0001085243

false

0001085243

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

VIRTRA,

INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38420 |

|

93-1207631 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 295

E. Corporate Place |

|

|

| Chandler,

AZ |

|

85225 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (480) 968-1488

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

VTSI |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

August 14, 2023, VirTra, Inc. issued a press release announcing its financial results for the second quarter and first half ended June

30, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained

in the website is not a part of this Current Report on Form 8-K.

The

information under this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIRTRA,

INC. |

| |

|

| Date:

August 14, 2023 |

By: |

/s/

Robert D. Ferris |

| |

Name: |

Robert

D. Ferris |

| |

Title: |

Co-Chief

Executive Officer |

Exhibit

99.1

VirTra

Reports Second Quarter and First Half 2023 Financial Results

Record

Quarterly and First Half Revenue of $10 Million and $20 Million, Up 29% and 38% Year-Over-Year, Respectively

Quarterly

Net Income Increases by $239,000 to $1.0 Million

CHANDLER,

Ariz. — August 14, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental

use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the

second quarter ended June 30, 2023. The financial statements are available on VirTra’s website and here.

Second

Quarter 2023 Financial Highlights:

| |

●

|

Total

revenue increased 29% to a record $10.3 million |

| |

●

|

Gross

profit increased 25% to $5.9 million, or 57% of total revenue |

| |

●

|

Net

income increased by $0.2 million to $1.0 million |

| |

●

|

Adjusted

EBITDA increased to $2.6 million |

| |

●

|

Cash

and cash equivalents of $13.3 million at June 30, 2023 |

Six

Month 2023 Financial Highlights:

| |

●

|

Total

revenue increased 38% to $20.4 million |

| |

●

|

Gross

profit increased 53% to $12.9 million, or 63% of total revenue |

| |

●

|

Net

income increased by $2.6 million to $4.0 million |

| |

●

|

Adjusted

EBITDA increased to $6.5 million |

Second

Quarter and Six Month 2023 Financial Highlights:

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| All figures in millions, except per share data | |

June 30, 2023 | | |

June 30, 2022 | | |

% Δ | | |

June 30, 2023 | | |

June 30, 2022 | | |

% Δ | |

| Total Revenue | |

$ | 10.3 | | |

$ | 8.0 | | |

| 29 | % | |

$ | 20.4 | | |

$ | 14.8 | | |

| 38 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

$ | 5.9 | | |

$ | 4.7 | | |

| 25 | % | |

$ | 12.9 | | |

$ | 8.4 | | |

| 53 | % |

| Gross Margin | |

| 57 | % | |

| 59 | % | |

| N/A | | |

| 63 | % | |

| 57 | % | |

| N/A | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) | |

$ | 1.0 | | |

$ | 0.8 | | |

| N/A | | |

$ | 4.0 | | |

$ | 1.4 | | |

| N/A | |

| Diluted EPS | |

$ | 0.09 | | |

$ | 0.07 | | |

| N/A | | |

$ | 0.36 | | |

$ | 0.13 | | |

| N/A | |

| Adjusted EBITDA | |

$ | 2.56 | | |

$ | 1.35 | | |

| N/A | | |

$ | 6.55 | | |

$ | 2.34 | | |

| N/A | |

Management

Commentary

“Led

by record-breaking revenue in the double-digit millions during the first two quarters of 2023, we have achieved the best bottom-line

results in our 30-year history,” said Bob Ferris, chairman and co-CEO of VirTra. “This exceptional financial performance

is a testament to the effectiveness of our internal process improvements and streamlined operations. To further solidify our market leadership

and expand revenue streams, we continue to actively pursue additional product and content development initiatives to enhance VirTra’s

already powerful training capabilities.”

John

Givens, co-CEO of VirTra, added: “Our topline results reflect the transformation we have made in fulfillment efficiency, which

serves as a key indicator of our scaling abilities and our long-term operational capabilities. We are now applying that same focus and

tenacity by taking proactive measures to increase our bookings and maximize our market potential, both domestically and internationally.

Our sales enhancement initiatives are already underway and coupled with our unwavering commitment to product quality and a customer-centric

approach, we are advancing along our strategic roadmap while further optimizing our business operations to even greater profitability

and efficiency in the years ahead.”

Second

Quarter 2023 Financial Results

Total

revenue increased 29% to $10.3 million from $8.0 million in the second quarter of 2022. The increase in revenue was driven by an improvement

in operations which helped to move through backlog and ship orders at a record pace.

Gross

profit increased 25% to $5.9 million from $4.7 million in the second quarter of 2022. Gross profit margin was 57%, a decrease compared

to 59% in the second quarter of 2022. The decrease in gross margins resulted from one-time inventory adjustments made when we went live

with our new ERP system, which had the effect of increasing the cost of sales in Q2 2023.

Net

operating expense was $4.0 million, compared to $3.7 million in the second quarter of 2022. The increase in net operating expense was

associated with salary and benefits increase and the Orlando office expenses.

Operating

income increased by $0.9 million to $1.9 million from $1.0 million in the second quarter of 2022.

Net

income was $1.0 million, or $0.09 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement

compared to net income of $0.8 million, or $0.07 per diluted share (based on 10.9 million weighted average diluted shares outstanding),

in the second quarter of 2022.

Adjusted

EBITDA, a non-GAAP metric, increased to $2.6 million from $1.3 million in the second quarter of 2022.

Six

Months Ended June 30, 2023 Financial Results

Total

revenue increased 38% to $20.4 million from $14.8 million in the first six months of 2022. The increase in revenue was driven by improvements

in operations, which helped the Company to move through the backlog and ship orders at a record pace.

Gross

profit increased 53% to $12.9 million from $8.4 million in the first six months of 2022. Gross profit margin was 63%, an increase compared

to 57% in the first half of 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while

maintaining cost of sales in line with 2022 levels.

Net

operating expense was $7.5 million, compared to $6.7 million in the first six months of 2022. The increase in net operating expense was

primarily due to an increase in salaries and benefits due to additional staff and the expenses for the new Orlando office, as well as

an increase in R&D spend.

Operating

income jumped to $5.4 million, a $3.6 increase from $1.8 million in the prior year period.

Net

income was $4.0 million, or $0.36 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement

compared to net income of $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding),

in the first half of 2022.

Adjusted

EBITDA, a non-GAAP metric, increased to $6.5 million from $2.3 million in the first six months of 2022.

Financial

Commentary

“The

strong first half results underscore the successful execution of our growth and profitability initiatives,” said CFO Alanna Boudreau.

“Achieving a robust gross profit margin of 63%, we exemplify our dedication to maintaining cost of sales while effectively selling

a favorable mix of simulators, accessories, and services. Our record net income of $4.0 million and adjusted EBITDA of $6.5 million demonstrate

the leverage in our model and our ability to effectively manage expenses. As we progress into the second half of the year with a markedly

lower backlog of $16.4 million, we’ve clearly proven our new and enhanced ability to promptly fulfill orders. Simultaneously, it

presents a challenge that encourages us to continue operating efficiently as we proactively optimize our sales pipeline. These efforts,

combined with the impressive first half performance, set us well on pace to exceed our targets for the year.”

Conference

Call

VirTra’s

management will hold a conference call today (August 14, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed

by a question-and-answer period.

U.S.

dial-in number: 1-877-407-9208

International

number: 1-201-493-6784

Conference

ID: 13739497

Please

call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you

have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The

conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s

website.

A

replay of the call will be available after 7:30 p.m. Eastern time on the same day through August 28, 2023.

Toll-free

replay number: 1-844-512-2921

International

replay number: 1-412-317-6671

Replay

ID: 13739497

About

VirTra, Inc.

VirTra

(Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement,

military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training

for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission

is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about

the company at www.VirTra.com.

About

the Presentation of Adjusted EBITDA

Adjusted

earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted

EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary

impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate

the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented

herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding

VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors,

and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA

when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a

substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of

America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities

and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity.

A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

| |

|

For

the Three Months Ended |

|

|

For

the Six Months Ended |

|

| |

|

June

30 |

|

|

June

30 |

|

|

Increase |

|

|

% |

|

|

June

30 |

|

|

June

30 |

|

|

Increase |

|

|

% |

|

| |

|

2023 |

|

|

2022 |

|

|

(Decrease) |

|

|

Change |

|

|

2023 |

|

|

2022 |

|

|

(Decrease) |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

|

$ |

1,026,635 |

|

|

$ |

787,374 |

|

|

$ |

239,261 |

|

|

|

30 |

% |

|

$ |

3,973,009 |

|

|

$ |

1,364,448 |

|

|

$ |

2,608,561 |

|

|

|

191 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision

for income taxes |

|

|

977,489 |

|

|

|

246,684 |

|

|

|

730,805 |

|

|

|

296 |

% |

|

|

1,618,834 |

|

|

|

370,684 |

|

|

|

1,248,150 |

|

|

|

337 |

% |

| Depreciation

and amortization |

|

|

253,911 |

|

|

|

230,942 |

|

|

|

22,969 |

|

|

|

10 |

% |

|

|

481,481 |

|

|

|

446,688 |

|

|

|

34,793 |

|

|

|

8 |

% |

| Interest

(net) |

|

|

61,237 |

|

|

|

|

|

|

|

61,237 |

|

|

|

100 |

% |

|

|

109,420 |

|

|

|

|

|

|

|

109,420 |

|

|

|

100 |

% |

| EBITDA |

|

$ |

2,319,271 |

|

|

$ |

1,265,000 |

|

|

$ |

1,054,271 |

|

|

|

83 |

% |

|

$ |

6,182,743 |

|

|

$ |

2,181,820 |

|

|

$ |

4,000,923 |

|

|

|

183 |

% |

| Right

of use amortization |

|

|

244,581 |

|

|

|

80,805 |

|

|

|

163,776 |

|

|

|

203 |

% |

|

|

366,355 |

|

|

|

160,658 |

|

|

|

205,697 |

|

|

|

128 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

$ |

2,563,852 |

|

|

$ |

1,345,805 |

|

|

$ |

1,218,047 |

|

|

|

91 |

% |

|

$ |

6,549,098 |

|

|

$ |

2,342,478 |

|

|

$ |

4,206,620 |

|

|

|

180 |

% |

Forward-Looking

Statements

The

information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor”

created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,”

“intends,” “may,” “plans,” “projects,” “will,” “should,” “could,”

“predicts,” “potential,” “continue,” “would” and similar expressions are intended to

identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually

achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on

our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed

in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made,

and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made

based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could

cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements,

you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors,

uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports

we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and

uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment

decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by this cautionary statement.

Investor

Relations Contact:

Matt

Glover and Alec Wilson

Gateway

Group, Inc.

VTSI@gateway-grp.com

949-574-3860

-Financial

Tables to Follow-

VIRTRA,

INC.

CONDENSED

BALANCE SHEETS

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 13,342,974 | | |

$ | 13,483,597 | |

| Accounts receivable, net | |

| 17,931,407 | | |

| 3,002,887 | |

| Inventory, net | |

| 9,967,539 | | |

| 9,592,328 | |

| Unbilled revenue | |

| 2,422,109 | | |

| 7,485,990 | |

| Prepaid expenses and other current assets | |

| 546,332 | | |

| 531,051 | |

| Total current assets | |

| 44,210,361 | | |

| 34,095,853 | |

| | |

| | | |

| | |

| Long-term assets: | |

| | | |

| | |

| Property and equipment, net | |

| 15,149,168 | | |

| 15,267,133 | |

| Operating lease right-of-use asset, net | |

| 968,234 | | |

| 1,212,814 | |

| Intangible assets, net | |

| 571,985 | | |

| 587,777 | |

| Security deposits, long-term | |

| 35,691 | | |

| 35,691 | |

| Other assets, long-term | |

| 202,462 | | |

| 376,461 | |

| Deferred tax asset, net | |

| 5,361,667 | | |

| 2,238,762 | |

| Total long-term assets | |

| 22,289,207 | | |

| 19,718,638 | |

| Total assets | |

$ | 66,499,568 | | |

$ | 53,814,491 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,156,170 | | |

$ | 1,251,240 | |

| Accrued compensation and related costs | |

| 1,653,150 | | |

| 1,494,890 | |

| Accrued expenses and other current liabilities | |

| 5,633,901 | | |

| 1,917,922 | |

| Note payable, current | |

| 246,215 | | |

| 232,537 | |

| Operating lease liability, short-term | |

| 569,692 | | |

| 557,683 | |

| Deferred revenue, short-term | |

| 8,379,515 | | |

| 4,302,492 | |

| Total current liabilities | |

| 17,638,643 | | |

| 9,756,764 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| Deferred revenue, long-term | |

| 2,539,330 | | |

| 1,605,969 | |

| Note payable, long-term | |

| 7,932,521 | | |

| 8,050,116 | |

| Operating lease liability, long-term | |

| 450,337 | | |

| 720,023 | |

| Total long-term liabilities | |

| 10,922,188 | | |

| 10,376,108 | |

| Total liabilities | |

| 28,560,831 | | |

| 20,132,872 | |

| | |

| | | |

| | |

| Commitments and contingencies (See Note 9) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock $0.0001 par value; 2,500,000 authorized; no shares issued or outstanding | |

| - | | |

| | |

| Common stock $0.0001 par value; 50,000,000 shares authorized; 10,926,774 shares issued and outstanding as of June 30,2023 and 10,900,759 shares issued and outstanding as of December 31,2022 | |

| 1,092 | | |

| 1,089 | |

| Class A common stock $0.0001 par value; 2,500,000 shares authorized; no shares issued or outstanding | |

| - | | |

| - | |

| Class B common stock $0.0001 par value; 7,500,000 shares authorized; no shares issued or outstanding | |

| - | | |

| - | |

| Additional paid-in capital | |

| 31,704,501 | | |

| 31,420,395 | |

| Retained earnings | |

| 6,233,144 | | |

| 2,260,135 | |

| Total stockholders’ equity | |

| 37,938,737 | | |

| 33,681,619 | |

| Total liabilities and stockholders’ equity | |

$ | 66,499,568 | | |

$ | 53,814,491 | |

VIRTRA,

INC.

CONDENSED

STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Net Sales | |

$ | 10,336,903 | | |

$ | 7,997,383 | | |

$ | 20,363,838 | | |

$ | 14,750,611 | |

| Total Revenue | |

| 10,336,903 | | |

| 7,997,383 | | |

| 20,363,838 | | |

| 14,750,611 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 4,416,202 | | |

| 3,253,651 | | |

| 7,494,199 | | |

| 6,319,789 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 5,920,701 | | |

| 4,743,732 | | |

| 12,869,639 | | |

| 8,430,822 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 3,280,344 | | |

| 3,085,051 | | |

| 5,991,681 | | |

| 5,381,443 | |

| Research and Development | |

| 711,754 | | |

| 617,058 | | |

| 1,478,050 | | |

| 1,296,453 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Operating expense | |

| 3,992,098 | | |

| 3,702,109 | | |

| 7,469,731 | | |

| 6,677,896 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| 1,928,603 | | |

| 1,041,623 | | |

| 5,399,908 | | |

| 1,752,926 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (expense): | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| 208,599 | | |

| 57,056 | | |

| 392,240 | | |

| 111,379 | |

| Other Expense | |

| (133,078 | ) | |

| (64,621 | ) | |

| (200,305 | ) | |

| (129,173 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net other income (expense) | |

| 75,521 | | |

| (7,565 | ) | |

| 191,935 | | |

| (17,794 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income before provision for income taxes | |

| 2,004,124 | | |

| 1,034,058 | | |

| 5,591,843 | | |

| 1,735,132 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 977,489 | | |

| 246,684 | | |

| 1,618,834 | | |

| 370,684 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 1,026,635 | | |

$ | 787,374 | | |

$ | 3,973,009 | | |

$ | 1,364,448 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.09 | | |

$ | 0.07 | | |

$ | 0.36 | | |

$ | 0.13 | |

| Diluted | |

$ | 0.09 | | |

$ | 0.07 | | |

$ | 0.36 | | |

$ | 0.13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 10,924,714 | | |

| 10,866,775 | | |

| 10,921,033 | | |

| 10,837,186 | |

| Diluted | |

| 10,933,130 | | |

| 10,892,302 | | |

| 10,925,702 | | |

| 10,867,667 | |

VIRTRA,

INC.

CONDENSED

STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Six Months Ended June 30 | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 3,973,009 | | |

$ | 1,364,448 | |

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 479,889 | | |

| 446,688 | |

| Right of use amortization | |

| 244,580 | | |

| 160,658 | |

| Employee stock compensation | |

| 199,475 | | |

| 70,497 | |

| Stock issued for service | |

| 75,000 | | |

| 350,001 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| (14,928,520 | ) | |

| (2,491,348 | ) |

| Inventory, net | |

| (375,211 | ) | |

| (3,816,862 | ) |

| Deferred taxes | |

| (3,122,905 | ) | |

| 255,511 | |

| Unbilled revenue | |

| 5,063,881 | | |

| (873,605 | ) |

| Prepaid expenses and other current assets | |

| (15,281 | ) | |

| 92,128 | |

| Other assets | |

| 173,999 | | |

| (186,727 | ) |

| Security deposits, long-term | |

| - | | |

| (15,979 | ) |

| Accounts payable and other accrued expenses | |

| 3,792,847 | | |

| 1,115,242 | |

| Payments on operating lease liability | |

| (257,677 | ) | |

| (170,535 | ) |

| Deferred revenue | |

| 5,010,384 | | |

| 921,613 | |

| Net cash provided by (used in) operating activities | |

| 313,470 | | |

| (2,778,270 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of intangible assets | |

| - | | |

| (86,012 | ) |

| Purchase of property and equipment | |

| (345,640 | ) | |

| (1,725,726 | ) |

| Net cash (used in) investing activities | |

| (345,640 | ) | |

| (1,811,738 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments of debt | |

| (118,087 | ) | |

| (115,049 | ) |

| Stock options exercised | |

| 9,634 | | |

| 12,725 | |

| Net cash (used in) financing activities | |

| (108,453 | ) | |

| (102,324 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and restricted cash | |

| (140,623 | ) | |

| (4,692,332 | ) |

| Cash and restricted cash, beginning of period | |

| 13,483,597 | | |

| 19,708,565 | |

| Cash and restricted cash, end of period | |

$ | 13,342,974 | | |

$ | 15,016,233 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash (refunded) paid: | |

$ | 134,514 | | |

$ | 99,035 | |

| Income taxes paid (refunded) | |

$ | - | | |

$ | 128,507 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash investing and financing activities: | |

| | | |

| | |

| Conversion of inventory to property and equipment | |

$ | - | | |

$ | 294,016 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

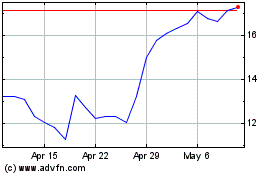

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024