Long-Awaited 5G Auction Expected to Stretch Carriers' Balance Sheets

December 08 2020 - 9:30AM

Dow Jones News

By Drew FitzGerald

Verizon Communications Inc. and other cellphone providers are

expected to spend billions of dollars to secure prized spectrum for

their 5G networks in a U.S. government sale that kicks off

Tuesday.

The Federal Communications Commission is launching a new auction

for C-band airwaves, a stretch of wireless frequencies especially

valued by companies trying to offer the fifth-generation

service.

Typical bidders like Verizon, AT&T Inc. and T-Mobile US Inc.

registered to participate. Cable, technology and investment

companies also entered the contest, which could last several

weeks.

"They all need to have a foot in the door," said Davis Hebert,

an analyst at debt research firm CreditSights. "C-band is going to

be the cornerstone of 5G networks for the next decade."

Wall Street analysts expect the auction to raise tens of

billions of dollars over the coming weeks, a reflection of high

demand. The frequencies sit in what telecom executives consider a

"sweet spot" for 5G transmissions because they can move plenty of

data quickly while still traveling long distances from a cellular

tower.

CreditSights expects bidders to spend about $38 billion to

secure the assets. Mr. Hebert expects cellphone carriers to "play

it safe from a credit perspective" to avoid dragging down their

bond ratings, which could limit their ability to outbid other

participants.

New Street Research told its clients the licenses could fetch

$52 billion if bidders use all the resources at their disposal,

though the total could be much less if federal officials make a

concerted effort to privatize nearby Defense Department spectrum,

adding more potential supply to the mix. Either way, New Street

predicted the bake-off "will be hard fought with carriers winning

spectrum based on their balance sheet capacity."

The wide-ranging projections reflect the uncertainty surrounding

an auction that took years to prepare. Satellite companies already

use C-band airwaves to beam TV feeds and other content to receivers

in the U.S. The satellite operators agreed to clear some space for

cellphone companies after a drawn-out lobbying fight that delayed

the sale of new licenses.

Verizon tapped the debt markets earlier this year to build up

cash before the auction. T-Mobile, which absorbed rival Sprint

Corp. earlier this year, also has cash on hand for bidding.

Investors expect Verizon, the country's largest carrier in terms of

subscribers, to bid aggressively to bolster its relatively low

share of midrange spectrum.

Spokespeople for AT&T and Verizon declined to comment.

T-Mobile didn't immediately respond to requests for comment. FCC

rules barring coordinated bids often constrain companies' ability

to discuss the auction.

The FCC is kick-starting the auction as President-elect Joe

Biden prepares to nominate a new chairman to steer the commission.

Current Chairman Ajit Pai, a Republican, has announced plans to

leave in January.

The transition won't affect the continuing auction, which

commission staff members oversee.

The FCC once doled out permission for radio and TV stations to

use certain frequencies for free. The telecom regulator started

selling new spectrum rights as demand for the resource grew.

Auction spending surged as the smartphone explosion fueled demand

for more data on the go.

The public ultimately benefits from the government's sale of new

licenses, with proceeds from the winning bids steered to the U.S.

Treasury. But the companies that win the licenses must pay for the

assets through new borrowing, which is ultimately secured by the

fees they charge their customers.

The commission's most expensive auction closed in 2015 with

nearly $45 billion in bids. The winners quickly used the licenses

to bolster their 4G service, allowing their customers to stream

more music and videos.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

December 08, 2020 09:15 ET (14:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

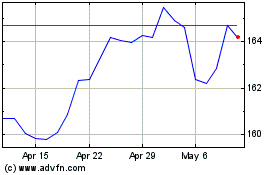

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Aug 2024 to Sep 2024

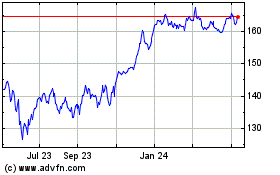

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Sep 2023 to Sep 2024