0001085243

false

0001085243

2023-08-15

2023-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 15, 2023

VIRTRA,

INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38420 |

|

93-1207631 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 295

E. Corporate Place |

|

|

| Chandler,

AZ |

|

85225 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (480) 968-1488

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

VTSI |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective

August 15, 2023, John Givens will assume the role of the Company’s Chief Executive Officer (CEO). Robert Ferris, the Company’s

founder and current chairman and co-CEO will transition to the position of Executive Chairman of the Board. Mr. Givens had been serving

as a director of VirTra since November 2020 and as the co-CEO since May 2022.

VirTra

entered into a three-year employment agreement with Mr. Givens effective August 15, 2023 that provides for an annual base salary of $349,859.90,

subject to increases based on the cost of living at a minimum. The agreement automatically extends for additional periods of one year.

The contract shall be renewed annually with upward adjustments each year applying the same percentage increase approved for Company-wide

cost-of-living adjustments. The employment agreement entitles Mr. Givens to an annual cash bonus if so determined by VirTra’s Board

of Directors. In addition, the agreement entitles Mr. Givens to participate in any equity incentive plan adopted by the company.

Pursuant

to the terms of the employment agreement, VirTra may terminate Mr. Givens’ employment for cause as defined in the employment agreement

and such cause is deemed to exist as determined by the Board of Directors at a Board meeting at which Mr. Givens and his counsel are

first given the opportunity to address the Board with respect to such determination. If Mr. Givens is terminated by VirTra for any reason

other than for cause, or if he voluntarily terminates his employment for good reason but not including a change in control, then VirTra

shall, subject to the terms of the employment agreement, be obligated to pay Mr. Givens an amount equal to the greater of (a) his annual

base salary in effect on the day preceding the date of such termination or (b) his annual base salary during the twelve full calendar

months preceding the date of such termination, times three. If a change of control of VirTra occurs while Mr. Givens is employed and

within 36 months from the date of such change in control his employment is terminated for any reason (except for the death or disability

of the executive or for Cause) or Mr. Givens terminates his employment for any reason, then VirTra shall, subject to certain limitations,

pay Mr. Givens any earned and accrued but unpaid base salary through the date of termination plus an amount of severance pay equal to

the greater of (a) his annual base salary in effect on the day preceding the date on which the change of control occurred or (b) his

annual base salary during the twelve full calendar months preceding the date on which the change of control occurred, times four. In

addition, any stock options awarded to Mr. Givens shall immediately vest and become exercisable upon a change of control. If Mr. Givens

is terminated for any reason other than his voluntary termination for good reason as defined in the employment agreement, he is prohibited

for a period of two years from the date of termination of the employment agreement from direct competition with VirTra and shall not

solicit any of VirTra’s employees or customers. The employment agreement requires VirTra to indemnify Mr. Givens to the fullest

extent permitted under Nevada law, as well as its articles of incorporation and bylaws, whichever affords the greater protection to him.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIRTRA,

INC. |

| |

|

| Date:

August 15, 2023 |

By: |

/s/

Robert D. Ferris |

| |

Name: |

Robert

D. Ferris |

| |

Title: |

Executive

Chairman |

Exhibit 10.1

EMPLOYMENT

AGREEMENT

THIS

AGREEMENT (the “Agreement”) is made and entered into as of August 15, 2023, “the Effective Date,” by and between

VIRTRA, INC., a Nevada corporation (the “Company”), and JOHN F. GIVENS II (the “Executive”).

WHEREAS

the Company desires to employ the Executive upon the terms and conditions specified in this Agreement and the Executive desires to serve

in the employ of the Company upon such terms and conditions; and

WHEREAS

the Company and the Executive desire to set forth in a written agreement the terms and conditions of Executive’s employment with

the Company.

NOW,

THEREFORE, in consideration of the premises and of the mutual covenants herein contained, it is agreed as follows:

1.

Employment. Subject to the terms and conditions of this Agreement, the Company agrees to employ the Executive as its Chief Executive

Officer during the Employment Period (as defined in Section 2) and Executive agrees to perform such acts and duties and furnish such

services to the Company. During the Employment Period, the Company shall continue to take such actions as necessary to cause the Executive’s

nomination as a member of the Board of Directors of the Company (the “Board”). The Executive hereby accepts such employment

and agrees to devote his full time and best efforts to the duties provided herein, provided, that the Executive may engage in other business

activities which (i) involve no conflict of interest with the interests of the Company and (ii) do not materially interfere with the

performance by the Executive of his duties under this Agreement. For the avoidance of doubt, and

notwithstanding anything to the contrary herein, the Executive is free to pursue opportunities

with any one or combination of all of Scuba Select LLC, Givens Group Solutions LLC, The Givens Group LLC, and Vialytix LLC; and

any such activities shall be deemed to be consistent with all of the Executive’s obligations under this Agreement. The Executive

shall report to the Board; however, the Board must first obtain Executive’s approval before changing the Executive’s duties

and responsibilities to the Company. In the event that the Executive does not consent to the proposed change(s) and the Board insists

that such change(s) be implemented, then the Board shall have the right to terminate the Executive with a termination payment tendered

pursuant to Section 11 as if the Company had terminated the Executive for a reason other than for Cause.

2.

Employment Period. The initial employment term shall be for a term commencing on the date hereof and, subject to termination under Section

10, expiring three (3) years from the date hereof. Notwithstanding the previous sentence, this Agreement and the employment of the Executive

shall be automatically extended for successive one-year periods upon the terms and conditions set forth herein, commencing on the first

anniversary of the date of this Agreement, and on each anniversary date thereafter. For purposes of this Agreement, any reference to

the “term” of this Agreement shall include the original term and any extension thereof.

3.

Compensation. For services rendered to the Company during the term of this Agreement, the Company shall compensate the Executive with

an initial base salary of $349,859.90 per annum. Such base salary shall be reviewed on an annual basis by the Board or appropriate compensation

committee that may be formed by the Board in the future (the “Compensation Committee”) and shall be subject to being increased

(at a minimum adjusted for cost of living), but not decreased at the discretion of the Board or Compensation Committee, if any.

4.

Incentive Compensation. The Board of the Company shall determine on an annual basis, based on the performance of the Company and such

other metrics as the Board may use from time to time, if and what amount of cash bonus that Executive is entitled to during the Employment

Period (“Incentive Compensation”). The Executive’s Incentive Compensation shall be determined after a financial audit

is performed by a certified PCAOB auditor and the audit report is delivered to the Board. In the event a certified audit is not performed

on the Company, then the Board shall determine the Executive’s Incentive Compensation based on the Company’s unaudited financial

statements and the Executive shall have the right to review such unaudited financial statements. Any bonus due to Executive will be paid

within ninety (90) days from the end of the Company’s fiscal year.

5.

Stock Options and Other Equity Compensation.

(a)

Outstanding Options and Restricted Stock Unit Grants. Any currently outstanding options to purchase Common Stock of the Company and

any restricted stock unit grants held by Executive shall remain in full force and effect in accordance with the terms in which they

were issued.

(b)

Future Options and Restricted Stock Plans. As further compensation, Employee shall be allowed to participate in any equity

compensation plan that may be adopted in the future by the Board, or Compensation Committee if any, for the Company’s

executives and/or employees. The amount of such grant and the terms of vesting shall be as determined by the Board, or Compensation

Committee if any. Any stock options granted to Executive shall be “Incentive Stock Options” within the meaning of the

Internal Revenue Code of 1986, as amended (the “Code”), subject to the limitations of the Code. Any stock options which

are not allowed to be incentive stock options under the Code shall be non-qualified stock options. Notwithstanding anything to the

contrary in any stock option agreement or other agreement between the Company and the Executive:

(i)

the Executive shall have the right during the 90-day period following the date of termination of his employment pursuant to this

Agreement for any reason (other than termination for Cause) to exercise any options to purchase shares of the Company’s common

stock theretofore granted to the Executive, to the extent that such options were exercisable on the date of such termination,

and

(ii)

all such options shall immediately vest and become exercisable upon a Change of Control (as hereinafter defined).

6.

Executive Benefits. During the Employment Period, the Company shall provide or cause to be provided to the Executive such employee benefits

as are provided to other executive officers of the Company, such as family medical, dental, vision, disability and life insurance, and

participation in pension and retirement plans, incentive compensation plans, stock option plans, Company-sponsored welfare benefit plans

for disability and life insurance and other benefit plans. During the Employment Period, the Company may provide or cause to be provided

to the Executive such additional benefits as the Company may deem appropriate from time to time.

7.

Expenses. The Company shall pay or reimburse the Executive for reasonable and necessary expenses incurred by the Executive in connection

with his duties on behalf of the Company in accordance with the general policies of the Company.

8.

Vacation. The Executive shall be entitled to vacation days as from time to time amended by the Board.

9.

Place of Performance. In connection with his employment by the Company, the Executive shall not be required, except with his consent,

to relocate his principal residence. Required travel on the Company’s business during any given month shall not, without the express

approval of the Executive, exceed 25% of the Executive’s working days, determined by averaging the number of working days each

month over the most recent six (6) month period.

10.

Termination.

(a)

Voluntary Termination. The Executive may, upon sixty (60) days’ prior notice, terminate his employment with the Company at any

time for Good Reason. “Good Reason” shall mean (i) the Company’s failure to elect or reelect, or to appoint or

reappoint, Executive to the office of Chief Executive Officer of the Company; (ii) failure by the Company to obtain the assumption

of this Agreement by any successor or assign of the Company; (iii) material breach of this Agreement by the Company, which breach is

not cured within five (5) days after written notice thereof is delivered to the Company; or (iv) the occurrence of a Change of

Control (as defined in Section 11). The Executive’s death or termination by reason of Disability during the term of the

Agreement shall constitute a voluntary termination of employment for purposes of Section 11. The provisions of Section 13 hereof

shall survive any such voluntary termination.

(b)

Termination for Cause. The Executive’s employment hereunder may be terminated for Cause and such termination shall be

effective upon the Board’s issuance of a notice of such termination. “Cause” shall mean (i) the Executive’s

willful, repeated or negligent failure to perform his duties hereunder and the continuation of such failure following twenty (20)

days written notice to such effect, (ii) the conviction or plea bargain of the Executive of any felony involving dishonesty, fraud,

theft, embezzlement or the like; (iii) the Executive’s commission of any act of fraud or theft involving the Company or its

business; or (iv) the Executive’s violation of any of the material terms, covenants, representations or warranties contained

in this Agreement and failure to correct such violation within twenty (20) days after receiving written notice by the Company.

Notwithstanding the foregoing, “Cause” shall only be deemed to exist if it is so determined by a resolution duly adopted

by the Board and at a duly noticed meeting at which the Executive and his counsel are first given the opportunity to address the

Board with respect to such determination.

(c)

Effect of Termination. Subject to Section 11 and any benefit continuation requirements of applicable laws, in the event the Executive’s

employment hereunder is voluntarily terminated for any reason whatsoever, except as described in Section 11, all compensation, and benefits

obligations of the Company to Executive shall cease as of the effective date of such termination.

11.

Termination Payments and Benefits. If the Executive’s employment hereunder is terminated by the Company for any reason other than

for Cause (as defined herein) or if Executive voluntarily terminates his own employment for Good Reason, as defined in Section 10(a)

but not including a Change of Control, then the Company shall, subject to subsection 1l(a) hereof, be obligated to pay to the Executive

an amount equal to the product of (i) the greater of (A) the Executive’s annual base salary in effect on the day preceding the

date of such termination or (B) the Executive’s annual base salary during the twelve full calendar months preceding the date of

such termination, times (ii) three (3) (such amount hereinafter referred to as the “Termination Payment Amount”).

(a)

Condition Precedent to Company’s Payment Obligation (Release of Claims). The Company’s obligation to pay the Termination

Payment Amount or any portion thereof shall be conditioned upon the Executive executing and delivering to the Company a mutual

release agreement to be negotiated by each party’s counsel (the “Release Agreement”). The Company shall be deemed

for all purposes to have executed and delivered the Release Agreement to the Executive immediately upon the Company’s receipt

of the Release Agreement duly executed by the Executive. In addition, the Company shall have no obligation to make any payment of

the Termination Payment Amount if the Executive shall be in default of his obligations under Section 13 hereof.

If

the Company does not provide Executive with the Release Agreement within ten (10) days of the first scheduled termination payment date,

as described in Section 11(b), then the Company shall be obligated to pay the first scheduled termination payment, even if the Release

Agreement is not received from the Executive. Subsequent termination payments, as described in Section 11(b), shall not be tendered by

the Company to Executive unless the Release Agreement is received by the next scheduled termination payment date; unless of course, the

Company again fails to provide the Executive with the Release Agreement within ten (10) days from such termination payment date. The

Company shall not circumvent payments of the Termination Payment Amount by providing Executive with the Release Agreement less than ten

(10) days from the scheduled termination payment date, pursuant to Section 11(b)

(b)

Method of Payment. The Termination Payment Amount shall be payable in eighteen (18) equal monthly payments commencing on the first

day of the month following the month in which the termination shall occur. The Company’s obligation to pay the Termination

Payment Amount shall be the same as a normal trade payable of the Company.

(c)

Benefits. Upon termination of this Agreement for any reason, the Company shall be obligated to provide the Executive with medical

insurance and other employee benefits only to the extent required by applicable law, and the Company shall have no obligation to

provide any benefits to the Executive which the Executive would have been entitled to receive if his employment had not been

terminated.

(d)

Change of Control.

(i)

For purposes of this Agreement, a “Change of Control” of the Company shall be deemed to occur if:

(A)

after the date of this Agreement, any person or entity, or any group of persons or entities becomes the “beneficial

owner” (as defined in the Securities Exchange Act of 1934, as amended from time to time), directly or indirectly, of

thirty-five percent (35%) or more of combined voting power of the Company’s then outstanding securities; or

(B)

the occurrence within any thirty-six-month period during the term of this Agreement of a change in the Board with the result that

the Incumbent Members do not constitute a majority of the Board. “Incumbent Members” in respect of any thirty-six month

period shall mean the members of the Board on the date immediately preceding the commencement of such thirty-six month period,

provided that any person becoming a Director during such thirty-six month period whose appointment, election or nomination for

election was supported by a majority of the Directors who, on the date of such election or nomination for election, comprised the

Incumbent Members shall be considered one of the Incumbent Members in respect of such thirty-six month period. Executive shall have

the right to waive a Change of Control based on a majority change of the Incumbent Members of the Board.

(ii)

Severance Compensation Upon a Change of Control and Termination of Employment. If (X) a Change of Control of the Company shall have

occurred while the Executive is an employee of the Company, and (Y) within thirty-six (36) months from the date of such Change in

Control (I) the Company shall terminate the Executive’s employment for any reason (except for the death or Disability of the

Executive or for Cause) or (II) the Executive shall elect to terminate his employment for any reason, then:

(A)

the Company shall (subject to (B) below) pay the Executive any earned and accrued but unpaid base salary through the date of

termination plus an amount of severance pay equal to the product of (i) the greater of (A) the Executive’s annual base salary

in effect on the day preceding the date on which the Change of Control occurred or (B) the Executive’s annual base salary

during the twelve (12) full calendar months preceding the date on which the Change of Control occurred, times (ii) four (4) (such

amount hereinafter referred to as the “Change of Control Termination Payment Amount”). The Change of Control Termination

Payment Amount payable under this subsection 11(d) shall be payable in a lump sum on the fourteenth day following the date of

termination hereunder, unless on or before such fourteenth day the Company shall have delivered to the Executive a standby letter of

credit issued by a financial institution with its principal office located in the continental United States having combined capital

and surplus of at least $100,000,000, which letter of credit shall (i) have a term of no less than 20 months from its date of

issuance; (ii) be irrevocable; (iii) be to the benefit of the Executive or his assignee; (iv) permit draws thereunder in an amount

up to the full amount of the unpaid Change of Control Termination Payment Amount upon the receipt by the issuing bank of a notice

from the Executive of the Company’s failure to pay any amount of the Change of Control Termination Payment Amount when due,

together with a draft in the amount to be paid under the letter of credit; and (v) permit multiple draws, up to the full amount of

the unpaid Change of Control Termination Payment Amount outstanding from time to time, in which event the Change of Control

Termination Payment Amount payable under this subsection 11(d) shall be payable in eighteen (18) monthly payments commencing on the

first day of the month following the month in which such letter of credit shall be issued; and

(B)

in the event that the payment, calculated as provided in (A) above, together with all other payments and the value of any benefit

received or to be received by the Executive in connection with termination contingent upon a Change in Control of the Company

(whether payable pursuant to the terms of this Agreement or any other agreement, plan or arrangement with the Company), (i)

constitutes a “parachute payment” within the meaning of Section 280G (b) (2) of the Internal Revenue Code of 1986, as

amended (“Code”) and (ii) such payment, together with all other payments or benefits which constitute “parachute

payments” within the meaning of Section 280G (b) (2) would result in all or a portion of such payment being subject to excise

tax under Section 4999 or the Code, then the Change of Control Termination Payment Amount shall be such lesser amount which would

not result in any portion of the severance pay determined hereunder being subject to excise tax under Section 4999 of the

Code.

(e)

Disability Defined. “Disability” shall mean the Executive’s incapacity due to physical or mental illness to

substantially perform the essential functions of the position on a full-time basis for six (6) consecutive months and, within thirty

(30) days after a notice of termination is thereafter given by the Company, the Executive shall not have returned to the full-time

performance of the Executive’s duties; provided, however, if the Executive shall not agree with a determination to terminate

him because of Disability, the question of Executive’s disability shall be subject to the certification of a qualified medical

doctor agreed to by the Company and the Executive or, in the event of the Executive’s incapacity to designate a doctor, the

Executive’s legal representative. In the absence of agreement between the Company and the Executive, each party shall nominate

a qualified medical doctor and the two doctors shall select a third doctor, who shall make the determination as to

Disability.

(f)

No Obligation to Mitigate. The Executive is under no obligation to mitigate damages, or the amount of any payment provided for

hereunder by seeking other employment or otherwise, and neither the obtaining of other employment of any other similar factor shall

reduce the amount of severance payment payable hereunder.

12.

Post-Termination Assistance. The Executive agrees that after his employment with the Company has terminated he will provide to the Company,

upon reasonable notice from the Company, such information and assistance in the nature of testifying and the preparation therefor as

may reasonably be requested by the Company in connection with any litigation, administrative or agency proceeding, or other legal proceeding

in which it or any of its affiliates is or may become a party; provided, however, that the company agrees to reimburse the executive

for any reasonable, related expenses, including travel expenses, and shall pay the executive a daily per diem comparable to his salary

under this agreement at time of termination (determined for this purpose on a per diem basis by dividing such salary by 200).

13.

Confidential Information: Covenant Not To Compete.

(a)

Confidential Information. The Executive agrees that during his employment with Company and thereafter, the Executive shall not at

any time, directly or indirectly, use or disclose to any person, except the Company and its directors, officers or employees, the

Company’s customer lists, records, statistics, manufacturing or installation processes, trade secrets or any other information

relating to the business, or the plans of the business or affairs of the Company acquired by Executive in the course of his

employment in any capacity whatsoever, except for information which (i) is publicly available other than by reason of the breach of

this Section 13(a) by the Executive, or (ii) is disclosed by the Executive in connection with the performance of his duties and an

officer and/or director of the Company.

(b)

Covenant Not to Compete.

(i)

For a period of either (X) two (2) years from the date of the termination of his employment with the Company for any reason other

than a voluntary termination by the Executive for Good Reason, as defined in Section 10(a), or (Y) twelve (12) months from the date

of voluntary termination by the Executive for Good Reason, as defined in Section 10(a), the Executive shall not, directly or

indirectly, for the Executive’s own benefit or for, with or through any other individual, firm, corporation, partnership or

other entity, whether acting in an individual, fiduciary or other capacity (collectively a “Person”), own, manage,

operate, control, advise, invest in (except as a four percent (4%) or less shareholder of a publicly held company), loan money to,

or participate or assist in the ownership, management, operation or control of or be associated as a director, officer, employee,

partner, consultant, advisor, creditor, agent, independent contractor or otherwise with, or acquiesce in the use of the

Executive’s name by, any Person, within any state in the United States of America or similar political subdivision of any

other country in which the Company conducts business in at the time of termination of the Executive, that is in direct competition

with the Company, and shall not solicit any employee or customer of the Company in connection with the business of any other Person. The

foregoing restrictions

on solicitation shall not preclude solicitations through the use of general advertising (such as web postings or advertisements in

publications) or search firms, employment agencies or similar entities not specifically directed at the Company. For the avoidance

of doubt, the parties acknowledge that notwithstanding

anything to the contrary herein Scuba Select LLC, Givens Group Solutions LLC, The Givens Group LLC, and Vialytix LLC are

not competitors of the Company. Executive represents that Scuba Select LLC, Givens Group Solutions LLC, The Givens Group LLC, and

Vialytix shall adhere to the terms of this 13 (b) (i) Covenant Not to Compete.

(ii)

Condition on Covenant Not to Compete. If the Executive’s employment with the Company is terminated for any reason other than

by the Company for Cause and (X) the Executive is not in default of his obligations under Section 13 hereof and (Y) the Executive

has not unreasonably refused to return an executed Release Agreement to the Company; then the Executive shall have the right to be

released from the Covenant Not to Compete if the Company fails to render to the Executive two (2) consecutive termination payments,

as provided herein. Before the Executive can be released from the Covenant Not to Compete, the Executive must provide written notice

to the Company, in the manner described in Section 19, providing ten (10) days for the Company to render the past due termination

payments to the Executive. If after ten (10) days the Company still has not paid the required termination payments to the Executive,

then the Executive shall be released from the Covenant Not to Compete. Further, if the Executive is released from the Covenant Not

to Compete, the Company shall not be relieved from its obligation to pay to the Executive the full Termination Payment Amount or

Change of Control Termination Payment Amount, as provided herein.

(c)

Acknowledgment of Restrictions. The Company and the Executive acknowledge the restrictions contained in subsections 13(a) and 13(b)

above to be reasonable for the purpose of preserving the Company’s proprietary rights and interests and that the consideration

therefor is comprised of the payments made hereunder and the mutual promises contained herein. If a court makes a final judicial

determination that any such restrictions are unreasonable or otherwise unenforceable against the Executive, the Executive and the

Company hereby authorize such court to amend this Agreement so as to produce the broadest, legally enforceable agreement and for

this purpose the restrictions on time period, geographical area and scope of activities set forth in said subsection 13(a) above are

divisible; if the court refuses to do so, the Executive and the Company hereby agree to modify the provision or provisions held to

be unenforceable to preserve each party’s anticipated benefits thereunder.

(d)

Specific Performance; Repayment of Termination Payment Amount. The Executive hereby acknowledges that the services to be rendered to

Company and the information disclosed and to be disclosed are of a unique, special and extraordinary character which would be

difficult or impossible for Company to replace or protect, and by reason thereof, the Executive hereby agrees that in the event he

violates any of the provisions of subsections 13(a) or 13(b) hereof, the Company shall, in addition to any other rights and remedies

available to it, at law or otherwise, be entitled to an injunction or restraining order to be issued by any court of competent

jurisdiction in any state enjoining and restraining the Executive from committing any violation of said subsection 13(a) or

13(b).

The

Executive agrees that, if he breaches subsection 13(a) or 13(b), he shall have forfeited all right to receive any amount of the Termination

Payment Amount and he shall promptly repay to the Company the entire Termination Payment Amount theretofore paid to him. For

the avoidance of doubt, notwithstanding anything to the contrary herein, the Executive is

free to pursue opportunities with any one or all of the following: Scuba Select LLC, Givens Group Solutions LLC, The Givens Group

LLC, and Vialytix LLC and any such activities shall be deemed to be consistent with all of the

Executive’s obligations under this Agreement.

14.

Assignment of Inventions.

(a)

General Assignment. The Executive agrees to assign and hereby does assign to the Company all right, title and interest in and to any

inventions, designs, patents, and copyrights made during employment by Company which relate, directly or indirectly, to the business

of the Company. For the avoidance of doubt, notwithstanding anything to the contrary herein, the foregoing sentence shall not apply

to any inventions, designs, patents, and copyrights howsoever produced or created for any one

or all of the following: Scuba Select LLC, Givens Group Solutions LLC, The Givens Group LLC, and Vialytix LLC and any such

activities shall be deemed to be consistent with all of the Executive’s obligations under this Agreement.

(b)

Further Assurances. The Executive shall acknowledge and deliver promptly to the Company without charge to the Company but at its

expense such written instruments and do such other acts, as may be necessary in the opinion of the Company to obtain, maintain,

extend, reissue and enforce United States and/or foreign letters patent and copyrights relating to the inventions, designs and

copyrights and to vest the entire right and title thereto in the Company or its nominee. The Executive acknowledges and agrees that

any copyright developed or conceived of by the Executive during the term of the Executive’s employment which is related to the

business of the Company shall be a “work for hire” under the copyright law of the United States and other applicable

jurisdictions.

15.

Indemnification: Litigation.

(a)

The Company shall indemnify the Executive to the fullest extent permitted by the laws of the state of the Company’s

incorporation in effect at the relevant time, or certificate of incorporation and by-laws of the Company, whichever affords the

greater protection to the Executive. The Executive shall be entitled to (i) advancement of expenses to the fullest extent permitted

by law and (ii) the benefits of any insurance policies the Company may elect to maintain generally for the benefit of its officers

and directors against all costs, charges and expenses, in either case incurred in connection with any action, suit or proceeding to

which he may be made a party by reason of being a director or officer of the Company.

(b)

In the event of any litigation or other proceeding between the Company and the Executive with respect to the subject matter of this

Agreement, the party which prevails in such litigation or other proceeding shall reimburse the other for all costs and expenses

related to the litigation or proceeding (including attorney’s fees and expenses) incurred by the prevailing party.

16.

Entire Agreement. This Agreement supersedes any and all other agreements (except agreements, if any, relating to restricted stock units

granted to the Executive by the Company), either oral or in writing, between the parties hereto with respect to the subject matter hereof

and contains the entire agreement of the parties with respect to the subject matter hereof. Except as aforesaid, no other agreement,

statement, promise or representation pertaining to the subject matter hereof that is not contained herein shall be valid or binding on

either party, and the Company and the Executive expressly agree that this Agreement supersedes in all respects each and all of the following

agreements to which they are or may be parties, whenever the same were entered into: (i) any Confidentiality and Proprietary Information

Agreement; (ii) any Restrictive Competition Agreement; and (iii) any Site Access Agreement and Confidential Information Agreement (including

any agreement similarly named in each of the foregoing cases).

17.

Withholding of Taxes. The Company may withhold from any amounts payable under this Agreement all federal, state, city or other applicable

taxes and withholdings as may be required pursuant to any law or government regulation or ruling.

18.

Successors and Binding Agreement. This Agreement shall be binding upon and inure to the benefit of the Company and successor (and such

successor shall thereafter be deemed the “Company” for the purposes of this Agreement), but will not otherwise be assignable,

transferable, or delegable by the Company.

(a) This

Agreement will inure to the benefit of and be enforceable by the Executive’s personal or legal representatives, executors, administrators,

successors, heirs, distributes and legatees.

(b) This

Agreement is personal in nature and neither of the parties hereto shall, without the consent of the other, assign, transfer or delegate

this Agreement or any rights or obligations hereunder except as expressly provided in Section 18(a) and 18(b).

19.

Notices. All communications hereunder, including without limitation notices, consents, requests or approvals, required or permitted to

be given hereunder, shall be in writing and be deemed to have been duly given when hand delivered or dispatched by electronic facsimile

transmission (with transmission and receipt confirmed), or five business days after having been mailed by United States registered or

certified mail, return receipt requested, postage prepaid, or two business days· after having been sent by a nationally recognized

overnight courier service, addressed to the Company (to the attention of the Board of Directors of the Company) at its principal executive

office and to the Executive at his principal residence at shown in the records of the Company, or to such other address as any party

may have furnished to the other in writing and in accordance herewith, except that notices of changes of address shall be effective only

upon receipt.

20.

Governing Law; Jurisdiction. The validity, interpretation, construction, and performance of this Agreement will be governed by and construed

in accordance with the substantive laws of the State of Arizona (including the Arizona Revised Uniform Arbitration Act A.R.S. Section

12- 3001 et seq. if the parties agree to settle any dispute by binding arbitration). The sole venue to be used for any dispute arising

out of this agreement will be the Superior Court of the State of Arizona in and for the County of Maricopa, with no party having the

right to remove such action to federal court.

21.

Validity. If any provision of this Agreement or the application of any provision hereof to any person or circumstances is held invalid,

unenforceable or otherwise illegal, the remainder of this Agreement and the application of such provision to any other person or circumstances

will not be affected, and the provision so held to be invalid, unenforceable or otherwise illegal will be reformed to the extent (and

only to the extent) necessary to make it enforceable, valid or legal.

22.

Survival of Provisions. Notwithstanding any other provision of this Agreement, the parties’ respective rights and obligations under

Sections 5(b), 10, 11, 12, 13, 14 and 15 shall survive any termination or expiration of this Agreement or the termination of the Executive’s

employment for any reason whatsoever.

23.

Miscellaneous. No provision of this Agreement may be modified, waived, or discharged unless such waiver, modification or discharge is

agreed to in writing signed by the Executive and the Company. No waiver by either party hereto at any time of any breach by the other

party hereto or compliance with any condition or provision of this Agreement to be performed by such other party will be deemed a waiver

of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. Unless otherwise noted, references

to “Sections” are to sections of this Agreement. The captions used in this Agreement are designed for convenient reference

only and are not to be used for the purpose of interpreting any provision of this Agreement.

24.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original and all of

which together will constitute one and the same agreement.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement, effective as of the Effective Date, by their signatures below:

| Company: VirTra Inc. |

|

| |

|

|

| Signature:

|

/s/

Bob Ferris |

|

| Title: |

Executive

Chair |

|

| |

|

|

| Executive: John F. Givens II |

|

| |

|

|

| Signature:

|

/s/

John F. Givens II |

|

v3.23.2

Cover

|

Aug. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2023

|

| Entity File Number |

001-38420

|

| Entity Registrant Name |

VIRTRA,

INC.

|

| Entity Central Index Key |

0001085243

|

| Entity Tax Identification Number |

93-1207631

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

295

E. Corporate Place

|

| Entity Address, City or Town |

Chandler

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85225

|

| City Area Code |

(480)

|

| Local Phone Number |

968-1488

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

VTSI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

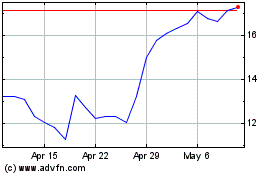

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024