Yield10 Bioscience, Inc. (Nasdaq:YTEN) ("Yield10" or the

"Company"), an agricultural bioscience company, today reported

financial results for the three and twelve months ended

December 31, 2021.

"In 2021 we executed against our strategic plan to position

Camelina as a commercial platform crop for the production of

low-carbon petroleum replacements and food products," said Oliver

Peoples, Ph.D., Chief Executive Officer of Yield10 Bioscience. "We

made solid progress as we focused on activities to position Yield10

to be able to launch and commercialize Camelina as a platform crop

to supply low-carbon feedstock oil for the renewable diesel market.

In addition, we advanced development of PHA bioplastics in

Camelina. These products are aligned with decarbonizing

transportation fuels and achieving zero plastic waste. Progress was

also made on expanding the patent position and mapping out the

regulatory strategy for the Camelina omega-3 (DHA+EPA) nutritional

oil. This sustainable fish oil replacement product together with

the high protein meal co-product from Camelina seed processing

represent significant additional market opportunities aligned with

global trends in sustainability, health and wellness, and food

security.

"Yield10 achieved significant momentum in early 2022 that we

anticipate continuing through the course of the year. Our

commercial team is engaging with potential supply chain

participants in the renewable diesel market while starting outreach

to growers to produce Camelina seed and oil under contract.

Together, these activities will enable our vision of establishing a

'capital light' low-carbon Camelina feedstock oil business.

"Furthermore, our research and development team continues to be

highly productive advancing the discovery and development of novel

seed yield and oil content performance traits, as well as deploying

well-established herbicide tolerance traits and pest resistance

traits into our Elite Camelina germplasm. Our goal is to develop

and launch our differentiated Elite Camelina varieties which

demonstrate economic value and attract grower interest to access

increasing acreage over time," said Peoples.

Recent Accomplishments

- Establishing commercial capabilities: Yield10

named Darren Greenfield as senior director of seed operations in

early 2022. He joined the Company from BASF Canada and brings more

than 25 years of experience with major agriculture companies

managing the development and commercial production of proprietary

canola plant varieties.

- Highlights of 2021 spring field test program:

Yield10 recently announced field test results showing that C3020

tested in Camelina and C3007 tested in canola produce increases in

seed oil content of up to 9 percent and 5 percent, respectively.

Camelina line E3902 showed a consistent 5 percent increase in oil

content as a percentage of seed weight over control plants and seed

scale up activities are continuing over winter 2021/2022. Yield10

also reported that PHA C3015 Camelina lines produced PHA at 6

percent of the total seed weight. Yield10 also collected

performance data on more than 20 base germplasm varieties, and

confirmed herbicide tolerance in a Camelina line sourced from a

third party.

- Advancing 2021/2022 winter season field testing and

seed scale up: Yield10 is performing seed scale up for

Camelina line E3902 as well as two winter Camelina lines to enable

larger acreage planting. Yield10's DH12 spring variety as well as

Camelina line E3902 were planted to determine if winter planting in

certain areas of the U.S. could be viable for these spring lines.

The harvest of seed from sites in the U.S. and Canada is expected

in second quarter 2022.

- Planning for 2022 field test program and seed scale up

underway: Yield10 plans to continue scaling up spring and

winter varieties of Camelina suitable to produce low-carbon

feedstock oil for renewable diesel. The Company also plans to test

several performance traits, conduct initial testing of a herbicide

tolerance trait in Camelina line E3902, and to scale up our

prototype Camelina PHA line for process development and product

sampling.

COVID-19 Impact on Operations. The Company has

implemented business continuity plans to address the COVID-19

pandemic and minimize disruptions to ongoing operations. To date,

despite the pandemic, Yield10 was able to move forward with the

operational steps required to execute its 2021-2022 winter field

trials in Canada and the United States. However, it is possible

that any potential future closures of research facilities, should

they continue for an extended time, or delays in receiving supplies

and materials needed to conduct field trials and research, or

economic repercussions of the pandemic or other geopolitical

uncertainty, such as the ongoing conflict between Ukraine and

Russia, could adversely impact the Company's anticipated time

frames for evaluating and/or reporting data from our field trials

and other work we plan to accomplish during 2022 and beyond.

FULL YEAR AND FOURTH QUARTER 2021 FINANCIAL

OVERVIEW

Cash Position

Yield10 Bioscience is managed with an emphasis on cash flow and

deploys its financial resources in a disciplined manner to achieve

its key strategic objectives.

The Company used $9.3 million in cash for its operating

activities during the year ended December 31, 2021 in

comparison to $8.7 million used for operating activities during the

year ended December 31, 2020. During early 2021, Yield10

raised $12.7 million, before issuance costs of $0.7 million, in an

underwritten public securities offering of 1,040,000 shares of

common stock and received additional cash of $3.9 million from

investors who exercised 481,973 warrants issued in the Company's

November 2019 securities offering. As a result, the Company ended

2021 with $16.0 million in unrestricted cash and cash equivalents

in comparison to a balance in unrestricted cash and cash

equivalents of $9.7 million as of December 31, 2020. The

Company anticipates total net cash usage during the year ended

December 31, 2022 in a range of $12.0 - $12.5 million as it

continues its controlled growth to support initial Camelina

commercialization activities. Yield10's present capital resources

are expected to fund its planned operations and to meet its

contractual obligations into the first quarter of 2023.

Operating Results

Research grant revenue for the year ended December 31, 2021

was $0.6 million in comparison to grant revenue of $0.8 million

recorded in the previous year. Research and development expense was

$6.2 million during the year ended December 31, 2021 compared

to $5.4 million recorded for the year ended December 31, 2020.

General and administrative expenses were $6.1 million and $5.0

million for the years ended December 31, 2021 and 2020,

respectively.

Yield10 reported a loss from operations of $11.7 million for the

full year 2021 as compared to a loss from operations of $9.6

million in 2020. For the year ended December 31, 2021, the

Company reported a net loss after taxes of $11.0 million, or $2.33

per share, in comparison to a net loss after taxes of $10.2

million, or $4.30 per share, during the year ended

December 31, 2020.

Research grant revenues were $0.2 million for each of the fourth

quarters of 2021 and 2020. Research and development expense

increased by $0.2 million from $1.4 million in the fourth quarter

of 2020 to $1.6 million in the fourth quarter of 2021. General and

administrative expenses also increased during the fourth quarter of

2021 by $0.1 million to $1.5 million in comparison to the fourth

quarter of 2020.

Yield10 reported a loss after taxes of $3.0 million for the

fourth quarter of 2021, or $0.61 per share, compared to a loss

after taxes of $2.6 million, or $0.79 per share, in the fourth

quarter of 2020.

Other Income (Expense)

Included within other income (expense) during the Company's year

ended December 31, 2021 is an investment gain of $0.7 million

from the surrender of its preferred shares in Tepha, Inc., a

related party, as a result of Tepha's merger with Becton Dickinson.

During the year ended December 31, 2020, other income

(expense) included a non-cash charge of $1.0 million resulting from

a change in the fair value of its warrant liability and the receipt

of $0.3 million in loan proceeds received in connection with a

Paycheck Protection Act Loan issued and forgiven under the

Coronavirus Aid, Relief and Economic Security Act.

Conference Call Information

Yield10 Bioscience management will host a conference call today

at 4:30 p.m. (ET) to discuss the fourth quarter and full year 2021

results. The Company also will provide a corporate update and

answer questions from the investor community. A live webcast of the

call with slides can be accessed through the Company's website at

www.yield10bio.com in the investor relations events section.

To participate in the call, dial toll-free 877-709-8150 or

201-689-8354 (international).

To listen to a telephonic replay of the conference call, dial

toll-free 877-660-6853 or 201-612-7415 (international) and enter

pass code 13727169. The replay will be available until March 30,

2022. In addition, the webcast will be archived on the Company's

website in the investor relations events section.

About Yield10 BioscienceYield10 Bioscience,

Inc. is an agricultural bioscience company that is using its

differentiated trait gene discovery platform, the “Trait Factory”,

to develop improved Camelina varieties for the production of

proprietary seed products, and to discover high value genetic

traits for the agriculture and food industries. Our goals are to

efficiently establish a high value seed products business based on

developing superior varieties of Camelina for the production of

feedstock oils for renewable diesel, PHA bioplastics and omega-3

(DHA+EPA) oils, and to license our yield traits to major seed

companies for commercialization in major row crops, including corn,

soybean and canola. Yield10 is headquartered in Woburn, MA and has

an Oilseeds Center of Excellence in Saskatoon, Canada.

For more information about the company, please visit

www.yield10bio.com, or follow the Company on Twitter, Facebook and

LinkedIn. (YTEN-E)

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements which are

made pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements in this release do not constitute guarantees of future

performance. Investors are cautioned that statements in this press

release which are not strictly historical statements, including,

without limitation, expectations regarding Yield10’s cash position,

cash forecasts and runway, expectations related to research and

development activities, intellectual property, the expected

regulatory path for traits, reproducibility of data from field

tests, the timing of completion of additional greenhouse and field

test studies, the outcomes of 2021-2022 winter field tests and seed

scale-up activities, the signing of research licenses and

collaborations, including whether the objectives of those

collaborations will be met, whether the Company will be able to

generate proof points for traits in development and advance

business discussions around its Camelina business plan, the

potential impact on operations of the COVID-19 pandemic, the

geopolitical uncertainty caused by the conflict between Ukraine and

Russia, and value creation as well as the overall progress of

Yield10 Bioscience, Inc., constitute forward-looking statements.

Such forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results to differ

materially from those anticipated, including the risks and

uncertainties detailed in Yield10 Bioscience’s filings with the

Securities and Exchange Commission. Yield10 Bioscience assumes no

obligation to update any forward-looking information contained in

this press release or with respect to the announcements described

herein.

Contacts:

Yield10 Bioscience:Lynne H. Brum, (617) 682-4693,

LBrum@yield10bio.com

Investor Relations: Bret Shapiro, (561) 479-8566,

brets@coreir.com Managing Director, CORE IR

Media Inquiries: Eric Fischgrund,

eric@fischtankpr.com FischTank Marketing and PR

(FINANCIAL TABLES FOLLOW)

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF

OPERATIONSUNAUDITED(In thousands,

except share and per share amounts)

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Grant revenue |

$ |

152 |

|

|

$ |

195 |

|

|

$ |

614 |

|

|

$ |

799 |

|

|

Total revenue |

|

152 |

|

|

|

195 |

|

|

|

614 |

|

|

|

799 |

|

| Expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

1,598 |

|

|

|

1,422 |

|

|

|

6,201 |

|

|

|

5,361 |

|

|

General and administrative |

|

1,522 |

|

|

|

1,383 |

|

|

|

6,105 |

|

|

|

5,047 |

|

|

Total expenses |

|

3,120 |

|

|

|

2,805 |

|

|

|

12,306 |

|

|

|

10,408 |

|

|

Loss from operations |

|

(2,968 |

) |

|

|

(2,610 |

) |

|

|

(11,692 |

) |

|

|

(9,609 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Change in fair value of warrants |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(957 |

) |

|

Loan forgiveness income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

333 |

|

|

Gain on investment in related party |

|

— |

|

|

|

— |

|

|

|

700 |

|

|

|

— |

|

|

Other income (expense), net |

|

(1 |

) |

|

|

(2 |

) |

|

|

(3 |

) |

|

|

83 |

|

|

Total other income (expense) |

|

(1 |

) |

|

|

(2 |

) |

|

|

697 |

|

|

|

(541 |

) |

| Loss from operations before

income taxes |

|

(2,969 |

) |

|

|

(2,612 |

) |

|

|

(10,995 |

) |

|

|

(10,150 |

) |

|

Income tax provision |

|

(11 |

) |

|

|

(30 |

) |

|

|

(36 |

) |

|

|

(56 |

) |

| Net loss |

$ |

(2,980 |

) |

|

$ |

(2,642 |

) |

|

$ |

(11,031 |

) |

|

$ |

(10,206 |

) |

| |

|

|

|

|

|

|

|

| Basic and diluted net loss per

share |

$ |

(0.61 |

) |

|

$ |

(0.79 |

) |

|

$ |

(2.33 |

) |

|

$ |

(4.30 |

) |

| Number of shares used in per

share calculations: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

4,881,809 |

|

|

|

3,333,870 |

|

|

|

4,731,833 |

|

|

|

2,373,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

BALANCE SHEETSUNAUDITED(In

thousands, except share and per share amounts)

| |

December 31,2021 |

|

December 31,2020 |

| Assets |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

5,329 |

|

|

$ |

3,423 |

|

|

Short-term investments |

|

10,661 |

|

|

|

6,279 |

|

|

Accounts receivable |

|

164 |

|

|

|

86 |

|

|

Unbilled receivables |

|

34 |

|

|

|

27 |

|

|

Prepaid expenses and other current assets |

|

436 |

|

|

|

527 |

|

|

Total current assets |

|

16,624 |

|

|

|

10,342 |

|

| Restricted cash |

|

264 |

|

|

|

264 |

|

| Property and equipment,

net |

|

890 |

|

|

|

921 |

|

| Right-of-use assets |

|

2,354 |

|

|

|

2,712 |

|

| Other assets |

|

283 |

|

|

|

283 |

|

|

Total assets |

$ |

20,415 |

|

|

$ |

14,522 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

83 |

|

|

$ |

60 |

|

|

Accrued expenses |

|

1,136 |

|

|

|

1,297 |

|

|

Lease liabilities |

|

514 |

|

|

|

457 |

|

|

Total current liabilities |

|

1,733 |

|

|

|

1,814 |

|

|

Lease liabilities, net of current portion |

|

2,649 |

|

|

|

3,163 |

|

|

Other liabilities |

|

7 |

|

|

|

13 |

|

|

Total liabilities |

|

4,389 |

|

|

|

4,990 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' Equity: |

|

|

|

|

Preferred stock ($0.01 par value per share); 5,000,000 shares

authorized; no shares issued or outstanding |

|

— |

|

|

|

— |

|

|

Common stock ($0.01 par value per share); 60,000,000 shares

authorized at December 31, 2021 and 2020, and 4,881,851 and

3,334,048 shares issued and outstanding at December 31, 2021

and 2020, respectively |

|

49 |

|

|

|

33 |

|

| Additional paid-in

capital |

|

402,283 |

|

|

|

384,758 |

|

| Accumulated other

comprehensive loss |

|

(175 |

) |

|

|

(159 |

) |

| Accumulated deficit |

|

(386,131 |

) |

|

|

(375,100 |

) |

|

Total stockholders' equity |

|

16,026 |

|

|

|

9,532 |

|

|

Total liabilities and stockholders' equity |

$ |

20,415 |

|

|

$ |

14,522 |

|

|

|

|

|

|

|

|

|

|

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH

FLOWSUNAUDITED(In

thousands)

| |

|

Years Ended December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

| Cash flows from

operating activities |

|

|

|

|

| Net loss |

|

$ |

(11,031 |

) |

|

$ |

(10,206 |

) |

| Adjustments to reconcile net

loss to cash used in operating activities: |

|

|

|

|

| Depreciation |

|

|

220 |

|

|

|

182 |

|

| Change in fair value of

warrants |

|

|

— |

|

|

|

957 |

|

| Loan forgiveness income |

|

|

— |

|

|

|

(333 |

) |

| Loss on disposal of fixed

assets |

|

|

— |

|

|

|

206 |

|

| Expense for 401(k) company

common stock match |

|

|

112 |

|

|

|

109 |

|

| Stock-based compensation |

|

|

1,675 |

|

|

|

739 |

|

| Noncash lease expense |

|

|

358 |

|

|

|

429 |

|

| Deferred tax asset |

|

|

35 |

|

|

|

56 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

Accounts receivable |

|

|

(78 |

) |

|

|

(14 |

) |

|

Unbilled receivables |

|

|

(7 |

) |

|

|

(7 |

) |

|

Prepaid expenses and other assets |

|

|

63 |

|

|

|

(69 |

) |

|

Accounts payable |

|

|

23 |

|

|

|

(219 |

) |

|

Accrued expenses |

|

|

(160 |

) |

|

|

99 |

|

|

Other liabilities |

|

|

(6 |

) |

|

|

13 |

|

|

Lease liabilities |

|

|

(457 |

) |

|

|

(601 |

) |

|

Net cash used in operating activities |

|

|

(9,253 |

) |

|

|

(8,659 |

) |

| |

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

| Purchase of property and

equipment |

|

|

(189 |

) |

|

|

(76 |

) |

| Proceeds from sale of property

and equipment |

|

|

— |

|

|

|

10 |

|

| Purchase of investments |

|

|

(10,639 |

) |

|

|

(9,279 |

) |

| Proceeds from sale and

maturity of short-term investments |

|

|

6,250 |

|

|

|

8,700 |

|

|

Net cash used in investing activities |

|

|

(4,578 |

) |

|

|

(645 |

) |

| |

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

| Proceeds from warrants

exercised |

|

|

3,856 |

|

|

|

1,658 |

|

| Proceeds from PPP loan |

|

|

— |

|

|

|

333 |

|

| Proceeds from securities

offerings, net of issuance costs |

|

|

11,993 |

|

|

|

5,305 |

|

| Taxes paid on employees'

behalf related to vesting of stock awards |

|

|

(103 |

) |

|

|

(17 |

) |

|

Net cash provided in financing activities |

|

|

15,746 |

|

|

|

7,279 |

|

| |

|

|

|

|

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

|

(9 |

) |

|

|

(37 |

) |

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

|

|

1,906 |

|

|

|

(2,062 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

3,687 |

|

|

|

5,749 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

5,593 |

|

|

$ |

3,687 |

|

| |

|

|

|

|

| Supplemental Cash Flow

Disclosure: |

|

|

|

|

| Interest paid |

|

$ |

9 |

|

|

$ |

8 |

|

| |

|

|

|

|

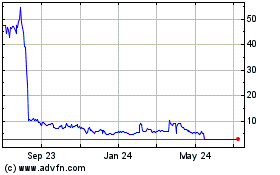

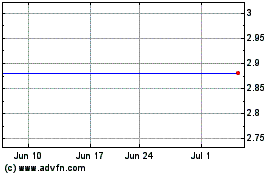

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Nov 2023 to Nov 2024