Superior Group of Companies, Inc. (NASDAQ: SGC) (the

“Company”), today announced its first quarter

2023 results.

First Quarter Results

For the first quarter of 2023, net sales

of $130.8 million compared to first quarter

2022 net sales of $143.6 million. Net

income of $0.9 million or $0.06 per diluted

share compared to $5.2 million or $0.32 per diluted

share, respectively, in the first quarter of 2022.

“We’ve kicked off 2023 as expected with our

Contact Centers segment continuing strong sales growth above 20%

while soft economic conditions restrained growth at our Healthcare

Apparel and Branded Products segments. During the quarter, we

delivered on our commitment to drive significant free cash flow,

lower working capital and reduce our net leverage position. As a

result, SGC is in an attractive position to generate improved

growth and profitability during the second half of the year as we

indicated last quarter,” said Michael Benstock, Chief Executive

Officer. “Today, we are reaffirming our full-year outlook, and as

we wait for macro conditions to turn more favorable, our team

remains focused on winning in the marketplace every day while

optimizing our longer-term strategy to capitalize on the large and

attractive end markets we serve. I also am pleased that our Board

recently approved another quarterly dividend, reflecting our

confidence in our continued solid performance during subdued

economic times, and am excited about the many opportunities ahead

of us to drive long-term shareholder value.”

Second Quarter 2023 Dividend

The Board of Directors declared a quarterly

dividend of $0.14 per share, payable June 2, 2023, to

shareholders of record as of May 19, 2023.

2023 Full-Year Outlook

For full-year 2023, the Company continues to

forecast sales to be $585 million to $595 million compared $579

million in 2022, and earnings per share to be $0.92 to $0.97

compared to $0.62 of adjusted earnings per share in 2022.

Webcast and Conference Call

The live webcast and archived replay can be

accessed in the investor relations section of the Company's website

at https://ir.superiorgroupofcompanies.com/Presentations.

Interested individuals may also join the teleconference by dialing

1-844-861-5505 for U.S. dialers and 1-412-317-6586 for

International dialers. The Canadian Toll-Free number is

1-866-605-3852. Please ask to be joined to the Superior Group of

Companies call. A telephone replay of the teleconference will be

available through May 20, 2023. To access the replay, dial

1-877-344-7529 in the United States or 1-412-317-0088 from

international locations. Canadian dialers can access the replay at

855-669-9658. Please reference conference number 3580777 for all

replay access.

Disclosure Regarding Forward Looking

StatementsCertain matters discussed in this Form 10-Q are

“forward-looking statements” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

generally be identified by use of the words “may,” “will,”

“should,” “could,” “expect,” "anticipate,” “estimate,” “believe,”

“intend,” “project,” “potential,” or “plan” or the negative of

these words or other variations on these words or comparable

terminology. Forward-looking statements in this Quarterly Report on

Form 10-Q may include, without

limitation: (1) projections of revenue, income, and other

items relating to our financial position and results of operations,

including short term and long term plans for cash (2)

statements of our plans, objectives, strategies, goals and

intentions, (3) statements regarding the capabilities, capacities,

market position and expected development of our business

operations, (4) statements of expected industry and general

economic trends and (5) the projected impact of the

COVID-19 pandemic on our, our customers’, and our suppliers’

businesses.

Such forward-looking statements are subject to

certain risks and uncertainties that may materially adversely

affect the anticipated results. Such risks and uncertainties

include, but are not limited to, the following: the impact of

competition; uncertainties related to supply disruptions,

inflationary environment (including with respect to the cost of

finished goods and raw materials and shipping costs), employment

levels (including labor shortages) and general economic and

political conditions in the areas of the world in which the Company

operates or from which it sources its supplies or the areas of the

United States of America (“U.S.” or “United States”) in which the

Company’s customers are located; lingering effects of the COVID-19

pandemic, including existing and possible future variants, on the

United States and global markets, our business, operations,

customers, suppliers and employees, including the length and scope

of restrictions imposed by various governments and organizations

and the continuing success of efforts to deliver effective vaccines

and boosters, among other factors; changes in the

healthcare, retail, hotel, food service, transportation

and other industries where uniforms and service apparel are

worn; our ability to identify suitable acquisition targets,

discover liabilities associated with such businesses during the

diligence process, successfully integrate any acquired businesses,

or successfully manage our expanding operations; the price and

availability of cotton and other manufacturing materials;

attracting and retaining senior management and key personnel; the

effect of the Company’s material weakness in internal control

over financial reporting; the Company’s ability to successfully

remediate its material weakness in internal control over

financial reporting and to maintain effective internal control over

financial reporting; and other factors described in the Company’s

filings with the Securities and Exchange Commission, including

those described in the “Risk Factors” section herein and

in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2022 and the Quarterly Report on Form 10-Q

for the quarter ended March 31, 2023. Shareholders, potential

investors and other readers are urged to consider these factors

carefully in evaluating the forward-looking statements made herein

and are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements made

herein are only made as of the date of this press release and

we disclaim any obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances, except as

may be required by law.

About Superior Group of Companies, Inc.

(SGC): Superior Group of Companies™, established in 1920, is a

combination of companies that help our customers unlock the power

of their brands by creating extraordinary brand engagement

experiences for their employees and customers. SGC’s commitment to

service, technology, quality and value-added benefits, as well as

our financial strength and resources, provides unparalleled support

for our customers’ diverse needs while embracing a “Customer 1st,

Every Time!” philosophy and culture in all of our business

segments. Visit www.superiorgroupofcompanies.com for more

information.

Contact:

Investor RelationsInvestors@superiorgroupofcompanies.com

Comparative figures are as follows:

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

(In thousands, except share and per share data) |

| |

| |

Three Months Ended March 31, |

| |

2023 |

|

2022 |

|

Net sales |

$ |

130,773 |

|

$ |

143,582 |

| |

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

Cost of goods sold |

|

83,665 |

|

|

93,801 |

|

Selling and administrative expenses |

|

43,379 |

|

|

42,214 |

|

Other periodic pension costs |

|

214 |

|

|

528 |

|

Interest expense |

|

2,570 |

|

|

299 |

| |

|

129,828 |

|

|

136,842 |

| Income before taxes on

income |

|

945 |

|

|

6,740 |

| Income tax expense |

|

57 |

|

|

1,510 |

| Net income |

$ |

888 |

|

$ |

5,230 |

| |

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

Basic |

$ |

0.06 |

|

$ |

0.33 |

|

Diluted |

$ |

0.06 |

|

$ |

0.32 |

| |

|

|

|

|

|

| Weighted average shares

outstanding during the period: |

|

|

|

|

|

|

Basic |

|

15,882,994 |

|

|

15,679,027 |

|

Diluted |

|

16,118,329 |

|

|

16,165,268 |

| |

|

|

|

|

|

| Cash dividends per common

share |

$ |

0.14 |

|

$ |

0.12 |

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except share and par value data) |

| |

| |

March 31, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

| |

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

26,600 |

|

|

$ |

17,722 |

|

|

Accounts receivable, less allowance for doubtful accounts of $6,346

and $7,622, respectively |

|

94,859 |

|

|

|

104,813 |

|

|

Accounts receivable - other |

|

398 |

|

|

|

3,326 |

|

|

Inventories |

|

122,214 |

|

|

|

124,976 |

|

|

Contract assets |

|

51,390 |

|

|

|

52,980 |

|

|

Prepaid expenses and other current assets |

|

11,856 |

|

|

|

14,166 |

|

|

Total current assets |

|

307,317 |

|

|

|

317,983 |

|

| Property, plant and equipment,

net |

|

51,460 |

|

|

|

51,392 |

|

| Operating lease right-of-use

assets |

|

13,853 |

|

|

|

9,113 |

|

| Deferred tax asset |

|

10,704 |

|

|

|

10,718 |

|

| Intangible assets, net |

|

54,427 |

|

|

|

55,753 |

|

| Other assets |

|

12,658 |

|

|

|

11,982 |

|

|

Total assets |

$ |

450,419 |

|

|

$ |

456,941 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

50,580 |

|

|

$ |

42,060 |

|

|

Other current liabilities |

|

31,608 |

|

|

|

38,646 |

|

|

Current portion of long-term debt |

|

3,750 |

|

|

|

3,750 |

|

|

Current portion of acquisition-related contingent liabilities |

|

806 |

|

|

|

736 |

|

|

Total current liabilities |

|

86,744 |

|

|

|

85,192 |

|

| Long-term debt |

|

139,673 |

|

|

|

151,567 |

|

| Long-term pension

liability |

|

13,019 |

|

|

|

12,864 |

|

| Long-term acquisition-related

contingent liabilities |

|

1,612 |

|

|

|

2,245 |

|

| Long-term operating lease

liabilities |

|

8,468 |

|

|

|

3,936 |

|

| Other long-term

liabilities |

|

8,248 |

|

|

|

8,538 |

|

|

Total liabilities |

|

257,764 |

|

|

|

264,342 |

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $.001 par value - authorized 300,000 shares (none

issued) |

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value - authorized 50,000,000 shares,

issued and outstanding 16,498,312 and 16,376,683 shares,

respectively |

|

16 |

|

|

|

16 |

|

|

Additional paid-in capital |

|

73,730 |

|

|

|

72,615 |

|

|

Retained earnings |

|

121,572 |

|

|

|

122,979 |

|

|

Accumulated other comprehensive loss, net of tax: |

|

|

|

|

|

|

|

|

Pensions |

|

(1,072 |

) |

|

|

(1,113 |

) |

|

Foreign currency translation adjustment |

|

(1,591 |

) |

|

|

(1,898 |

) |

|

Total shareholders’ equity |

|

192,655 |

|

|

|

192,599 |

|

|

Total liabilities and shareholders’ equity |

$ |

450,419 |

|

|

$ |

456,941 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(Unaudited) |

|

(In thousands) |

| |

| |

Three Months Ended March 31, |

|

| |

2023 |

|

|

2022 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

| Net income |

$ |

888 |

|

|

$ |

5,230 |

|

| Adjustments to reconcile net

income to net cash provided by (used) in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

3,388 |

|

|

|

2,923 |

|

|

Provision for bad debts - accounts receivable |

|

(97 |

) |

|

|

639 |

|

|

Share-based compensation expense |

|

1,080 |

|

|

|

1,212 |

|

|

Deferred income tax provision |

|

- |

|

|

|

46 |

|

|

Change in fair value of acquisition-related contingent

liabilities |

|

(563 |

) |

|

|

406 |

|

|

Change in fair value of written put options |

|

(442 |

) |

|

|

- |

|

|

Changes in assets and liabilities, net of acquisition of

businesses: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

10,150 |

|

|

|

760 |

|

|

Accounts receivable - other |

|

2,928 |

|

|

|

(907 |

) |

|

Contract assets |

|

1,590 |

|

|

|

(2,969 |

) |

|

Inventories |

|

2,807 |

|

|

|

(8,713 |

) |

|

Prepaid expenses and other current assets |

|

2,403 |

|

|

|

(1,897 |

) |

|

Other assets |

|

(657 |

) |

|

|

(524 |

) |

|

Accounts payable and other current liabilities |

|

1,596 |

|

|

|

(5,744 |

) |

|

Long-term pension liability |

|

209 |

|

|

|

553 |

|

|

Other long-term liabilities |

|

(230 |

) |

|

|

258 |

|

|

Net cash provided by (used in) operating activities |

|

25,050 |

|

|

|

(8,727 |

) |

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

| Additions to property, plant

and equipment |

|

(2,114 |

) |

|

|

(4,188 |

) |

| Acquisition of businesses |

|

- |

|

|

|

(125 |

) |

|

Net cash used in investing activities |

|

(2,114 |

) |

|

|

(4,313 |

) |

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

| Proceeds from borrowings of

debt |

|

1,000 |

|

|

|

62,858 |

|

| Repayment of debt |

|

(12,938 |

) |

|

|

(48,998 |

) |

| Payment of cash dividends |

|

(2,295 |

) |

|

|

(1,918 |

) |

| Proceeds received on exercise

of stock options |

|

35 |

|

|

|

196 |

|

| Tax withholdings on vesting of

restricted shares and performance based shares |

|

- |

|

|

|

(232 |

) |

|

Net cash provided by (used in) financing activities |

|

(14,198 |

) |

|

|

11,906 |

|

| |

|

|

|

|

|

|

|

| Effect of currency exchange

rates on cash |

|

140 |

|

|

|

514 |

|

| Net increase (decrease) in

cash and cash equivalents |

|

8,878 |

|

|

|

(620 |

) |

| Cash and cash equivalents

balance, beginning of period |

|

17,722 |

|

|

|

8,935 |

|

| Cash and cash equivalents

balance, end of period |

$ |

26,600 |

|

|

$ |

8,315 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

|

(Unaudited) |

|

(In thousands, except share and par value data) |

| |

| |

Three Months Ended March 31, |

| |

2023 |

|

2022 |

|

Net income |

$ |

888 |

|

$ |

5,230 |

| Interest expense |

|

2,570 |

|

|

299 |

| Income tax expense |

|

57 |

|

|

1,510 |

| Depreciation and

amortization |

|

3,388 |

|

|

2,923 |

| EBITDA(1) |

$ |

6,903 |

|

$ |

9,962 |

(1) EBITDA, which is a non-GAAP financial

measure, is defined as net income excluding interest expense,

income tax expense and depreciation and amortization expense. The

Company believes EBITDA is an important measure of operating

performance because it allows management, investors and others to

evaluate and compare the Company’s core operating results from

period to period by removing (i) the impact of the Company’s

capital structure (interest expense from outstanding debt), (ii)

tax consequences and (iii) asset base (depreciation and

amortization). The Company uses EBITDA internally to monitor

operating results and to evaluate the performance of its business.

In addition, the compensation committee has used EBITDA in

evaluating certain components of executive compensation, including

performance-based annual incentive programs. EBITDA is not a

measure of financial performance under GAAP and should not be

considered in isolation or as an alternative to net income, cash

flows from operating activities or any other measure determined in

accordance with GAAP. The items excluded to calculate EBITDA are

significant components in understanding and assessing the Company’s

results of operations. The presentation of the Company’s EBITDA may

change from time to time, including as a result of changed business

conditions, new accounting pronouncements or otherwise. If the

presentation changes, the Company undertakes to disclose any change

between periods and the reasons underlying that change. The

Company’s EBITDA may not be comparable to a similarly titled

measure of another company because other entities may not calculate

EBITDA in the same manner.

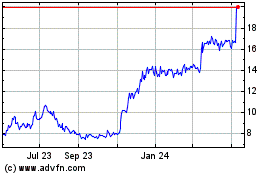

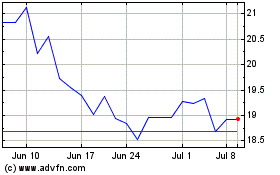

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Apr 2023 to Apr 2024