

54,884

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds From Operations per Share - Diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of Common

Shares and OP Units

|

|

|

40,876

|

|

|

|

40,876

|

|

|

|

40,876

|

|

|

|

40,876

|

|

|

Diluted funds from operations, per share

|

|

$

|

1.23

|

|

|

$

|

0.10

|

|

|

$

|

0.01

|

|

|

$

|

1.34

|

|

(i) Represents those acquisitions as previously disclosed in

the Company’s Form 8-K as filed with the Securities and Exchange Commission on November 3, 2011.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ACADIA REALTY TRUST

|

|

|

(Registrant)

|

|

|

|

|

Date: January 27, 2012

|

By:

|

/s/ Jonathan Grisham

|

|

|

Name: Jonathan Grisham

Title: Sr. Vice President

and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

23.1

|

|

Consent of BDO

|

|

|

|

|

|

|

|

|

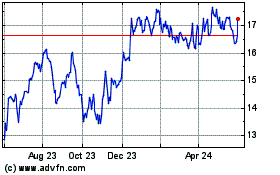

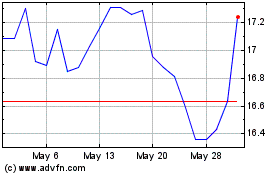

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From May 2024 to Jun 2024

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jun 2023 to Jun 2024