TechTarget, Inc. (NASDAQ: TTGT) today announced financial

results for the first quarter ended March 31, 2009 and the second

quarter ended June 30, 2009.

“We are pleased that the restatement project is now behind us.

It is important to point out that the restatement involved a change

only in the timing of our recognizing revenue. The validity of our

revenue was never questioned, our total revenue did not change for

any specific customer contract and the aggregate revenue shifted

between the annual periods reviewed was approximately 1%.

Turning to the company’s performance, the market seems to

have stabilized and we are encouraged by our sequential

revenue growth in Q2 and our strong cash flow” said Greg Strakosch,

Chairman and CEO of TechTarget. “Our primary focus continues to be

to take advantage of the downturn by investing and growing market

share, while maintaining healthy profitability.”

Total revenues for the first quarter are as follows:

Three Months Ended March 31, (In $000's,

unaudited) 2009

% ofRevenues

2008

% ofRevenues

%Change2009

vs.2008

Revenues: Online $ 16,282 88 % $ 18,210 78 %

(11 )% Events 2,190 12 % 3,985 17 % (45 )% Print - -

1,068 5 % (100 )% Total revenues 18,472

100 % 23,263 100 % (21 )%

Adjusted EBITDA (earnings before interest, taxes, depreciation,

and amortization, as further adjusted for stock-based compensation)

for the first quarter was $1.6 million compared to $3.0 million for

the comparable prior year quarter. The first quarter of 2009

includes professional fees of $191,000 incurred in connection with

the company’s activities related to the restatement of prior

periods.

Total revenues for the second quarter are as follows:

Three Months Ended June 30, (In $000's,

unaudited)

2009

% ofRevenues

2008

% ofRevenues

%Change2009

vs.2008

Revenues: Online $ 17,801 82 % $ 19,071 69 %

(7 )% Events 3,936 18 % 7,262 26 % (46 )% Print - -

1,282 5 % (100 )% Total revenues 21,737

100 % 27,615 100 % (21 )%

Adjusted EBITDA for the second quarter was $3.9 million compared

to $5.8 million for the comparable prior year quarter. The second

quarter of 2009 includes professional fees of $417,000 incurred in

connection with the company’s activities related to the restatement

of prior periods.

Total Non-GAAP gross profit margin (gross profit

margin less stock-based compensation) increased for both the

first and second quarters to 69% and 72% respectively compared to

68% and 68%, respectively for the comparable prior year quarters.

Online Non-GAAP gross profit margin was 71% for the first quarter

of 2009 compared to 72% for the comparable prior year quarter.

Online Non-GAAP gross profit margin for Q2 2009 increased to 74%

compared to 71% for the comparable prior year quarter.

Net loss for the first quarter of 2009 was $2.3 million compared

to a net loss of $436,000 for the comparable prior year quarter.

Adjusted net income (net income adjusted for amortization and

stock-based compensation, as further adjusted for the related

income tax impact) for the first quarter was $594,000 compared to

$1.6 million for the comparable prior year quarter. Net loss per

basic share for the first quarter was ($0.06) compared to ($0.01)

for the comparable prior year quarter. Adjusted net income per

share (adjusted net income divided by adjusted weighted average

diluted shares outstanding) for the first quarter of 2009 was $0.01

compared to $0.04 for the comparable prior year quarter. Net loss

for the second quarter of 2009 was $543,000 compared to net income

of $1.1 million for the comparable prior year quarter. Adjusted net

income for the second quarter was $2.2 million compared to $3.3

million for the comparable prior year quarter. Net loss per basic

share for the second quarter was ($0.01) compared to net income per

basic share of $0.03 for the comparable prior year quarter.

Adjusted net income per share for the second quarter of 2009 was

$0.05 compared to $0.07 for the comparable prior year quarter.

As of June 30, 2009, TechTarget had $75.7 million of cash,

cash equivalents and short and long-term investments. Outstanding

bank debt was $1.5 million as of June 30, 2009. Our net cash, as

defined as cash, cash equivalents and investments less bank debt

increased by $7.6 million compared to December 31, 2008.

Recent Company Highlights

• Continued the strategy of aggressive new site launches to respond

to areas of opportunity with five new sites launches in 2009:

SearchCloudComputing.com™; SearchVirtualDesktop.com™;

SearchCompliance.com™; SearchEnterpriseWAN.com™; and

SearchMid-MarketSecurity.com™. • Launched operations in India with

government approval of its India branch office, the hire of veteran

IT editor Sandeep Ajgaonkar, formerly of IndiaExpress and CNET

India, as General Manager, and the announcement of plans to launch

three India-focused websites by the end of 2009: SearchCIO.in™,

SearchDataCenter.in™, and SearchSecurity.in™. • Published a new

research report in partnership with Google, examining the buying

process and research of IT buyers across the United Kingdom. The

research was released to customers at an event at Google's UK

Headquarters in London. • Recognized by The Boston Business Journal

as one of the top 20 “Best Places to Work” in the large company

category. This is the 4th time the Company has been named to this

list. • Named to the BtoB magazine “Media Power 50” list of the 50

most powerful business-to-business advertising venues for the ninth

consecutive year - ranked #6 overall. Others in the top 10 included

the Wall Street Journal, Google, the National Football League, and

CNBC’s “Power Lunch.”

Financial Guidance

In the third quarter of 2009, the Company expects total revenues

to be within the range of $21.7 million to $22.7 million and

adjusted EBITDA to be within the range of $4.0 million to $4.8

million.

Compliance Status

TechTarget today filed its Forms 10-Q for the quarters ending

March 31 and June 30, 2009 and the Company believes that it is now

compliant with all of its public filing requirements. With the

filing of our Form 10-K and related amended quarterly filings in

mid-July, we have completed our revenue restatement activities and

do not expect to incur any additional restatement expenses related

to those activities.

Conference Call and Webcast

TechTarget will discuss these financial results in a conference

call at 5:00 pm (Eastern Time) today (August 17, 2009).

Supplemental financial information and prepared remarks for the

conference call will be posted to the investor relations section of

our website simultaneously with this press release.

NOTE: The

prepared remarks will not be read on the conference call. The

conference call will include only brief remarks followed by

questions and answers.

The public is invited to listen to a live webcast of

TechTarget’s conference call, which can be accessed on the Investor

Relations section of our website at http://investor.techtarget.com/. The

conference call can also be heard via telephone by dialing (888)

679-8035 (US callers) or 617-213-4848 (International

callers) ten minutes prior to the call and referencing

participant pass code 80683943 for both domestic and

international callers. Participants may pre-register for the call

at:

https://www.theconferencingservice.com/prereg/key.process?key=PQE4GJH4G. Pre-registrants

will be issued a pin number to use when dialing into the live call

which will provide quick access to the conference by bypassing the

operator upon connection. (Due to the length of the above URL, it

may be necessary to copy and paste it into your Internet browser's

URL address field. You may also need to remove an extra space in

the URL if one exists.)

For those investors unable to participate in the live conference

call, a replay of the conference call will be available via

telephone beginning August 17, 2009 at 7:30 p.m. ET through August

31, 2009 at 11:59pm (ET). To listen to the replay, dial

888-286-8010 and use the pass

code 63031470. International callers should dial

617-801-6888 and also use the pass code 63031470 to listen to the

replay. The webcast replay will also be available for replay on

http://investor.techtarget.com/ during

the same period.

Non-GAAP Financial Measures

This press release and the accompanying tables include a

discussion of adjusted EBITDA, Non-GAAP gross profit, adjusted net

income and adjusted net income per share, all of which are non-GAAP

financial measures which are provided as a complement to results

provided in accordance with accounting principles generally

accepted in the United States of America ("GAAP"). The term

"adjusted EBITDA" refers to a financial measure that we define as

earnings before net interest, income taxes, depreciation, and

amortization, as further adjusted for stock-based compensation. The

term “Non-GAAP gross profit “ refers to a financial measure which

we define as gross profit less stock-based compensation. The

term “Non-GAAP Gross Profit Margin” refers to a financial measure

which we define as gross profit less stock-based compensation

as a percentage of total revenues. The term “adjusted net income”

refers to a financial measure which we define as net income

adjusted for amortization and stock-based compensation, as further

adjusted for the related income tax impact for the specific

adjustments. The term “adjusted net income per share” refers to a

financial measure which we define as adjusted net income divided by

adjusted weighted average diluted shares outstanding. These

Non-GAAP measures should be considered in addition to results

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results. In addition, our

definition of adjusted EBITDA, Non-GAAP gross profit, adjusted net

income and adjusted net income per share may not be comparable to

the definitions as reported by other companies. We believe adjusted

EBITDA, Non-GAAP gross profit, adjusted net income and adjusted net

income per share are relevant and useful information because it

provides us and investors with additional measurements to compare

the Company’s operating performance. These measures are part of our

internal management reporting and planning process and are primary

measures used by our management to evaluate the operating

performance of our business, as well as potential acquisitions. The

components of adjusted EBITDA include the key revenue and expense

items for which our operating managers are responsible and upon

which we evaluate their performance. In the case of senior

management, adjusted EBITDA is used as the principal financial

metric in their annual incentive compensation program. Adjusted

EBITDA is also used for planning purposes and in presentations to

our board of directors. Non-GAAP gross profit is useful to us and

investors because it presents an additional measurement of our

financial performance by excluding the impact of certain non-cash

expenses not directly tied to the core operations of our business.

Adjusted net income is useful to us and investors because it

presents an additional measurement of our financial performance,

taking into account depreciation, which we believe is an ongoing

cost of doing business, but excluding the impact of certain

non-cash expenses and items not directly tied to the core

operations of our business. Furthermore, we intend to provide these

non-GAAP financial measures as part of our future earnings

discussions and, therefore, the inclusion of these non-GAAP

financial measures will provide consistency in our financial

reporting. A reconciliation of these non-GAAP measures to GAAP is

provided in the accompanying tables.

Forward Looking Statements

Certain matters included in this press release may be considered

to be "forward-looking statements" within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

Those statements include statements regarding the intent, belief or

current expectations of the company and members of our management

team. All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: guidance on our future financial results

and other projections or measures of our future performance; our

expectations concerning market opportunities and our ability to

capitalize on them; and the amount and timing of the benefits

expected from acquisitions, from new products or services and from

other potential sources of additional revenue. Investors and

prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. These statements speak only as of the date of this

press release and are based on our current plans and expectations,

and they involve risks and uncertainties that could cause actual

future events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, those relating to:

market acceptance of our products and services; relationships with

customers, strategic partners and our employees; difficulties in

integrating acquired businesses; and changes in economic or

regulatory conditions or other trends affecting the Internet,

Internet advertising and information technology industries. These

and other important risk factors are discussed or referenced in our

Annual Report on Form 10-K/A filed with the Securities and Exchange

Commission, under the heading "Risk Factors" and elsewhere, and any

subsequent periodic or current reports filed by us with the SEC.

Except as required by applicable law or regulation, we do not

undertake any obligation to update our forward-looking statements

to reflect future events or circumstances.

About TechTarget

TechTarget, a leading online technology media company, gives

technology providers ROI-focused marketing programs to generate

leads, shorten sales cycles, and grow revenues. With its network of

more than 60 technology-specific websites and more than 7.5 million

registered members, TechTarget is a primary Web destination for

technology professionals researching products to purchase. The

company is also a leading provider of independent, peer and vendor

content, a leading distributor of white papers, and a leading

producer of webcasts, podcasts, videos and virtual trade shows for

the technology market. Its websites are complemented by numerous

invitation-only events. TechTarget provides proven lead generation

and branding programs to top advertisers including Cisco, Dell,

EMC, HP, IBM, Intel, Microsoft, SAP and Symantec.

(C) 2009 TechTarget, Inc. All rights reserved. TechTarget and

the TechTarget logo are registered trademarks, and

SearchCloudComputing.com; SearchVirtualDesktop.com;

SearchCompliance.com; SearchEnterpriseWAN.com;

SearchMid-MarketSecurity.com and SearchCIO.in™,

SearchDataCenter.in™, and SearchSecurity.in™ are trademarks, of

TechTarget. All other trademarks are the property of their

respective owners.

TECHTARGET, INC. Consolidated Balance Sheets (in

$000's)

March 31, 2009

December 31,2008

Assets (Unaudited) Current assets: Cash and cash

equivalents $ 22,948 $ 24,130 Short-term investments 41,114 42,863

Accounts receivable, net of allowance for doubtful accounts 13,684

17,622 Prepaid expenses and other current assets 7,072 6,251

Deferred tax assets 2,836 2,959 Total current assets

87,654 93,825 Property and equipment, net 3,710 3,904

Long-term investments 6,619 2,575 Goodwill 88,958 88,958 Intangible

assets, net of accumulated amortization 16,027 17,242 Deferred tax

assets 3,545 3,369 Other assets 132 139 Total

assets $ 206,645 $ 210,012

Liabilities and Stockholders'

Equity Current liabilities: Current portion of bank term loan

payable $ 2,250 $ 3,000 Accounts payable 2,232 3,404 Accrued

expenses and other current liabilities 2,260 2,908 Accrued

compensation expenses 788 702 Deferred revenue 7,910

8,749 Total current liabilities 15,440 18,763 Long-term

liabilities: Other liabilities 244 312 Total

liabilities 15,684 19,075 Commitments - -

Stockholders' equity: Preferred stock - - Common stock 42 42

Additional paid-in capital 223,746 221,597 Warrants 2 2 Accumulated

other comprehensive loss 106 (77 ) Accumulated deficit

(32,935 ) (30,627 ) Total stockholders' equity 190,961

190,937 Total liabilities and stockholders' equity $ 206,645

$ 210,012

TECHTARGET, INC. Consolidated Balance

Sheets (in $000's) June

30, 2009

December 31,2008

Assets (Unaudited) Current assets: Cash and cash

equivalents $ 33,408 $ 24,130 Short-term investments 36,075 42,863

Accounts receivable, net of allowance for doubtful accounts 14,116

17,622 Prepaid expenses and other current assets 5,319 6,251

Deferred tax assets 2,876 2,959 Total current assets

91,794 93,825 Property and equipment, net 3,449 3,904

Long-term investments 6,209 2,575 Goodwill 88,958 88,958 Intangible

assets, net of accumulated amortization 14,846 17,242 Deferred tax

assets 3,518 3,369 Other assets 88 139 Total

assets $ 208,862 $ 210,012

Liabilities and Stockholders'

Equity Current liabilities: Current portion of bank term loan

payable $ 1,500 $ 3,000 Accounts payable 3,153 3,404 Accrued

expenses and other current liabilities 1,843 2,908 Accrued

compensation expenses 790 702 Deferred revenue 8,432

8,749 Total current liabilities 15,718 18,763 Long-term

liabilities: Other liabilities 181 312 Total

liabilities 15,899 19,075 Commitments - -

Stockholders' equity: Preferred stock - - Common stock 42 42

Additional paid-in capital 226,330 221,597 Warrants 2 2 Accumulated

other comprehensive loss 67 (77 ) Accumulated deficit

(33,478 ) (30,627 ) Total stockholders' equity 192,963

190,937 Total liabilities and stockholders' equity $ 208,862

$ 210,012

TECHTARGET, INC. Consolidated Statements of

Operations (in $000's, except share and per share

amounts) Three Months Ended

March 31, 2009 2008 (Unaudited) Revenues:

Online $ 16,282 $ 18,210 Events 2,190 3,985 Print -

1,068 Total revenues 18,472 23,263 Cost of

revenues: Online (1) 4,880 5,169 Events (1) 1,081 1,827 Print

- 546 Total cost of revenues 5,961

7,542 Gross profit 12,511 15,721 Operating expenses:

Selling and marketing (1) 7,516 8,444 Product development (1) 2,081

2,762 General and administrative (1) 3,919 3,795 Depreciation 536

724 Amortization of intangible assets 1,215 1,480

Total operating expenses 15,267 17,205

Operating loss (2,756 ) (1,484 ) Interest income (expense),

net (110 ) 418 Loss before benefit from income

taxes (2,866 ) (1,066 ) Benefit from income taxes

(558 ) (630 ) Net loss $ (2,308 ) $ (436 ) Net

loss per common share: Basic and diluted $ (0.06 ) $ (0.01 )

Weighted average common shares outstanding: Basic and diluted

41,754,131 41,158,418 (1) Amounts

include stock-based compensation expense as follows: Cost of online

revenue $ 234 $ 98 Cost of events revenue 17 22 Selling and

marketing 1,328 1,392 Product development 131 140 General and

administrative 893 601

TECHTARGET, INC. Consolidated

Statements of Operations (in $000's, except share and per

share amounts)

Three Months Ended June 30, Six Months Ended June

30, 2009 2008 2009 2008

(Unaudited) Revenues: Online $ 17,801 $ 19,071 $ 34,083 $

37,281 Events 3,936 7,262 6,126 11,247 Print - 1,282

- 2,350 Total revenues 21,737 27,615

40,209 50,878 Cost of revenues: Online (1)

4,776 5,481 9,656 10,650 Events (1) 1,455 2,923 2,536 4,750 Print

- 632 - 1,178 Total cost of revenues

6,231 9,036 12,192 16,578 Gross

profit 15,506 18,579 28,017 34,300 Operating expenses:

Selling and marketing (1) 8,023 8,885 15,539 17,329 Product

development (1) 2,194 2,890 4,275 5,652 General and administrative

(1) 4,064 3,459 7,983 7,254 Depreciation 498 581 1,034 1,305

Amortization of intangible assets 1,181 1,332

2,396 2,812 Total operating expenses 15,960

17,147 31,227 34,352 Operating income (loss)

(454 ) 1,432 (3,210 ) (52 )

Interest income (expense), net 174

268 64 686 Income (loss) before

provision for (benefit from) income taxes (280 ) 1,700 (3,146 ) 634

Provision for (benefit from) income taxes 263

648 (295 ) 18 Net income (loss) $ (543 ) $

1,052 $ (2,851 ) $ 616 Net income (loss) per common share:

Basic $ (0.01 ) $ 0.03 $ (0.07 ) $ 0.01 Diluted $ (0.01 ) $ 0.02 $

(0.07 ) $ 0.01 Weighted average common shares outstanding:

Basic 41,759,506 41,375,997 41,756,818

41,267,207 Diluted 41,759,506 43,598,364

41,756,818 43,531,804 (1) Amounts include

stock-based compensation expense as follows: Cost of online revenue

$ 78 $ 43 $ 312 $ 141 Cost of events revenue 36 25 53 47 Selling

and marketing 1,478 1,347 2,806 2,739 Product development 132 140

263 280 General and administrative 917 858 1,810 1,459

TECHTARGET, INC. Reconciliation of Net Income (Loss) to

Adjusted EBITDA (in $000's)

Three Months Ended March 31, 2009 2008

(Unaudited) Net loss $

(2,308 ) $ (436 ) Interest

income (expense), net (110 ) 418 Benefit from income taxes (558 )

(630 ) Depreciation 536 724 Amortization of intangible assets

1,215 1,480

EBITDA (1,005

) 720 Stock-based compensation expense

2,603 2,253

Adjusted EBITDA $ 1,598

$ 2,973 Three Months Ended June

30, Six Months Ended June 30, 2009

2008 2009 2008 (Unaudited)

Net income (loss) $

(543 ) $ 1,052 $ (2,851

) $ 616 Interest income, net 174 268 64 686

Provision for (benefit from) income taxes 263 648 (295 ) 18

Depreciation 498 581 1,034 1,305 Amortization of intangible assets

1,181 1,332 2,396 2,812

EBITDA

1,225 3,345 220

4,065 Stock-based compensation expense 2,641

2,413 5,244 4,666

Adjusted EBITDA $

3,866 $ 5,758 $ 5,464 $

8,731 TECHTARGET, INC. Reconciliation of Net

Income (Loss) to Adjusted Net Income and Net Income (Loss)

per Diluted Share to Adjusted Net Income per Share (in

$000's, except share and per share amounts)

Three Months Ended March 31, 2009 2008

(Unaudited) Net loss $

(2,308 ) $ (436 ) Amortization

of intangible assets 1,215 1,480 Stock-based compensation expense

2,603 2,253 Impact of income taxes 916 1,662

Adjusted net income $ 594 $

1,635

Net loss per diluted share $ (0.06 )

$ (0.01 ) Weighted average diluted shares

outstanding 41,754,131 41,158,418

Adjusted net income per

share $ 0.01 $ 0.04 Adjusted

weighted average diluted shares outstanding

42,522,199 43,465,245 Options, warrants and

restricted stock, treasury method included in adjusted weighted

average diluted shares above 768,068 2,306,827

Weighted average diluted shares outstanding

41,754,131 41,158,418 Three

Months Ended June 30, Six Months Ended June

30, 2009 2008 2009

2008 (Unaudited)

Net income (loss) $ (543 ) $

1,052 $ (2,851 ) $ 616

Amortization of intangible assets 1,181 1,332 2,396 2,812

Stock-based compensation expense 2,641 2,413 5,244 4,666 Impact of

income taxes 1,096 1,528 2,019 3,223

Adjusted net income $ 2,183 $

3,269 $ 2,770 $ 4,871

Net income (loss) per diluted share $

(0.01 ) $ 0.02 $ (0.07

) $ 0.01 Weighted average diluted shares

outstanding 41,759,506 43,598,364

41,756,818 43,531,804

Adjusted net

income per share $ 0.05 $ 0.07

$ 0.06 $ 0.11 Adjusted weighted

average diluted shares outstanding 42,763,961

43,598,364 42,643,080

43,531,804 Options, warrants and restricted stock, treasury

method included in adjusted weighted average diluted shares above

1,004,455 - 886,262 -

Weighted

average diluted shares outstanding 41,759,506

43,598,364 41,756,818

43,531,804 TECHTARGET, INC. Reconciliation of

Total Gross Profit Margin to Total Non-GAAP Gross Profit

Margin (in $000's)

Three Months Ended March 31, 2009

2008 (Unaudited)

Total gross profit margin $ 12,511

68 % $ 15,721 68 %

Stock-based compensation expense 251

120

Total non-GAAP gross profit margin

$ 12,762 69 % $

15,841 68 % Three

Months Ended June 30, Six Months Ended June

30, 2009 2008 2009

2008 (Unaudited)

Total gross profit margin

$ 15,506 71 % $

18,579 67 % $ 28,017

70 % $ 34,300 67

% Stock-based compensation expense 114

68 365 188

Total non-GAAP gross profit margin $

15,620 72 % $ 18,647

68 % $ 28,382 71

% $ 34,488 68 %

TECHTARGET, INC. Reconciliation of Online Gross Profit

Margin to Online Non-GAAP Gross Profit Margin (in

$000's)

Three Months Ended March 31, 2009 2008

(Unaudited) Online

gross profit margin $ 11,402 70

% $ 13,041 72 %

Stock-based compensation expense 234 98

Online non-GAAP gross profit margin $

11,636 71 % $ 13,139

72 % Three Months Ended June

30, Six Months Ended June 30, 2009

2008 2009 2008

(Unaudited)

Online gross profit margin $ 13,025

73 % $ 13,590 71

% $ 24,427 72 % $

26,631 71 % Stock-based compensation

expense 78 43 312

141

Online non-GAAP gross

profit margin $ 13,103 74 %

$ 13,633 71 % $

24,739 73 % $ 26,772

72 % TECHTARGET, INC. Financial

Guidance for the Three Months Ended September 30, 2009 (in

$000's)

For the Three Months

EndedSeptember 30, 2009

Range Revenues $

21,700 $ 22,700

Adjusted EBITDA $ 4,000 $

4,800 Depreciation, amortization and stock-based

compensation 4,520 4,520 Interest income, net 190 190 Provision for

income taxes 370 700

Net income $

(700 ) $ (230 )

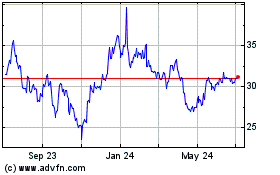

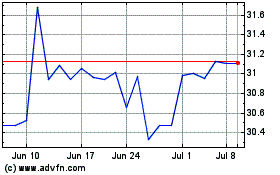

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2024 to May 2024

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From May 2023 to May 2024