NOTES TO THE FINANCIAL STATEMENTS AS OF DEC. 31, 2019 AND 2018 AND FOR THE YEAR ENDED DEC. 31, 2019

1. DESCRIPTION OF PLANS

The following includes a brief description of the New Century Energies, Inc. Employees’ Savings and Stock Ownership Plan for Bargaining Unit Employees and Former Non-Bargaining Unit Employees (BU Savings Plan) and the New Century Energies, Inc. Employee Investment Plan for Bargaining Unit Employees and Former Non-Bargaining Unit Employees (EIP Savings Plan), collectively the “Plans.” Participants should refer to their respective Plan Document or Summary Plan Description for more complete information. The notes to the financial statements generally apply to the Plans and specific disclosures are presented to address matters for individual plans, where applicable.

General – The Plans are defined contribution benefit plans which provide eligible employees of Plan sponsor, Xcel Energy Inc., and its participating subsidiaries (Xcel Energy) the opportunity to contribute to a qualified retirement savings plan. Each Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA), as amended.

For the BU Savings Plan and the EIP Savings Plan, Xcel Energy contributes the employer matching contribution in cash. Participant deferrals and matching contributions are invested into one or more investment funds as elected by the participants.

Plan and Trust Management – The Plan administrator is Xcel Energy, who has authority to control and manage the operation and administration of the Plans. Plan assets are held by a trustee under a trust agreement as adopted by Xcel Energy. The Plans’ assets invested in Xcel Energy Inc. common stock are held in the Xcel Energy Stock Fund within the Master Trust (see Note 4). The Xcel Energy Stock Fund also holds an immaterial amount of cash equivalents for operational purposes. Individual participant accounts are valued daily based on the current market value of each asset type. The Vanguard Group is the record keeper and Vanguard Fiduciary Trust Company (VFTC) serves as trustee for the Plans.

Transfer of Plan Assets – Assets are typically transferred amongst plans when a participant moves from one benefit plan to another within Xcel Energy. In 2019, $45,447 of participant assets were transferred from the BU Savings Plan to the Xcel Energy 401(k) Savings Plan as reported on the Statement of Changes in Net Assets Available for Benefits for the year ended Dec. 31, 2019. There were no participant assets transferred from (or into) the EIP Savings Plan in 2019.

Eligibility

BU Savings Plan

All regular, full-time employees of Xcel Energy whose collective bargaining agreement allows for participation in the Plan on the first day of the month following date of hire, while a regular, part-time employee (one who works less than 40 hours per week) must complete one year and 1,000 hours of service to become eligible.

EIP Savings Plan

All regular, full-time employees of Xcel Energy whose collective bargaining agreement allows for participation in the Plan as soon as it is administratively feasible following their date of hire.

Employee and Employer Contributions – Each plan allows participants to contribute a portion of their compensation as pre-tax, pre-tax rollovers from other qualified retirement plans and allows for a discretionary employer matching contribution (see Note 3). The BU Savings Plan also allows participant after-tax contributions. The EIP Savings Plan allows Roth 401(k) after-tax contributions.

Vesting – Employee contributions, matching contributions made by Xcel Energy and earnings in each Plan are immediately vested.

Distributions

BU Savings Plan

Benefits may be distributed after termination of employment, disability, or death (payable to designated beneficiary) in the form of a single lump sum or installments, rollover to an IRA or another employer’s qualified plan.

EIP Savings Plan

Benefits may be distributed after termination of employment, disability, or death (payable to designated beneficiary) in the form of installments, a single lump sum or a rollover to an IRA or another employer’s qualified plan.

For each of the Plans, if the total amount of the participant’s vested account balance exceeds $1,000 at a distributable event, the participant may defer distribution until age 70½, unless the participant consents in writing to commence distributions at an earlier date. If the total amount is less than $1,000, the Plan Administrator will schedule a payment date and the amount will be distributed as soon as it is administratively possible. All vested account balances remaining in the Plans after the participant decides to terminate employment with Xcel Energy for any reason, will be invested in the funds of the participant’s choice. The participant will continue to receive their share of investment earnings and dividend distributions until the account is completely distributed.

Participant Accounts – Both Plans maintain individual accounts for each participant. Each participant’s account is credited with the participant’s contributions, Company matching contributions, and Plan earnings as applicable. Participant accounts are also charged with withdrawals, an allocation of Plan losses as applicable, and administrative expenses not paid by the Company. Allocations are based on participant earnings or account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Forfeited Amounts – For the plan year ended Dec. 31, 2019, Xcel Energy did not apply forfeitures to reduce employer contributions.

Plan Termination – While Xcel Energy expects to continue the Plans, it reserves the right at its sole and absolute discretion to amend, modify, change or terminate the Plans for whatever reason it deems appropriate, subject to collective bargaining obligations. If Xcel Energy were to terminate the Plans, assets would be distributed in accordance with ERISA guidelines.

Administrative Expenses – Xcel Energy pays certain administrative expenses of the Plans. Certain investment advisory, trustee and recordkeeping fees are paid by the Plans or by the participant, as applicable. The Self Directed Brokerage Option annual account maintenance fee and plan recordkeeping fees are paid by the participant. Loan set-up fees are paid by Xcel Energy under the BU Savings Plan. Loan set-up fees and annual maintenance fees are paid by the participant under the EIP Savings Plan.

Xcel Energy Inc. Common Stock Dividends

BU Savings Plan

Dividends paid on shares held in Xcel Energy Inc. common stock within the Master Trust are paid quarterly to Plan participants in cash as a taxable distribution.

EIP Savings Plan

Dividends paid on shares held in Xcel Energy Inc. common stock within the Master Trust are automatically reinvested in Xcel Energy Inc. common stock unless the participant elects to receive them as a taxable cash distribution.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting – The accompanying financial statements of the Plans have been prepared under the accrual method of accounting in conformity with accounting principles generally accepted in the United States of America (GAAP).

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and changes therein and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of additions and deductions during the reporting period. Actual results could differ from those estimates.

Risks and Uncertainties – The Plans provide for investment in a variety of investment funds. Investments, in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investments, it is reasonably possible that changes in investment values will occur in the near term and such changes could materially affect participants’ account balances and amounts reported in the financial statements. For further discussion on the risks and uncertainties related to the novel coronavirus (COVID-19), see Note 10.

Fair Value Measurements – The Plans present money market funds and mutual funds (registered investment companies), the Xcel Energy Stock Fund held within the Master Trust, collective trusts, and self-directed brokerage accounts investments at fair value in its financial statements.

The fair values of money market funds are based on quoted net asset value, calculated as $1 per share, and thus are included in the Fair Value hierarchy as Level 1 investments (see note 6). The fair values of mutual funds and Xcel Energy Inc. common stock are based on quoted market prices.

The self-directed brokerage option allows participants to self-direct investments in a wider variety of mutual funds, equity securities, and debt securities. Within self-directed brokerage accounts, the fair value of mutual funds and equity securities are based on quoted market prices, while the fair values of debt securities are based on market interest rate curves and recent trades of similarly rated securities.

Collective trusts include investments in retirement target date trusts, which have been assigned as Level 2 investments, and are valued at the underlying investments’ net asset value at the close of the day multiplied by the number of shares in the fund. These assets did not have any unfunded commitments at Dec. 31, 2019, and 2018, and there are no redemption restrictions.

Notes Receivable from Participants – Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as deemed distributions based on Plan document terms.

Investments – The Plans’ net asset investments include money market funds, various mutual funds, collective trusts, a portion of the Master Trust, and self-directed brokerage accounts. Each participant elects the percentage of his or her account balance to be invested in each investment option. Investment income includes interest and dividends. Realized gains and losses on the sale of investments and unrealized gains or losses in the fair value of investments are shown as net appreciation (depreciation) in the fair value of investments. Total investment income is allocated to each fund based on the number of units in each fund. Security transactions are recognized on the trade date (the date the order to buy or sell is executed).

Income Recognition – The difference between fair value and cost of investments, including realized and unrealized gains and losses, is reflected in the Statements of Changes in Net Assets Available for Benefits. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date.

Payment of Benefits – Benefit payments are recorded when paid.

Recently Issued Accounting Pronouncements

Fair Value Measurement — In August 2018, the Financial Accounting Standards Board (FASB) issued Fair Value Measurement — Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement, Topic 820 (ASU No. 2018-13), which amends certain disclosure requirements of ASC 820, effective for fiscal years beginning after Dec. 15, 2019 with early adoption permitted. The ASU removed the requirement to disclose amounts and reasons for transfers between level 1 and level 2 of the fair value hierarchy, as well as the policy for timing of transfers between levels. The ASU also modified the disclosure for investments in certain entities that calculate NAV to disclose the timing of liquidation of an investee’s assets and the date when restrictions from redemption might lapse and clarified the requirement to disclose uncertainty in measurement as of the reporting date. The Plan is currently evaluating the impact of this ASU on its financial statements, but does not expect the ASU to have a material impact.

Recently Adopted Accounting Pronouncements

Master Trust Reporting – In February 2017, the FASB issued Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Plans (Topic 967), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting (Accounting Standards Update No. 2017-06). The amendments in this update state that for each master trust in which a plan holds an interest, a plan's interest in that master trust and any change in that interest are required to be presented in separate line items in the Statement of Net Assets Available for Benefits and in the Statement of Changes in Net Assets Available for Benefits. It also removes the requirement to disclose the percentage interest in master trust for plans with divided interest, but requires plans to disclose the dollar amount of their interest by investment type. Xcel Energy implemented the guidance on Jan. 1, 2019 and the adoption impacts were not material.

3. PLAN FUNDING

Employee Contributions

BU Savings Plan

Participants may elect to contribute up to 20% of their annual compensation in pre-tax contributions and up to 8% in after-tax contributions. The combination of pre-tax contributions up to $19,000 in 2019, and after-tax contributions cannot exceed 20% of their annual compensation. Participants who are age 50 or older during the Plan year may make additional pre-tax (catch-up) contributions up to $6,000 in 2019. The Plan is required to make corrective distributions when IRS limits are exceeded due to excess deferrals, excess contributions and excess annual additions, which are returned to participants during the subsequent Plan year.

EIP Savings Plan

Participants may elect to make either regular 401(k) pre-tax deferrals, Roth 401(k) after-tax deferrals or a combination of both not to exceed 30% of their base pay or $19,000 in 2019. Participants who are age 50 or older during the Plan year, may make additional catch-up contributions (pre-tax and/or Roth) up to $6,000 in 2019. The Plan is required to make corrective distributions when IRS limits are exceeded due to excess deferrals, excess contributions and excess annual additions, which are returned to participants during the subsequent Plan year.

The EIP Savings Plan has an automatic enrollment program for newly hired/rehired full-time employees in regular status. Eligible employees who do not make an affirmative election or do not waive Plan participation within 30 days from date of hire/rehire are automatically enrolled at an initial percentage of base pay (4% pre-tax in 2019 and 2018), contribution rates are automatically increased each year by 1% (capped at 10%), and their accounts are automatically invested in an age-appropriate target-date fund. Employees who are automatically enrolled can opt out of the default options and make their own independent choices at any time.

Employer Contributions

BU Savings Plan

Xcel Energy may contribute cash or shares of Xcel Energy stock as a matching contribution equal to 100% of the first 3%, and 50% of the next 4% of a participant’s pre-tax contribution during the Plan year. All Plan participants are eligible for the matching contribution, regardless of their employment status at year-end. Employer contributions may be made at any time during the Plan year or after its close, but not later than 60 days after the close of the Plan year. 2019 employer contributions were paid in February 2020. The contribution is based on each participant’s annual contribution and eligible compensation as defined in the Plan Document.

EIP Savings Plan

Xcel Energy may contribute cash or shares of Xcel Energy stock as a matching contribution equal to 50% of the first 8% of base pay contributed by the employee on a pre-tax and/or Roth 401(k) after-tax basis during the Plan year. All employees participating in the Plan are eligible for a matching contribution, regardless of their employment status at year-end. Matching contributions are allocated after the close of the Plan year, typically during the first quarter. 2019 employer contributions were paid in February 2020. The contribution is based on each employee’s annual contribution and eligible compensation as defined in the Plan Document.

Investment of Employee and Employer Contributions – Participants may invest their contributions among various investment funds offered by the Plans. Any dividends and interest earned on their investments will be reinvested in each of those same investments automatically. For the 2019 Plan year, Xcel Energy matching contributions made to the BU Savings Plan and the EIP Savings Plan were paid in cash and invested in accordance with the participant’s investment election.

4. INTEREST IN MASTER TRUST

The Master Trust is an investment vehicle consisting of Xcel Energy Inc. common stock and a small amount of cash to ensure daily liquidity. The Master Trust pools the stock investment from all four Xcel Energy Inc. sponsored 401(k) plans to reduce administrative and investment expenses. The value of each Plan’s interest in the Master Trust is based on the beginning of the year value of the interest in the Master Trust, plus actual contributions, transfers and allocated investment income or loss, less actual distributions and allocated administrative expenses. Investment income and administrative expenses related to the Master Trust are allocated to the individual plans based upon the daily valuation of the balances invested by each plan.

The net change in value from participation in the Master Trust is reported as one line item in the accompanying Statements of Changes in Net Assets Available for Benefits and each Plan’s interest in the Master Trust is reported as a single line item in the accompanying Statements of Net Assets Available for Benefits.

A summary of the Plans’ interest in Master Trust as of Dec. 31, 2019 and 2018 are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2019

|

|

|

|

|

|

|

BU Savings Plan

|

|

EIP Savings Plan

|

|

Interest in Master Trust (in approximate shares)

|

|

1,226,433

|

|

|

654,546

|

|

|

Interest in Master Trust (in percentage)

|

|

16.9

|

%

|

|

|

9.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2018

|

|

|

|

|

|

|

BU Savings Plan

|

|

EIP Savings Plan

|

|

Interest in Master Trust (in approximate shares)

|

|

1,401,553

|

|

|

752,437

|

|

|

Interest in Master Trust (in percentage)

|

|

17.8

|

%

|

|

|

9.5

|

%

|

A summary of the Plans’ interest in income from the Master Trust for the year ended Dec. 31, 2019 is below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended Dec. 31, 2019

|

|

|

|

|

|

|

BU Savings Plan

|

|

EIP Savings Plan

|

|

Interest in Income from the Master Trust (in percentage)

|

|

17.5

|

%

|

|

9.1

|

%

|

The Plans have an undivided interest in each security in the Master Trust.

A summary of the net assets of the Master Trust and the Plans’ interest in Master Trust as of Dec. 31, 2019 and 2018 are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2019

|

|

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

BU Savings Plan Interest in Master Trust Balances

|

|

EIP Savings Plan Interest in Master Trust Balances

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

$

|

461,335,591

|

|

|

$

|

77,866,254

|

|

|

$

|

41,557,125

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends receivable

|

|

2,942,840

|

|

|

496,706

|

|

|

265,091

|

|

|

|

|

Total net assets

|

|

$

|

464,278,431

|

|

|

$

|

78,362,960

|

|

|

$

|

41,822,216

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2018

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

BU Savings Plan Interest in Master Trust Balances

|

|

EIP Savings Plan Interest in Master Trust Balances

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

$

|

388,474,256

|

|

|

$

|

69,054,501

|

|

|

$

|

37,072,566

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends receivable

|

|

2,996,148

|

|

|

532,590

|

|

|

285,926

|

|

|

Total net assets

|

|

$

|

391,470,404

|

|

|

$

|

69,587,091

|

|

|

$

|

37,358,492

|

|

Master Trust and Plans’ interest in Master Trust income for the year ended Dec. 31, 2019 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2019

|

|

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

BU Savings Plan Interest in Master Trust Balances

|

|

EIP Savings Plan Interest in Master Trust Balances

|

|

|

|

Total interest, dividend and other income

|

|

$

|

12,180,716

|

|

|

$

|

2,095,705

|

|

|

$

|

1,099,318

|

|

|

|

|

Realized and unrealized gain in Xcel Energy Stock Fund

|

|

109,071,368

|

|

|

19,067,854

|

|

|

9,955,888

|

|

|

|

|

Total net gain

|

|

$

|

121,252,084

|

|

|

$

|

21,163,559

|

|

|

$

|

11,055,206

|

|

|

|

5. FEDERAL INCOME TAX STATUS

The Internal Revenue Service (IRS) has determined and informed Xcel Energy by letters dated March 24, 2017 and March 13, 2017, respectively, that the BU Savings Plan and the EIP Savings Plan meet the requirements of Section 401(a) of the Internal Revenue Code (IRC) of 1986, as amended. Xcel Energy believes that the Plans are currently designed and being operated in compliance with applicable requirements of the IRC and the Plans continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plans’ financial statements.

6. FAIR VALUE MEASUREMENTS

The accounting guidance for fair value measurements and disclosures provides a single definition of fair value and requires certain disclosures about assets and liabilities measured at fair value. A hierarchical framework for disclosing the observability of the inputs utilized in measuring assets and liabilities at fair value was established by this guidance. The three levels in the hierarchy are as follows:

Level 1 – Quoted prices are available in active markets for identical assets as of the reporting date. The types of assets included in Level 1 are highly liquid and actively traded instruments with quoted prices, such as listed mutual funds and money market funds.

Level 2 – Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as of the reporting date. The types of assets included in Level 2 are typically either comparable to actively traded securities or contracts, or priced with models using highly observable inputs, as is the case with preferred stock. The collective trusts are not actively traded on an exchange.

Level 3 – Significant inputs to pricing have little or no observability as of the reporting date. The types of assets included in Level 3 are those with inputs requiring significant management judgment or estimation.

The following tables present, for each of these hierarchy levels, the Plans’ assets measured at fair value on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BU Savings Plan

|

|

Dec. 31, 2019

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

235,380,098

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

235,380,098

|

|

|

Collective Trusts

|

|

—

|

|

|

150,612,547

|

|

|

—

|

|

|

150,612,547

|

|

|

Self-Directed Brokerage Accounts

|

|

4,843,730

|

|

|

54,792

|

|

|

—

|

|

|

4,898,522

|

|

|

Money Market Funds

|

|

27,490,021

|

|

|

—

|

|

|

—

|

|

|

27,490,021

|

|

|

Plan Interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

78,362,960

|

|

|

—

|

|

|

—

|

|

|

78,362,960

|

|

|

Total

|

|

$

|

346,076,809

|

|

|

$

|

150,667,339

|

|

|

$

|

—

|

|

|

$

|

496,744,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2018

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

201,430,255

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

201,430,255

|

|

|

Collective Trusts

|

|

—

|

|

|

123,412,770

|

|

|

—

|

|

|

123,412,770

|

|

|

Self-Directed Brokerage Accounts

|

|

4,552,727

|

|

|

12,794

|

|

|

—

|

|

|

4,565,521

|

|

|

Money Market Funds

|

|

26,828,467

|

|

|

—

|

|

|

—

|

|

|

26,828,467

|

|

|

Plan Interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

69,587,091

|

|

|

—

|

|

|

—

|

|

|

69,587,091

|

|

|

Total

|

|

$

|

302,398,540

|

|

|

$

|

123,425,564

|

|

|

$

|

—

|

|

|

$

|

425,824,104

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EIP Savings Plan

|

|

Dec. 31, 2019

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

44,564,479

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

44,564,479

|

|

|

Collective Trusts

|

|

—

|

|

|

43,919,614

|

|

|

—

|

|

|

43,919,614

|

|

|

Self-Directed Brokerage Accounts

|

|

234,560

|

|

|

—

|

|

|

—

|

|

|

234,560

|

|

|

Money Market Funds

|

|

4,676,714

|

|

|

—

|

|

|

—

|

|

|

4,676,714

|

|

|

Plan Interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

41,822,216

|

|

|

—

|

|

|

—

|

|

|

41,822,216

|

|

|

Total

|

|

$

|

91,297,969

|

|

|

$

|

43,919,614

|

|

|

$

|

—

|

|

|

$

|

135,217,583

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2018

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

35,761,786

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

35,761,786

|

|

|

Collective Trusts

|

|

—

|

|

|

34,897,549

|

|

|

—

|

|

|

34,897,549

|

|

|

Self-Directed Brokerage Accounts

|

|

241,378

|

|

|

—

|

|

|

—

|

|

|

241,378

|

|

|

Money Market Funds

|

|

5,523,816

|

|

|

—

|

|

|

—

|

|

|

5,523,816

|

|

|

Plan Interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

Xcel Energy Stock Fund

|

|

37,358,492

|

|

|

—

|

|

|

—

|

|

|

37,358,492

|

|

|

Total

|

|

$

|

78,885,472

|

|

|

$

|

34,897,549

|

|

|

$

|

—

|

|

|

$

|

113,783,021

|

|

For the years ended Dec. 31, 2019 and 2018, there were no transfers in or out of Levels 1 or 2.

7. NOTES RECEIVABLE FROM PARTICIPANTS

The Plans allow participants to borrow against funds held in their account in any amount greater than $1,000 but less than 50% of the participant’s vested account balance. In no event can a participant borrow more than $50,000 less the participant’s highest outstanding loan balance during the preceding 12 months. Only one outstanding loan is permitted at any time and may not exceed a period of 5 years for a general-purpose loan or 15 years for a principal residence loan. The loan shall bear a rate of interest equal to the prime rate in effect on the first business day of the month the loan request is approved plus 1%, and stays in effect until the loan is repaid. Repayment of the loan plus interest is made through automatic payroll deductions and is credited to each participant’s account as paid. If a participant retires or terminates employment for any reason, the outstanding loan balance must be repaid within 90 days from the date of termination, unless the participant elects to continue making monthly installment payments established by the Plan Administrator.

A summary of the Plans’ notes receivable as of Dec. 31, 2019 and 2018 is below:

BU Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2019

|

|

Dec. 31, 2018

|

|

Interest rates on outstanding loans

|

|

4.25% - 6.5%

|

|

4.25% - 6.25%

|

|

|

Maturity range

|

|

2020 - 2034

|

|

|

2019 - 2033

|

|

EIP Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2019

|

|

Dec. 31, 2018

|

|

Interest rates on outstanding loans

|

|

4.25% - 8.25%

|

|

4.25% - 8.25%

|

|

|

Maturity range

|

|

2020 - 2034

|

|

|

2019 - 2033

|

|

8. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

The Plans’ investments include shares of Xcel Energy Inc. common stock. For the BU Savings Plan, on the Statements of Net Assets Available for Benefits, the value of interest in Master Trust included dividends declared and payable to the Plan of $496,706 at Dec. 31, 2019, and $532,590 at Dec. 31, 2018. For the EIP Savings Plan, on the Statements of Net Assets Available for Benefits, the value of interest in Master Trust included dividends declared and payable to the Plan of $265,091 at Dec. 31, 2019, and $285,926 at Dec. 31, 2018.

The Plans also invest in shares of mutual funds and collective trusts managed by an affiliate of VFTC. VFTC acts as trustee for all Plan investments. Transactions in such investments qualify as party-in-interest transactions that are exempt from the prohibited transaction rules. The BU Savings Plan incurred fees for investment management and recordkeeping services of $405,334 for the year ended Dec. 31, 2019. The EIP Savings Plan incurred fees for investment management and recordkeeping services of $172,321 for the year ended Dec. 31, 2019.

9. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of Net Assets Available for Benefits and Net Increase in Net Assets Available for Benefits per the financial statements to net assets and net income per the Form 5500 as of Dec. 31, 2019 and 2018, and for the year ended Dec. 31, 2019, as applicable:

BU Savings Plan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Net assets available for benefit per the financial statements

|

|

$

|

512,967,135

|

|

|

$

|

441,539,670

|

|

|

Deemed distributions of participant loans

|

|

(14,858)

|

|

|

(8,377)

|

|

|

Net assets available for benefit per the Form 5500

|

|

$

|

512,952,277

|

|

|

$

|

441,531,293

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

Increase in net assets available for benefit per the financial statements

|

|

$

|

71,427,465

|

|

|

|

|

Transfer of Plan Assets

|

|

45,447

|

|

|

|

|

Deemed distributions activity

|

|

(6,481)

|

|

|

|

|

Net income per the 5500

|

|

$

|

71,466,431

|

|

|

|

EIP Savings Plan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Net assets available for benefit per the financial statements

|

|

$

|

140,601,843

|

|

|

$

|

119,044,864

|

|

|

Deemed distributions of participant loans

|

|

(11,910)

|

|

|

(13,928)

|

|

|

Net assets available for benefit per the Form 5500

|

|

$

|

140,589,933

|

|

|

$

|

119,030,936

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

Increase in net assets available for benefit per the financial statements

|

|

$

|

21,556,979

|

|

|

|

|

|

|

|

|

|

|

Deemed distributions activity

|

|

2,018

|

|

|

|

|

Net income per the 5500

|

|

$

|

21,558,997

|

|

|

|

10. SUBSEQUENT EVENTS

Subsequent to Dec. 31, 2019, the global outbreak of the COVID-19 pandemic has, and may continue to, adversely impact economic conditions worldwide. Due to the economic disruption caused by the pandemic, there has been increased volatility in the values of investment securities, which could result in significant fluctuations. The extent of the impact of COVID-19 on the Plans’ participants’ account balances and the amounts reported in the 2019 Statement of Net Assets Available for Benefits cannot be predicted at this time.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress. The CARES Act provides immediate and temporary relief for retirement plan sponsors and participants with respect to employer contributions, distributions and participant loans. The provisions of the CARES Act may be effective and implemented immediately, prior to amending the Plan document.

The Plans are currently evaluating applicable relief provisions included in the CARES Act and its future effects on the Plans’ net assets available for benefits and changes in net assets available for benefits are uncertain.

|

|

|

|

|

|

|

|

NEW CENTURY ENERGIES, INC. EMPLOYEES’ SAVINGS AND STOCK OWNERSHIP PLAN FOR BARGAINING UNIT EMPLOYEES AND FORMER NON-BARGAINING UNIT EMPLOYEES

|

Schedule 1

|

|

Schedule of Assets (Held at Year End)

|

|

|

As of Dec. 31, 2019

|

|

|

|

|

|

New Century Energies, Inc. Employee’s Saving and Stock Ownership Plan for Bargaining Unit Employees and Former Non-Bargaining Unit Employees, EIN 41-0448030, Plan 005

|

|

|

Attachment to Form 5500, Schedule H, Part IV, Line 4(i)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

|

|

Investment Type

|

|

Cost

|

|

Current Value

|

|

*

|

|

Vanguard PRIMECAP Fund Admiral Shares

|

|

Registered Investment Company

|

|

**

|

|

$

|

90,123,687

|

|

|

*

|

|

Vanguard Wellington Fund Admiral Shares

|

|

Registered Investment Company

|

|

**

|

|

51,365,158

|

|

|

*

|

|

Vanguard Institutional 500 Index Trust

|

|

Common/Collective Trust

|

|

**

|

|

46,870,520

|

|

|

*

|

|

Vanguard Institutional Total Bond Market Index Trust

|

|

Common/Collective Trust

|

|

**

|

|

35,139,252

|

|

|

*

|

|

Vanguard Developed Markets Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

34,397,231

|

|

|

*

|

|

Vanguard Federal Money Market Fund

|

|

Money Market Fund

|

|

**

|

|

27,490,021

|

|

|

*

|

|

Vanguard Mid-Cap Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

24,500,272

|

|

|

*

|

|

Vanguard Small-Cap Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

11,251,716

|

|

|

*

|

|

Vanguard Emerging Markets Stock Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

11,247,149

|

|

|

*

|

|

Vanguard Target Retirement 2025 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

10,338,760

|

|

|

*

|

|

Vanguard Target Retirement 2045 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

8,550,765

|

|

|

*

|

|

Vanguard Target Retirement 2020 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

8,479,618

|

|

|

*

|

|

Vanguard Target Retirement 2035 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

7,531,836

|

|

|

*

|

|

Vanguard Value Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

7,165,067

|

|

|

*

|

|

Vanguard Target Retirement 2040 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

6,974,997

|

|

|

*

|

|

Vanguard Target Retirement 2050 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

5,634,786

|

|

|

|

|

BlackRock Total Return Bond Fund; Class M

|

|

Common/Collective Trust

|

|

**

|

|

5,454,449

|

|

|

*

|

|

Vanguard Inflation Protected Securities Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

5,329,818

|

|

|

*

|

|

Self-Directed Brokerage Fund

|

|

Self-Directed Brokerage Fund

|

|

**

|

|

4,898,522

|

|

|

*

|

|

Vanguard Target Retirement 2030 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

4,760,084

|

|

|

*

|

|

Vanguard Target Retirement Income Trust I

|

|

Common/Collective Trust

|

|

**

|

|

4,735,626

|

|

|

*

|

|

Vanguard Target Retirement 2055 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,847,911

|

|

|

*

|

|

Vanguard Target Retirement 2015 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

1,806,347

|

|

|

*

|

|

Vanguard Target Retirement 2060 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

956,513

|

|

|

*

|

|

Vanguard Target Retirement 2065 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

531,083

|

|

|

*

|

|

Notes Receivable from Participants, net of deemed distributions of $14,858 — Interest rates between 4.25%-6.5% with maturities ranging from 2020 through 2034

|

|

|

|

**

|

|

6,708,151

|

|

|

|

|

Total Investments

|

|

|

|

|

|

$

|

425,089,339

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Party in Interest

|

|

|

|

|

|

|

|

**

|

|

Historical cost is not required for participant-directed funds.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW CENTURY ENERGIES, INC. EMPLOYEE INVESTMENT PLAN FOR BARGAINING UNIT EMPLOYEES AND FORMER NON-BARGAINING UNIT EMPLOYEES

|

Schedule 1

|

|

Schedule of Assets (Held at Year End)

|

|

|

As of Dec. 31, 2019

|

|

|

|

|

|

New Century Energies, Inc. Employee Investment Plan for Bargaining Unit Employees and Former Non-Bargaining Unit Employees, EIN 41-0448030, Plan 006

|

|

|

Attachment to Form 5500, Schedule H, Part IV, Line 4(i)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

|

|

Investment Type

|

|

Cost

|

|

Current Value

|

|

*

|

|

Vanguard Institutional 500 Index Trust

|

|

Common/Collective Trust

|

|

**

|

|

$

|

13,218,245

|

|

|

*

|

|

Vanguard Developed Markets Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

10,654,687

|

|

|

*

|

|

Vanguard Institutional Total Bond Market Index Trust

|

|

Common/Collective Trust

|

|

**

|

|

8,231,219

|

|

|

*

|

|

Vanguard PRIMECAP Fund Admiral Shares

|

|

Registered Investment Company

|

|

**

|

|

8,211,652

|

|

|

*

|

|

Vanguard Wellington Fund Admiral Shares

|

|

Registered Investment Company

|

|

**

|

|

8,067,569

|

|

|

*

|

|

Vanguard Mid-Cap Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

7,429,191

|

|

|

*

|

|

Vanguard Federal Money Market Fund

|

|

Money Market Fund

|

|

**

|

|

4,676,714

|

|

|

*

|

|

Vanguard Emerging Markets Stock Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

3,379,796

|

|

|

*

|

|

Vanguard Target Retirement 2050 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

3,178,993

|

|

|

*

|

|

Vanguard Value Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

3,047,692

|

|

|

*

|

|

Vanguard Small-Cap Index Fund Institutional Plus Shares

|

|

Registered Investment Company

|

|

**

|

|

3,037,802

|

|

|

*

|

|

Vanguard Target Retirement 2040 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,809,902

|

|

|

*

|

|

Vanguard Target Retirement 2045 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,797,267

|

|

|

*

|

|

Vanguard Target Retirement 2030 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,634,372

|

|

|

*

|

|

Vanguard Target Retirement 2055 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,243,708

|

|

|

*

|

|

Vanguard Target Retirement 2025 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

2,030,679

|

|

|

*

|

|

Vanguard Target Retirement 2035 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

1,857,118

|

|

|

|

|

BlackRock Total Return Bond Fund; Class M

|

|

Common/Collective Trust

|

|

**

|

|

1,640,025

|

|

|

*

|

|

Vanguard Target Retirement 2020 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

1,339,441

|

|

|

*

|

|

Vanguard Target Retirement 2015 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

870,222

|

|

|

*

|

|

Vanguard Inflation Protected Securities Fund Institutional Shares

|

|

Registered Investment Company

|

|

**

|

|

736,090

|

|

|

*

|

|

Vanguard Target Retirement 2060 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

729,162

|

|

|

*

|

|

Vanguard Target Retirement Income Trust I

|

|

Common/Collective Trust

|

|

**

|

|

304,404

|

|

|

*

|

|

Self-Directed Brokerage Fund

|

|

Self-Directed Brokerage Fund

|

|

**

|

|

234,560

|

|

|

*

|

|

Vanguard Target Retirement 2065 Trust I

|

|

Common/Collective Trust

|

|

**

|

|

34,857

|

|

|

*

|

|

Notes Receivable from Participants, net of deemed distributions of $11,910 — Interest rates between 4.25% - 8.25% with maturities ranging from 2020 through 2034

|

|

|

|

**

|

|

3,438,029

|

|

|

|

|

Total Investments

|

|

|

|

|

|

|

$

|

96,833,396

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Party in Interest

|

|

|

|

|

|

|

|

**

|

|

Historical cost is not required for participant-directed funds.

|

|

|

|

|

|

|

XCEL ENERGY INC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Xcel Energy Inc. has duly caused this annual report on Form 11-K to be signed on its behalf by the undersigned, thereunto duly authorized on June 26, 2020.

NEW CENTURY ENERGIES, INC. EMPLOYEES’ SAVINGS AND

STOCK OWNERSHIP PLAN FOR BARGAINING UNIT EMPLOYEES

AND FORMER NON-BARGAINING UNIT EMPLOYEES

NEW CENTURY ENERGIES, INC. EMPLOYEE INVESTMENT

PLAN FOR BARGAINING UNIT EMPLOYEES AND FORMER

NON-BARGAINING UNIT EMPLOYEES

|

|

|

|

|

|

|

|

|

|

|

|

By

|

/s/ Jeffrey S. Savage

|

|

|

|

Senior Vice President, Controller

|

|

|

|

Member, Pension Trust Administration Committee

|

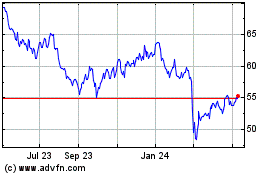

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Sep 2023 to Sep 2024