Verastem Oncology Announces Up to $60 Million Private Placement Offering of Series B Convertible Preferred Stock

January 24 2023 - 5:46PM

Business Wire

Verastem Oncology (Nasdaq:VSTM), a biopharmaceutical company

committed to advancing new medicines for patients with cancer,

today announced that it has entered into a definitive agreement to

sell approximately 2.1 million shares of its Series B Convertible

Preferred Stock (the “Preferred Stock”) to affiliates of BVF

Partners L.P. in a private placement to raise aggregate gross

proceeds of up to approximately $60 million in two tranches, before

deducting fees to the placement agent and other estimated offering

expenses payable by the Company. The initial tranche, consisting of

1.2 million shares of Preferred Stock for gross proceeds of

approximately $30 million, representing a purchase price per common

share equal to $0.5901, is anticipated to close on January 27,

2023, subject to the satisfaction of customary closing conditions.

The second tranche, consisting of 0.9 million shares of Preferred

Stock for gross proceeds of approximately $30 million, resulting in

a purchase price per common share equal to $0.75, will close within

seven trading days of the Company’s common stock trading for a

10-day volume weighted average price of at least $1.125 per share

with aggregate trading volume during the same 10-day period of at

least $25 million within 18 months from the closing date of the

initial tranche.

Truist Securities acted as sole placement agent for the private

placement.

The shares of Preferred Stock are convertible into the Company’s

common stock, par value $0.0001 per share (the “Common Stock”), at

the option of the holders at any time, subject to certain

limitations, at a conversion rate equal to $0.5901 per share, a

premium above the 5 day average closing price of $0.5860 as of

January 24, 2023. The holders will initially be prohibited from

converting Preferred Stock into Common Stock if, as a result of

such conversion, any holder, together with its affiliates, would

beneficially own 9.99% or more of the total Common Stock then

issued and outstanding immediately following the conversion of such

shares of Preferred Stock.

Shares of Preferred Stock will have no voting rights, except as

required by law and except that the consent of a majority of the

holders of the outstanding Preferred Stock will be required to

amend the terms of the Preferred Stock. In the event of the

Company’s liquidation, dissolution or winding up, holders of

Preferred Stock are entitled to receive, in preference to any

distributions of any of the assets or surplus funds of the Company

to the holders of the Common Stock, an amount equal to $1.00 per

share of Preferred Stock (“Liquidation Preference”). After payment

of the Liquidation Preference, each holder of shares of Preferred

Stock shall be entitled to participate pari passu with the holders

of the Common Stock on an as-converted basis. Holders of Preferred

Stock are entitled to receive when, as and if dividends are

declared and paid on the Common Stock, an equivalent dividend,

calculated on an as-converted basis. Shares of Preferred Stock are

otherwise not entitled to dividends.

The Preferred Stock ranks (i) senior to all of the Common Stock;

(ii) senior to all other classes and series of equity securities of

the Corporation that by their terms do not rank senior to the

Preferred Stock; (iii) senior to all shares of the Company’s Series

A Convertible Preferred Stock; (iv) on parity with any class or

series of capital stock of the Company hereafter created

specifically ranking by its terms on parity with the Preferred

Stock; (v) junior to any class or series of capital stock of the

Company hereafter created specifically ranking by its terms senior

to any Preferred Stock; and (vi) junior to all of the Company’s

existing and future debt obligations.

Verastem intends to use the net proceeds from the private

placement for general corporate purposes, which may include working

capital, capital expenditures, research and development

expenditures, clinical trial expenditures, commercial expenditures,

milestone payments under in-license agreements, and possible

acquisitions.

The securities to be sold in the private placement have not been

registered under the Securities Act of 1933, as amended

(“Securities Act”), or any state or other applicable jurisdiction's

securities laws, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the Securities Act and applicable

state or other jurisdictions' securities laws. The Company has

agreed to file a registration statement with the U.S. Securities

and Exchange Commission registering the resale of the Preferred

Stock and the shares of Common Stock issuable upon the conversion

of the Preferred Stock issued in the private placement no later

than the 10th day after the filing of the Company’s Annual Report

on Form 10-K for the year ended December 31, 2022.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any offer, solicitation or sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. Any offering of the securities under the resale

registration statement will only be made by means of a

prospectus.

About Verastem Oncology

Verastem Oncology (Nasdaq: VSTM) (Verastem, Inc.) is a

development-stage biopharmaceutical company committed to the

development and commercialization of new medicines to improve the

lives of patients diagnosed with cancer. Our pipeline is focused on

novel small molecule drugs that inhibit critical signaling pathways

in cancer that promote cancer cell survival and tumor growth,

including RAF/MEK inhibition and focal adhesion kinase (FAK)

inhibition.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are subject to risks, uncertainties and other factors,

including without limitation, statements regarding the expected

timing for the closing of either tranche of the private placement,

the expectation that the second tranche will close, and the

expected use of proceeds from the private placement. These risks,

uncertainties and other factors could cause actual results to

differ materially from those referred to in the forward-looking

statements, including, without limitation, whether or not the

Company will be able to consummate the private placement on the

timeline or with the terms anticipated, if at all. The reader is

cautioned not to rely on these forward-looking statements. Other

risks and uncertainties include those identified under the heading

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2021 as filed with the Securities and

Exchange Commission (“SEC”) on March 28, 2022 and in any subsequent

filings with the SEC. The forward-looking statements contained in

this press release reflect Verastem Oncology’s views as of the date

hereof, and the Company does not assume and specifically disclaims

any obligation to update any forward-looking statements whether as

a result of new information, future events or otherwise, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230124006022/en/

Investors: Dan Calkins Investor Relations +1 781-469-1694

dcalkins@verastem.com

Nate LiaBraaten +1 212-600-1902 nate@argotpartners.com

Media: Lisa Buffington Corporate Communications +1

781-292-4205 lbuffington@verastem.com

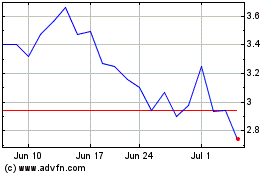

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

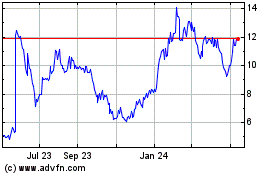

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Nov 2023 to Nov 2024