Pfizer Nutrition Business Could Fit Nestle

July 29 2011 - 6:31AM

Dow Jones News

Nestle SA (NESN.VX) is rumored to be among the potential buyers

for Pfizer Inc.'s (PFE) nutrition business after the U.S.

pharmaceutical company said it was exploring strategic options for

the unit.

Nestle, along with Danone SA (BN.FR), Abbott Laboratories (ABT)

and Mead Johnson Nutrition Co. (MJN) are among the companies to

have been linked with the Pfizer unit, which analysts value at $7.8

billion to $10.4 billion.

A purchase by Nestle would help it improve margins at its own

nutrition business, which generated sales of 10.8 billion Swiss

francs ($13.49 billion) in 2010, said Bank Vontobel analyst

Jean-Philippe Bertschy.

Currently the business has margins of around 19% but it wants to

increase them further in the next two or three years.

The Pfizer business, which generated sales of $1.8 billion in

2010 and had a profit margin of 20% to 25%, could also bolster the

position of Nestle's infant nutrition business in Asia, Bertschy

added.

The Pfizer business has an 11% share of the Chinese

market--bigger than Nestle--and 16% in Hong Kong.

"A purchase by Nestle would help Nestle secure its No. 1

position," said Bertschy. "Thanks to synergies, Nestle might be

able to get margins in excess of 20%."

Nestle was also more able to afford the cost than its rivals, he

added.

"We might have some antitrust concerns, but I don't think this

will be a major concern. I think Nestle would be prepared to sell

some businesses in some countries."

Nestle spokeswoman Melanie Kohli said, "As a matter of principle

we do not comment on market rumors."

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

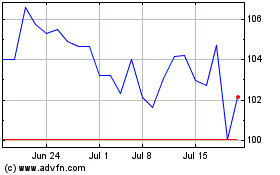

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2024 to May 2024

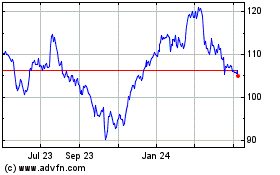

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From May 2023 to May 2024