Current Report Filing (8-k)

December 23 2022 - 4:06PM

Edgar (US Regulatory)

0000793074false00007930742022-12-202022-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2022

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nebraska | 0-14690 | 47-0648386 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| |

| 14507 Frontier Road | | |

| Post Office Box 45308 | | |

| Omaha | , | Nebraska | | 68145-0308 |

| (Address of principal executive offices) | | (Zip Code) |

(402) 895-6640

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR40.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | WERN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On December 20, 2022, Werner Enterprises, Inc. (the "Company") entered into a $1.075 billion unsecured credit facility with the lenders thereto, Wells Fargo Bank, National Association as Administrative Agent, Swingline Lender, and Issuing Lender, BMO Harris Bank N.A. as Syndication Agent, The Toronto-Dominion Bank as Documentation Agent, and The Huntington National Bank as Co-Agent, (the "2022 Credit Agreement"), replacing the Company's previous $300 million unsecured credit facility with BMO Harris Bank N.A. (the "BMO Line of Credit") and the credit agreement with Wells Fargo Bank, National Association, consisting of a $300 million unsecured credit facility (the "Wells Line of Credit") and a $100 million unsecured term loan (the "Wells Term Loan"). The 2022 Credit Agreement is scheduled to mature on December 20, 2027 and has a $100 million maximum limit for the aggregate amount of letters of credit issued. On December 20, 2022, the Company borrowed $600 million at an interest rate of 5.67%, based on the one-month Secured Overnight Financing Rate ("SOFR") plus 0.10% and a margin of 1.25%. The proceeds of the 2022 Credit Agreement may be used by the Company for working capital and other general corporate purposes, including the financing of acquisitions and other investments permitted under the agreement.

Revolving credit loans drawn under the 2022 Credit Agreement will bear interest, at the Company's option, at (i) the Base Rate (the highest of (a) the Prime Rate, (b) the Federal Funds Rate plus 0.50%, or (c) the one-month Term SOFR plus 1.10%), plus a margin ranging between 0.125% and 0.750%, or (ii) Term SOFR plus 0.10% and a margin ranging between 1.125% and 1.750%. Swingline loans drawn under the 2022 Credit Agreement will bear interest at the Base Rate, as defined above, plus a margin ranging between 0.125% and 0.750%. The 2022 Credit Agreement also requires the Company to pay quarterly (i) a letter of credit commission on the daily amount available to be drawn under such standby letters of credit at rates ranging between 1.125% and 1.750% per annum and (ii) a nonrefundable commitment fee on the average daily unused amount of the commitment at rates ranging between 0.125% and 0.250% per annum. The margin, letter of credit commission, and commitment fee rates are based on the Company's ratio of net funded debt to earnings before interest, income taxes, depreciation and amortization ("EBITDA"). There are no scheduled principal payments due on the 2022 Credit Agreement until the maturity date, and interest will be payable in arrears at the periodic intervals defined in the 2022 Credit Agreement not to exceed three months.

Availability of such funds under the 2022 Credit Agreement is conditional upon various customary terms and covenants. Such covenants include, among other things, two financial covenants requiring the Company (i) not to exceed a maximum ratio of net funded debt to EBITDA and (ii) to exceed a minimum ratio of EBITDA to interest expense. A violation of such terms and covenants could result in a default under the 2022 Credit Agreement. In the event of default, lenders (i) will not be obligated to make loans to the Company, (ii) could require the Company to immediately repay any then-outstanding debt (including any accrued interest), and (iii) could require the Company to immediately deliver cash collateral for any then-outstanding letters of credit.

As of December 20, 2022, the Company's outstanding debt totaled $693.8 million, including $600 million of revolving credit loans under the 2022 Credit Agreement and $93.8 million under the Company's existing 1.28% fixed rate term loan commitment with BMO Harris N.A. Considering outstanding borrowings and stand-by letters of credit currently issued of $58.8 million, the Company has a remaining borrowing capacity of $416.2 million to fund capital expenditures, business acquisitions, common stock repurchases, working capital and other general corporate purposes.

The foregoing description of the 2022 Credit Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the 2022 Credit Agreement, a copy of which will be filed with the Company’s Form 10-K for the year ended December 31, 2022.

ITEM 1.02. TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT.

Concurrently with entering into the 2022 Credit Agreement on December 20, 2022, the Company paid off and terminated the BMO Line of Credit, Wells Line of Credit, and Wells Term Loan, which were each scheduled to mature on May 14, 2024.

As of December 20, 2022, there was $300 million, $185 million, and $100 million outstanding under the BMO Line of Credit, Wells Line of Credit, and Wells Term Loan, respectively. As of December 20, 2022, borrowings of $600 million under the 2022 Credit Agreement were used to pay off the outstanding balances, accrued interest and fees under the BMO Line of Credit, Wells Line of Credit, and Wells Term Loan, as well as certain transaction fees and expenses associated with the 2022 Credit Agreement.

ITEM 2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

The information set forth in Item 1.01 above related to the 2022 Credit Agreement is incorporated by reference into this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| WERNER ENTERPRISES, INC. |

| | |

Date: December 23, 2022 | By: | | /s/ John J. Steele |

| | | John J. Steele |

| | | Executive Vice President, Treasurer and

Chief Financial Officer |

| | |

Date: December 23, 2022 | By: | | /s/ James L. Johnson |

| | | James L. Johnson |

| | | Executive Vice President, Chief Accounting

Officer and Corporate Secretary |

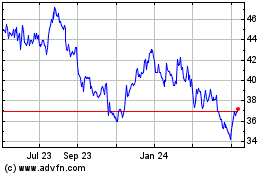

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From May 2024 to Jun 2024

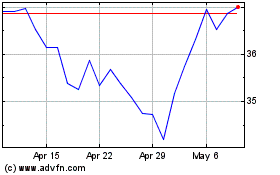

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Jun 2023 to Jun 2024