Current Report Filing (8-k)

November 02 2020 - 4:23PM

Edgar (US Regulatory)

false

0000807707

0000807707

2020-11-02

2020-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2020

VOXX INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

0-28839

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

13-1964841

(I.R.S. Employer Identification No.)

|

2351 J Lawson Blvd., Orlando, FL

|

32824

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(800) 645-7750

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each Class:

|

Trading Symbol:

|

Name of Each Exchange on which Registered

|

|

Class A Common Stock $.01 par value

|

VOXX

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13c-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On November 2, 2020, VOXX International Corporation (the “Company”) and Avalon Park Group Management, Inc. and its affiliates, of which Beat M. Kahli, a 20.3% stockholder of the Company, is the controlling party (“Avalon”) entered into a Standstill Agreement (the “Agreement”) concerning trading of the Company’s publicly listed securities. The Agreement is the direct result of Avalon submitting a Non-Binding Indication of Interest (“IOI”) to the Company and its Investment Banker related to the strategic process concerning Eyelock LLC (“Eyelock”).

Since the Company began its strategic process to evaluate all options related to Eyelock, it has received interest from many parties and has executed 14 Non-Disclosure Agreements as of this filing date, with due diligence underway. During the standstill period the strategic process will continue, and management and its Investment Banker will continue to talk with interested parties.

On October 6, 2020, Beat M. Kahli, reporting under Avalon Park International, LLC and Kahli Holding AG, filed a Form 4 with the Securities and Exchange Commission (“SEC”) in which it was disclosed that these entities combined, as of the filing date, had acquired an ownership stake of 20.3% of the Class A Common shares in the Company. Mr. Kahli is the sole manager and controlling member of Avalon Park International, LLC and the controlling shareholder of Kahli Holding AG. Mr. Kahli and the Company’s President and Chief Executive Officer, Mr. Patrick M. Lavelle have known each other for approximately five years and are partners in an unrelated commercial real estate venture in Florida.

As the Company has determined to pursue Avalon’s IOI, the Company and Avalon have entered into the Agreement, which provides that Avalon and its authorized representatives, may receive certain confidential, non-public information for its evaluation of Eyelock. Under the terms of the Agreement, Avalon will not, without the prior written consent of the Company, for the period commencing from the date that confidential information is furnished under this Agreement through the earlier to occur of (i) April 15, 2021 and (ii) three (3) business days after the public announcement (by the filing by the Company of a Form 8-K with the SEC) of a definitive agreement with respect to the Proposed Transaction in which Avalon is the purchasing party: (a) purchase, offer or agree to purchase, sell, offer or agree to sell or trade in any outstanding equity securities of VOXX International Corporation or any rights or options to purchase any such securities, whether by direct purchase, merger or otherwise; or (b) form, join or in any way participate in a group in connection with any of the foregoing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

VOXX INTERNATIONAL CORPORATION (Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 2, 2020

|

|

BY:

|

/s/ Charles M. Stoehr

|

|

|

|

|

Charles M. Stoehr

|

|

|

|

|

Senior Vice President and

|

|

|

|

|

Chief Financial Officer

|

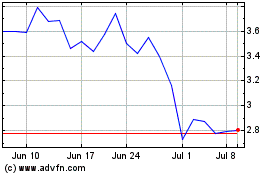

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Aug 2024 to Sep 2024

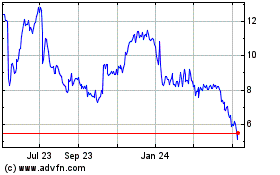

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Sep 2023 to Sep 2024