Verint Concerned that Successful Board-Led

Strategy That Has Driven Strong Results Could Be Derailed by

Neuberger Berman

Board Determined to Protect Stockholders from

Neuberger Berman’s Ill-Informed and Dangerous Ideas

Cloud and Automation Acceleration Drive Strong

Q1 2020 Results

Verint Reiterates Commitment to Continue Board

Refreshment This Fiscal Year

Verint® Systems Inc. (Nasdaq: VRNT) today announced that it has

sent a letter to stockholders in connection with its upcoming

Annual Meeting of Stockholders to be held on June 20, 2019, at

8:30am ET. Stockholders of record as of May 7, 2019 will be

entitled to vote at the meeting.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190603005436/en/

(Photo: Business Wire)

The letter urges stockholders to vote the WHITE proxy card “FOR”

all of the company’s highly qualified and experienced directors,

who are driving and overseeing strong performance at Verint.

The stockholder letter, along with other materials related to

the company’s 2019 Annual Meeting, will be available at

www.VoteVerint.com and at www.sec.gov. The website will be updated

as additional information becomes available.

The full text of Verint’s letter to stockholders follows.

June 3, 2019

Dear Fellow Stockholders,

Over two years ago, Verint’s Board began a strategic

transformation that is delivering significant value to our

stockholders. This successful strategy, which includes accelerated

innovation, evolving financial disclosures and Board refreshment –

is under serious threat – and so is the value of your

investment.

DON’T LET NEUBERGER BERMAN DERAIL VERINT’S

SUCCESSFUL TRANSFORMATION

Neuberger Berman, a 2.6% stockholder who has already had input

into the selection of one of our eight directors, is attempting to

gain additional Board influence so that it can force significant

and abrupt changes on Verint that we believe would destroy

value.

Our Board has embraced change and is committed to further

change to continue to drive stockholder value, but believes

that Neuberger Berman’s ideas, if adopted, would harm our customer

relationships, disrupt our business momentum, and remove Board

members who are vital to the success of our company.

WE ARE OPPOSING NEUBERGER BERMAN IN THIS

PROXY CONTEST BECAUSE WE BELIEVE THEIR IDEAS ARE HIGHLY RISKY AND

DAMAGING TO YOUR INVESTMENT

We are determined to protect our stockholders from Neuberger

Berman’s ill-informed and dangerous ideas. We believe their

proposed actions – some of which they have not fully disclosed in

public – would damage the value of your investment. We have engaged

extensively and have tried to reason with Neuberger Berman, but –

despite their public claims – they are privately insisting on

increasing their influence on our Board, we believe, to further

their value-destructive agenda.

IN OUR PRIVATE DISCUSSIONS, NEUBERGER BERMAN

HAS DEMANDED WE COMMIT TO THE FOLLOWING VALUE-DESTRUCTIVE

ACTIONS

- Halt our strong momentum while their

unqualified nominees re-evaluate our successful strategy and

products

- Split the company now, regardless of

the consequences

- Change product and strategy direction

even if it causes concern and confusion for our customers

OUR TRANSFORMATION ALREADY ADDRESSES

NEUBERGER BERMAN’S PUBLIC DEMANDS

We believe Neuberger Berman is trying to

mislead you by asking for changes that they know have already been

underway for two years, at the Board’s initiation.

NEUBERGER BERMAN’S PUBLIC

DEMANDS

VERINT-INITIATED CHANGE OVER THE PAST TWO YEARS Enhanced

Disclosure

- As the business has transformed - Verint has enhanced its

disclosure

- Comprehensive metrics for each business segment

- Comprehensive cloud metrics

- Comprehensive three year targets

Capital

AllocationStrategy

- Three year capital allocation framework, including cash

generation and expected uses of capital

- Absent desirable acquisitions, return cash to stockholders

- Convertible notes (due June 2021) expected to be settled in

cash through refinancing, not shares

Board Refreshment

- Added three independent directors in the last three years

- One recent director was recommended by Neuberger Berman

- Committed to add another independent director this year

VERINT’S INNOVATION ACCELERATION STRATEGY IS

WORKING AND DELIVERING SIGNIFICANT STOCKHOLDER VALUE

TSR Performance Stronger than

Peers’1

1 Year 2 Year

3 Year Verint

56.0 %

51.6 % 75.5 % Enterprise

Peers2 Enterprise Peers include CVLT, NTCT, CSGS, NICE, NUAN, PEGA,

and MSTR. 14.7 % 23.5 %

41.8 % Security Peers3 Security Peers include FEYE, FSCT, SCWX,

EVBG, MSI, BAE, RTN and MANT. (5.5) %

24.2 % 46.8 % NASDAQ 15.0 %

35.3 % 64.0 % S&P 500 11.2 %

22.9 % 41.4 % Russell 2000

4.3 % 15.7 % 43.9 % S&P 1500

IT Svcs 23.2 % 53.3 %

73.9 %

This table shows that our strategy is clearly working. We

believe Neuberger Berman has attempted to deliberately mislead

stockholders by quoting TSR metrics that intentionally exclude the

market’s positive reaction to our FY2019 results and enhanced

disclosures. We believe that Neuberger Berman is misleading

investors by using metrics that date back to periods prior to 2013,

a time when Verint was a controlled company and its parent company

was in turmoil, as they well know. These distraction tactics do not

change the fact that our performance over the last three years has

been excellent.

STRONG Q1 2020 RESULTS ACROSS KEY

METRICS4

Our strong momentum over the last two years accelerated in

Q1. Non-GAAP revenue increased 11% y-o-y, margins expanded by

340bps and EPS increased 38% y-o-y. Cash from operations increased

55% y-o-y, reflecting the underlying strength in our business.

FY20 GUIDANCE RAISED AGAIN FOR REVENUE AND

EPS5

Verint recently raised guidance for the third time for FY20

since providing initial guidance in December. Revenue growth is

expected to accelerate to 10%. Strong revenue growth combined with

continued margin expansion is expected to drive 14% EPS growth.

THREE YEAR TARGETS - 10% REVENUE CAGR

AND 14% EPS CAGR

Our strong results and stock appreciation

reflect the successful execution of our strategy to accelerate

innovation in the areas of automation and cloud. We believe this

strategy will enable us to sustain growth and drive long-term value

for ALL stockholders.

Three Year Targets by Business

Segment6

Verint Revenue:

~$1.65 Billion

Adjusted EBITDA Margin:

~27%

Diluted EPS:

$4.70

CustomerEngagement

Revenue:

~$1.08 Billion

Adjusted EBITDA Margin:

~30%

Cloud Revenue Mix:

>40%

Recurring Revenue Mix:

~70%

Cyber Intelligence Revenue:

~$575 Million

Adjusted EBITDA Margin:

>20%

Gross Margin Expansion fromSoftware Model

Transition

CLOUD FIRST STRATEGY

Verint is now one of the largest cloud vendors in our Customer

Engagement market and we target 30% - 40% cloud revenue CAGR over

the next three years. We have a CLOUD FIRST strategy and our

salesforce is leading with SaaS. All our solutions run in the

Verint cloud and we have a robust cloud offering ranging from

small- to medium-sized business solutions all the way up to

enterprise-class solutions, elevating customer experience and

driving operating efficiencies.

Based on our cloud leadership, we believe our large installed

base will migrate to the cloud over time creating an opportunity

for 2x cloud revenue uplift. We make it easy for our customers to

seamlessly transition their installed base by providing

feature parity between our

on-premise and cloud solutions. Cloud adoption in our market

provides a significant opportunity for revenue upside and margin

expansion.

ANALYSTS SUPPORT VERINT’S STRATEGY AND

GROWTH POTENTIAL

As our growth strategy continues to drive successful results and

share price appreciation, research analysts have reported their

positive views on Verint’s performance and outlook:

“Prospects are brightening as the company is executing well, and

both segments are achieving healthy revenue growth and improved

profitability.”

- Shaul Eyal, Analyst, Oppenheimer &

Co. research report, May 30, 20197

“In our opinion after almost two years of hitting/beating Street

estimates, this story is starting to finally get the respect from

investors it deserves despite some of the recent noise from short

reports/bears. The major investments in automation/analytics and

cloud are clearly paying dividends in the field and speak to

secular tailwinds as more contact centers move to the cloud.”

- Daniel Ives, Analyst, Wedbush

Securities research report, May 30, 20197

“We are encouraged by the more granular disclosure, and believe

that execution towards the company’s targets should lead to

multiple expansion over time. Our price target goes to $72, from

$71. Maintain Overweight.”

- Paul Coster, Analyst, JP Morgan

Securities research report, May 22, 20197

“Revenue-growth is inflecting to above 10% CAGR, and [Verint]

seems well positioned for the deployment of actionable intelligence

into adjacencies. We are increasing our estimates…Reiterate

Overweight with conviction.”

- Paul Coster, CFA, Analyst, JP Morgan

research report, May 7, 20197

VERINT IS COMMITTED TO CONTINUING TO EVOLVE

OUR DISCLOSURES

As our business has evolved, our disclosure has also evolved and

it will continue to do so. Verint has enhanced its disclosure in

the past as our business changed, based on what we heard would be

useful to our investors. We did so again in our first quarter 2020

earnings announcement, sharing three-year non-GAAP revenue and EPS

targets that reflect our confidence in our growth strategy and the

relevance of these metrics to investors.

Analysts are commenting positively on our enhanced

disclosure.

“We also loudly applaud the increased transparency around

revenue/cloud targets as this continues to be a driver for the

stock to get re-rated as [Verint] shifts to a software based model

adding leverage/scale over the next 12 to 18 months.”

- Daniel Ives, Analyst, Wedbush

Securities research report, May 21, 20197

“We also liked [the] expanded view into three year Customer

Engagement targets, which demonstrate the potential growth and

margin opportunities around these trends.”

- Dan Bergstrom, Analyst, RBC Capital

Markets research report, May 21, 20197

“We really appreciate the new disclosures. It's very

helpful.”

- Anubhav Mehla, Jefferies Research

Associate, Verint Customer Engagement Automation and Cloud Strategy

webcast, May 7, 20197

VERINT HAS ROBUST ENGAGEMENT WITH

STOCKHOLDERS AND IS COMMITTED TO CONTINUED BOARD

REFRESHMENT

Your Board and management team have deep, ongoing engagement

with the company’s stockholders, conducting more than 100 calls and

meetings with investors representing approximately 65% of our

shares over the past 12 months, and we welcome constructive ideas

to drive long-term sustainable value creation.

We are committed to ongoing Board refreshment, and we have added

three new directors over the last three years, including one

director at Neuberger Berman’s suggestion in 2017. This fiscal

year we intend to continue the refreshment process and add a

director with recent and relevant experience in cloud, cyber

security, and/or software who will also enhance the diversity of

the Board.

VERINT’S HIGHLY QUALIFIED AND INDEPENDENT

BOARD IS COMMITTED AND BEST-SUITED TO EXECUTE THE STRATEGY THAT

WILL DRIVE VALUE CREATION FOR ALL VERINT STOCKHOLDERS

We strongly urge

stockholders to support Verint by voting “FOR” Verint’s entire slate of eight highly

qualified directors on the WHITE proxy card.

Sincerely,

The Board of Directors of Verint Systems Inc.

If you have any questions, or need assistance

in voting your shares, please call the firm assisting us in the

solicitation of proxies:

INNISFREE M&A INCORPORATED

TOLL-FREE at 1 (877) 750-9496 (from the U.S.

and Canada)

OR +1 (412) 232-3651 (from other

locations)

Remember: Please simply discard any Gold proxy

card you may receive from Neuberger Berman. Any vote on Neuberger

Berman’s Gold proxy card (even a vote in protest of their nominees)

will revoke any earlier proxy card that you have submitted to

Verint.

SUPPLEMENTAL INFORMATION REGARDING NON-GAAP FINANCIAL

MEASURES

This document contains non-GAAP financial measures and non-GAAP

forward looking statements. The tables below reconcile the non-GAAP

financial measures to the most directly comparable financial

measures prepared in accordance with Generally Accepted Accounting

Principles (“GAAP”).

We believe these non-GAAP financial measures, used in

conjunction with the corresponding GAAP measures, provide investors

with useful supplemental information about the financial

performance of our business by: (i) facilitating the comparison of

our financial results and business trends between periods, by

excluding certain items that either can vary significantly in

amount and frequency, are based upon subjective assumptions, or in

certain cases are unplanned for or difficult to forecast; (ii)

facilitating the comparison of our financial results and business

trends with other technology companies who publish similar non-GAAP

measures; and (iii) allowing investors to see and understand key

supplementary metrics used by our management to run our business,

including for budgeting and forecasting, resource allocation, and

compensation matters. We also make these non-GAAP financial

measures available because a number of our investors have informed

us that they find this supplemental information useful.

Non-GAAP financial measures should not be

considered in isolation as substitutes for, or superior to,

comparable GAAP financial measures. The non-GAAP financial measures

we present have limitations in that they do not reflect all of the

amounts associated with our results of operations as determined in

accordance with GAAP, and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to or in addition to the adjustments

made in these non-GAAP financial measures. Other companies may

calculate similar non-GAAP financial measures differently than we

do, limiting their usefulness as comparative measures.

Year Ended

January 31, 2017

Year Ended

January 31, 2018

Year EndedJanuary 31,

2019

Three MonthsApril 30,

2018

Three MonthsApril 30,

2019

Revenue Reconciliation GAAP Revenue $1,062.1

$1,135.2 $1,229.7 $289.2 $315.2 Revenue

Adjustments 10.6 15.3 15.4 2.8 8.9

Non-GAAP Revenue

$1,072.7 $1,150.5 $1,245.1 $292.0

$324.2 Table of Reconciliation from GAAP Cloud

Revenue to Non-GAAP Cloud Revenue Customer Engagement

Cloud Revenue – GAAP $122.0 $150.7 Estimated

Revenue Adjustments 13.0 14.7

Cloud Revenue – Non-GAAP

$135.0 $165.4 Operating Income

Reconciliation GAAP Operating Income $17.4

$48.6 $114.2 $7.8 $14.5 As a

Percentage of GAAP Revenue 1.6% 4.3% 9.3%

2.7% 4.6% Revenue Adjustments $10.6 $15.3 $15.4 $2.8

$8.9 Amortization of Acquired Technology 37.3 38.2 25.4 7.4 6.7

Amortization of Other Acquired Intangible Assets 44.1 34.2 31.0 7.7

7.7 Stock-Based Compensation Expenses 65.6 69.4 66.7 16.4 17.1

Acquisition Expenses, Net 12.9 1.6 9.9 2.3 3.9 Restructuring

Expenses 15.7 13.4 4.9 1.1 1.4 Impairment Charges - 3.3 – - - Other

Adjustments 1.0 2.1 (0.6) 0.6 2.1

Non-GAAP Operating Income

$204.6 $226.1 $266.9 $46.1 $62.3

As a Percentage of Non-GAAP Revenue 19.1%

19.7% 21.4% 15.8% 19.2% Net

(Loss) Income Attributable to Verint Systems Inc.

Reconciliation GAAP Net (Loss) Income Attributable to Verint

Systems Inc. $(29.4) $(6.6) $66.0

$(2.2) $1.6 Total GAAP Net (Loss) Income Adjustments

188.1 187.5 146.7

36.7 47.5

Non-GAAP Net Income Attributable

to Verint Systems Inc. $158.7 $180.9

$212.7 $34.5 $49.1 GAAP Diluted Net (Loss)

Income per Common Share Attriburtble

to Verint Systems Inc.

$(0.47) $(0.10) $1.00 $(0.03) $0.02 Non-GAAP Diluted Net Income per

Common Share Attributable

to Verint Systems Inc.

$2.51 $2.81 $3.21 $0.53 $0.73

GAAP Weighted-Average Shares Used

in Computing Diluted Net (Loss) Income per Common Share

62,593 63,312 66,245 63,928

67,088 Additional Weighted-Average Shares Applicable to

Non-GAAP Net Income per Common Share Attributable to Verint Systems

Inc. 538 1,046 – 1,203 -

Non-Gaap Diluted Weighted-Average

Shares Used in Computing Net Income per Common Share

63,131 64,358

66,245 65,131

67,088

Our non-GAAP Consolidated, Customer Engagement, and Cyber

Intelligence three-year targets exclude various GAAP measures,

including:

- Amortization of intangible assets.

- Stock-based compensation expenses.

- Revenue adjustments.

- Acquisition expenses.

- Restructuring expenses.

Our non-GAAP Consolidated three-year targets also reflect income

tax provisions on a non-GAAP basis.

We are unable, without unreasonable efforts, to provide a

reconciliation for these GAAP measures which are excluded from our

non-GAAP Consolidated, Customer Engagement, and Cyber Intelligence

three-year targets, due to the level of unpredictability and

uncertainty associated with these items. For these same reasons, we

are unable to assess the probable significance of these excluded

items.

Our non-GAAP Consolidated, Customer Engagement, and Cyber

Intelligence three-year targets reflect foreign currency exchange

rates approximately consistent with current rates.

Our non-GAAP outlook for the year ending January 31, 2020

excludes the following GAAP measures which we are able to quantify

with reasonable certainty:

- Amortization of intangible assets of

approximately $55 million.

- Amortization of discount on convertible

notes of approximately $12 million.

Our non-GAAP outlook for the year ending January 31, 2020

excludes the following GAAP measures for which we are able to

provide a range of probable significance:

- Revenue adjustments are expected to be

between approximately $24 million and $26 million.

- Stock-based compensation is expected to

be between approximately $73 million and $77 million, assuming

market prices for our common stock approximately consistent with

current levels.

Our non-GAAP outlook does not include the potential impact of

any in-process business acquisitions that may close after the date

hereof, and, unless otherwise specified, reflects foreign currency

exchange rates approximately consistent with current rates.

We are unable, without unreasonable efforts, to provide a

reconciliation for other GAAP measures which are excluded from our

non-GAAP outlook, including the impact of future business

acquisitions or acquisition expenses, future restructuring

expenses, and non-GAAP income tax adjustments due to the level of

unpredictability and uncertainty associated with these items. For

these same reasons, we are unable to assess the probable

significance of these excluded items.

About Verint Systems Inc.

Verint® (Nasdaq: VRNT) is a global leader in Actionable

Intelligence® solutions with a focus on customer engagement

optimization and cyber intelligence. Today, over 10,000

organizations in more than 180 countries—including over 85 percent

of the Fortune 100—count on intelligence from Verint solutions to

make more informed, effective and timely decisions. Learn more

about how we’re creating A Smarter World with Actionable

Intelligence® at www.verint.com.

VERINT, ACTIONABLE INTELLIGENCE, THE CUSTOMER ENGAGEMENT

COMPANY, NEXT IT, FORESEE, OPINIONLAB, KIRAN ANALYTICS, TERROGENCE,

SENSECY, CUSTOMER ENGAGEMENT SOLUTIONS, CYBER INTELLIGENCE

SOLUTIONS, EDGEVR, RELIANT, VANTAGE, STAR-GATE, SUNTECH, and VIGIA

are trademarks or registered trademarks of Verint Systems Inc. or

its subsidiaries. Other trademarks mentioned are the property of

their respective owners.

Important Additional Information and Where to Find It

Verint has filed a definitive proxy statement on Schedule 14A

and form of associated WHITE Proxy Card with the Securities and

Exchange Commission (“SEC”) in connection with the solicitation of

proxies for its 2019 Annual Meeting (the “Definitive Proxy

Statement”). Details concerning the nominees of Verint’s Board of

Directors for election at the 2019 Annual Meeting are included in

the Definitive Proxy Statement. Verint has mailed solicitation

materials, including a WHITE proxy card, to stockholders of record

entitled to vote at the 2019 Annual Meeting. BEFORE MAKING ANY

VOTING DECISION, INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE

URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE

SEC, INCLUDING VERINT’S DEFINITIVE PROXY STATEMENT AND ANY

SUPPLEMENTS THERETO AND ACCOMPANYING WHITE PROXY CARD, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders are able to obtain

a free copy of the Definitive Proxy Statement and of these other

documents through the website maintained by the SEC at

http://www.sec.gov and through the website maintained by Verint at

http://www.verint.com/investor-relations as soon as

reasonably practicable after such materials are electronically

filed with, or furnished to, the SEC.

Certain Information Regarding Participants

Verint, its directors and certain of its officers and other

employees will be deemed to be participants in the solicitation of

Verint’s stockholders in connection with Verint’s 2019 Annual

Meeting. Information regarding the names, affiliations and direct

and indirect interests (by security holdings or otherwise) of these

persons is set forth in the Definitive Proxy Statement filed with

the SEC in connection with Verint’s 2019 Annual Meeting. Additional

information regarding the interests of participants of Verint in

the solicitation of proxies in respect of Verint’s 2019 Annual

Meeting will be filed with the SEC when they become available.

Stockholders are able to obtain a free copy of the Definitive Proxy

Statement and other documents filed by Verint with the SEC from the

sources listed above.

This document contains “forward-looking statements,” including

statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of

similar effect relating to Verint Systems Inc. These

forward-looking statements are not guarantees of future performance

and they are based on management’s expectations that involve a

number of risks, uncertainties and assumptions, any of which could

cause actual results to differ materially from those expressed in

or implied by the forward-looking statements. For a detailed

discussion of these risk factors, see our Annual Report on Form

10-K for the fiscal year ended January 31, 2019, and other filings

we make with the SEC. The forward-looking statements contained in

this document are made as of the date of this document and, except

as required by law, Verint assumes no obligation to update or

revise them or to provide reasons why actual results may

differ.

1 Bloomberg and Capital IQ, as of 8-Apr-2019.

2 Enterprise Peers include CVLT, NTCT, CSGS, NICE, NUAN, PEGA,

and MSTR.

3 Security Peers include FEYE, FSCT, SCWX, EVBG, MSI, BAE, RTN

and MANT.

4 The $324 million revenue, 19.2% operating margin and $0.73 EPS

are non-GAAP metrics.

5Our guidance for FY20F revenue of $1,375 million and Diluted

EPS of $3.65 are on a non-GAAP basis.

6 All targets are on a non-GAAP basis.

7 Permission to use quote neither sought nor obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190603005436/en/

Investor MediaAlan

Rodenalan.roden@verint.comMedia:Jim Barron/David MillarSard

Verbinnen & Co.212 687 8080

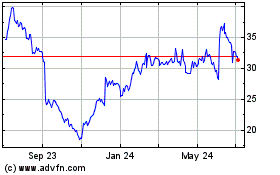

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

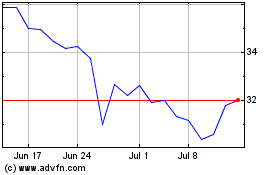

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jul 2023 to Jul 2024