Verastem Oncology Announces Proposed Public Offering of Common Stock and Pre-Funded Warrants

June 15 2023 - 4:00PM

Business Wire

Verastem Oncology, (Nasdaq: VSTM), a biopharmaceutical company

committed to advancing new medicines for patients with cancer,

today announced that it intends to offer and sell shares of its

common stock and pre-funded warrants in an underwritten public

offering. In connection with the proposed offering, Verastem

Oncology intends to grant the underwriters a 30-day option to

purchase up to an additional 15% of the shares of its common stock

offered in the public offering (including shares underlying the

pre-funded warrants), at the public offering price, less

underwriting discounts and commissions. The offering is subject to

market and other conditions, and there can be no assurance as to

whether or when the offering may be completed, or as to the actual

size or terms of the offering. All of the securities to be sold in

the offering are to be sold by Verastem Oncology.

RBC Capital Markets and Cantor are acting as joint book-running

managers and representatives of the underwriters for the proposed

offering.

Verastem Oncology intends to use the net proceeds from the

proposed public offering for (i) continued research and development

of its product candidates (ii) potential launch of avutometinib and

defactinib in low-grade serous ovarian cancer, and (iii) working

capital and other general corporate purposes.

A shelf registration statement on Form S-3 relating to the

public offering of the securities described above was declared

effective by the Securities and Exchange Commission (the “SEC”) on

April 6, 2022. The offering will be made only by means of a written

prospectus and prospectus supplement that form a part of the

registration statement. Before you invest, you should read the

preliminary prospectus supplement relating to and describing the

terms of such public offering, the accompanying base prospectus,

and the related registration statement and other documents that

Verastem Oncology has filed with the SEC for more complete

information about Verastem Oncology and the proposed offering.

These documents, when available, are free and can be found by

visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

copies of the preliminary prospectus supplement and accompanying

prospectus relating to the proposed offering may be obtained, when

available, by contacting RBC Capital Markets, LLC, Attention:

Equity Capital Markets, 200 Vesey Street, 8th Floor, New York, NY,

10281, or by telephone at (877) 822-4089 or by email at

equityprospectus@rbccm.com or Cantor Fitzgerald & Co.,

Attention: Capital Markets, 499 Park Avenue, 4th Floor, New York,

NY, 10022, by email at prospectus@cantor.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

About Verastem Oncology

Verastem Oncology (Nasdaq: VSTM) is a development-stage

biopharmaceutical company committed to the development and

commercialization of new medicines to improve the lives of patients

diagnosed with cancer. Our pipeline is focused on novel small

molecule drugs that inhibit critical signaling pathways in cancer

that promote cancer cell survival and tumor growth, including

RAF/MEK inhibition and focal adhesion kinase (FAK) inhibition.

Forward-looking statements:

Certain of the statements made in this press release, including

those relating to Verastem Oncology’s proposed public offering, are

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “target,” “potential,” “will,” “would,” “could,”

“should,” “continue,” “can,” “promising” and similar expressions

are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words.

Each forward-looking statement is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in such statement. Applicable risks

and uncertainties include, without limitation: our ability to

successfully complete the proposed offering on the timeline and

with terms and conditions satisfactory to us; the possible adverse

impact on the market price of our shares of common stock due to the

dilutive effect of the securities to be sold in the proposed

offering; capital market risks; and the impact of general economic

or industry conditions. There can be no assurance that we will be

able to complete the proposed public offering on the anticipated

terms, or at all. You should not place undue reliance on these

forward-looking statements, which apply only as of the date of this

press release. Other risks and uncertainties include those

identified in Verastem Oncology’s Annual Report on Form 10-K for

the year ended December 31, 2022 as filed with the SEC on March 14,

2023 and any subsequent SEC filings, including the registration

statement and prospectus supplement related to the proposed

offering. The forward-looking statements contained in this press

release reflect Verastem Oncology’s views as of the date of this

release, and Verastem Oncology does not undertake and specifically

disclaims any obligation to update any forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230615289303/en/

Investors: Dan Calkins +1 781-469-1694 dcalkins@verastem.com

Nate LiaBraaten +1 212-600-1902 nate@argotpartners.com

Media: Lisa Buffington +1 (781) 292-4205

lbuffington@verastem.com

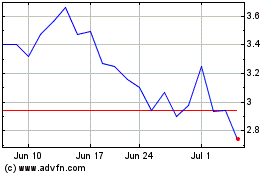

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

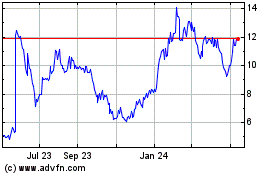

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Nov 2023 to Nov 2024