Verastem Oncology Announces Reverse Stock Split

May 31 2023 - 9:11AM

Business Wire

Verastem Oncology, (Nasdaq: VSTM), a biopharmaceutical company

committed to advancing new medicines for patients with cancer,

today announced that it will effect a 1-for-12 reverse stock split

of its issued and outstanding common stock. Verastem’s stockholders

approved an amendment to Verastem’s Restated Certificate of

Incorporation (as amended, the “Amended Charter”) to effect the

reverse stock split at Verastem’s Annual Meeting of Stockholders

held on May 15, 2023. The reverse stock split is intended to

increase the per share trading price of the Verastem’s common stock

to ensure Verastem will satisfy the price requirement for continued

listing on the Nasdaq Global Market, and potentially attract a

broader range of investors. Pursuant to the Amended Charter, the

reverse stock split will become effective at 5:00 p.m. Eastern Time

on May 31, 2023 (the “Effective Time”) and the Company expects that

its common stock will open for trading on June 1, 2023 on the

Nasdaq Capital Market on a split-adjusted basis under the Company’s

existing trading symbol “VSTM”. As a result of the reverse stock

split, the CUSIP number for the Company’s common stock will now be

92337C203.

Upon effectiveness of the reverse stock split, every 12 shares

of Verastem’s issued and outstanding common stock will

automatically be converted into one share of common stock at the

Effective Time. The reverse stock split will affect all

stockholders uniformly and will not alter any stockholder's

percentage interest in the Company's equity, except to the extent

that the reverse stock split results in some stockholders receiving

cash in lieu of fractional shares. No fractional shares will be

issued in connection with the reverse stock split, and stockholders

who would otherwise be entitled to a fractional share will receive

a cash payment equal to the closing price of our common stock as

reported on the Nasdaq Capital Market on May 30, 2023, as adjusted

by the reverse stock split ratio of 1-for-12, multiplied by the

applicable fraction of a share to which the stockholder would

otherwise be entitled. The reverse stock split will reduce the

number of shares of outstanding common stock from approximately

200,872,633 shares to approximately 16,739,386 shares. Proportional

adjustments will be made to the number of shares of common stock

issuable upon exercise of Verastem’s outstanding stock options,

restricted stock units, and preferred stock, as well as the

applicable exercise price. The par value of Verastem’s common stock

will remain unchanged at $0.0001 per share after the reverse stock

split. There will be no change in the authorized number of shares

of the Company’s common stock or preferred stock after the reverse

stock split.

Computershare Trust Company, N.A. (“Computershare”) will act as

the transfer agent for the reverse stock split. Stockholders

holding their shares electronically in book-entry form are not

required to take any action to receive post-split shares.

Stockholders owning shares through a bank, broker or other nominee

will have their positions automatically adjusted to reflect the

reverse stock split, subject to brokers’ particular processes, and

will not be required to take any action in connection with the

reverse stock split. For those stockholders holding physical stock

certificates, Computershare will send instructions for exchanging

those certificates for shares held electronically in book-entry

form or for new certificates, in either case representing the

post-split number of shares.

Additional information concerning the reverse stock split can be

found in Verastem’s definitive proxy statement filed with the

Securities and Exchange Commission on April 5, 2023.

About Verastem Oncology

Verastem Oncology (Nasdaq: VSTM) is a development-stage

biopharmaceutical company committed to the development and

commercialization of new medicines to improve the lives of patients

diagnosed with cancer. Our pipeline is focused on novel small

molecule drugs that inhibit critical signaling pathways in cancer

that promote cancer cell survival and tumor growth, including

RAF/MEK inhibition and focal adhesion kinase (FAK) inhibition. For

more information, please visit www.verastem.com.

Forward-Looking Statements Notice

This press release includes forward-looking statements about

Verastem Oncology, including statements related to the timing and

impact of our reverse stock split. The words "anticipate,"

"believe," "estimate," "expect," "intend," "may," "plan,"

"predict," "project," "target," "potential," "will," "would,"

"could," "should," "continue," “can,” “promising” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Each forward-looking statement is subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in such statement.

Applicable risks and uncertainties include, among others, the risk

that the reverse stock split may not occur on time or at all, and

the risks identified under the heading “Risk Factors” in Verastem

Oncology’s Annual Report on Form 10-K for the year ended December

31, 2022 as filed with the Securities and Exchange Commission (SEC)

on March 14, 2023 and in any subsequent filings with the SEC. The

forward-looking statements contained in this press release reflect

Verastem Oncology’s views as of the date hereof, and Verastem

Oncology does not assume and specifically disclaims any obligation

to update any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230531005450/en/

Investors: Dan Calkins +1 781-469-1694

dcalkins@verastem.com

Nate LiaBraaten +1 212-600-1902 nate@argotpartners.com

Media: Lisa Buffington +1 (781) 292-4205

lbuffington@verastem.com

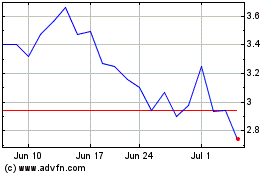

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

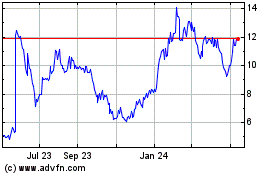

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Nov 2023 to Nov 2024