Current Report Filing (8-k)

September 02 2020 - 7:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of earliest event reported: September 1, 2020

TSR,

Inc.

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

00-8656

|

|

13-2635899

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

400

Oser Avenue, Suite 150, Hauppauge, NY 11788

(Address

of Principal Executive Offices) (Zip Code)

(631)

231-0333

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange On Which Registered

|

|

Common

Stock, par value $0.01 per share

|

|

TSRI

|

|

NASDAQ

Capital Market

|

|

Preferred

Share Purchase Rights1

|

|

--

|

|

--

|

|

|

1

|

Registered

pursuant to Section 12(b) of the Act pursuant to a Form 8-A filed by the registrant on March 15, 2019. Until the Distribution

Date (as defined in the registrant’s Rights Agreement dated August 29, 2018), the Preferred Share Purchase rights will be

transferred only with the share of the registrant’s Common Stock to which the Preferred Share Purchase Rights are attached.

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

September 1 2020, TSR, Inc. issued a press release announcing the acquisition of Geneva Consulting Group, Inc. A copy of the press

release is being furnished as Exhibit 99.1 hereto and is incorporated herein by reference. The information in this Item 7.01 and

the related Item 9.01, including the press release furnished as Exhibit 99.1 hereto, is being furnished and shall not be deemed

to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be deemed

incorporated by reference into any reports or filings with the Securities and Exchange Commission, whether made before or after

the date hereof, except as expressly set forth by specific reference in such report or filing.

Item 8.01 Other Events

On

September 1, 2020, TSR, Inc. (the “Company”) completed the acquisition of all of the outstanding stock of Geneva Consulting

Group, Inc., a New York corporation (“Geneva”) and provider of temporary and permanent information technology personnel

based in Port Washington, New York. The stock of Geneva was purchased from the three shareholders of Geneva (the “Sellers”),

none of which had, or will have following the acquisition, a material relationship with the Company or its affiliates.

The

purchase price for the shares of Geneva is comprised of the following: (i) $1.45 million in cash paid to Sellers at the closing

of the acquisition, (ii) an amount, up to $0.75 million, that is equal to the amount of Geneva’s loan under the Paycheck

Protection Program (“PPP”), a program established under the congressionally-approved Coronavirus Aid, Relief, and

Economic Security Act that is administered by the U.S. Small Business Administration (“SBA”) that is forgiven by the

SBA, (iii) an amount, up to $0.30 million which may be paid as an earnout payment in part in February 2021 and in part in August

2021 (the “Earnout Payments”) and (iv) bonus payments payable in $10,000 increments. Any such Earnout Payments and

bonus payments will be determined based upon the achievement of certain criteria relating to the number the Company’s contractors

working full-time at Company clients on such dates.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

TSR, Inc.

|

|

|

|

|

|

|

By:

|

/s/ John G. Sharkey

|

|

|

|

John G. Sharkey

|

|

|

|

Senior Vice President and Chief Financial Officer

|

Dated:

September 2, 2020

2

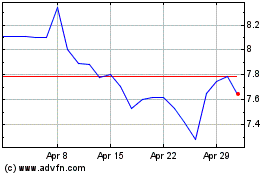

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Sep 2023 to Sep 2024