Current Report Filing (8-k)

November 02 2021 - 8:50AM

Edgar (US Regulatory)

0001682745false00016827452021-10-282021-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 28, 2021

VERRA MOBILITY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

1-37979

|

81-3563824

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

1150 N. Alma School Road

Mesa, Arizona

(Address of principal executive offices)

|

85201

(Zip Code)

|

(480) 443-7000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

(Title of each class)

|

|

(Trading symbol)

|

|

(Name of each exchange on which registered)

|

|

Class A common stock, par value $0.0001 per share

|

|

VRRM

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1

Item 1.01 Entry into a Material Definitive Agreement

On November 1, 2021, VM Consolidated, Inc., a Delaware corporation (“VM Consolidated”) and an indirect wholly owned subsidiary of Verra Mobility Corporation, a Delaware corporation (the “Company”), Project Titan Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and a wholly owned subsidiary of VM Consolidated, T2 Systems Parent Corporation, a Delaware corporation (“T2 Systems”), and Thoma Bravo Discover Fund, L.P., a Delaware limited partnership, solely in its capacity as representative, entered into an Agreement and Plan of Merger (the “Merger Agreement”). Upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into T2 Systems (the “Merger”), with T2 Systems surviving the Merger as an indirect wholly owned subsidiary of the Company. At the closing of the Merger (the “Closing”), VM Consolidated will pay a purchase price of $347.0 million on a cash-free, debt-free basis, subject to certain customary purchase price adjustments. The purchase price paid by VM Consolidated in the Merger will be increased by the costs of an impending asset acquisition by T2 Systems, Inc., an indirect wholly owned subsidiary of T2 Systems, which costs include a $9.0 million purchase price and the assumption of liabilities in the form of obligations assumed under contracts assigned to T2 Systems, Inc.

The Merger Agreement includes representations, warranties and covenants of the parties that are customary for a transaction of this nature. The Merger Agreement also contains certain indemnification obligations with respect to breaches of representations and warranties and certain other specified matters. To provide for losses for which VM Consolidated would not otherwise be able to seek indemnification from T2 Systems under the Merger Agreement, VM Consolidated purchased a buyer-side representations and warranties insurance policy (the “R&W Policy”), which R&W Policy shall be issued as of the Closing, and which will be its primary recourse with respect to breaches of T2 Systems’ representations and warranties, which will not survive the Closing. The R&W Policy is subject to a cap and certain customary terms, exclusions and deductibles, which limit VM Consolidated’s ability to make recoveries under the R&W Policy.

The obligation of the parties to consummate the Merger is subject to the satisfaction or waiver of customary closing conditions set forth in the Merger Agreement, including the expiration or termination of applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, required stockholder approval and the accuracy of the other party’s representations and warranties and the performance, in all material respects, by the other party of its obligations under the Merger Agreement. The Merger Agreement includes certain termination rights of both VM Consolidated and T2 Systems, including providing that either party, subject to certain exceptions and limitations, may terminate the Merger Agreement if the Merger is not consummated by January 14, 2022. The Closing is expected to take place in the fourth quarter of 2021.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement attached hereto as Exhibit 2.1, which is incorporated herein by reference.

The Merger Agreement has been attached to provide investors with information regarding its terms and is not intended to provide any factual information about the Company, VM Consolidated or T2 Systems. The representations, warranties and covenants in the Merger Agreement were made only for the purpose of the Merger Agreement and solely for the benefit of the parties to the Merger Agreement as of specific dates. Such representations, warranties and covenants may have been made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, may or may not have been accurate as of any specific date, and may be subject to important limitations and qualifications and may therefore not be complete. The representations, warranties and covenants in the Merger Agreement may also be subject to standards of materiality applicable to the contracting parties that may differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, VM Consolidated or T2 Systems or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Item 5.05 Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics

On October 28, 2021, the Company's Board of Directors (the “Board”) adopted an amended and restated Code of Business Ethics and Conduct (the “Amended Code”) for the Company. The Amended Code maintains the essential principles and standards contained in the prior code and includes additional guidance on the handling of personal information and the laws and regulations that affect the movement of goods, services, and information across international borders. Additionally, and largely related to the Company’s continued geographic expansion through M&A, internal references to US-centric human resources-related policies were removed and replaced with references to the employees’ applicable local policies on such matters. The Amended Code is applicable to all directors, officers, and employees of the Company and its subsidiaries and affiliates. The adoption of the Amended Code did not relate to or result in any waiver, explicit or implicit, of any provision of the prior code.

The Amended Code is available in the Corporate Governance section of the Company’s website at www.ir.verramobility.com. The information on the Company’s website does not constitute part of this Current Report on Form 8-K for any purpose and is not incorporated by reference herein. The foregoing summary of the Amended Code is subject to and qualified in its entirety by reference to the full text of Amended Code.

Item 7.01 Regulation FD Disclosure

On November 2, 2021, the Company issued a press release announcing the entry into the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information furnished pursuant to this Item 7.01 and the accompanying Exhibit 99.1 furnished herewith, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and is not to be incorporated by reference into any filing of the Company.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description of Exhibits

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of November 1, 2021, by and between T2 Systems Parent Corporation, VM Consolidated, Inc., Project Titan Merger Sub, Inc. and Thoma Bravo Discover Fund, L.P.

|

|

99.1

|

|

Press Release, dated November 2, 2021, issued by Verra Mobility Corporation.

|

|

104

|

|

Cover page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Dated: November 2, 2021

|

Verra Mobility Corporation

|

|

|

|

|

|

|

By:

|

/s/ Patricia Chiodo

|

|

|

Name:

|

Patricia Chiodo

|

|

|

Title:

|

Chief Financial Officer

|

1

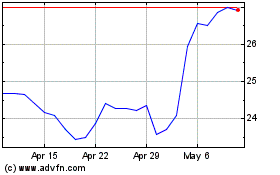

Verra Mobility (NASDAQ:VRRM)

Historical Stock Chart

From Aug 2024 to Sep 2024

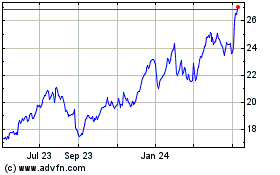

Verra Mobility (NASDAQ:VRRM)

Historical Stock Chart

From Sep 2023 to Sep 2024